Supply Chain Financing Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Supply Chain Financing Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

supply chain financing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SUPPLY CHAIN FINANCING FINANCIAL MODEL FOR STARTUP INFO

Highlights

Develop a comprehensive five-year financial model incorporating financial supply chain analysis to enhance your supply chain finance solutions for early-stage startups. This template aims to impress investors and facilitate capital raising by leveraging effective working capital financing strategies, such as invoice financing options, trade credit management, and receivables financing. Additionally, it should integrate dynamic discounting solutions and inventory financing strategies to optimize cash flow and manage supply chain risks. By employing financial modeling techniques and cost of capital considerations in the supply chain, businesses can demonstrate robust credit risk assessment and supply chain performance metrics, ultimately positioning themselves favorably for potential acquisition or investment.

This financial model template addresses key pain points by offering comprehensive supply chain finance solutions that enhance working capital financing options for businesses. It integrates invoice financing options and factoring services, enabling companies to optimize cash flow and improve their credit risk assessment processes. The inclusion of trade credit management and supplier financing programs facilitates effective receivables financing while ensuring robust inventory financing strategies. By utilizing dynamic discounting solutions and reverse factoring, businesses can enhance cash flow optimization and mitigate supply chain risk management challenges. Additionally, the financial modeling techniques embedded in this ready-made template provide valuable insights into supply chain performance metrics and the cost of capital in supply chain decisions, ultimately supporting informed business financing models.

Description

The financial model overview incorporates various supply chain finance solutions tailored for startups, providing a robust framework for effective working capital financing, along with diverse invoice financing options to enhance cash flow optimization. This pro forma template features essential financial statements and performance metrics, facilitating sound decision-making by addressing operational and financial risk factors, including credit risk assessment and supply chain risk management. With a highly adaptable Excel template, users can accurately forecast income statements, balance sheets, and cash flow projections over a five-year horizon, while also incorporating dynamic discounting solutions and receivables financing strategies. The model allows for seamless adjustments, automatically updating metrics and offering critical financial performance ratios and KPIs necessary for assessing business profitability and liquidity through asset-based lending and factoring services, essential for monitoring supply chain performance metrics and optimizing cost of capital in the supply chain.

SUPPLY CHAIN FINANCING FINANCIAL MODEL REPORTS

All in One Place

Business owners and managers can effortlessly navigate this comprehensive business plan Excel template. It consolidates all financial assumptions—revenues, expenses, and operations—into one cohesive view. This streamlined approach facilitates informed decision-making and enhances cash flow optimization. With insights into working capital financing options, supply chain performance metrics, and trade credit management, users can better assess financial supply chain dynamics. By leveraging powerful financial modeling techniques and exploring inventory financing strategies, you can optimize your capital structure and mitigate supply chain risks effectively. Embrace this tool to drive sustainable profitability and growth.

Dashboard

A comprehensive dashboard featuring vital financial indicators is essential for any five-year forecast. Our dashboard integrates crucial data from your company's financial statements and forecasts, enabling users to easily navigate and focus on specific timeframes. By leveraging key performance metrics, such as cash flow optimization and working capital financing, users can conduct in-depth analysis and make informed strategic decisions. This financial supply chain analysis equips businesses to enhance trade credit management and optimize their overall supply chain performance, ensuring sustainable growth and profitability.

Business Financial Statements

Our financial planning model showcases consolidated startup financial statements, including forecast income statements, projected balance sheets, and cash flow spreadsheets. Tailored for effective cash flow optimization, these templates can be generated monthly or annually. Users can seamlessly create rolling projections by integrating current financial statement formats with reports from popular accounting software like QuickBooks, Xero, and FreshBooks. Enhance your financial strategy with advanced modeling techniques that support working capital financing, receivables financing, and supply chain performance metrics, ensuring robust supply chain risk management and dynamic discounting solutions for your business growth.

Sources And Uses Statement

This pro forma template includes a comprehensive sources and uses of funds statement, providing valuable insights into your company's funding structure. It effectively illustrates the allocation and utilization of financial resources, enabling you to optimize working capital financing and enhance cash flow management. By leveraging financial modeling techniques, users can assess various business financing models, including invoice financing options and asset-based lending. This tool is essential for businesses looking to improve supply chain performance metrics and implement effective supply chain risk management strategies. Maximize your funding strategies and drive growth with this professional resource.

Break Even Point In Sales Dollars

Understanding the break-even point in unit sales is crucial for assessing profitability across different sales levels. This analysis reveals the revenue needed to cover fixed costs without generating profit or loss. Utilizing financial modeling techniques, such as marginal costing, can enhance insights into how costs behave at varying output levels. Incorporating metrics such as cash flow optimization and working capital financing can further refine your approach to risk management. Implementing strategies like invoice financing options and supplier financing programs supports sustainable growth and profitability.

Top Revenue

Enhance your financial insights with our bottom-up financial model, designed for in-depth analysis of your company’s revenue streams. This specialized template allows you to isolate and evaluate performance by product or service category, enabling efficient cash flow optimization and informed decision-making. By leveraging financial modeling techniques, you can improve trade credit management, explore invoice financing options, and optimize your working capital financing strategies. Empower your business with precise analytics that drive profitability and mitigate supply chain risks for sustainable growth.

