Tailor Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Tailor Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

tailor Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

TAILOR STARTUP BUDGET INFO

Highlights

This five-year financial model template for tailor businesses is designed for early-stage startups looking to impress investors and secure funding from banks, angel investors, grants, and VC funds. By utilizing advanced financial forecasting tools and comprehensive financial planning techniques, this template enables startups to create accurate cash flow projections and profitability analysis. Entrepreneurs can apply financial modeling best practices, including scenario analysis methods and sensitivity analysis, to assess the impact of varying macro-economic assumptions and modeling assumptions. The template emphasizes the importance of capital expenditure planning and employs valuation methodologies like discounted cash flow analysis to enhance forecasting accuracy and financial performance metrics, ensuring that startups can effectively communicate their financial statement projections and support data-driven decision making.

The ready-made Excel financial model template effectively addresses pain points for users by providing robust financial forecasting tools that enhance forecasting accuracy through comprehensive financial planning. With sophisticated budgeting models and cash flow projections, it empowers users to utilize scenario analysis methods and risk assessment in finance, ensuring that macro-economic assumptions are seamlessly integrated into the model. By adhering to financial modeling best practices and incorporating valuation methodologies, the template enables detailed investment analysis techniques, including discounted cash flow analysis and sensitivity analysis, allowing users to assess profitability and make data-driven decisions. Its structured approach, featuring financial statement projections and capital expenditure planning, not only simplifies variable cost modeling but also helps in tracking financial performance metrics against established goals, making it an invaluable resource for startup financing and operational oversight.

Description

The tailor startup financial model template excels in providing a comprehensive financial planning framework that incorporates various financial forecasting tools to evaluate the business's feasibility. Utilizing budgeting models, it allows for detailed cash flow projections and sensitivity analysis to assess the impact of macro-economic assumptions and changing market trends on profitability. Additionally, investment analysis techniques help create robust financial statement projections, while scenario analysis methods enhance forecasting accuracy by considering different variables. The model incorporates financial modeling best practices, including capital expenditure planning and discount cash flow analysis, ensuring that users can derive insightful risk assessments in finance. With adaptable features for five-year monthly and yearly projections, it facilitates data-driven decision-making and provides essential financial performance metrics and valuations methodologies that banks and investors require for evaluating business viability.

TAILOR FINANCIAL PLAN REPORTS

All in One Place

Concerned about creating a comprehensive five-year forecast for your startup? Fear not! Our expertly designed financial planning template equips you with essential financial forecasting tools and budgeting models. With integrated cash flow projections and scenario analysis methods, you’ll master investment analysis techniques in no time. Benefit from best practices in financial modeling and enhance your forecasting accuracy. This all-in-one solution empowers data-driven decision making, ensuring you stay ahead in capital expenditure planning and risk assessment. Transform your financial statement projections into actionable insights and watch your startup thrive!

Dashboard

A financial projection Excel template serves as a powerful dashboard, enabling professionals to enhance their financial forecasting accuracy. It facilitates comprehensive financial planning by analyzing key performance metrics, cash flow projections, and profitability analysis. With rapid and precise data delivery, this tool aids startups in evaluating their financial health and refining investment analysis techniques. By optimizing capital expenditure planning and employing scenario analysis methods, businesses can make informed, data-driven decisions. Additionally, transparent financial reports foster stronger relationships with stakeholders, ensuring trust and promoting effective collaboration in the competitive business landscape.

Business Financial Statements

This startup financial projection template boasts a comprehensive financial summary that seamlessly integrates key metrics from various spreadsheets, including pro forma balance sheets, profit and loss projections, and cash flow projections. Designed for clarity and precision, this summary is formatted for immediate inclusion in your pitch deck. By utilizing advanced financial forecasting tools and adopting best practices in financial modeling, you’ll enhance your data-driven decision-making process, ensuring your investment analysis techniques are backed by solid financial statement projections and robust scenario analysis methods. Elevate your financial narrative with ease and accuracy.

Sources And Uses Statement

The pro forma cash flow projection, often visualized in a sources and uses template, outlines how a company intends to finance its projects and allocate capital. This essential tool ensures that funding sources align with their corresponding uses, promoting accurate financial modeling. In the Sources section, clearly enumerate funding sources, while the Uses section should detail how these funds will be utilized. A balanced table indicates sufficient capital for current operations, whereas an imbalance signals potential expansion plans or the need for additional equity, aiding in effective financial performance metrics and data-driven decision-making.

