Trattoria Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Trattoria Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

trattoria Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

TRATTORIA FEASIBILITY STUDY INFO

Highlights

Develop a comprehensive trattoria business plan that includes a five-year financial model tailored for early-stage startups, aimed at impressing investors and securing funding from banks, angel investors, grants, and VC funds. This model should encompass key components such as trattoria revenue projections, cost of goods sold for the trattoria, and a thorough analysis of operating expenses and labor costs. Additionally, implement a robust restaurant cash flow management strategy alongside a menu pricing strategy that optimizes profit margins. Conduct profitability analysis for the trattoria, utilizing financial statements and ratios to perform breakeven analysis and sales forecasting. This financial planning approach will effectively outline capital requirements and ensure meticulous expense tracking, ultimately demonstrating the potential investment return and aligning with restaurant financial benchmarks to attract potential funding sources.

The trattoria financial model alleviates common pain points for restaurant owners by providing a comprehensive overview of critical metrics such as revenue projections, operating expenses, and labor costs, allowing for effective cash flow management. With features like breakeven analysis and a robust menu pricing strategy, this model enables users to achieve optimal restaurant profit margins. It tracks important financial ratios and benchmarks, ensuring that both startup costs and the cost of goods sold are accounted for, ultimately informing significant financial decisions. The dynamic dashboard simplifies expense tracking and sales forecasting, fostering a proactive approach to managing capital requirements and assessing the return on investment. By simulating various scenarios, users can anticipate the financial impact of business strategies, thereby enhancing their overall profitability analysis for the trattoria.

Description

This comprehensive trattoria business plan includes a financial model that supports detailed analysis of operating expenses, labor costs, and cost of goods sold, enabling accurate revenue projections and cash flow management. With a focus on profitability analysis, the model facilitates menu pricing strategy assessments and breakeven analysis, ensuring sustainable profit margins. Financial statements generated from this model will provide insights into restaurant sales forecasting and expense tracking, while capital requirements are easily assessed to project investment return. Utilizing financial ratios and benchmarking within the trattoria context allows for a more informed approach to long-term financial planning and operational success.

TRATTORIA FINANCIAL PLAN REPORTS

All in One Place

This trattoria financial model is expertly designed for user convenience, streamlining your financial analysis. Key assumptions are clearly defined on one sheet, while structured formulas in the trattoria revenue projection template automatically update all 15 sheets. Simply adjust the parameters in the highlighted cells, and the 5-year financial projection template will generate comprehensive profit and loss forecasts, along with a detailed breakeven analysis. This tool ensures effective cash flow management and offers insights into operating expenses, labor costs, and overall restaurant profitability, making it an invaluable resource for your trattoria business plan.

Dashboard

To effectively analyze your trattoria's financial performance and make accurate revenue projections, a comprehensive financial modeling approach is essential. Utilizing a three-year financial projection template can streamline the process, encompassing key elements such as profit and loss forecasts, balance sheet projections, and cash flow management. This tool allows for easy visualization through graphs and charts, facilitating better decision-making regarding operating expenses, menu pricing strategy, and labor costs. Moreover, it aids in conducting profitability analysis and evaluating investment returns, ensuring your trattoria remains financially robust and poised for growth.

Business Financial Statements

Our comprehensive financial model template for your trattoria includes a seamlessly integrated financial summary, consolidating key data from multiple spreadsheets. This includes essential components like the projected balance sheet, profit and loss forecast, and cash flow management tools—all meticulously formatted for your pitch deck. With insights into startup costs, revenue projections, and operating expenses, our model will empower you to conduct effective profitability analysis and optimize menu pricing strategies, ensuring robust financial statements and healthy profit margins. Elevate your trattoria business plan with our professional financial forecasting tools today.

