Third Party Logistics Provider Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Third Party Logistics Provider Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

third party logistics provider Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

THIRD PARTY LOGISTICS PROVIDER FINANCIAL MODEL FOR STARTUP INFO

Highlights

When evaluating a third party logistics provider, it's crucial to consider the logistics provider revenue model alongside their operational efficiency in logistics to ensure optimal performance metrics for 3PL. Utilizing effective logistics service pricing strategies can enhance profitability by improving logistics provider profit margins. Furthermore, implementing supply chain finance strategies and analyzing transportation management costs can significantly impact budgeting for third party logistics. This includes conducting a thorough logistics cost analysis, focusing on inventory management costs, and assessing the financial risks in 3PL agreements. By leveraging financial modeling in logistics and performing cost per shipment analysis, businesses can improve cash flow management in logistics, leading to better logistics provider ROI calculations for future investments or negotiations.

This third-party logistics pricing model excels in addressing common pain points faced by logistics providers, particularly concerning profit margins and operational efficiency. By utilizing advanced logistics cost analysis, users can effectively assess transportation management costs and budget for third-party logistics, ensuring a clear understanding of inventory management costs and warehouse management cost structures. The template incorporates performance metrics for 3PL, enhancing contract negotiation logistics and optimizing logistics service pricing strategies. Furthermore, it includes comprehensive financial modeling in logistics, allowing for precise cost per shipment analysis and logistics provider ROI calculations, while also providing insights into cash flow management in logistics to mitigate financial risks in 3PL agreements and enhance overall profitability.

Description

Our Third Party Logistics Provider Excel Financial Model is meticulously crafted to facilitate informed business and financial decisions through precise reporting on logistics provider profit margins and transportation management costs. This model empowers users to project financial outcomes by incorporating dynamic assumptions on revenue, expenses, and initial investments. It distinctly stands out by offering advanced features for logistics cost analysis, such as performance metrics for 3PL and cost per shipment analysis, which enhance the financial modeling in logistics. Additionally, it includes tools for budgeting for third party logistics, evaluating operational efficiency in logistics, and considering the financial risks in 3PL agreements, complete with visuals to track cash flow management in logistics and debt service. The comprehensive design also accommodates inventory management costs and offers insights into contract negotiation logistics, thereby simplifying strategic decision-making for effective supply chain finance strategies.

THIRD PARTY LOGISTICS PROVIDER FINANCIAL MODEL REPORTS

All in One Place

This advanced financial modeling Excel template enhances operational efficiency in logistics by seamlessly streamlining your processes. With straightforward input in designated cells, all formulas across approximately 15 sheets update automatically, providing real-time insights. Track key financial metrics, including logistics provider profit margins and transportation management costs, while maintaining clarity in your assumptions on a single sheet. This powerful tool enables effective budgeting for third party logistics, facilitating informed decision-making and optimizing your logistics service pricing strategies for improved ROI. Leverage this template to navigate the complexities of logistics cost analysis and mitigate financial risks in 3PL agreements.

Dashboard

The financial dashboard in our Excel model serves as a powerful tool for analyzing third-party logistics pricing models and performance metrics for 3PL. This visual summary, presented through charts and graphs, empowers analysts to effectively communicate logistics cost analysis, revenue forecasts, and profit margins. With the capability to dissect key financial metrics over a five-year projection—including pro forma income statements and cash flow management—stakeholders can grasp the financial impact of outsourcing logistics and make informed decisions to enhance operational efficiency in logistics.

Business Financial Statements

Our comprehensive pro forma Excel template empowers business owners to develop crucial financial statements, perform logistics cost analysis, and forecast key metrics. This tool enhances communication with stakeholders by visualizing results through engaging financial graphs and charts. With these insights, you can effectively present your logistics provider revenue model and showcase the operational efficiency in logistics. Additionally, our template assists in budgeting for third party logistics, allowing for informed decision-making in contract negotiations and cash flow management, ultimately driving improved ROI and sustainability in your logistics operations.

Sources And Uses Statement

To optimize cash flow management in logistics, our financial planning model includes a comprehensive sources and uses of funds statement. This tool highlights primary funding sources alongside corresponding expenditure activities, providing invaluable insights for logistics provider revenue models. Start-ups, in particular, can leverage this framework for effective budgeting in third-party logistics and enhance operational efficiency. By employing strategic financial modeling in logistics, businesses can better navigate financial risks in 3PL agreements, ensuring a robust approach to performance metrics and cost per shipment analysis. This ultimately fosters informed decision-making and sustainable growth.

