Small Engine Repair Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Small Engine Repair Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

small engine repair Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SMALL ENGINE REPAIR FINANCIAL MODEL FOR STARTUP INFO

Highlights

Creating a robust small engine repair business plan is essential for forecasting repair shop financial projections and effectively managing labor cost analysis small engines and mechanic overhead expenses. By implementing a well-defined service pricing strategy, mechanics can enhance repair service profitability while keeping an eye on small engine maintenance costs and tooling and equipment depreciation. Parts inventory management plays a critical role in maintaining a healthy cash flow management for mechanics, especially during seasonal fluctuations in revenue. Additionally, having a comprehensive marketing budget for the repair shop can aid in client acquisition cost and customer retention strategies, ensuring sustained growth. Understanding fixed vs variable costs will also aid in accurately estimating repair shop startup costs and the long-term financial impact of warranty services, ultimately leading to a solid profit margin small engine repair.

This financial model addresses the pain points of small engine repair businesses by providing a comprehensive overview of repair shop financial projections, enabling users to efficiently manage small engine maintenance costs and labor cost analysis. It simplifies the complexities of mechanic overhead expenses and tooling and equipment depreciation, allowing for clear insights into profit margins and seasonal fluctuations in revenue. By integrating service pricing strategy and parts inventory management, the model helps optimize client acquisition costs while also prioritizing customer retention strategies. Additionally, the dashboard facilitates effective cash flow management for mechanics, making it easier to forecast shop rental expenses and analyze fixed vs variable costs, ultimately enhancing repair service profitability and streamlining warranty services financial impact.

Description

The small engine repair business plan includes a comprehensive financial model that outlines critical elements such as repair shop financial projections, mechanic overhead expenses, and tooling and equipment depreciation, which are essential for monitoring small engine maintenance costs and labor cost analysis. By utilizing a well-structured service pricing strategy and analyzing profit margins, shop rental expense forecasting, and client acquisition costs, the model facilitates effective cash flow management for mechanics, ensuring sustainability amid seasonal fluctuations in revenue. Additionally, it emphasizes parts inventory management and customer retention strategies to enhance repair service profitability, while also considering fixed vs variable costs and the financial impact of warranty services. This adaptable framework allows for detailed automotive service revenue modeling over a five-year horizon, providing valuable insights to businesses seeking to succeed in the competitive small engine repair market.

SMALL ENGINE REPAIR FINANCIAL MODEL REPORTS

All in One Place

A comprehensive financial forecast template integrates the income statement, cash flow statement, and balance sheet, offering a holistic view of your small engine repair business. Regular updates—ideally monthly—ensure accurate tracking of small engine maintenance costs, labor cost analysis, and mechanic overhead expenses. At year-end, this template captures all financial changes, essential for assessing service pricing strategy, repair shop profitability, and parts inventory management. Regardless of business size, preparing a detailed three-statement financial model is critical for navigating cash flow management and forecasting repair shop startup costs effectively.

Dashboard

To develop a robust financial model for your small engine repair business, integrate key components like small engine maintenance costs, labor cost analysis, and tooling equipment depreciation. Utilizing a comprehensive three-way financial model will enhance your startup business plan, making your financial projections more appealing. Leverage the Dashboard tab for insightful charts and graphs to analyze factors like client acquisition cost, parts inventory management, and seasonal fluctuations in revenue. This tailored approach will guide you in establishing a sound service pricing strategy and improving repair shop profitability while effectively managing cash flow and expenses.

Business Financial Statements

Our financial projection model simplifies your small engine repair business plan. By simply updating inputs in the Assumptions section, all three annual financial reporting templates are automatically generated. This streamlined approach helps you analyze mechanic overhead expenses, service pricing strategy, and cash flow management for mechanics. Gain insights into parts inventory management, labor cost analysis, and warranty services financial impact. Optimize your marketing budget for the repair shop and forecast shop rental expenses effortlessly. Improve customer retention strategies and tackle seasonal fluctuations in revenue with accurate financial projections tailored to enhance your shop's profitability and growth.

Sources And Uses Statement

Understanding the sources and uses of capital is essential for a small engine repair business. This clarity allows for accurate tracking of income streams and expenditure areas, aiding in effective cash flow management. By monitoring repair shop startup costs, parts inventory management, and mechanic overhead expenses, your business can optimize its service pricing strategy. Additionally, insight into tooling and equipment depreciation, alongside labor cost analysis, enhances financial projections, ensuring profitability amid seasonal fluctuations. With these strategies, you can improve client acquisition costs and strengthen customer retention, ultimately bolstering your repair service's overall financial health.