Sources And Uses Statement

A well-structured trattoria business plan incorporates a detailed financial analysis, including revenue projections, operating expenses, and cash flow management. Utilize pro forma financial statements to track costs of goods sold and labor, ensuring effective expense tracking. Your menu pricing strategy should align with profitability analysis to optimize restaurant profit margins. A comprehensive breakeven analysis will aid in understanding capital requirements and investment returns. By maintaining financial ratios and benchmarks, you can forecast sales accurately and ensure sustainable growth for your trattoria. Adaptability in financial modeling will support informed decision-making as your restaurant evolves.

Break Even Point In Sales Dollars

The breakeven analysis chart is an essential financial tool for trattoria business planning, enabling owners to evaluate the interplay between fixed and variable costs and revenue. By calculating the breakeven point (BEP), it identifies when startup investments will yield a positive return. Our comprehensive financial plan visually represents this analysis, integrating it with sales forecasting and cost of goods sold for the trattoria. This approach determines the necessary sales volume at specific menu pricing to cover total operating expenses, ensuring robust cash flow management and informed profitability analysis for optimal restaurant financial performance.

Top Revenue

This financial model provides a comprehensive revenue tab for a detailed analysis of your trattoria's revenue streams. Utilize this template to categorize and assess the revenue generated by individual menu items or services. It serves as a vital component of your trattoria business plan, facilitating effective restaurant cash flow management and aiding in menu pricing strategy. By incorporating restaurant financial benchmarks and profit margins, you'll enhance your profitability analysis, ensuring informed decisions for long-term success. Streamline your financial modeling for restaurants and optimize your operating expenses with this essential tool.

Business Top Expenses Spreadsheet

The "Top Expenses" section of your trattoria business plan is crucial for outlining annual operating expenses. This pro forma template provides a comprehensive breakdown of costs—including fixed expenses and customer acquisition costs—essential for effective cash flow management. By gaining insights into your spending patterns, you can better control finances and optimize resource allocation. This meticulous financial analysis aids in assessing your trattoria's revenue projections, labor costs, and cost of goods sold, ultimately guiding your menu pricing strategy and enhancing profitability analysis. Understanding these factors is key to achieving a successful financial model and investment return for your restaurant.

TRATTORIA FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive trattoria business plan is essential for forecasting costs and evaluating financial health. Effective financial analysis, including revenue projections and cash flow management, lays the groundwork for securing loans and attracting investors. Utilizing a three-statement model helps assess profitability, allowing for better tracking of restaurant financial ratios and operating expenses. A strategic menu pricing strategy, aligned with expense tracking, identifies potential weaknesses and opportunities, ensuring your trattoria remains competitive. With careful financial modeling and breakeven analysis, you can enhance restaurant profit margins and maximize your investment return, ultimately driving long-term success.

CAPEX Spending

Capital budgeting analysis is crucial for a successful trattoria startup plan. Carefully tracking startup costs, such as capital requirements and operating expenses, ensures effective cash flow management. A comprehensive understanding of these expenses influences accurate financial modeling and investment decisions. By forecasting capital expenditures (CAPEX) and utilizing tools like cash flow charts, restaurateurs can effectively monitor and analyze their financial performance. This diligence enhances menu pricing strategies and supports profitability analysis, ultimately contributing to achieving sustainable profit margins in the competitive Italian restaurant market.

Loan Financing Calculator

The loan amortization schedule within this five-year financial model provides a comprehensive overview of your trattoria's repayment plan. It details periodic payments, breaking down both principal and interest components essential for effective cash flow management. This schedule extends to the loan term’s conclusion, ensuring complete transparency regarding your capital requirements and financial obligations. Utilizing such a robust financial tool not only aids in tracking expenses but also supports key analyses like revenue projections and profitability assessments, ultimately guiding your menu pricing strategy and overall restaurant success.

