Software As A Service Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Software As A Service Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

software as a service Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SOFTWARE AS A SERVICE FINANCIAL MODEL FOR STARTUP INFO

Highlights

An effective SaaS financial forecasting approach requires a detailed understanding of the software as a service pricing model, including subscription-based pricing and its impact on recurring revenue models. Establishing robust SaaS revenue streams and accurately calculating customer acquisition cost SaaS alongside the lifetime value of customer SaaS is crucial for optimizing SaaS profit margins and operational expenses. By integrating SaaS churn rate analysis into your break-even analysis SaaS, you can better assess the sustainability of your SaaS business model. This comprehensive financial modeling for SaaS not only aids in evaluating SaaS growth metrics and key performance indicators but also provides a reliable framework for SaaS valuation methods, ensuring informed decision-making across all stages of your startup's development.

The software as a service pricing model provides clarity on subscription-based pricing structures, allowing users to effectively assess SaaS revenue models while analyzing SaaS financial projections. This Excel template alleviates concerns about operational expenses by detailing the cost structure and enabling a comprehensive break-even analysis to optimize profit margins. It helps users evaluate customer acquisition costs, estimate the lifetime value of customers, and conduct SaaS churn rate analysis, ensuring that key performance indicators are met. By incorporating financial modeling for SaaS, this tool simplifies the process of forecasting recurring revenue streams, managing SaaS marketing expenses, and ultimately supporting strategic decisions that drive growth through accurate SaaS valuation methods and insightful analysis of SaaS growth metrics.

Description

When launching a software as a service (SaaS) business, a thorough financial feasibility assessment is crucial, as it enables you to evaluate the SaaS revenue model, including subscription-based pricing and recurring revenue streams. Utilizing a comprehensive SaaS financial projections template, you can gain insights into your SaaS cost structure, customer acquisition costs, and operational expenses while analyzing key performance indicators like the lifetime value of a customer and the churn rate. This model not only prepares you for financial forecasting over a 5-year horizon, encompassing pro forma income statements and cash flow statements, but also aids in break-even analysis and valuations necessary for securing loans or attracting investors. By adjusting inputs in the SaaS financial planning model, you can easily update projections related to revenue growth and profit margins, providing you with a powerful tool for strategic decision-making and long-term success in the competitive SaaS landscape.

SOFTWARE AS A SERVICE FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive Software as a Service (SaaS) financial projections spreadsheet incorporates essential financial assumptions related to costs and revenue, providing users with a clear overview of their SaaS business model. By leveraging key metrics such as customer acquisition cost, lifetime value, and churn rate analysis, you'll be empowered to make informed decisions that enhance profitability and optimize your recurring revenue model. This tool is invaluable for conducting break-even analysis, assessing operational expenses, and strategizing for sustainable growth, ultimately guiding you towards more effective financial modeling for SaaS success.