Break Even Point In Sales Dollars

A Break-Even Point (BEP) calculation is essential for a small engine repair business plan, determining when total revenue matches total costs. This analysis helps assess both fixed and variable costs, informing labor cost analysis and profit margins. Utilizing a P&L template, shop owners can evaluate service pricing strategies, ensuring that sales prices cover mechanic overhead expenses, tooling and equipment depreciation, and parts inventory management. Understanding contribution margins enhances repair shop profitability, aiding in cash flow management and forecasting seasonal fluctuations in revenue. Ultimately, effective BEP analysis supports client acquisition and customer retention strategies for sustained success.

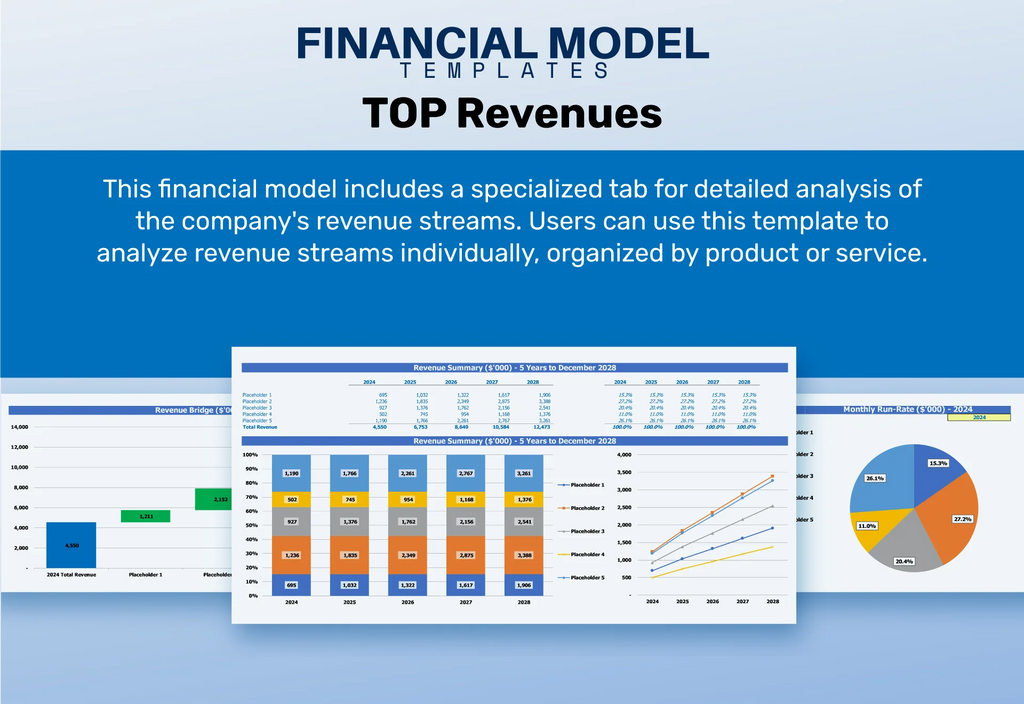

Top Revenue

The Top Revenue section of the five-year projection plan presents a comprehensive overview of your offerings' financial performance. Utilizing this forecast template, you can analyze annual revenue streams, revealing insights into revenue depth and revenue bridge. This allows for informed decision-making regarding service pricing strategy, parts inventory management, and seasonal fluctuations in revenue. With this data, you can enhance your small engine repair business plan, ensuring optimal repair shop profitability while effectively managing mechanic overhead expenses and cash flow. Robust projections pave the way for sustainable client acquisition and improved customer retention strategies.

Business Top Expenses Spreadsheet

Tracking expenses is crucial for a successful small engine repair shop. Our three-statement model template categorizes expenditures into four sections, plus an 'other' category for additional entries. This structured approach aids in managing mechanic overhead expenses and forecasting repair shop startup costs. For a comprehensive view of financial health, consider labor cost analysis and tooling and equipment depreciation over five years. This financial model offers insights into service pricing strategy, parts inventory management, and cash flow management, ensuring informed decisions and enhanced repair service profitability.

SMALL ENGINE REPAIR FINANCIAL PROJECTION EXPENSES

Costs

Our financial Excel template is an essential tool for small engine repair businesses, enabling meticulous tracking of both actual and projected expenses. It offers valuable insights into small engine maintenance costs, allowing you to identify savings and enhance your service pricing strategy. This comprehensive resource supports repair shop financial projections, aiding in pitches to investors and loan applications. By analyzing mechanic overhead expenses and tooling and equipment depreciation, you can better manage cash flow and optimize profitability. Invest in this template to forecast shop rental expenses and improve client acquisition costs effectively.

