Supply Chain Management Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Supply Chain Management Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

supply chain management Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SUPPLY CHAIN MANAGEMENT FINANCIAL MODEL FOR STARTUP INFO

Highlights

This highly versatile and user-friendly supply chain management business projection template is designed for effective financial forecasting, enabling users to create a detailed forecasted profit and loss statement, cash flow projection, and balance sheet with both monthly and annual timelines. Suitable for startups or established supply chain management businesses, this template integrates various components such as inventory management models, demand planning, and cost optimization strategies to enhance operational efficiency. Users can leverage performance metrics and scenario analysis to drive better procurement strategies and risk management in their supply chains, ultimately improving supply chain visibility and strengthening supplier relationship management. Consider utilizing this comprehensive financial planning tool before making investment decisions in your supply chain management endeavors, as it provides a foundation for analyzing transportation costs and working capital management while promoting sustainability in supply chains.

The ready-made financial model excels at alleviating pain points by incorporating advanced supply chain analytics and integrated supply chain strategies that enhance demand planning and operational efficiency, thus streamlining inventory management models and logistics optimization. It offers detailed cash flow analysis and working capital management insights, facilitating effective cost optimization strategies and procurement strategies that improve overall financial performance metrics. Additionally, scenario analysis features enable users to assess risk management in supply chains while enhancing supplier relationship management and ensuring high supply chain visibility, ultimately leading to more accurate financial forecasting and intensified transportation cost analysis, all through a user-friendly interface that requires no ongoing commitments.

Description

Our supply chain analytics financial model integrates key components such as demand planning, inventory management models, and operational efficiency to facilitate effective financial forecasting and performance metrics analysis. Users can leverage scenario analysis and procurement strategies to optimize working capital management while enhancing supply chain visibility. The model includes comprehensive cash flow analysis, transportation cost analysis, and cost optimization strategies, ensuring a robust understanding of financial performance metrics related to supplier relationship management and logistics optimization. Additionally, it accounts for project valuation, startup costs, and dynamic variables to support informed decision-making through sustainability in supply chains and risk management in supply chains.

SUPPLY CHAIN MANAGEMENT FINANCIAL MODEL REPORTS

All in One Place

Elevate your supply chain management with our robust financial model, designed to adapt to future expansions. Our five-year financial projection incorporates essential elements such as demand planning, risk management in supply chains, and cost optimization strategies. Each assumption is rigorously tested through comprehensive scenario analysis to ensure resilience and scalability. Tailored to the unique needs of your business, our integrated supply chain financial model empowers you to enhance operational efficiency and performance metrics, ultimately driving financial performance and sustainability. Experience unmatched supply chain visibility and working capital management with our customizable template.

Dashboard

Unlock the potential of your financial forecasting with our advanced projections template. This invaluable tool streamlines cash flow analysis while ensuring a precise pro forma balance sheet. Users can effortlessly access detailed breakdowns across any timeframe—monthly or annually. The integrated dashboard offers supply chain visibility through summarized data, presented in both numerical and graphical formats. Enhance your decision-making with insights into inventory management models and operational efficiency, ultimately driving improved financial performance metrics and cost optimization strategies. Embrace data-driven planning for a sustainable and integrated supply chain.

Business Financial Statements

Understanding the interplay between financial reporting templates is crucial for comprehensive performance analysis. The forecasted income statement offers valuable insights into operational efficiency and core revenue-generating activities. Additionally, the pro forma balance sheet and cash flow projections provide a focused view on working capital management, highlighting asset structure and liquidity. By integrating these financial forecasting tools, companies can optimize procurement strategies, enhance supply chain visibility, and implement effective risk management in supply chains, ultimately driving improved financial performance metrics and sustainability in operations.

Sources And Uses Statement

Effective financial forecasting plays a crucial role in supply chain analytics, enabling businesses to enhance operational efficiency and risk management. By utilizing an integrated supply chain approach, organizations can develop an inventory management model that identifies funding sources and outlines significant expenditure areas. This comprehensive financial model not only highlights transportation cost analysis and working capital management but also incorporates performance metrics to optimize procurement strategies. Ultimately, scenario analysis contributes to improved cash flow analysis and sustainable practices, ensuring a robust foundation for planning and execution in demand planning and production planning.

Break Even Point In Sales Dollars

A CVP (Cost-Volume-Profit) graph analyzes the sales volume required for a company to break even, covering both fixed and variable costs. This crucial financial forecasting tool enables businesses to pinpoint their profitability timeline. By calculating the break-even point in dollars, financial specialists assess the viability of new ventures and inform pricing strategies. This insight empowers management in inventory management and demand planning, ensuring that operational efficiency and cost optimization strategies align with financial performance metrics. Ultimately, CVP analysis enhances supply chain visibility and supports sustainable supplier relationship management.

Top Revenue

Effective revenue generation is crucial for sustainable business success. Management must utilize financial forecasting within an integrated supply chain model to project future revenues accurately, ensuring robust performance metrics. An imprecise revenue forecast can compromise various elements of the business plan. Therefore, financial analysts should prioritize meticulous planning and employ scenario analysis in their inventory management model and demand planning strategies. By leveraging historical financial data, companies can enhance working capital management, optimize costs, and improve operational efficiency, ultimately driving financial performance and strengthening supplier relationships in the logistics optimization process.

