Walking Guide Tours Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Walking Guide Tours Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

walking guide tours Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

WALKING GUIDE TOURS FINANCIAL MODEL FOR STARTUP INFO

Highlights

In developing a walking tour business plan, it's essential to conduct a thorough market analysis and create a detailed budget that encompasses expenses for guided tours and operational costs for walking guides. By utilizing a financial modeling approach, operators can establish a robust revenue model that includes break-even analysis for walking tours and insights into pricing strategies that optimize profit margins. A focus on cash flow management and an understanding of customer acquisition costs will enhance financial planning, while assessing the financial risks and potential profitability of walking tours ensures a sustainable investment. Utilizing a comprehensive financial dashboard can assist in tracking core metrics, ultimately aiding in securing funding from banks or investors to support the growth of guided walking tours.

This ready-made financial model for guided walking tours addresses key pain points by providing a comprehensive framework for financial planning, allowing users to easily navigate through essential components like cost analysis for walking tours, expenses for guided tours, and walking tour revenue models. With an emphasis on profitability of walking tours, the template simplifies the complexities of cash flow management for tours, empowering users to effectively assess walking tour profit margins while developing a strategic walking tours pricing strategy. Additionally, it supports in-depth walking tour market analysis and break-even analysis for walking tours, ensuring informed decision-making around investment in walking tours and operational costs. By streamlining the financial projections process, it minimizes the risks associated with tourism financial modeling and enhances customer acquisition cost strategies, making it ideal for both startups and established walking guide services looking to optimize their business plans.

Description

In developing a comprehensive business plan for guided walking tours, it is crucial to conduct a thorough financial analysis, which encompasses walking tour revenue models, cost analysis for walking tours, and financial projections to assess the profitability of the venture. By focusing on walking tour profit margins, the budgeting for guided tours can inform a strategic pricing strategy that effectively balances operational costs against expected walking tour revenue. Conducting a break-even analysis for walking tours will help in understanding the customer acquisition cost and forecasting cash flow management. Additionally, evaluating the expenses for guided tours alongside walking guide service pricing will support financial planning and risk assessment, allowing for a solid investment in walking tours. Ultimately, this financial modeling aids in identifying key performance indicators for the walking tour market analysis, ensuring an informed approach to navigating the financial landscape of the tourism industry.

WALKING GUIDE TOURS FINANCIAL MODEL REPORTS

All in One Place

This Excel financial model is your go-to solution for guided walking tours, offering 15 customizable templates that streamline your financial planning. Easily update highlighted input areas in a centralized template, and watch as changes are reflected across all sheets, simplifying your budget management. Whether you're analyzing walking tour profit margins, evaluating pricing strategies, or conducting a cost analysis for walking tours, this tool provides essential insights into your walking tour business plan. Make informed decisions and optimize profitability with ease, ensuring a sharp focus on cash flow management and financial risks.

