Sushi Restaurant Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Sushi Restaurant Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

sushi restaurant Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SUSHI RESTAURANT FEASIBILITY STUDY INFO

Highlights

When developing a sushi restaurant business plan, it is crucial to incorporate detailed sushi restaurant revenue projections and cost structure to ensure a thorough profitability analysis. Creating a comprehensive overview of sushi restaurant startup costs, including operating expenses and overhead costs, will aid in effective cash flow forecasting. Implementing a strategic menu pricing strategy and conducting a market analysis will support sales forecasting and investment analysis. Additionally, understanding financial statements and utilizing break-even analysis will provide insights into financial ratios and performance metrics, ultimately guiding funding options and expense management to meet capital requirements. This structured approach ensures a well-rounded financial projection, enhancing the chances of success for your sushi restaurant venture.

The sushi restaurant financial model in Excel addresses critical pain points for potential buyers by offering a comprehensive solution for managing startup costs, operating expenses, and overhead costs, all while providing detailed revenue projections and sales forecasting. This adaptable template includes essential tools for profitability analysis, such as break-even analysis and cash flow forecasting, enabling users to anticipate capital requirements and investment needs effectively. With a robust menu pricing strategy and expense management features, users can ensure competitive positioning and maximize margins. Furthermore, the automatic updates to financial statements and performance metrics allow for real-time monitoring of financial ratios, making it easier to assess funding options and make informed decisions about future growth.

Description

The sushi restaurant financial model is a comprehensive tool designed to facilitate informed operational and financial decisions through precise reporting. This Excel-based template offers forecasts for revenue and expenses spanning up to 60 months, incorporating essential financial statements such as profit and loss projections, cash flow analyses, and balance sheet forecasts on both a monthly and annual basis. Additionally, it encompasses sales forecasting, market analysis, and profitability assessments, alongside expense management tools that help in effectively analyzing the sushi restaurant cost structure. The model also explores various funding options, including equity investments, while providing insights into break-even analysis and capital requirements, making it accessible for users without advanced finance skills to successfully manage their sushi restaurant business plan.

SUSHI RESTAURANT FINANCIAL PLAN REPORTS

All in One Place

To grasp the full scope of your sushi restaurant business, utilize a comprehensive five-year cash flow projection template. This tool provides essential insights into revenue projections and cost structures, aiding in profitability analysis. By evaluating operating expenses and capital requirements, entrepreneurs can develop an effective pricing model and make informed decisions on funding options. With precise cash flow forecasting, owners can enhance expense management while ensuring sustainable growth. Ultimately, these financial projections will empower you to analyze performance metrics and gauge your restaurant's viability in a competitive market.

Dashboard

The comprehensive dashboard in this sushi restaurant business plan consolidates essential financial inputs and startup metrics vital for robust financial analysis. It integrates data from financial statements, including the Balance Sheet and profit and loss statement, along with a detailed monthly cash flow forecast. Users can easily visualize key financial information through intuitive graphs and charts, facilitating sushi restaurant revenue projections, expense management, and profitability analysis. This powerful tool aids in strategic decision-making, enhancing performance metrics and ensuring sustainable growth in a competitive market.

Business Financial Statements

This sushi restaurant financial model template serves as an essential tool for effective financial planning. It includes comprehensive proformas for key financial statements, enabling owners to analyze revenue projections, operating expenses, and cash flow forecasting. Through detailed profitability analysis and break-even assessments, entrepreneurs can develop a robust sushi restaurant business plan. Additionally, it aids in determining startup costs, capital requirements, and funding options, ensuring informed decision-making. With a focus on expense management and performance metrics, this template creates a solid foundation for assessing your restaurant's financial health and long-term success.

Sources And Uses Statement

A sushi restaurant's sources and uses of capital statement is essential for stakeholders, outlining financing strategies and capital allocation. The funds sourced must equal or exceed their intended uses. In the Sources section, detail funding avenues such as loans or investments, while the Uses section should itemize expenses like startup costs and operating expenses. A balanced or surplus Sources section suggests potential business expansion or reinvestment options. Conversely, if Uses surpass Sources, additional equity may be needed. This clarity fosters sound financial management, aiding in revenue projections and overall profitability analysis for the sushi restaurant.

Break Even Point In Sales Dollars

A break-even analysis is essential for a sushi restaurant business plan, assessing the sales volume needed to cover fixed and variable costs. This financial model assists in pinpointing the timeline for potential profitability. It provides valuable insights for owners considering startup viability and aids managers in devising an effective menu pricing strategy. By understanding the break-even point, sushi restaurant operators can make informed decisions about cost structure, pricing models, and overall financial projections, ensuring sustainable operations and profitability. Such analysis is crucial for securing funding options and managing expenses effectively.

Top Revenue

In the sushi restaurant business plan, understanding top-line and bottom-line metrics is vital for success. The top line reflects total revenues, indicating sales growth, while the bottom line reveals net income, highlighting profitability after accounting for operating expenses. Investors focus on these trends to assess financial health. Effective sushi restaurant revenue projections and cost structures facilitate accurate cash flow forecasting and break-even analysis. By implementing a strategic menu pricing model and careful expense management, restaurateurs can enhance financial statements and achieve robust profitability, securing funding options for future growth.