Break Even Point In Sales Dollars

Our projected income statement template includes a comprehensive 5-year breakeven analysis, essential for effective capital expenditure planning. By utilizing financial forecasting tools, companies can determine the optimal pricing for their products and services, ensuring revenue covers costs. This strategic approach leverages sensitivity analysis and scenario analysis methods, enhancing forecasting accuracy. Ultimately, this template supports data-driven decision-making and robust financial modeling best practices, empowering businesses to achieve profitability through informed investment analysis techniques.

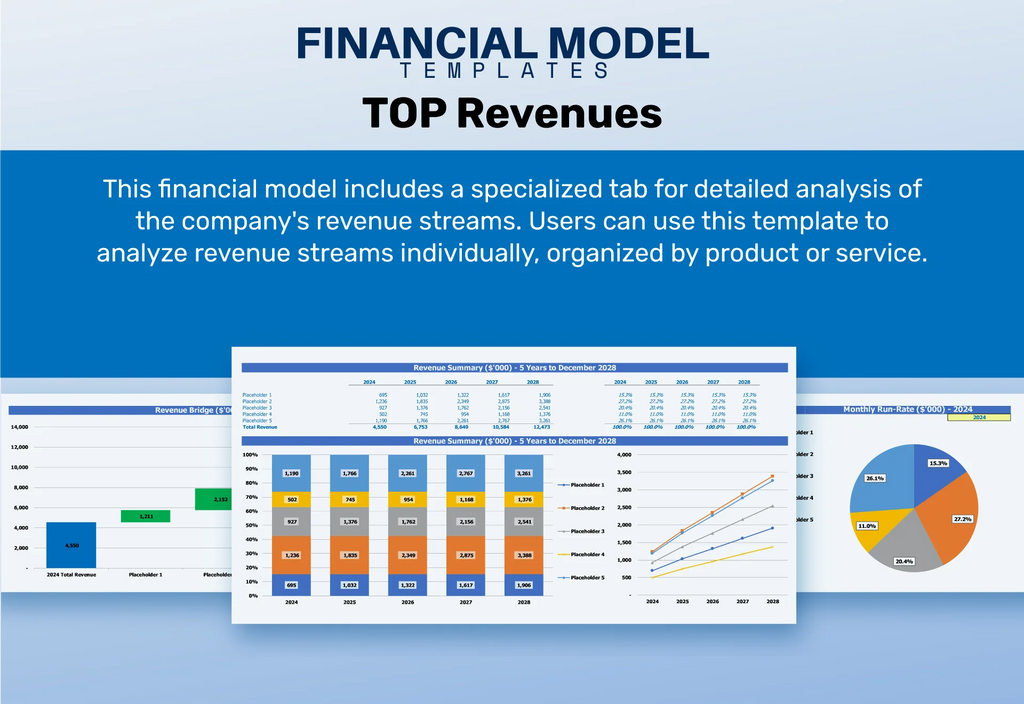

Top Revenue

This financial model template, designed for comprehensive financial planning, features a robust revenue tab that facilitates detailed analysis of your company’s income. Utilizing advanced budgeting models and financial forecasting tools, you can categorize and evaluate revenue generated by each product or service. By integrating investment analysis techniques and cash flow projections, this template empowers data-driven decision-making, ensuring forecasting accuracy and enhancing your financial performance metrics. Embrace effective capital expenditure planning and risk assessment in finance to optimize profitability through informed insights.

Business Top Expenses Spreadsheet

Create a comprehensive financial report using the Top Expenses tab to analyze your firm's operational costs. This internal report breaks down expenses by category, aiding in budgeting models and cash flow projections. By assessing total expenses for a specific period, you can compare actual vs. forecasted spending, enhancing forecasting accuracy. Leverage these insights for scenario analysis methods and sensitivity analysis to identify growth opportunities. Utilize your findings to inform future capital expenditure planning and financial statement projections, driving data-driven decision-making and optimizing overall financial performance metrics.

TAILOR FINANCIAL PROJECTION EXPENSES

Costs

Effortlessly monitor all full-time and part-time employees' salary costs with our streamlined budgeting model. This intuitive tool seamlessly integrates with your comprehensive financial planning, enhancing forecasting accuracy across financial statement projections. By employing our financial forecasting tools, you can gain valuable insights into cash flow projections and capital expenditure planning. Leverage investment analysis techniques and scenario analysis methods to optimize your financial performance metrics, ensuring that your team makes data-driven decisions that align with modeling assumptions and macro-economic factors for sustained profitability. Experience the power of effective financial modeling best practices today.