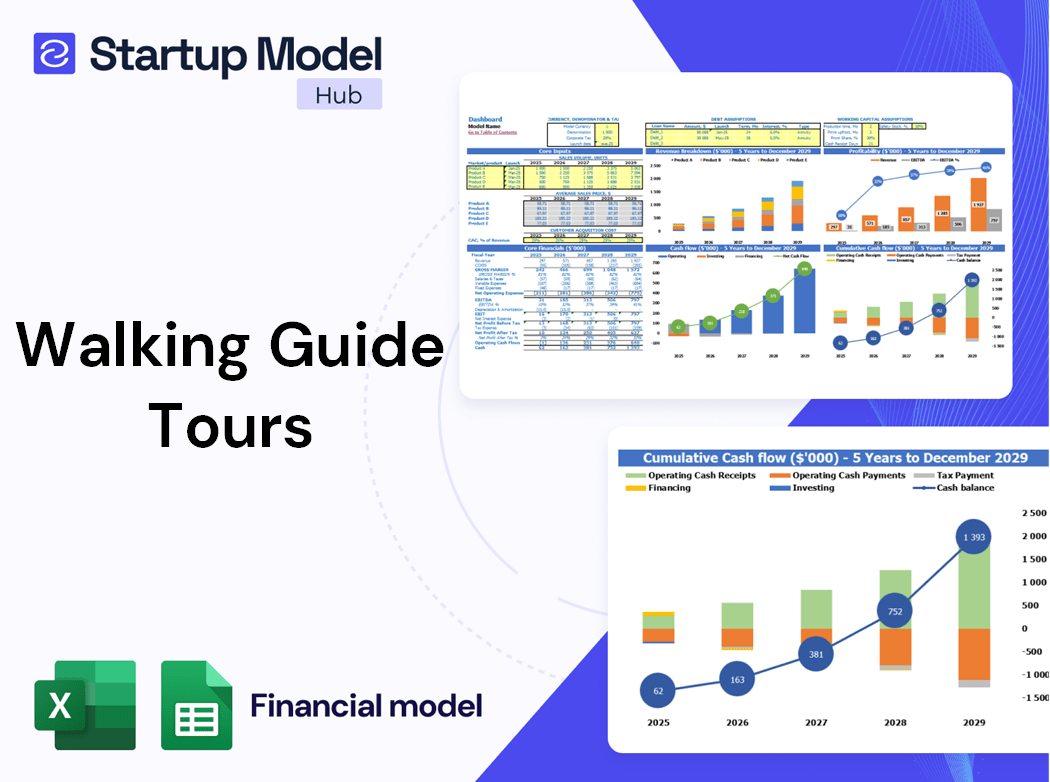

Dashboard

Our comprehensive dashboard simplifies tracking your walking tour financials, including budgeting, revenue models, and cost analysis. With dynamic charts and graphs, visualize essential metrics such as profit margins and customer acquisition costs effortlessly. Enhance your presentations with visually engaging data, showcasing key insights like break-even analysis and operational costs. This powerful tool streamlines your financial planning and elevates your walking tour business plan, ensuring you effectively communicate profitability and market potential to stakeholders. Take the guesswork out of tourism financial modeling and invest confidently in your guided walking tour business.

Business Financial Statements

Our financial model for walking tours encompasses a comprehensive approach, including profit and loss forecasts, projected balance sheets, and cash flow management strategies tailored for guided tours. These key financial statements can be generated on a monthly or annual basis, aiding in budget formulation and financial planning for walking guides. Users can enhance their projections by integrating current business financials with data from accounting applications like QuickBooks and Xero, ensuring accurate cost analysis and a solid understanding of walking tour profit margins, pricing strategies, and market viability.

Sources And Uses Statement

A financial model template for walking tours showcases the balance between income sources and projected expenses. In the Sources section, outline funding avenues, while the Uses segment details budget allocations for operational costs and guided tour expenses. Ensuring that the Sources match or exceed Uses is crucial; a surplus indicates potential for business expansion or improved cash flow management. Conversely, a deficit highlights the need for additional investment. This structured financial planning is essential for attaining optimal profit margins and understanding the profitability and market dynamics of guided walking tours.

Break Even Point In Sales Dollars

A break-even analysis is essential for guided walking tours, allowing you to identify when your business will cover expenses and start generating profit. To conduct this analysis, pinpoint your fixed costs—overhead like rent and salaries that remain constant—and variable costs that fluctuate with sales, such as supplies and marketing expenses. Understanding these elements aids in crafting a robust walking tour business plan, informs your pricing strategy, and enhances cash flow management. This financial planning is crucial for navigating the potential risks and maximizing profit margins in the competitive walking tour market.