TRATTORIA INCOME STATEMENT METRICS

Financial KPIs

The gross profit margin is a crucial metric for your trattoria business plan, reflecting financial health and profitability. By dividing gross profit by net sales, this ratio provides insights into your menu pricing strategy and overall operating efficiency. Incorporating this calculation within your Italian restaurant financial analysis allows for effective restaurant cash flow management and expense tracking. Understanding your gross profit margin aids in pinpointing areas for improvement, enhancing profitability analysis for trattoria, and informing strategic decisions to optimize revenue projections and achieve a favorable investment return.

Cash Flow Forecast Excel

When seeking funding for your trattoria, stakeholders such as banks will typically require a detailed five-year financial projection. This business plan should encompass cash flow management, revenue projections, and operating expenses. A robust financial modeling for restaurants, including a breakeven analysis and profitability analysis, demonstrates your trattoria's potential for sustainable growth. Presenting accurate expense tracking and capital requirements will bolster your case, showing lenders that your Italian restaurant can generate sufficient cash flow to meet repayment obligations. Prepare to showcase your restaurant financial statements to highlight your menu pricing strategy and anticipated profit margins.

KPI Benchmarks

The financial benchmarking tab in our trattoria business plan template empowers owners to evaluate key performance indicators (KPIs) against industry standards. By comparing essential metrics like revenue projections, operating expenses, and labor costs, you can identify best practices that enhance efficiency. This benchmarking process is crucial for startups, guiding restaurant financial analysis and helping to optimize menu pricing strategies. Ultimately, leveraging this tool not only aids in profitability analysis and expense tracking but also strengthens restaurant cash flow management and improves overall financial health, ensuring a solid return on investment for your trattoria.

P&L Statement Excel

A well-structured income statement is essential for your trattoria business plan, as it highlights profitability and financial health. Accurate profit and loss forecasting enables effective cash flow management, ensuring labor costs and operating expenses are aligned with revenue projections. Without meticulous financial modeling and expense tracking, even a thriving trattoria risks operating in the dark. Solid restaurant financial statements provide clarity, supporting informed decisions on menu pricing strategy and assessing breakeven analysis. Ensure your trattoria’s investment return and profitability analysis are grounded in real numbers to achieve sustainable success in the competitive Italian restaurant market.

Pro Forma Balance Sheet Template Excel

The projected balance sheet template is essential for any trattoria business plan, detailing both current and long-term assets, liabilities, and equity. It serves as a crucial tool for Italian restaurant financial analysis, enabling accurate calculations of financial ratios and benchmarks. Additionally, the pro forma balance sheet provides insights into capital requirements and supports effective expense tracking. By utilizing this report, trattoria owners can enhance their profitability analysis, manage restaurant cash flow, and optimize their menu pricing strategy, ultimately improving revenue projections and investment returns.

