Staffing Agency Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Staffing Agency Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

staffing agency Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

STAFFING AGENCY STARTUP BUDGET INFO

Highlights

A comprehensive staffing agency 5-year projection plan is essential for both startups and established companies looking to raise funds from investors or banks, as it helps determine funding requirements and make critical cash flow projections. This plan also plays a key role in developing a robust budgeting process while enhancing the overall business strategy. Utilizing a staffing agency business plan Excel financial template allows for a thorough profitability analysis, enabling businesses to evaluate startup ideas, plan pre-launch expenses, and effectively manage client acquisition costs. Furthermore, this tool aids in assessing the staffing agency's cost structure, including overhead costs and operating expenses, while providing insights into scalability analysis and break-even analysis. By incorporating these financial benchmarks and conducting a market analysis, agencies can better navigate risk management and optimize their pricing strategy, leading to improved financial statements and enhanced profitability.

The staffing agency financial model Excel template addresses critical pain points by streamlining the budgeting process and providing a comprehensive pricing strategy that aligns with market analysis, ensuring that client acquisition costs and operating expenses are well-managed. It enables users to conduct profitability analysis and break-even analysis, facilitating better cash flow management and financial projections that adapt to economic factors. The template also includes features for evaluating scalability, which helps agencies assess their growth strategies while maintaining a clear understanding of the commission structure and overhead costs. Additionally, it offers insights into financial benchmarks and investment funding opportunities, empowering staffing agencies to mitigate risks effectively while enhancing overall financial health.

Description

This staffing agency financial projection template provides a comprehensive five-year forecast, integrating essential inputs and assumptions vital for strategic decision-making regarding staffing agency revenue models and pricing strategies. With its advanced bottom-up approach, users gain insight into the staffing agency's cost structure, profitability analysis, and cash flow management, facilitating a thorough understanding of operating expenses and client acquisition costs. The model efficiently generates monthly and annual projections for financial statements, including the projected income statement, balance sheet, and cash flow forecast, while consolidating discounted cash flow valuation calculations. Additionally, it offers key financial performance ratios and benchmarks critical for assessing profitability and liquidity, enhancing risk management and supporting growth strategies, ultimately allowing agency operators to focus on client relationships and scaling their business without being bogged down by intricate calculations.

STAFFING AGENCY FINANCIAL PLAN REPORTS

All in One Place

Introducing our innovative financial projection model designed specifically for staffing agencies. This flexible Excel template organizes key components like operating expenses, hiring plans, and revenue forecasts into intuitive tabs. Easily edit or remove any projections, ensuring your staffing agency's financial statements remain accurate and relevant. What sets this model apart is its adaptable structure, allowing for tailored financial analyses to accommodate various business needs. With unlocked cells and formulas, you can customize your staffing agency’s financial planning, ensuring robust growth strategies and effective cash flow management. Your roadmap to profitability starts here.

Dashboard

Utilizing a startup financial model template in an Excel dashboard is invaluable for engaging with stakeholders, potential investors, and lenders. This comprehensive tool offers a clear analysis of your staffing agency's financial statements while incorporating essential elements like commission structure, operating expenses, and cash flow management. It visually represents key financial projections and benchmarks, enabling effective assessments of your revenue model and scalability. With this dashboard, you can confidently demonstrate your agency's profitability analysis and growth strategies, making a compelling case for investment and strategic partnerships.

Business Financial Statements

A comprehensive understanding of a staffing agency's financials involves three key templates: 1. **Income Statement** - Captures revenues, expenses, and losses, accounting for depreciation, taxes, and interest. 2. **Balance Sheet** - Provides a snapshot of assets, liabilities, and shareholders' equity, ensuring the equation assets = liabilities + equity holds true. 3. **Cash Flow Statement** - Illustrates cash inflows and outflows from operations, investments, and financing, with the end balance aligning with the cash total on the balance sheet. These tools support effective financial projections, profitability analysis, and strategic growth initiatives.

Sources And Uses Statement

A staffing agency's financial projections are crucial for demonstrating its revenue model and cost structure to stakeholders. The sources and uses of funds statement should clearly outline funding sources alongside intended expenses, ensuring the total sources meet or exceed uses. A balanced report indicates strong cash flow management, while a surplus suggests potential for growth strategies or reinvestment. Conversely, if uses surpass sources, it signals a need for additional equity or adjustments in budgeting. This analysis informs strategic decisions and enhances profitability analysis, ensuring long-term sustainability in a competitive market.

Break Even Point In Sales Dollars

This startup financial model template includes a comprehensive break-even analysis for unit sales over five years. It effectively showcases both the numeric calculations and a visual chart, providing valuable insights into the staffing agency's cost structure and profitability analysis. By integrating key elements such as staffing agency revenue models and operating expenses, this template facilitates a deeper understanding of cash flow management and financial projections, aiding decision-making for growth strategies and risk management. Utilize this tool to enhance your staffing agency’s budgeting process and drive informed financial planning.