Top Revenue

In crafting a comprehensive business plan for guided walking tours, revenue forecasting is vital to assess profitability. Effective financial planning involves analyzing various factors, such as walking tour pricing strategies, operational costs, and customer acquisition expenses. Utilizing a robust financial model allows walking guides to project revenue streams, understand break-even points, and evaluate profit margins. Historical data can inform growth rate assumptions, aiding in a cost analysis for walking tours. By strategically managing cash flow and financial risks, businesses can optimize their walking tour revenue model for long-term success.

Business Top Expenses Spreadsheet

The expense report serves as a vital tool for guided walking tours, offering a detailed summary of operational costs. By categorizing expenses, you can enhance financial planning and create accurate financial projections. This analysis aids in developing a robust walking tour business plan, enabling you to monitor monthly, quarterly, or annual expenses. Regular assessments ensure you stay on track with your walking tour budget, allowing for strategic adjustments to optimize profitability and manage financial risks effectively. By leveraging these insights, you can refine your pricing strategy and bolster customer acquisition for sustained success in the walking tour market.

WALKING GUIDE TOURS FINANCIAL PROJECTION EXPENSES

Costs

To optimize your guided walking tours' financial planning, implement a robust startup financial model. Developing a solid financial forecast template allows for accurate cost analysis, covering crucial aspects like expenses, profitability, and cash flow management. Our three-way financial model offers a comprehensive view of your walking tour business plan, aiding in effective communication with potential investors and creditors. By understanding your walking tour revenue model and operational costs, you can enhance your pricing strategy and assess the financial risks and profitability of your tours for sustained growth.

CAPEX Spending

Capital expenditures (CAPEX) are essential for purchasing assets that drive the success of walking tours. These significant investments must be accurately reflected in your financial planning, including the pro forma balance sheet and projected income statement. Effective cost analysis for walking tours enhances operational efficiency and improves the overall customer experience. By prioritizing CAPEX, you can optimize your walking tour revenue model, manage cash flow, and safeguard against financial risks. A well-structured business plan, including break-even analysis and pricing strategies, ensures sustainable profitability and guides your investment in the walking tour market.

Loan Financing Calculator

A loan amortization schedule is essential for stakeholders in the walking tour industry, detailing periodic payments on an amortizing loan. It showcases how the principal reduces over time, aiding in financial planning for walking guides. Utilizing a financial forecast template with a built-in amortization calculator allows businesses to assess initial amounts, terms, and interest rates. This tool is invaluable for cash flow management, enabling walking tour operators to track outstanding debt and repayment strategies, ultimately reducing financial risks and enhancing profit margins in their guided walking tours business plan.

WALKING GUIDE TOURS EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net profit margin is a crucial metric in walking tours financial projections, illustrating how effectively a guided walking tour business converts revenue into profit. This figure highlights the efficiency of your pricing strategy and helps in assessing the overall profitability of walking tours. By analyzing net income as a percentage of revenue, you can better forecast long-term growth and manage financial risks. Understanding this dynamic is essential for a solid walking tour business plan, enabling informed decisions regarding operational costs, customer acquisition, and investment in marketing strategies.

Cash Flow Forecast Excel

A 5-year cash flow projection template is vital for any walking tour startup, enabling effective financial planning and enhanced profitability. This essential tool supports robust decision-making by detailing expenses for guided tours, cash flow management, and financial analysis for walking tours. Additionally, it plays a crucial role in securing bank loans and attracting investors, showcasing your walking tour business plan's potential for successful repayments. With accurate financial modeling, you can confidently navigate pricing strategies, break-even analysis, and customer acquisition costs, ultimately maximizing profit margins and minimizing financial risks in the competitive walking tour market.

KPI Benchmarks

A financial plan template with a benchmark tab is essential for evaluating guided walking tours. It calculates key indicators such as profitability, operational costs, and cash flow management. By comparing average values, a comprehensive cost analysis for walking tours is conducted, facilitating effective financial planning. This analysis aids startups in developing a robust walking tour business plan, optimizing pricing strategies and revenue models. By carefully assessing financial risks and conducting break-even analysis, companies can strategically manage expenses and improve profit margins, ultimately ensuring sustainable growth and customer acquisition in the competitive tourism market.