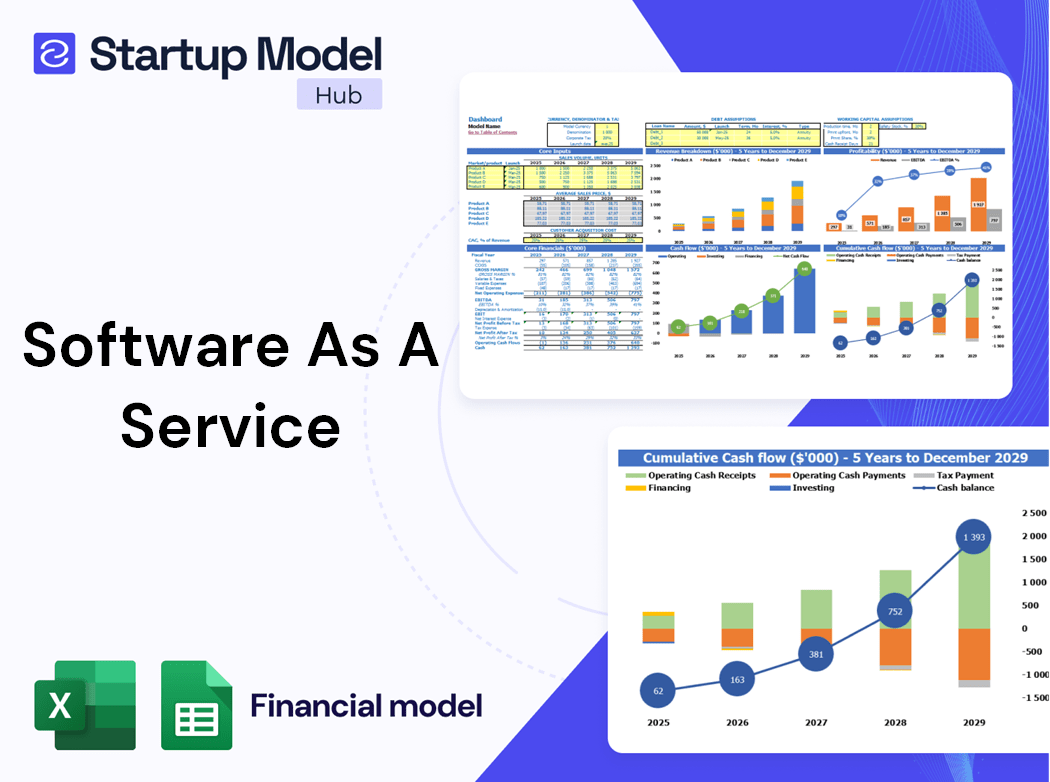

Dashboard

Our cash flow statement template features an intuitive dashboard, designed to streamline your SaaS financial forecasting. This comprehensive tool allows you to easily analyze key performance indicators, such as customer acquisition cost and lifetime value. With embedded calculations, you can efficiently evaluate your SaaS business model, track expenses, anticipate revenue streams, and conduct break-even analysis. Monitor your SaaS growth metrics and operational expenses to enhance profitability and optimize your subscription-based pricing strategy. This dashboard is essential for achieving your business objectives and maximizing SaaS profit margins.

Business Financial Statements

Our comprehensive financial model Excel template empowers SaaS business owners to construct crucial financial statements, projections, and analyses effectively. By leveraging our tool, users can clearly communicate key insights, including SaaS revenue models, customer acquisition costs, and profit margins, through visually engaging financial graphs and charts. These visual aids not only simplify complex data but also enhance presentations for potential investors, showcasing your SaaS growth metrics and operational efficiencies, ultimately supporting strategic decision-making and investment conversations. Transform your financial forecasting with our intuitive solution today.

Sources And Uses Statement

The sources and uses statement, derived from the SaaS revenue model, offers a clear snapshot of funding sources and their allocations. This financial document ensures that the sources and uses balance perfectly, reflecting a sound SaaS business model. In the context of recapitalization, restructuring, or mergers and acquisitions, this statement becomes essential, serving as a vital tool for financial modeling for SaaS. By analyzing this statement, stakeholders can make informed decisions that enhance SaaS profit margins, optimize operational expenses, and improve overall SaaS financial projections.

Break Even Point In Sales Dollars

This startup costs template offers a comprehensive break-even analysis for up to five years, providing insights into your SaaS business model. It features detailed calculations of the break-even point in unit sales, presented both numerically and visually through charts. This tool aids in financial forecasting by highlighting key performance indicators, such as customer acquisition cost and lifetime value of customers. By understanding your SaaS cost structure and revenue streams, you can optimize pricing strategies and enhance profit margins for sustainable growth in a competitive landscape.