TRATTORIA INCOME STATEMENT VALUATION

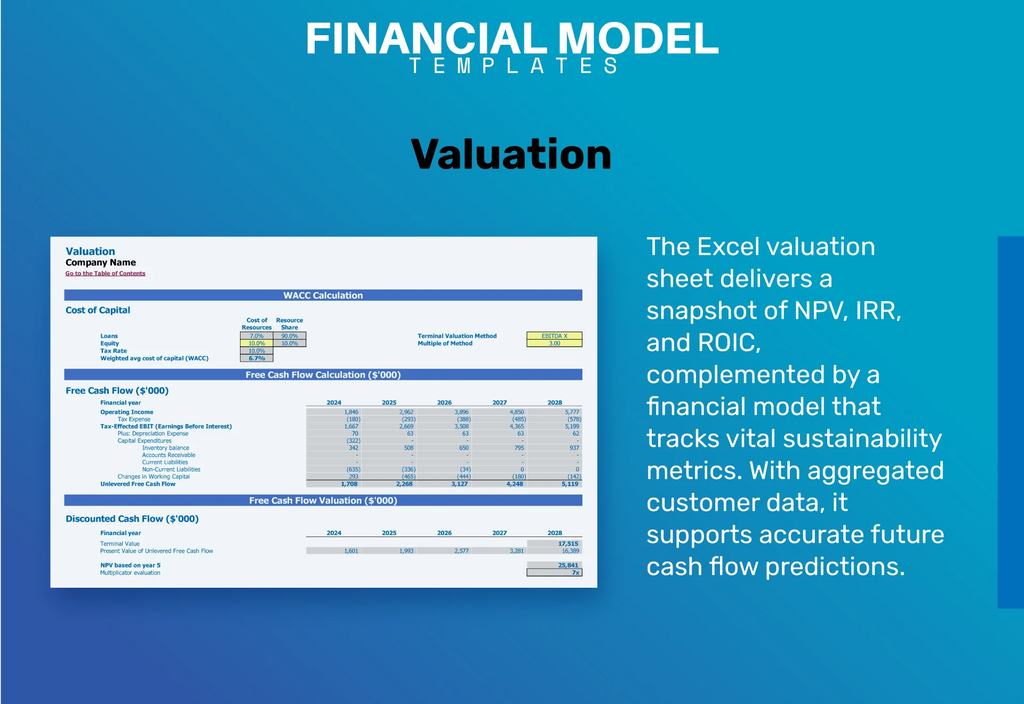

Startup Valuation Model

A comprehensive trattoria business plan requires a rigorous financial analysis, including the Weighted Average Cost of Capital (WACC) and Discounted Cash Flows (DCF). WACC, a key metric, helps assess capital structure through the weighted breakdown of equity and debt, crucial for lenders evaluating loan risks. DCF analysis enables accurate revenue projections and investment assessments by determining future cash flows. Incorporating these financial tools into your trattoria startup costs and expense tracking will enhance your menu pricing strategy and boost profitability while guiding effective cash flow management and understanding profit margins.

Cap Table

A comprehensive financial model is vital for your trattoria's success. Our trattoria business plan includes a cap table template that outlines multiple funding rounds, enabling you to project ownership stakes and assess potential dilution. This tool considers equity shares, preferred shares, and employee stock options, crucial for understanding your trattoria's capital requirements. Additionally, integrating revenue projections, operating expenses, and cash flow management will help optimize your menu pricing strategy and enhance profitability. Effective tracking of financial statements and ratios will drive informed decisions and long-term investment returns for your Italian restaurant.

KEY FEATURES

An integrated financial model for our trattoria ensures clarity on profitability, cash flow, and effective investment returns for stakeholders.

Utilizing a comprehensive financial model enhances strategic insights, ensuring effective cash flow management and accurate revenue projections for your trattoria.

A robust financial model for your trattoria ensures effective cash flow management, maximizing profitability and guiding strategic decision-making.

A robust financial model will help you identify late payments and their impact on your trattoria's cash flow.

A robust financial model for your trattoria ensures accurate revenue projections and effective cash flow management for sustainable growth.

The financial model simplifies trattoria planning, enabling precise revenue projections and effective cash flow management without extensive formulas or consultants.

A robust financial model for your trattoria enables strategic decision-making through accurate revenue projections and cost management insights.

A robust financial model allows trattoria owners to forecast cash flow scenarios, optimizing revenue projections and managing operating expenses effectively.

A comprehensive financial model for your trattoria ensures informed decision-making and attracts investors with clear revenue projections.

The trattoria financial model streamlines your business plan, making it easier to attract investors and secure funding for growth.

ADVANTAGES

A robust financial model enables accurate restaurant sales forecasting and effective cost management for a successful trattoria business plan.

A solid financial model demonstrates your trattoria's profitability potential, ensuring lenders trust your timely repayment ability.

Utilizing a trattoria financial model ensures accurate revenue projections and effective expense tracking to enhance profitability and avoid cash flow issues.

Utilizing a trattoria financial forecast template helps effectively schedule startup loan repayments while optimizing cash flow management and profitability.

A financial model simplifies trattoria business planning by consolidating revenue projections, expenses, and profitability analysis for informed decision-making.