CAPEX Spending

This financial Excel model is essential for crafting a comprehensive small engine repair business plan. It enables accurate capital expenditure forecasts, crucial for managing high startup costs and ongoing tooling and equipment depreciation. By analyzing repair shop financial projections, you can make informed decisions on service pricing strategy and client acquisition costs. Furthermore, effective cash flow management for mechanics ensures you account for fixed versus variable costs, ultimately enhancing repair service profitability. Equip your business with this model to optimize parts inventory management and navigate seasonal fluctuations in revenue confidently.

Loan Financing Calculator

Effectively managing loans and repayment schedules is crucial for small engine repair businesses, especially during startup and growth phases. Utilizing robust financial software allows for detailed tracking of outstanding balances, maturity dates, and maintenance ratios. A clear loan repayment schedule should outline both interest and principal, linking seamlessly to cash flow management. By understanding how fixed and variable costs, such as mechanic overhead and tooling depreciation, influence financial projections, businesses can enhance profitability. This insight supports strategic decisions regarding service pricing, parts inventory management, and customer retention strategies, ultimately driving success in a competitive market.

SMALL ENGINE REPAIR EXCEL FINANCIAL MODEL METRICS

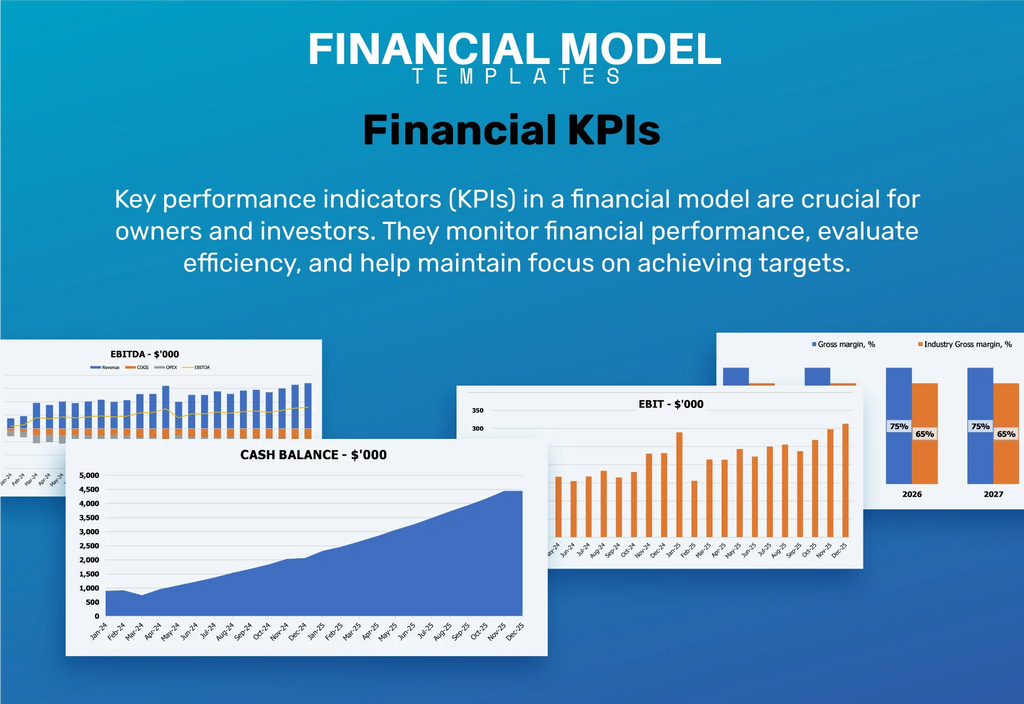

Financial KPIs

A well-structured small engine repair business plan is essential for monitoring key performance indicators like earnings growth and net income. Utilizing a comprehensive profit and loss template enables accurate tracking of sales, revenue, and profitability over five years. This financial tool also aids in analyzing mechanic overhead expenses, service pricing strategy, and parts inventory management. By forecasting shop rental expenses and seasonal fluctuations in revenue, you can enhance cash flow management and improve client acquisition costs. Ultimately, focusing on these metrics will drive customer retention strategies and bolster repair service profitability.

Cash Flow Forecast Excel

A forecast cash flow statement is crucial for a small engine repair business plan, as it illustrates the company's ability to generate cash flows. It highlights consolidated funds and identifies potential gaps that may hinder securing additional financing. By analyzing labor costs, mechanic overhead expenses, and tooling depreciation, the forecast helps refine the service pricing strategy and optimize parts inventory management. Understanding these financial dynamics ensures effective cash flow management for mechanics, ultimately enhancing repair service profitability and supporting robust client acquisition strategies in a competitive market.