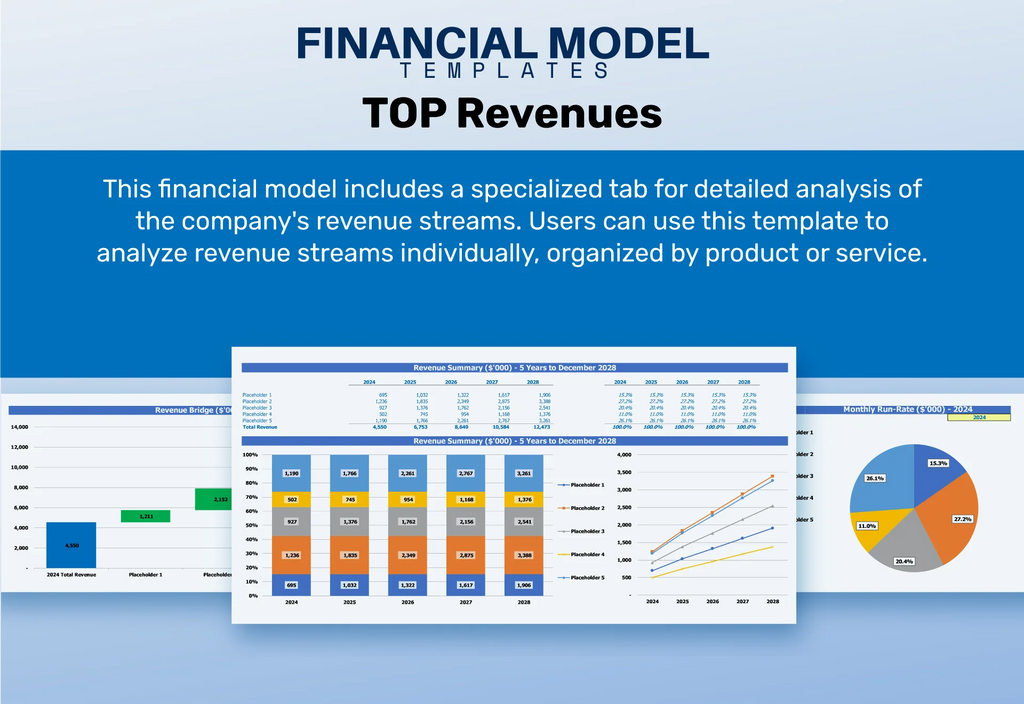

Top Revenue

This financial projection model in Excel features a comprehensive revenue tab designed for in-depth analysis of your SaaS revenue streams. By utilizing this template, you can systematically evaluate revenue contributions from each product or service, enhancing your understanding of customer acquisition costs and lifetime value. This detailed approach aids in refining your SaaS business model, optimizing subscription-based pricing, and improving profit margins. Leverage this tool for effective SaaS financial forecasting and break-even analysis, ensuring a solid foundation for strategic growth and operational efficiency.

Business Top Expenses Spreadsheet

Our financial model template for startups features a dedicated tab that highlights your four primary expenses, with all remaining costs aggregated under 'Other.' This innovative SaaS business model allows for automatic calculations based on your assumptions, streamlining the process of financial forecasting and reporting. Gain valuable insights at a glance, enabling you to assess your cost structure while optimizing your subscription-based pricing and revenue streams. This approach not only enhances profitability but also supports effective SaaS growth metrics and improves your break-even analysis and customer acquisition strategies.

SOFTWARE AS A SERVICE FINANCIAL PROJECTION EXPENSES

Costs

Streamline your SaaS financial forecasting with our intuitive projection tool. Effortlessly map out fixed operating expenses, including R&D and SG&A, using automated, end-to-end formulas. This user-friendly sheet simplifies your SaaS business model, allowing you to focus on critical metrics like customer acquisition costs and churn rates. Gain insights into your recurring revenue model and profit margins without the hassle of manual updates. Perfect for SaaS founders seeking clarity in operational expenses and break-even analysis, our tool empowers you to refine your strategic approach and drive growth.

CAPEX Spending

Effective revenue generation is crucial for sustainable SaaS businesses. A robust financial modeling approach is essential for accurate SaaS financial projections, focusing on subscription-based pricing and operational expenses. Management must prioritize precise revenue forecasting, as inaccuracies can impact the entire financial model. Utilizing proforma templates, teams can analyze growth metrics and customer acquisition costs while considering churn rate analysis and profit margins. This strategic planning guides the development of a solid SaaS revenue model, ensuring a comprehensive understanding of lifetime customer value and ultimately enhancing the company’s valuation.