Business Top Expenses Spreadsheet

Effective revenue generation is crucial for sustainable business growth. Management must focus on precise financial forecasting when preparing pro forma financial statements. Accurate revenue projections are vital, as they influence the entire integrated supply chain model. Misestimations can significantly derail five-year forecasts. Utilizing scenario analysis and performance metrics, management and financial analysts can refine their strategies, ensuring optimal operational efficiency. By leveraging historical data and incorporating best practices in demand planning and inventory management, companies can enhance cash flow and strengthen supplier relationship management, ultimately driving financial performance and long-term resilience.

SUPPLY CHAIN MANAGEMENT FINANCIAL PROJECTION EXPENSES

Costs

Our five-year projection plan enhances financial forecasting by enabling businesses to budget expenses and visualize cost changes over time. Utilizing key metrics like income percentages, recurring costs, and payroll, it categorizes expenses into fixed and variable classes, including wages, COGS, and capital expenditures. This comprehensive financial tool not only supports demand planning and working capital management but also aids in operational efficiency and risk management in supply chains. With our model, businesses can effectively navigate financial uncertainties and optimize their overall performance, ensuring sustainable growth and profitability.

CAPEX Spending

The CAPEX budget serves as a vital tool for understanding and forecasting capital expenditures, credit costs, and initial startup investments. By integrating supply chain analytics with financial forecasting, businesses can enhance their inventory management model and optimize procurement strategies. This approach not only boosts operational efficiency but also supports effective risk management in supply chains. Leveraging performance metrics and scenario analysis, organizations can ensure sustainable growth while maintaining cash flow analysis for better financial performance. Ultimately, a well-structured CAPEX budget aids in aligning financial goals with strategic planning for enhanced supply chain visibility and cost optimization.

Loan Financing Calculator

Similar to the structured approach of a financial forecasting model, loan amortization involves systematically spreading repayment over a specified duration, encompassing multiple reporting periods. This process typically entails fixed, periodic payments—often monthly—allowing for effective working capital management. Organizations can integrate this model with supply chain analytics to enhance cash flow analysis and operational efficiency. By aligning payment schedules with demand planning and inventory management models, businesses can optimize their financial performance metrics and maintain robust supplier relationship management while mitigating risks in their supply chains.

SUPPLY CHAIN MANAGEMENT EXCEL FINANCIAL MODEL METRICS

Financial KPIs

In developing your Excel financial model, focus on return on investment (ROI) as a crucial performance metric for assessing profitability. ROI, a key indicator in financial forecasting, measures the ratio of cash inflows to outflows stemming from business investments. By calculating ROI—dividing net investment gains by total investment costs—you gain valuable insights into financial performance metrics. This analysis not only enhances operational efficiency but also informs demand planning, cost optimization strategies, and risk management in supply chains, ensuring that your integrated supply chain thrives.

Cash Flow Forecast Excel

Our cash flow statement template is a vital tool for assessing your business’s financial health and liquidity. It enables you to track and analyze cash flows, integrating key metrics like payable and receivable days, yearly income, and working capital. This streamlined approach enhances financial forecasting and supports effective cash flow analysis. By utilizing performance metrics and scenario analysis, you can improve operational efficiency and informed decision-making. This template not only aids in managing cash flow but also enhances visibility across your integrated supply chain, ensuring optimal procurement strategies and cost optimization.

KPI Benchmarks

The benchmarking tab is a vital component of our three-statement financial model template, facilitating in-depth supply chain analytics. It calculates essential industry and financial metrics, enabling you to gauge your company's performance against peers. By leveraging these benchmarks, you can identify areas for improvement in operational efficiency and cost optimization strategies. This insight also enhances demand planning and supplier relationship management, ultimately driving better financial performance metrics. Stay ahead in the market by analyzing successful companies and refining your strategy with this comprehensive risk management tool.

P&L Statement Excel

The Monthly Income Statement within our three-statement financial model provides essential reporting and insights. It offers a comprehensive forecast for revenue streams, linking gross and net earnings with cash flow analysis for precise financial performance metrics. Additionally, the Yearly Profit and Loss Statement template offers a detailed overview of revenue, general and administrative expenses, and incorporates critical elements like graphs, assumptions, ratios, and margins. By leveraging this integrated supply chain analysis, organizations can enhance operational efficiency, implement cost optimization strategies, and improve demand planning and performance metrics for better financial forecasting and sustainability in supply chains.

Pro Forma Balance Sheet Template Excel

The balance sheet forecast offers a vital snapshot of a company's financial health at a specific moment. This report allows stakeholders to assess assets, liabilities, and equities effectively. When combined with the profit and loss (P&L) forecast, it unveils the investments necessary to achieve targeted sales and profits. Integrating this financial forecasting within an Excel model enhances supply chain visibility and supports informed decisions in inventory management and cost optimization strategies. Ultimately, this comprehensive approach helps prepare the organization for anticipated revenues and bolsters operational efficiency.