KPI Benchmarks

Our financial excel template simplifies benchmarking by incorporating essential metrics that reveal your small engine repair business's performance. By comparing your shop’s operational and financial metrics against industry competitors, you gain valuable insights into areas needing improvement, such as service pricing strategy or labor cost analysis. This tool helps identify weaknesses in client acquisition costs and cash flow management, enabling you to enhance profitability and optimize parts inventory management. With a clear view of fixed vs. variable costs, you can make informed decisions on marketing budget allocation and shop rental expense forecasting for sustained success.

P&L Statement Excel

A small engine repair income statement serves as a vital management tool, enabling you to assess revenue and expenses over time. This forecasted profit and loss statement provides insights into financial health by detailing the costs deducted from total revenue. Our comprehensive 5-year financial model offers monthly and yearly projections, covering aspects like small engine maintenance costs, parts inventory management, and mechanic overhead expenses. By analyzing revenue potential and service pricing strategies, you can enhance repair shop profitability and effectively manage cash flow, ensuring informed decision-making for your small engine repair business.

Pro Forma Balance Sheet Template Excel

Our projected balance sheet template offers a comprehensive snapshot of your small engine repair business over five years. This financial statement outlines total assets, liabilities, and shareholders’ equity, enabling you to assess cash flow management, seasonal revenue fluctuations, and profitability. By comparing historical data, you can refine your service pricing strategy, optimize parts inventory management, and improve labor cost analysis. Use this tool to forecast shop rental expenses and mechanic overhead, helping you navigate small engine maintenance costs and ultimately enhance client acquisition and retention strategies. Achieve clarity in your financial position and strategic planning today.

SMALL ENGINE REPAIR FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

When presenting to investors, a robust small engine repair business plan is essential. Leverage our five-year financial projection template, which includes built-in valuation tools to showcase projected profit margins and cash flow management. Highlight key metrics, such as labor cost analysis and tooling depreciation, to illustrate your repair shop's profitability. Our templates also help analyze parts inventory management and fixed vs. variable costs, ensuring a comprehensive overview for stakeholders. With a strategic service pricing strategy and effective customer retention strategies, you can confidently demonstrate the potential for strong returns on investment.

Cap Table

A Pro Forma Cap Table is essential for small engine repair start-ups, serving as a strategic tool to assess equity distribution among investors. It enables businesses to analyze the monetary contributions of each investor, ensuring transparency in share allocation. By incorporating mechanisms for labor cost analysis, tooling and equipment depreciation, and shop rental expense forecasting, entrepreneurs can enhance their financial projections. This analysis aids in managing cash flow effectively and optimizing repair service profitability, ultimately contributing to a robust business plan that addresses market dynamics and client acquisition costs.

KEY FEATURES

A well-structured financial model enhances profit margins and streamlines cash flow management for small engine repair businesses.

A robust financial forecasting model enhances profitability by effectively managing small engine repair shop costs and optimizing revenue strategies.

A robust financial model enhances profit margin insights and optimizes repair service profitability through detailed cost analysis and pricing strategies.

A robust financial model enhances profitability and guides strategic decisions for small engine repair businesses, ensuring sustainable growth and success.

A robust financial model optimizes small engine repair profitability by analyzing labor costs, marketing budgets, and seasonal revenue fluctuations.

A robust cash flow model empowers small engine repair businesses to forecast financial impacts and optimize profitability through strategic decision-making.

A well-structured small engine repair business plan enhances cash flow management and minimizes overhead expenses, ensuring sustained profitability and growth.

A robust financial model helps forecast cash flow, ensuring informed decisions and better cash management for your small engine repair business.

A robust financial model enhances trust among stakeholders by clearly outlining small engine repair business profitability and efficient resource management.

A comprehensive financial model enhances stakeholder confidence, facilitating better investment opportunities and ensuring sustainable growth for your small engine repair business.

ADVANTAGES

Utilizing a small engine repair financial projection template empowers effective hiring decisions while enhancing profitability and managing expenses efficiently.

A robust financial projection model enhances your small engine repair business by optimizing service pricing strategy and improving client acquisition costs.

A solid financial model enhances your small engine repair business plan by optimizing profit margins and managing costs effectively.

A robust financial model enhances your small engine repair business plan, ensuring precise cash flow management and improved profitability.

A robust financial model enhances small engine repair profitability by optimizing labor costs and improving service pricing strategies.