Break Even Point In Sales Dollars

A break-even analysis chart is essential for third party logistics providers to determine the sales volume needed to cover both fixed and variable costs, achieving zero profit. Once revenue surpasses this point, profitability begins. Utilizing a five-year projection plan enables the development of a break-even chart that outlines the minimum service sales required for cost recovery. Additionally, employing break-even formula tools in Excel allows stakeholders to assess the necessary sales volume for return on investment and establish a timeline for financial stability. This strategic approach enhances operational efficiency and informs pricing strategies within the logistics sector.

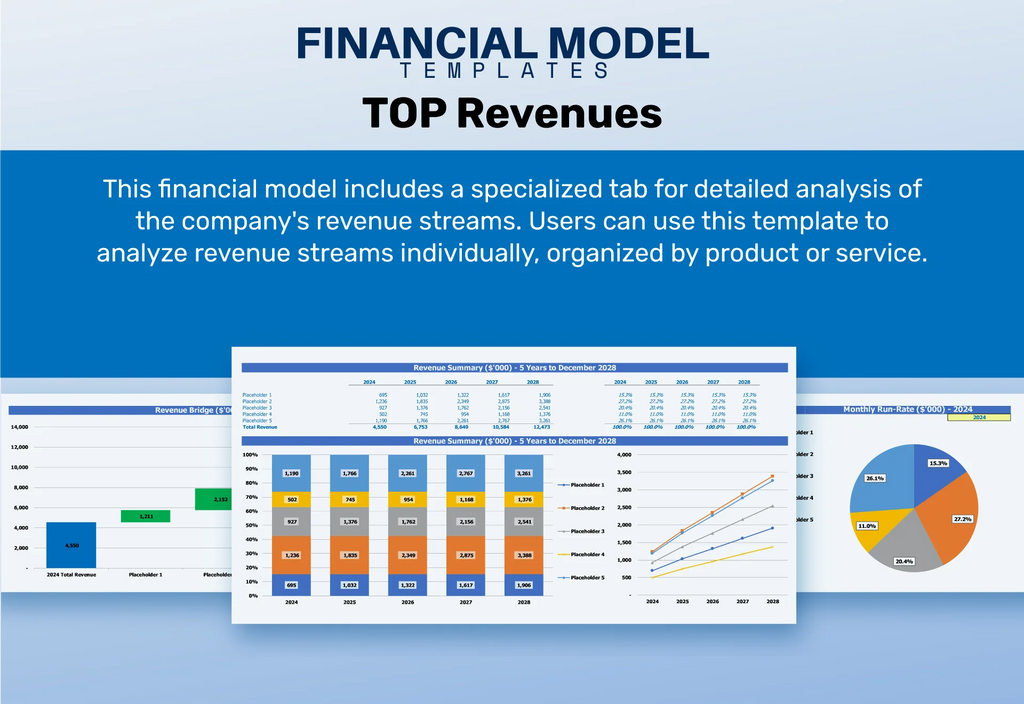

Top Revenue

Effective revenue generation is crucial for sustainable business operations, particularly for logistics providers. In preparing a five-year financial projection, management must accurately forecast future revenues, as they significantly influence the enterprise's value within a 3PL financial model. An imprecise revenue forecast can lead to cascading impacts on overall business financial projections. It’s essential for management and financial analysts to meticulously analyze logistics service pricing strategies and operational efficiency to develop robust revenue models. Utilizing proforma templates aids in projecting revenues by leveraging historical financial data and informed assumptions about growth rates, ultimately enhancing profitability and cash flow management.

Business Top Expenses Spreadsheet

To optimize success, companies must rigorously monitor financial expenditures, particularly in logistics. Implementing a robust financial modeling framework allows businesses to categorize costs—such as transportation management, inventory management, and warehouse operations—into actionable segments. Additionally, employing logistics cost analysis and performance metrics for third-party logistics (3PL) can enhance operational efficiency and boost profit margins. By focusing on cost per shipment analysis and cash flow management, organizations can effectively negotiate contracts and implement supply chain finance strategies, ultimately increasing their return on investment and ensuring long-term profitability in a competitive landscape.

THIRD PARTY LOGISTICS PROVIDER FINANCIAL PROJECTION EXPENSES

Costs

Our Excel financial model template equips users with essential tools for logistics cost analysis and strategic budgeting for third-party logistics (3PL). This comprehensive framework enables businesses to forecast operational expenses, evaluate revenue models, and manage cash flow effectively. By pinpointing financial risks in 3PL agreements and optimizing performance metrics for 3PL, users can enhance operational efficiency and improve profit margins. This budgeting template is vital for entrepreneurs seeking investment or loan support, providing clear insights to address weaknesses and drive business success in logistics management.