P&L Statement Excel

To safeguard the profitability of walking tours, leveraging financial projections and profit-and-loss statements is crucial. This approach enables accurate forecasts of profits and losses, grounded in historical performance. Our comprehensive business plan and financial modeling tools facilitate effective decision-making for start-ups and expanding companies. By analyzing expenses, assessing the walking tour revenue model, and implementing a strategic pricing strategy, you can enhance your walking guide service's profitability. This proactive financial planning ensures a robust cash flow management system, mitigating risks and paving the way for sustained growth in the competitive tourism market.

Pro Forma Balance Sheet Template Excel

In crafting a robust walking tours business plan, our financial modeling incorporates monthly and annual pro forma statements, seamlessly linked to cash flow projections, profit and loss statements, and detailed cost analysis for guided tours. This comprehensive setup ensures a thorough understanding of financial planning, addressing aspects like walking tour revenue models, pricing strategies, and profit margins. By assessing expenses and operational costs, we help evaluate the financial risks and profitability of walking tours, enabling effective cash flow management and break-even analysis to optimize investment and customer acquisition strategies.

WALKING GUIDE TOURS FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Unlock the potential of your walking tour business with a comprehensive financial plan that includes cost analysis for guided tours, financial projections, and a sound walking tour revenue model. Utilize tools like the weighted average cost of capital (WACC) and discounted cash flow (DCF) for effective cash flow management. Craft a robust walking tour business plan featuring a pricing strategy that maximizes profit margins while considering customer acquisition costs. By conducting a thorough walking tour market analysis and break-even analysis, you can confidently navigate the financial risks and enhance profitability in this thriving sector.

Cap Table

Our cap table serves as a dynamic tool for optimizing financial projections and strategically allocating assets over time. It provides essential insights into walking tour profit margins and aids in crafting an effective walking tour business plan. This transparency not only guides financial planning for walking guides but also attracts potential investors by clearly outlining expected returns. By analyzing costs, pricing strategies, and customer acquisition costs, we can navigate the financial risks inherent in the walking tour market. This approach fosters robust cash flow management and enhances overall profitability, ensuring a solid foundation for sustainable growth.

KEY FEATURES

Implementing a robust financial model for walking tours maximizes profit margins while minimizing risks and enhancing overall profitability.

Utilizing our financial model simplifies cost analysis, enhances profitability, and supports effective budgeting for your walking tour business.

Developing a robust financial model for walking tours ensures profitability and informed decision-making in a competitive tourism market.

Our financial model streamlines walking tour budget planning, enhancing profitability and reducing risks without requiring complex formulas or external consultants.

Implementing a robust financial model enhances walking tour profitability, ensuring effective budgeting and sustainable growth for guided experiences.

Using financial projections for walking tours empowers guided tours to optimize profit margins and strategically plan for sustainable growth.

A robust financial model for walking tours enhances stakeholder trust by ensuring clear profitability and effective cash flow management.

Implementing a robust financial model ensures clear projections, boosting investor confidence and facilitating increased funding for walking tours.

A robust financial model for walking tours enhances profitability, ensuring informed decisions in pricing, budgeting, and cash flow management.

Develop a robust financial model to attract investors and maximize profitability in your walking tour business venture.

ADVANTAGES

Optimize your walking tour business with a comprehensive financial model to effectively plan for cash gaps and enhance profitability.

A comprehensive financial model enhances walking tour profitability, enabling informed decisions on pricing strategy and cost management for sustained growth.

A robust financial model for walking tours effectively predicts cash flow, ensuring strategic investments and maximizing profitability.

A flexible, five-year financial model enhances walking tour profitability by providing clear insights for budgeting and revenue strategies.

Utilizing a robust financial model enhances credibility, attracting investors while maximizing profitability for your walking tour business.