Loan Financing Calculator

Our SaaS financial model template incorporates embedded formulas, simplifying your financial forecasting process. With a detailed loan amortization schedule, you can effortlessly distinguish between principal and interest calculations. This tool will provide instant insights into your repayment structure, including breakdowns of principal and interest payments, payment frequency, and total repayment duration. By leveraging this model, you can enhance your SaaS revenue projections and improve your understanding of key financial metrics, ensuring informed decisions that drive growth and optimize your SaaS business model.

SOFTWARE AS A SERVICE EXCEL FINANCIAL MODEL METRICS

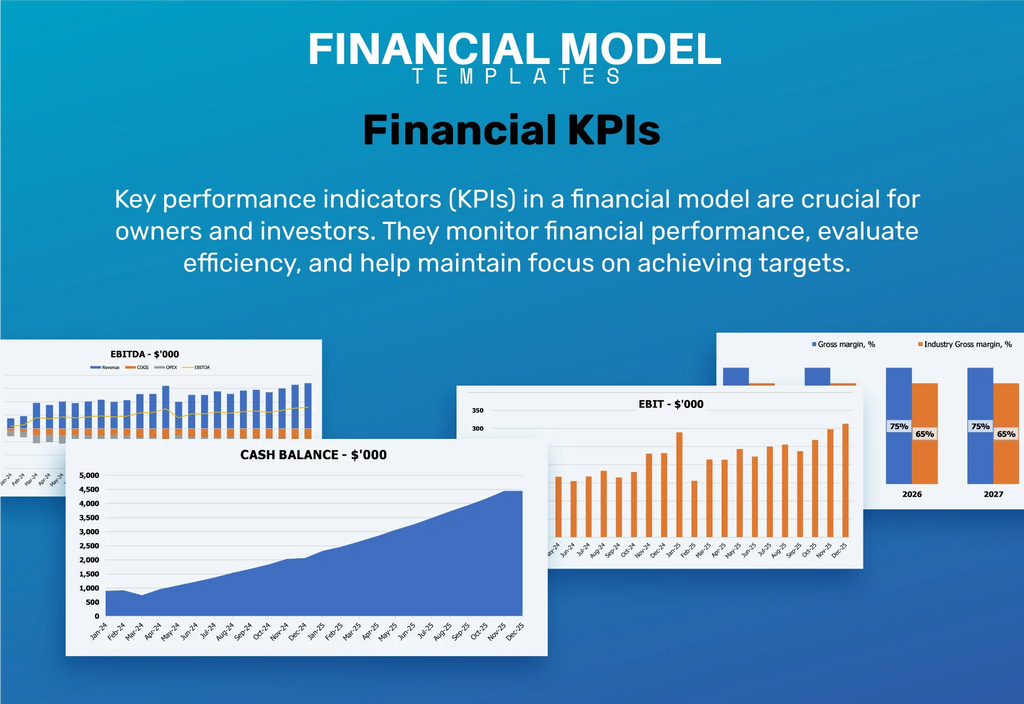

Financial KPIs

Visualize crucial financial indicators through a comprehensive three-statement model spanning five years and 24 months. Monitor EBITDA/EBIT to gauge operational success and assess SaaS profit margins. Track cash flows to analyze inflows and outflows, ensuring effective management of operational expenses. Additionally, forecast your cash balance to predict future liquidity and support your SaaS business model. This strategic financial modeling for SaaS empowers you to make informed decisions, optimize your subscription-based pricing, and enhance your customer acquisition cost and lifetime value, driving growth in your recurring revenue streams.

Cash Flow Forecast Excel

Our cash flow model template is essential for SaaS businesses, providing insights into liquidity and financing needs. It features a dedicated sheet for tracking cash flows, incorporating key factors like customer acquisition cost, recurring revenue models, and operational expenses. By analyzing payable and receivable days, yearly income, and net cash, users can efficiently forecast three-year financial projections. This template enhances cash flow management and supports strategic decision-making, ensuring a clearer view of cash availability and optimizing SaaS profit margins while minimizing churn rates. Unlock your company’s financial potential with this professional forecasting tool.