CAPEX Spending

Capital expenditures (CapEx) are crucial for long-term growth, encompassing investments in property, plant, and equipment (PPE). Understanding CapEx is essential for logistics providers, as it directly affects operational efficiency and financial health. Our Excel financial model includes a dedicated CapEx tab, aiding in strategic planning and analysis of logistics cost structures. By effectively managing CapEx alongside depreciation and financial reporting, businesses can enhance their supply chain finance strategies and optimize logistics provider profit margins. This approach ensures informed decision-making and a robust logistics service pricing strategy.

Loan Financing Calculator

The loan amortization schedule template is a vital tool in financial modeling for startups. It provides a clear overview of the repayment schedule, detailing periodic payments that include both principal and interest components. This structured visualization is essential for understanding cash flow management in logistics, especially when employing third-party logistics (3PL) providers. By analyzing this schedule, companies can optimize their logistics cost analysis, enhance operational efficiency, and effectively budget for third-party logistics, ensuring that financial risks in 3PL agreements are minimized and profit margins maximized.

THIRD PARTY LOGISTICS PROVIDER EXCEL FINANCIAL MODEL METRICS

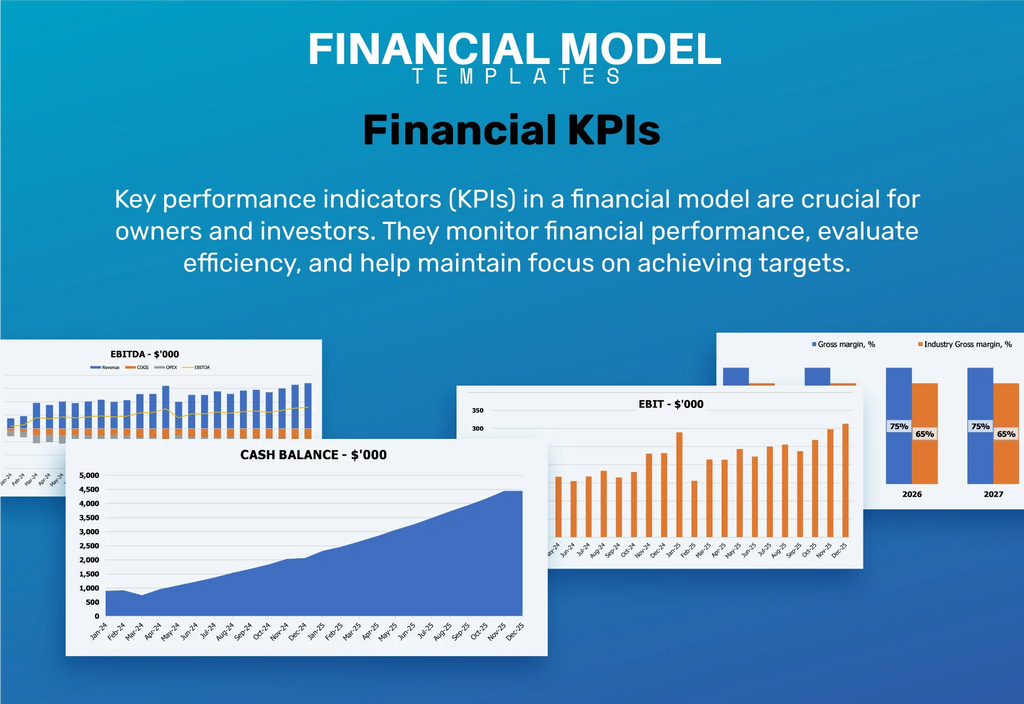

Financial KPIs

In the realm of third-party logistics (3PL), EBIT—earnings before interest and taxes—serves as a crucial profitability metric. By analyzing operating expenses, including logistics costs and transportation management expenses, businesses can accurately assess their true profit-generating potential. This financial modeling not only enhances operational efficiency in logistics but also assists in developing effective logistics service pricing strategies. Understanding EBIT enables logistics providers to make informed decisions during contract negotiations and optimize their revenue model, ultimately improving profit margins and mitigating financial risks in 3PL agreements.

Cash Flow Forecast Excel

A precise operating pro forma cash flow projection is crucial for logistics providers, as it reveals the cash generated from core business operations. This calculation focuses exclusively on revenue from primary activities, excluding secondary income sources like interest or investments. Understanding operational efficiency in logistics is key to evaluating logistics provider profit margins and ensuring effective budgeting for third-party logistics. By leveraging accurate financial modeling in logistics, companies can strengthen their logistics service pricing strategies and enhance cash flow management, ultimately driving profitability and reducing financial risks in 3PL agreements.