Business Top Expenses Spreadsheet

The Top Revenue tab in the 5-year forecast template expertly organizes financial insights related to your product or service offerings. This section provides a clear annual overview of your revenue streams, highlighting revenue depth and leveraging financial modeling techniques. By analyzing these figures, you can optimize cash flow and assess key supply chain performance metrics, enabling informed decisions about working capital financing and invoice financing options. Utilize this data to enhance trade credit management and explore various business financing models, ensuring robust financial supply chain analysis for sustained growth.

SUPPLY CHAIN FINANCING FINANCIAL PROJECTION EXPENSES

Costs

The supply chain financing pro forma template is an essential tool for estimating costs, risks, and key financial ratios. By employing financial modeling techniques, you can identify areas requiring greater focus and resources. This template serves as an early warning system for potential issues, enabling effective supply chain risk management and optimization strategies. Understanding expenses in relation to your business financing models is crucial, as they directly influence your ability to attract investors and secure credit. Leverage this tool to enhance your cash flow optimization and achieve better outcomes in your supply chain performance metrics.

CAPEX Spending

Startup expenses are crucial metrics in financial modeling techniques, enabling analysts to assess initial costs and monitor investments effectively. Understanding these expenditures is essential for optimizing cash flow and evaluating overall supply chain performance metrics. By incorporating capital expenditures into a cash flow forecasting model, businesses can enhance their budgeting strategies and secure working capital financing. The right financial supply chain analysis is key to driving performance, ensuring that startups effectively manage trade credit and leverage invoice financing options for growth. This approach sets the foundation for sustainable success in a competitive landscape.

Loan Financing Calculator

The company's repayment structure is meticulously outlined in a loan amortization schedule template. Our projected income statement template integrates this schedule, featuring advanced algorithms that calculate each installment's breakdown of principal and interest. This ensures clarity in working capital financing, facilitating effective supply chain finance solutions. By implementing financial modeling techniques, organizations can optimize cash flow and enhance trade credit management, ultimately driving improved supply chain performance metrics. This structured approach not only supports efficient receivables financing but also aids in assessing credit risk, thereby bolstering overall financial health.

SUPPLY CHAIN FINANCING EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The supply chain finance forecast template incorporates tailored key performance indicators (KPIs) that reflect both company-specific and sector-wide metrics. These include essential profitability, cash flow, and liquidity indicators, all vital for optimizing working capital financing. By leveraging these KPIs, companies can enhance their credit risk assessment and attract potential investors by showcasing robust financial modeling techniques. This comprehensive approach not only strengthens trade credit management but also enables effective receivables financing and inventory financing strategies, ultimately promoting superior supply chain performance and cash flow optimization.

Cash Flow Forecast Excel

Our cash flow pro forma template empowers users to project future financial scenarios, essential for assessing working capital financing needs and optimizing cash flow. This strategic tool aids startups in effectively managing financial supply chain performance metrics, ensuring they can accurately plan and track expenses. By leveraging financial modeling techniques, businesses can enhance trade credit management and explore various financing options, such as invoice financing and asset-based lending, to meet their financial goals and fuel profitability. This proactive approach is crucial for sustainable growth in a dynamic market.

KPI Benchmarks

Our financial planning startup offers a robust benchmarking template, empowering clients to analyze industry and financial metrics. By leveraging supply chain finance solutions, such as trade credit management and receivables financing, businesses can assess their performance against peers. Our insights reveal key areas for improvement, enabling effective strategies like dynamic discounting solutions and inventory financing. With a focus on cash flow optimization and credit risk assessment, we help clients build sustainable business financing models that drive supply chain performance and enhance working capital financing outcomes. Elevate your financial strategies with our expert guidance.

P&L Statement Excel

The pro forma income statement integrates non-cash transactions into its expenses, reflecting the true cost of doing business. For instance, asset depreciation is recorded as it represents the value consumed to generate revenue. Unlike a cash flow pro forma, which captures only actual cash movements, the forecast income statement provides a comprehensive view of expenses incurred during the period. This holistic approach is essential for financial modeling techniques, aiding in cash flow optimization and enhancing business financing models, ultimately supporting effective supply chain finance solutions and credit risk assessment.

Pro Forma Balance Sheet Template Excel

The startup financial model template seamlessly integrates your balance sheet forecast with cash flow projections and income statements, offering a comprehensive view of your assets, liabilities, and equity accounts. By utilizing advanced financial modeling techniques, businesses can enhance cash flow optimization and assess credit risk effectively. This holistic approach supports informed decisions regarding working capital financing options, such as invoice financing and reverse factoring, while also establishing robust supplier financing programs. Elevate your financial supply chain analysis to boost overall supply chain performance metrics and mitigate supply chain risks.