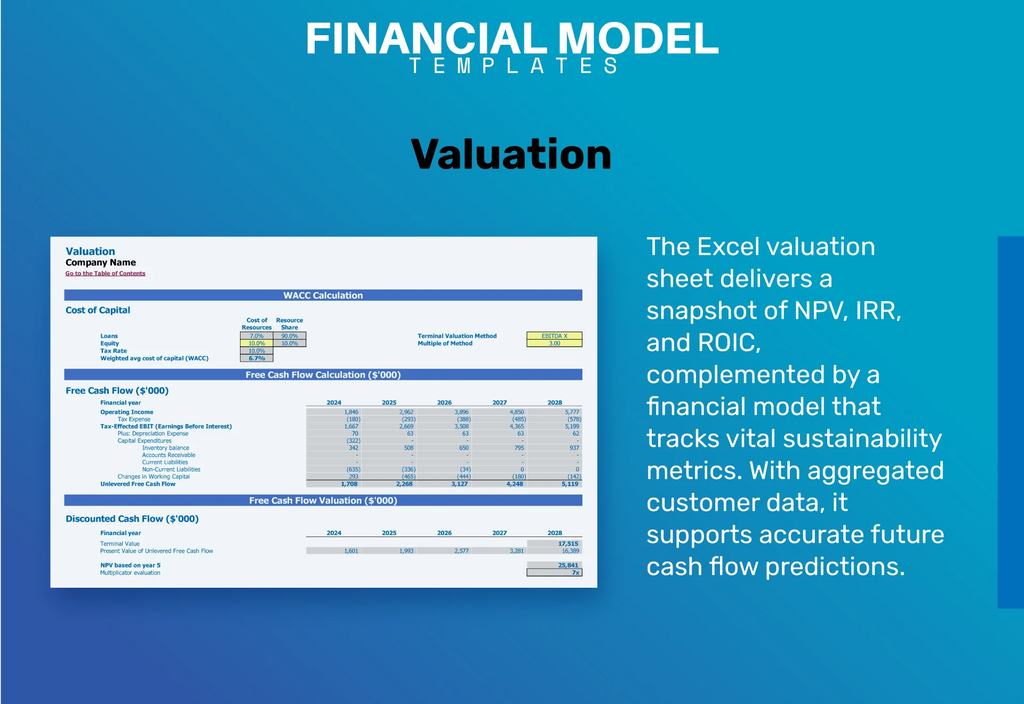

SUPPLY CHAIN MANAGEMENT FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This supply chain management financial projection template employs the Discounted Cash Flow (DCF) methodology for robust valuation analysis. It not only generates a comprehensive valuation but also enhances decision-making by calculating key financial performance metrics, including residual value and replacement costs. Users can conduct scenario analysis and assess market comparables while optimizing procurement strategies. By integrating these insights, businesses can improve inventory management, enhance operational efficiency, and bolster working capital management, ultimately driving sustainability in supply chains and supporting effective risk management. Unlock your supply chain's potential through strategic financial forecasting and analysis.

Cap Table

A captable is a vital tool for supply chain analytics, providing a clear overview of a company's securities distribution among investors. It highlights the percentage of shares held by each participant, including common and preferred shares, along with their corresponding prices. This comprehensive financial performance metric not only aids in cash flow analysis but also enhances visibility in procurement strategies and working capital management. By using captables effectively, businesses can optimize operational efficiency, strengthen supplier relationships, and support better decision-making in demand planning and risk management within integrated supply chains.

KEY FEATURES

An effective inventory management model enhances operational efficiency and boosts financial performance metrics, attracting investor interest and confidence.

With an integrated supply chain financial forecasting model, you can effectively attract investors by showcasing strong operational efficiency and performance metrics.

Leveraging financial forecasting enhances cash flow analysis, allowing businesses to proactively identify potential shortfalls in cash balances.

The financial model enhances supply chain visibility, enabling proactive cash flow analysis and informed decision-making for operational efficiency.

Effective supply chain analytics enhances financial forecasting, leading to better decision making and improved operational efficiency.

Enhance operational efficiency and confidently choose investments by leveraging a robust cash flow analysis within your Excel financial model.

Our convenient all-in-one dashboard enhances financial forecasting and supply chain visibility, driving operational efficiency and optimized cost strategies.

Our financial model enhances operational efficiency by providing comprehensive forecasting reports that drive informed decision-making and optimize performance metrics.

Our integrated supply chain analytics model enhances operational efficiency, enabling precise demand planning and effective cost optimization strategies.

Enhance your financial forecasting accuracy, enabling you to focus more on product innovation and customer engagement.

ADVANTAGES

The financial model enriches supply chain analytics, enhancing demand planning and improving operational efficiency for better customer insights.

The business revenue model template enhances financial forecasting by providing clear visibility into expenses and income over time.

Reassessing assumptions with an integrated supply chain financial model enhances operational efficiency and optimizes cash flow analysis for better outcomes.

The bottom-up financial model enhances supply chain visibility, ensuring accurate demand planning and improved operational efficiency.

An effective financial model enhances supply chain visibility, enabling informed decision-making and improved operational efficiency for your pitch deck.