KPI Benchmarks

Leverage our comprehensive three-statement financial model template to conduct a precise benchmarking analysis. This tool features a dedicated tab for evaluating key financial metrics within your logistics operations. By comparing your company's performance against industry peers, you can assess operational efficiency, profit margins, and logistics service pricing strategies. This benchmarking process enables you to identify financial risks in 3PL agreements and optimize cash flow management, ultimately enhancing your logistics provider ROI calculations. Stay competitive and elevate your logistics strategy by understanding your standing in the industry.

P&L Statement Excel

Our Proforma Income Statement Excel tool is designed to assist startups in crafting a comprehensive overview of income and expenses. This financial modeling resource enables users to analyze logistics service pricing strategies and assess logistics provider profit margins on a monthly or annual basis. By utilizing this tool, businesses can effectively manage cash flow and evaluate operational efficiency in logistics, ultimately enhancing decision-making around budgeting and financial risks in 3PL agreements. Streamline your logistics cost analysis and drive profitability with our intuitive platform.

Pro Forma Balance Sheet Template Excel

The projected balance sheet serves as a snapshot of a company's assets and liabilities at a specific moment, highlighting its net worth and differentiating between equity and debt. Conversely, the projected income statement outlines operational results over time, providing insights into revenue models and financial performance. Analyzing these financial metrics is crucial for logistics providers to enhance operational efficiency and assess profit margins. By integrating effective budgeting for third-party logistics and employing sound supply chain finance strategies, businesses can better manage logistics costs, optimize cash flow, and mitigate financial risks in their 3PL agreements.

THIRD PARTY LOGISTICS PROVIDER FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive financial template for third party logistics providers equips you with crucial insights for investors. The weighted average cost of capital (WACC) demonstrates the minimum expected return on invested funds, while free cash flow valuation reveals liquidity available to both shareholders and creditors. Additionally, discounted cash flow analysis highlights the present value of future cash flows, essential for informed decision-making. Leverage this tool to enhance logistics cost analysis, optimize budgeting for third party logistics, and support effective contract negotiation, elevating your operational efficiency and overall financial performance.

Cap Table

The equity cap table is an essential component of a feasibility study template for startups and early-stage ventures. It provides a comprehensive overview of the company’s securities, detailing investor shares, value, and potential dilution over time. By integrating this tool, businesses can enhance their financial modeling in logistics, making informed decisions regarding third-party logistics pricing models and budgeting. This clarity aids in contract negotiations, optimizes cash flow management, and assesses the financial risks in 3PL agreements, ultimately driving operational efficiency and improving logistics provider profit margins.

KEY FEATURES

Implementing effective financial modeling in logistics enhances cash flow management, ensuring stability and appealing to external stakeholders like banks.

A robust third party logistics pricing model enhances profit margins while optimizing cash flow management and operational efficiency in logistics.

Implementing a robust logistics provider revenue model enhances operational efficiency and maximizes profit margins in third-party logistics.

Understanding the third party logistics pricing model enhances operational efficiency and boosts logistics provider profit margins for sustainable success.

Implementing a robust logistics provider revenue model enhances trust among stakeholders by ensuring transparency and financial accountability.

A robust financial model enhances transparency, fostering stakeholder confidence and facilitating easier access to investments in third-party logistics.

Implementing a robust logistics provider revenue model enhances operational efficiency and maximizes profit margins in third-party logistics.

Utilizing a sophisticated third-party logistics pricing model ensures reliable financial insights, enhancing operational efficiency and optimizing profit margins.

Implementing a logistics provider revenue model enhances budgeting for third-party logistics, ensuring you track spending and stay within budget effectively.

Utilizing a cash flow analysis template enhances logistics provider profit margins by accurately forecasting future cash inflows and outflows.

ADVANTAGES

An effective financial model enhances cash flow management in logistics, optimizing accounts payable and receivable for improved operational efficiency.

Utilizing a robust financial model enhances forecast accuracy for third-party logistics provider revenues and expenses, maximizing profitability and strategic planning.

Utilizing a robust logistics provider revenue model enhances operational efficiency and boosts profit margins in third-party logistics.

Optimize your logistics costs and enhance cash flow management using a comprehensive third-party logistics pricing model.

Leveraging a robust financial modeling in logistics enhances operational efficiency and boosts logistics provider profit margins significantly.