Business Top Expenses Spreadsheet

To achieve success in the sushi restaurant business, meticulous monitoring of financial costs is crucial. Utilizing a five-year forecast template, expenses are categorized to facilitate clear analysis, including a section for miscellaneous costs. This structure not only aids in expense management but also enhances cash flow forecasting and profitability analysis. Effective cost control directly contributes to increased profitability, enabling the restaurant to maximize financial performance and bonuses. By implementing strategic oversight of startup costs and operating expenses, sushi restaurant owners can better position themselves for sustained growth and success within the competitive market.

SUSHI RESTAURANT FINANCIAL PROJECTION EXPENSES

Costs

An effective sushi restaurant business plan hinges on a robust financial model. Utilizing a comprehensive Excel template can streamline your sushi restaurant revenue projections and expense management. This tool not only clarifies your sushi restaurant cost structure but also enhances cash flow forecasting and break-even analysis. By organizing your financial statements and capital requirements, you improve communication with investors and creditors. Ultimately, this sushi restaurant financial model equips you with essential performance metrics and pricing strategies, ensuring your venture is poised for profitability and long-term success.

CAPEX Spending

In a sushi restaurant business plan, capital expenditures represent significant startup costs, encompassing property, equipment, and fixtures. These assets have a defined lifespan, leading to depreciation, which impacts financial statements and profitability analysis. A robust capital budgeting analysis is crucial for forecasting sushi restaurant revenue projections and cash flow. By strategically managing these expenditures, the restaurant can enhance performance metrics and effectively utilize funding options. Integrating insights from expense management and operating expenses will aid in developing a sustainable pricing model, ensuring long-term profitability and success in the competitive sushi market.

Loan Financing Calculator

Our financial model for the sushi restaurant incorporates a comprehensive loan amortization schedule, detailing repayment timelines. This template highlights principal and interest breakdowns for each installment, whether monthly, quarterly, or annually. By integrating this approach into our sushi restaurant business plan, we ensure precise cash flow forecasting and expense management. The structure supports effective analysis of startup costs, operating expenses, and overall financial projections, enhancing our profitability analysis and investment outlook. This robust financial framework is vital for sustainable growth and successful performance metrics in the competitive sushi restaurant landscape.

SUSHI RESTAURANT PROFIT MARGINS METRICS

Financial KPIs

Utilizing a comprehensive sushi restaurant business plan, you can effectively visualize key financial indicators (KPIs) over five years. This startup financial projection template includes critical metrics such as EBITDA/EBIT to assess operating performance, cash flow forecasting for tracking inflows and outflows, and projected cash balance to understand liquidity. Additionally, conducting a thorough sushi restaurant profitability analysis, market analysis, and expense management will enhance your menu pricing strategy. By analyzing your sushi restaurant’s financial statements and employing a robust investment analysis, you can ensure sustainable growth and profitability.

Cash Flow Forecast Excel

Our sushi restaurant business plan includes an innovative cash flow pro forma template, enabling precise forecasts of future financial performance. This tool is essential for determining loan requirements and capital needs, ensuring your investment analysis is robust. Effective planning and diligent tracking of financial statements—including revenue projections, operating expenses, and profitability analysis—are crucial for any startup. By implementing a comprehensive expense management strategy and evaluating your pricing model, you can optimize profitability. Ultimately, thorough financial projections and performance metrics will guide your sushi restaurant towards sustainable growth and success.

KPI Benchmarks

Unlock your sushi restaurant's potential with our comprehensive financial benchmarking analysis. Utilize our pro forma template to streamline your sushi restaurant business plan, facilitating insightful comparisons of revenue projections, cost structures, and profitability analysis against industry peers. This essential tool aids in cash flow forecasting, expense management, and investment analysis, empowering you to identify performance metrics and enhance your menu pricing strategy. For startups, understanding your financial ratios and capital requirements in relation to others in the market is crucial for achieving a competitive edge and closing performance gaps effectively.

P&L Statement Excel

The Profit and Loss Statement is crucial for your sushi restaurant business plan, showcasing sales across primary revenue streams and key expense categories. This financial statement enables stakeholders to evaluate profitability, assess income and expense structure, and determine loan repayment capabilities. Utilizing this template for cash flow forecasting enhances your ability to conduct profitability analysis and build accurate sushi restaurant revenue projections. Additionally, it supports effective expense management and informs your pricing strategy, ensuring a clear understanding of capital requirements and financial performance metrics for future growth.

Pro Forma Balance Sheet Template Excel

The comprehensive financial model integrates monthly and yearly projected balance sheets over five years, linking key statements such as cash flow, pro forma income, and essential inputs. This three-way structure offers a holistic view of your sushi restaurant business plan, detailing assets, liabilities, and equity. By utilizing this model, you can effectively assess revenue projections, analyze costs, and refine your pricing strategy, ensuring informed decisions for optimal profitability and sustainable growth in the competitive sushi restaurant market.