CAPEX Spending

CAPEX start-up costs encompass essential expenditures for acquiring assets vital to a firm's success. These significant investments must be reflected in the projected balance sheet, as they play a crucial role in operational enhancement. Typically allocated to upgrading technology and equipment, these costs not only feature in the Profit and Loss statement but also significantly impact cash flow projections. By incorporating robust financial forecasting tools and comprehensive financial planning, businesses can effectively assess these capital expenditures, ensuring better risk assessment and improved forecasting accuracy for long-term profitability.

Loan Financing Calculator

A loan amortization schedule is a crucial component of comprehensive financial planning, detailing a company's commitment to repayment. This innovative startup financial plan incorporates an intuitive loan amortization schedule, equipped with automated formulas for enhanced usability. It specifies repayment dates, installment amounts, and the allocation between principal and interest. Additionally, it outlines key loan terms, including duration, interest rates, and repayment frequency. By integrating this schedule, businesses enhance forecasting accuracy and strengthen their budgeting models, laying a solid foundation for effective cash flow projections and capital expenditure planning.

TAILOR INCOME STATEMENT METRICS

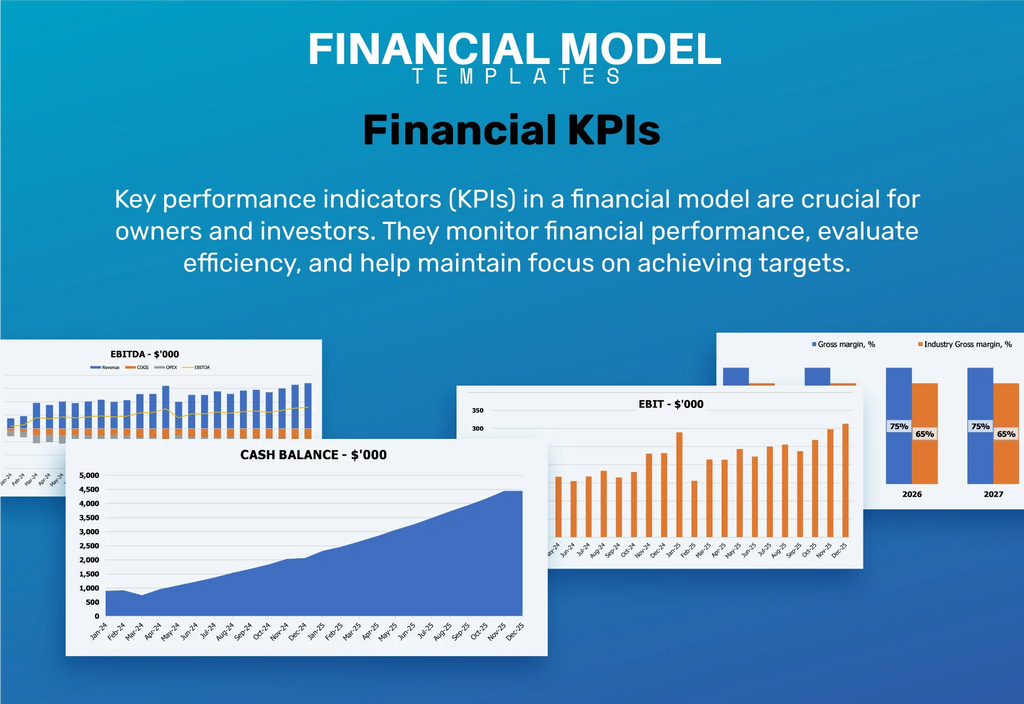

Financial KPIs

The return on capital is a crucial metric that illustrates the expected balance sheet alignment for startups, alongside the profit and loss statement. It effectively measures returns relative to capital employed, underscoring the importance of sound financial management. By leveraging financial forecasting tools and conducting thorough investment analysis techniques, businesses can enhance their profitability analysis and drive data-driven decision making. Employing effective budgeting models and cash flow projections ensures comprehensive financial planning, ultimately leading to improved forecasting accuracy and robust financial performance metrics. Fostering these practices yields substantial benefits for organizations.

Cash Flow Forecast Excel

An Excel cash flow statement provides a comprehensive view of your business's cash utilization over a specified period. It meticulously details all cash inflows and outflows, making it an essential tool for effective financial forecasting. By integrating this statement with budgeting models and investment analysis techniques, you can enhance the accuracy of your cash flow projections. This data-driven approach supports robust scenario analysis methods and ensures sound capital expenditure planning, ultimately facilitating better financial performance metrics and strategic decision-making for sustained profitability.