Top Revenue

This comprehensive startup financial model template includes a dedicated tab for an in-depth analysis of your staffing agency’s revenue model. Users can evaluate revenue streams by specific service categories, enhancing your pricing strategy and profitability analysis. This tool supports the budgeting process, offering insights into operating expenses, client acquisition costs, and cash flow management. By utilizing this template, staffing agencies can refine their financial projections and develop effective growth strategies, ensuring sustainable scalability and improved financial performance. Gain a clearer understanding of your agency's financial landscape with detailed insights into your revenue structure.

Business Top Expenses Spreadsheet

To support your staffing agency's financial health, we’ve organized a comprehensive business financial model template. The Top Expenses tab categorizes annual expenditures into four key groups, offering an in-depth analysis of costs, including client acquisition and fixed overheads. This structured approach empowers you to understand the roots of your spending, enabling effective cash flow management and informed decision-making. By leveraging this information, you can enhance your budgeting process, optimize your pricing strategy, and ultimately drive profitability and growth within your staffing agency.

STAFFING AGENCY FINANCIAL PROJECTION EXPENSES

Costs

Financial projections are essential for staffing agencies, guiding effective cash flow management and identifying potential operational challenges. A well-structured budget not only highlights operating expenses and overhead costs but also aids in client acquisition cost analysis and profitability evaluation. By utilizing a business plan forecast template, agencies can unveil financial issues early, enabling strategic solutions. This approach supports investment funding pursuits and strengthens overall financial statements, ensuring scalability and sustainable growth. Ultimately, robust financial analysis empowers staffing agencies to enhance their pricing strategy and achieve long-term success.

CAPEX Spending

Capital expenditures (CAPEX) represent significant investments a staffing agency makes to acquire essential assets, directly impacting its overall financial health. These expenses, crucial for enhancing operational efficiency, should be reflected in the projected balance sheet. Effective budgeting processes ensure that funds are allocated towards improving technology and equipment quality. By integrating these costs into both the profit and loss statement and cash flow forecasts, agencies can better manage overhead and assess profitability. A thorough analysis of CAPEX also informs financial projections, supporting growth strategies and optimizing client acquisition costs for sustainable success.

Loan Financing Calculator

Our feasibility study template includes a comprehensive loan amortization schedule, conveniently located in the 'Capital' tab. This feature is designed to enhance your staffing agency's financial projections by enabling users to efficiently track loans, interest, and equity. Leveraging pre-built formulas, it facilitates internal calculations, ensuring accuracy in your staffing agency's budgeting process. This streamlined approach supports effective cash flow management and financial benchmarks, essential for evaluating profitability and growth strategies. Maximize your agency's potential with this invaluable resource.

STAFFING AGENCY INCOME STATEMENT METRICS

Financial KPIs

The staffing agency pro forma financial statements template includes essential KPIs to evaluate sales performance, such as revenue growth, gross margin, and EBITDA margin. It also addresses cash flow dynamics through metrics like the cash burn rate and assists in raising investment by analyzing runway and funding needs. While not all metrics are mandatory, you can tailor the model to reflect your agency’s unique financial benchmarks and growth strategies. This flexibility allows for a comprehensive staffing agency profitability analysis, enabling effective cash flow management and informed decision-making.

Cash Flow Forecast Excel

A cash flow proforma template is crucial for any staffing agency startup, offering insights into financial health and future profitability. This essential tool aids in developing effective staffing agency pricing strategies and budgeting processes while showcasing your potential for securing investment funding and bank loans. By analyzing cash flow alongside operating expenses and overhead costs, you can enhance your agency’s scalability and risk management efforts. Ultimately, a well-structured cash flow statement not only supports strategic planning but also serves as a vital resource for navigating client acquisition costs and achieving financial benchmarks.

KPI Benchmarks

A financial benchmarking tab within a staffing agency's model calculates key performance indicators alongside industry averages. This comparative analysis is vital for evaluating operational efficiency and profitability. By leveraging financial benchmarks, agencies can identify best practices and refine their staffing agency pricing strategy, cost structure, and client acquisition costs. This tool is indispensable for startups aiming for scalability and growth, enabling them to align their financial statements with industry standards and enhance their budgeting process for sustained success.

P&L Statement Excel

To ensure a staffing agency's profitability, employing a profit and loss projection is crucial. This financial model accurately forecasts revenues and expenses, guiding startups toward future success. Additionally, it generates comprehensive annual reports that capture key insights, including after-tax balance and net profit. By leveraging these financial projections, staffing agencies can refine their pricing strategy, manage operating expenses, and optimize their commission structure, ultimately enhancing cash flow management and scalability. This approach not only aids in effective budgeting but also supports informed decision-making and strategic growth initiatives.

Pro Forma Balance Sheet Template Excel

The projected balance sheet template in Excel is essential for any staffing agency, offering a comprehensive overview of current and long-term assets, liabilities, and equity. This vital report aids in analyzing financial health, enabling effective staffing agency profitability analysis and cash flow management. By leveraging this template, agencies can calculate key financial ratios, supporting budgeting processes and enhancing decision-making. It serves as a foundational tool in evaluating investment funding and optimizing the staffing agency's revenue model, ultimately contributing to strategic growth and a robust financial framework.