SUSHI RESTAURANT PROFIT MARGINS VALUATION

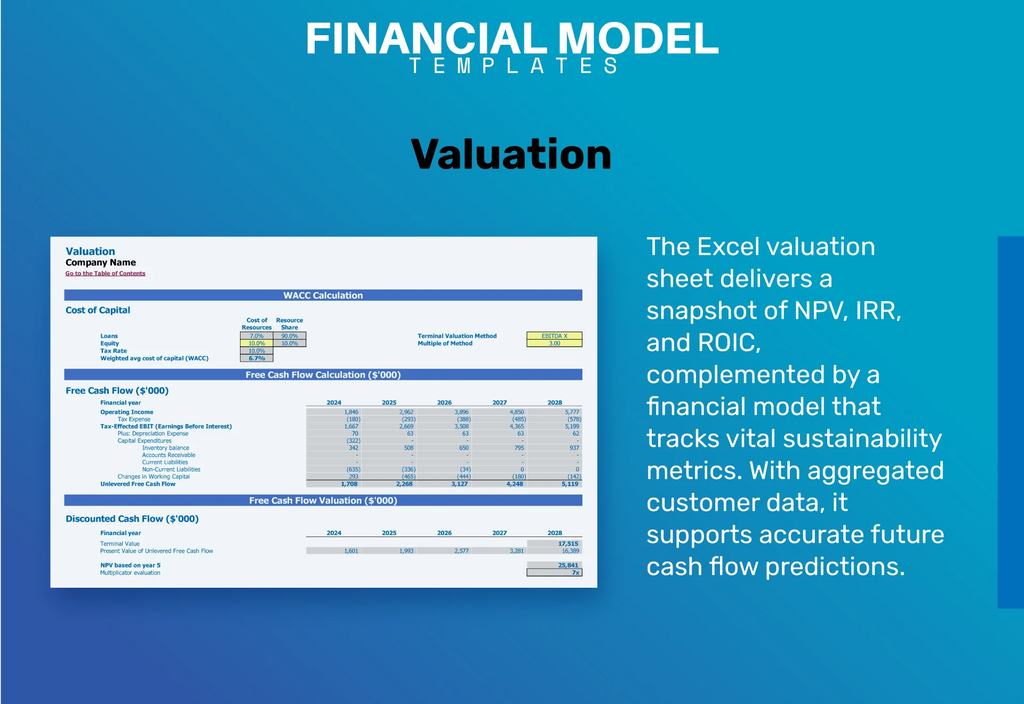

Startup Valuation Model

This sushi restaurant financial model includes a comprehensive valuation analysis template designed for precise Discounted Cash Flow (DCF) valuation. It empowers users to conduct in-depth evaluations of financial metrics such as residual value, replacement costs, and market comparables. Additionally, the model facilitates a thorough examination of sushi restaurant revenue projections, cash flow forecasting, and expense management strategies. By leveraging this tool, operators can enhance their sushi restaurant business plan, ensuring informed decisions on pricing strategies, startup costs, and funding options for optimal profitability and sustainable growth.

Cap Table

Our comprehensive five-year sushi restaurant business plan features a detailed cap table that outlines four rounds of financing. This essential tool illustrates how shares allocated to new investors influence overall investment income. Following each financing round, the cap table clearly presents the ownership structure and highlights percentage changes, including dilution effects. By integrating this analysis with our sushi restaurant revenue projections and profitability analysis, stakeholders can better understand the financial landscape and make informed decisions regarding funding options and capital requirements.

KEY FEATURES

A robust financial model ensures accurate revenue projections and effective expense management for your sushi restaurant's success.

Our comprehensive financial model empowers sushi restaurant entrepreneurs to optimize profitability and strategize effectively for long-term success.

A robust sushi restaurant financial model enhances decision-making through precise revenue projections and effective expense management strategies.

This financial model streamlines sushi restaurant revenue projections and cash flow forecasting, ensuring informed decision-making for sustainable growth.

A comprehensive sushi restaurant financial model streamlines decision-making by providing clear revenue projections and expense management insights.

A robust financial model streamlines cash flow forecasting, enabling sushi restaurant owners to focus on product quality and customer engagement.

A robust financial model for your sushi restaurant ensures accurate revenue projections and effective expense management for long-term profitability.

A comprehensive sushi restaurant financial model enables accurate revenue projections and informed decision-making for sustainable profitability.

A comprehensive sushi restaurant business plan ensures sustainable profitability through effective financial projections and expense management.

Effective cash flow forecasting empowers your sushi restaurant to preemptively address financial gaps and drive sustainable growth.

ADVANTAGES

A robust financial model empowers your sushi restaurant to optimize revenue projections and streamline operating expenses effectively.

A robust financial model helps sushi restaurant owners accurately track expenses and optimize revenue projections for successful operations.

The sushi restaurant startup financial plan effectively forecasts cash gaps, ensuring informed decisions for sustainable growth and profitability.

A robust financial model streamlines sushi restaurant revenue projections and expense management, enhancing profitability and informed decision-making.

A comprehensive sushi restaurant financial model reveals crucial insights into cash flow, enhancing decision-making and profitability analysis.