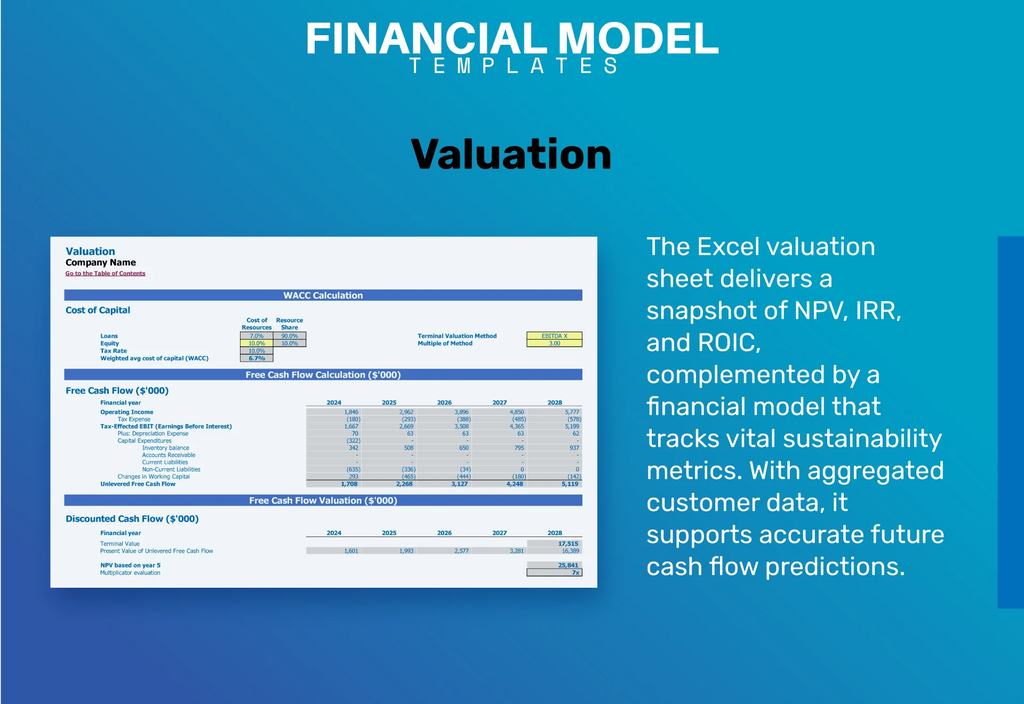

SUPPLY CHAIN FINANCING FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Utilizing our pro forma income statement template, users can seamlessly conduct a Discounted Cash Flow valuation by simply inputting a few key rates in the Cost of Capital section. This powerful tool is essential for optimizing cash flow and enhancing supply chain performance metrics. By leveraging financial modeling techniques and exploring options like invoice financing and reverse factoring, businesses can effectively manage their working capital financing needs. Maximize your supply chain financing solutions and improve asset-based lending strategies with our innovative resources tailored for comprehensive financial supply chain analysis.

Cap Table

A capitalization table, or captable, is a vital tool for understanding your company’s financial landscape. It provides insights into investments, shareholder equity, and your available financial resources. By leveraging this information, businesses can enhance their supply chain finance solutions, optimize working capital financing, and refine their financial modeling techniques. Additionally, it aids in assessing credit risk and evaluating supplier financing programs. Utilizing a captable effectively supports cash flow optimization and strengthens trade credit management strategies, ultimately improving your organization’s overall supply chain performance metrics.

KEY FEATURES

Implementing innovative supply chain finance solutions optimizes cash flow, enhances working capital, and mitigates risks for startups.

Utilizing our 5 Year Financial Projection Template enhances cash flow optimization and strengthens your supply chain finance solutions for investors.

Enhancing cash flow optimization through supply chain finance solutions boosts working capital and mitigates risks effectively for businesses.

Unlock reliable cash flow optimization and informed decision-making with our user-friendly supply chain financing three-statement financial model in Excel.

**Optimizing cash flow** through **supply chain finance solutions** enhances working capital financing and reduces costs of capital in supply chain.

Effective financial modeling techniques enhance cash flow optimization and mitigate supply chain risks, empowering informed decision-making and strategic growth.

Optimize cash flow and enhance supplier relationships through innovative supply chain finance solutions for greater value and efficiency.

Leverage our proven supply chain financing model for optimized cash flow and reduced costs without hidden fees or monthly payments.

Utilizing financial modeling techniques helps identify cash gaps and surpluses proactively, enhancing cash flow optimization and overall supply chain performance.

Effective financial modeling techniques enable proactive cash flow optimization, preventing deficits and identifying opportunities for growth reinvestment.

ADVANTAGES

Optimize your cash flow and mitigate risks with effective supply chain finance solutions for upcoming cash gaps.

Utilizing a 3 Statement Financial Model Excel Template empowers businesses to identify strengths and weaknesses in their cash flow optimization strategies.

Utilize financial modeling techniques to enhance cash flow optimization and identify issues in customer payments effectively.

Enhance stakeholder trust with a three-way financial model that optimizes working capital financing and boosts supply chain performance metrics.

The financial model template streamlines cash flow optimization by consolidating all assumptions, enhancing decision-making in supply chain finance solutions.