KPI Benchmarks

A financial projection serves as a proforma that incorporates an industry analysis, allowing for a comprehensive evaluation through the comparison of key financial performance metrics and indicators. By utilizing effective financial forecasting tools and benchmarking against industry standards, companies can gain invaluable insights into their competitive positioning. This objective assessment fosters data-driven decision-making, enabling businesses to refine their budgeting models, enhance profitability analysis, and improve forecasting accuracy for future cash flow projections. Ultimately, this strategic approach to benchmarking empowers organizations to optimize financial outcomes and capitalize on investment opportunities.

P&L Statement Excel

Utilizing a pro forma profit and loss statement is essential for any business aiming for profitability. This sophisticated budgeting model forecasts potential earnings and losses, making it invaluable for startups focused on future financial success. Additionally, this forecasting tool compiles an annual report based on comprehensive financial planning and macro-economic assumptions, ensuring that no detail is overlooked. By analyzing cash flow projections and applying sensitivity analysis, you’ll gain clarity on your after-tax balance and net profit, enabling data-driven decision-making for sustainable growth. Invest in your financial modeling best practices to enhance forecasting accuracy and performance metrics.

Pro Forma Balance Sheet Template Excel

The projected balance sheet template in Excel serves as a crucial tool for financial forecasting, encapsulating a startup's assets, liabilities, and shareholders' equity at a specific moment. This point-in-time report empowers users to conduct comprehensive financial planning, leveraging budgeting models and cash flow projections to visualize the company's financial health. By understanding what the business owes and owns, stakeholders can make data-driven decisions, enhance forecasting accuracy, and apply investment analysis techniques, ensuring effective capital expenditure planning and a clear financial performance metric overview. This template is vital for informed financial modeling and strategic growth initiatives.

TAILOR INCOME STATEMENT VALUATION

Startup Valuation Model

Our comprehensive financial planning template equips you with essential valuation methodologies for your business plan's financial projections. Stakeholders will appreciate insights like the weighted average cost of capital (WACC), which indicates the minimum return on invested capital. Additionally, our free cash flow analysis demonstrates cash available to all investors, including shareholders and creditors. By employing discounted cash flow analysis, you can effectively convey the present value of future cash flows, enhancing forecasting accuracy and supporting data-driven decision making. Elevate your investment analysis with our robust financial modeling best practices and scenario analysis methods.

Cap Table

The simple cap table serves as an invaluable financial forecasting tool, encapsulating four rounds of financing to analyze the effects of investor shares on company earnings. By providing detailed insights after each funding round, it aids in comprehensive financial planning and investment analysis techniques. This cap table not only reflects changes in equity but also enhances forecasting accuracy, empowering stakeholders to make data-driven decisions. Utilizing such modeling assumptions and scenario analysis methods, companies can effectively manage capital expenditure planning and assess financial performance metrics to optimize profitability.

KEY FEATURES

Robust **financial modeling best practices** enhance **forecasting accuracy**, enabling **data-driven decision making** for improved **financial performance metrics**.

Structured financial modeling best practices enhance forecasting accuracy and enable data-driven decision-making for improved investment analysis and planning.

Implementing cash flow projections enhances forecasting accuracy, allowing businesses to identify potential shortfalls in cash balances proactively.

The tailored P&L template enhances forecasting accuracy, acting as an 'early warning system' for effective cash flow management.

Comprehensive financial planning enhances forecasting accuracy, enabling data-driven decision-making through effective budgeting models and investment analysis techniques.

Our Excel template streamlines financial modeling, enabling efficient reports and calculations that meet lender requirements effortlessly.

Utilizing robust financial forecasting tools enhances forecasting accuracy, empowering data-driven decision making for sustainable growth and profitability.

Utilizing scenario analysis methods and cash flow projections empowers your business to identify optimal growth strategies and funding opportunities.

Utilizing advanced financial forecasting tools enhances forecasting accuracy, enabling data-driven decision making for comprehensive financial planning and investment analysis.

Effective financial modeling best practices enhance forecasting accuracy, enabling data-driven decision making and robust capital expenditure planning for sustainable growth.

ADVANTAGES

A robust 5-year financial model enhances forecasting accuracy and supports data-driven decision making for startup cost assumptions.

Unlock new opportunities with tailored financial forecasting tools that enhance accuracy and drive data-driven decision making for better outcomes.

Utilizing comprehensive financial planning and cash flow projections enhances forecasting accuracy, attracting top talent to your startup.

Utilizing advanced financial forecasting tools enhances budgeting accuracy and supports strategic decision-making for future expenses.

Profit loss projections enhance forecasting accuracy, allowing proactive identification of potential financial challenges and enabling informed decision-making.