STAFFING AGENCY INCOME STATEMENT VALUATION

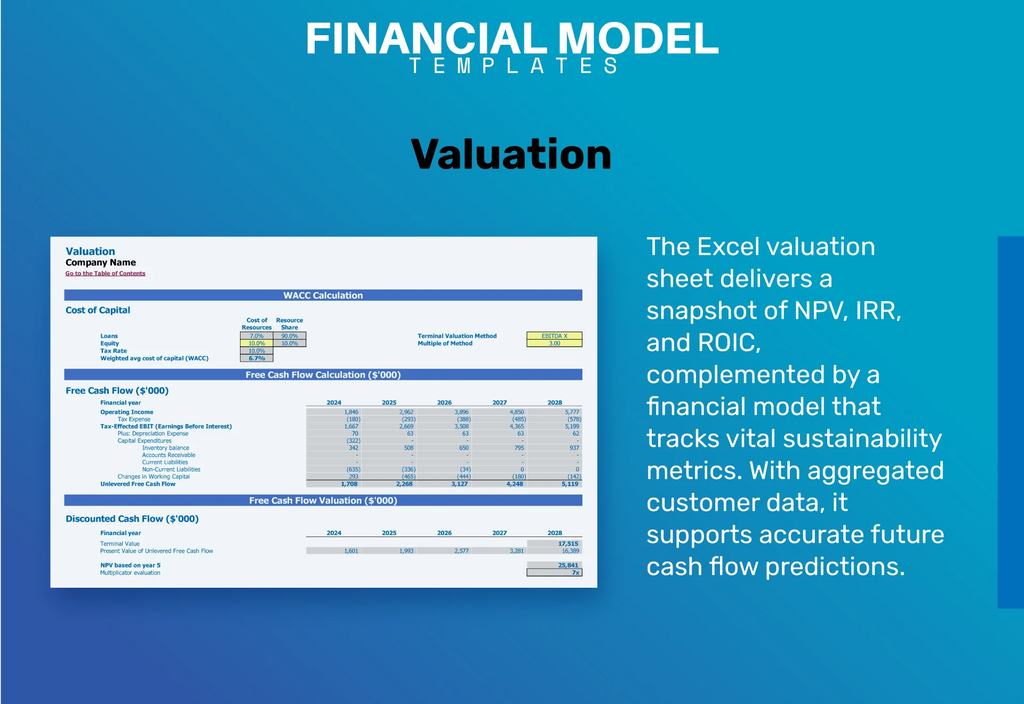

Startup Valuation Model

In evaluating a staffing agency's financial health, key metrics like the Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) are essential. WACC reflects the cost of capital—integral for assessing risk and securing loans. Meanwhile, DCF analysis quantifies future cash flows, aiding in strategic investment decisions. By integrating these elements into a comprehensive profitability analysis, staffing agencies can refine their pricing strategy, manage operating expenses, and enhance cash flow management—ultimately driving sustainable growth and improving financial benchmarks.

Cap Table

Our staffing agency revenue model seamlessly integrates the cap table within our cash flow management framework. This model aligns funding rounds with various financial instruments, such as equity and convertible notes. Moreover, it illustrates how strategic decisions influence share ownership and dilution, providing a clear picture of overall profitability. By leveraging this enhanced model, staffing agencies can effectively analyze client acquisition costs, optimize their pricing strategy, and conduct robust financial projections, thereby ensuring sustainable growth and improved market positioning.

KEY FEATURES

A well-structured staffing agency revenue model enhances profitability and streamlines budgeting, saving you significant time and resources.

A robust staffing agency revenue model streamlines financial analysis, enabling you to focus more on client acquisition and business growth.

A robust staffing agency financial model enhances profitability analysis, guiding effective pricing strategies and informed decision-making for sustainable growth.

A robust cash flow forecast empowers staffing agencies to strategically manage expenses and optimize profitability through informed decision-making.

An effective staffing agency revenue model enhances profitability and supports informed decision-making for sustainable growth and financial stability.

Effective staffing agency financial projections enhance decision-making, reduce risks, and attract investors by showcasing solid growth potential.

A robust staffing agency revenue model enhances profitability analysis and streamlines cash flow management for sustainable growth.

A robust staffing agency financial model simplifies budgeting, enhances profitability analysis, and streamlines cash flow management for rapid insights.

A robust staffing agency revenue model enhances profitability by optimizing pricing strategies and managing operating expenses effectively.

A comprehensive financial model enhances staffing agency profitability by providing detailed forecasts, performance reviews, and actionable insights for informed decision-making.

ADVANTAGES

Optimize your staffing agency's cash flow management to enhance profitability and drive sustainable growth through a robust financial model.

Utilizing a staffing agency financial model template enables effective planning for cash gaps and enhances overall financial stability.

Gain control over your staffing agency's success with a financial model that enhances profitability and streamlines strategic planning.

A comprehensive staffing agency financial model reveals strengths and weaknesses, enhancing profitability and guiding strategic decision-making effectively.

A robust staffing agency financial model empowers growth strategies and enhances profitability by optimizing cost structures and cash flow management.