KPI Benchmarks

Benchmarking is an essential financial metric in SaaS financial modeling, enabling companies to assess their performance against key industry parameters. By analyzing SaaS profit margins, customer acquisition costs, and churn rates, organizations can identify improvement areas and establish effective SaaS revenue models. This comparative analysis not only enhances operational expenses management but also aids in financial forecasting and determining optimal pricing strategies, such as subscription-based pricing. Ultimately, benchmarking equips both established and startup SaaS businesses with actionable insights to drive growth and ensure sustainable profitability in a competitive landscape.

P&L Statement Excel

In today's competitive landscape, a well-structured projected profit and loss statement is crucial for any SaaS business. This tool not only tracks financial performance but also enables accurate SaaS financial forecasting for future income and expenses. By leveraging this statement, entrepreneurs can analyze key performance indicators and develop strategies to optimize the subscription-based pricing model, enhance customer acquisition, and minimize churn rate. With a clear roadmap, SaaS companies can confidently navigate operational expenses, improve profit margins, and ultimately strengthen their SaaS revenue model for sustainable growth.

Pro Forma Balance Sheet Template Excel

The projected balance sheet for a SaaS startup highlights essential assets, including cash, fixed assets, and equipment, alongside current and long-term liabilities and equity. This financial modeling is crucial for assessing the SaaS business model's viability, particularly when approaching creditors like banks. They seek a detailed understanding of your assets, liabilities, and ownership structure to evaluate your loan application effectively. Incorporating SaaS financial projections into this analysis helps illustrate your subscription-based pricing strategy, customer acquisition costs, and expected profit margins, ultimately enhancing your appeal to potential investors and lenders.

SOFTWARE AS A SERVICE FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Effective financial modeling for SaaS not only assesses Return on Investment and Investor Equity Share but also optimizes Cash Burn Rate analysis. By closely examining key financial metrics such as customer acquisition costs and lifetime value, businesses can enhance their SaaS revenue model and reduce churn rates. This clarity allows for informed decisions about operational expenses and growth strategies, ultimately attracting potential investors. A robust SaaS business model, backed by solid financial projections and break-even analysis, ensures you capture interest and drive sustainable growth.

Cap Table

Cap Table Startup provides a comprehensive overview of a company's financial health, outlining ownership structures, share distribution, and expenditures. The pro forma cap table goes beyond surface-level insights, detailing equity shares, preferred shares, options, and other key indicators. This data is crucial for understanding the SaaS business model's financial projections, including customer acquisition costs, churn rate analysis, and profit margins. By integrating these elements, companies can better assess their SaaS revenue model, operational expenses, and ultimately, enhance financial forecasting and valuation methods for sustained growth.

KEY FEATURES

Effective financial modeling for SaaS reveals key metrics, helping identify and address customer payment issues promptly.

A cash flow model enhances financial forecasting by revealing unpaid invoices and optimizing customer payment strategies for improved cash flow.

A robust financial model for SaaS optimizes pricing strategies and forecasts growth, enhancing profitability and strategic decision-making.

A comprehensive financial model empowers SaaS businesses to optimize pricing, enhance profitability, and streamline growth strategies effectively.

A solid SaaS financial model enhances stakeholder trust by revealing clear insights into revenue streams and growth potential.

A robust financial model enhances investor confidence, leading to increased funding opportunities for SaaS companies through clear cash flow projections.

A robust financial model for SaaS enhances investor confidence by accurately forecasting revenue streams and optimizing customer acquisition costs.

A robust financial model enhances SaaS decision-making by providing clear insights into profit margins and customer acquisition costs.

Effective financial modeling for SaaS enables accurate revenue projections and strategic decision-making, optimizing growth and profitability.

Our clear SaaS financial model enhances decision-making by providing detailed projections across various planning categories, enabling informed growth strategies.

ADVANTAGES

A robust financial model illuminates SaaS strengths and weaknesses, guiding strategic decisions to maximize profitability and growth.

The three-way financial model enhances SaaS decision-making by providing clear insights into revenue streams, costs, and growth metrics.

Utilizing SaaS financial modeling enhances revenue forecasting and improves decision-making for strategic growth and profitability.

Effective financial modeling for SaaS enhances revenue forecasting, optimizes costs, and improves decision-making for sustainable growth.

Unlock the potential of your SaaS business with a robust financial model that optimizes revenue streams and profit margins.