SaaS Actuals Opt-In Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

SaaS Actuals Opt-In Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

saas actuals opt in Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SAAS ACTUALS OPT IN FINANCIAL MODEL FOR STARTUP INFO

Highlights

Unlock the potential of your SaaS startup with our comprehensive financial model tailored for fundraising and business planning. This five-year SaaS financial model is designed to provide thorough insights into recurring revenue projections, customer acquisition costs, and churn rate calculations, allowing entrepreneurs to strategically assess their SaaS business model canvas. Equipped with financial forecasting tools and SaaS metrics analysis, you can evaluate key financial KPIs for SaaS, including monthly recurring revenue and the lifetime value of a customer. Our model not only facilitates cost structure analysis and valuation of SaaS companies but also integrates predictive analytics for SaaS to optimize conversion rates and user engagement metrics. With built-in financial charts, summaries, and funding forecasts, you can effectively implement SaaS pricing strategies and secure the necessary SaaS funding strategies to propel your startup forward.

This ready-made financial model in Excel addresses key pain points for SaaS businesses by providing a comprehensive yet user-friendly solution for analyzing essential metrics like monthly recurring revenue, churn rate calculation, and customer acquisition cost. By utilizing this template, users can easily generate accurate recurring revenue projections and lifetime value of a customer assessments, streamlining financial forecasting and enhancing decision-making capabilities. The model supports various SaaS pricing strategies and aids in understanding the valuation of SaaS companies, while also offering features for predictive analytics and cost structure analysis that align with revenue recognition standards. Additionally, it highlights vital financial KPIs for SaaS, ensuring businesses can optimize their conversion rate and improve user engagement metrics, ultimately supporting effective SaaS funding strategies and growth.

Description

Our SaaS financial model leverages predictive analytics for SaaS to offer comprehensive recurring revenue projections and detailed insights into vital financial KPIs for SaaS, including customer acquisition cost and churn rate calculation. This template allows you to effectively assess your SaaS pricing strategies and optimize conversion rates while providing the necessary tools for cost structure analysis and financial forecasting. By utilizing our SaaS business model canvas, you can gain a clearer understanding of user engagement metrics and the lifetime value of a customer, which is crucial for the valuation of SaaS companies. With built-in revenue recognition standards, this model ensures that all financial statements and cash flow analyses are aligned with industry standards, enabling you to present robust financial documentation to potential lenders and investors.

SAAS ACTUALS OPT IN FINANCIAL MODEL REPORTS

All in One Place

Unlock your startup's potential with a robust 5-year financial projection template. Don't let your lack of financial expertise hold you back. Our comprehensive income statement template equips you with essential SaaS metrics analysis tools, helping you calculate monthly recurring revenue, churn rates, and customer acquisition costs. Utilize predictive analytics for SaaS to enhance revenue projections and optimize your pricing strategies. With our user-friendly framework, you can confidently develop financial KPIs for SaaS, ensuring informed decisions for sustainable growth and valuation of your company. Start forecasting your success today!

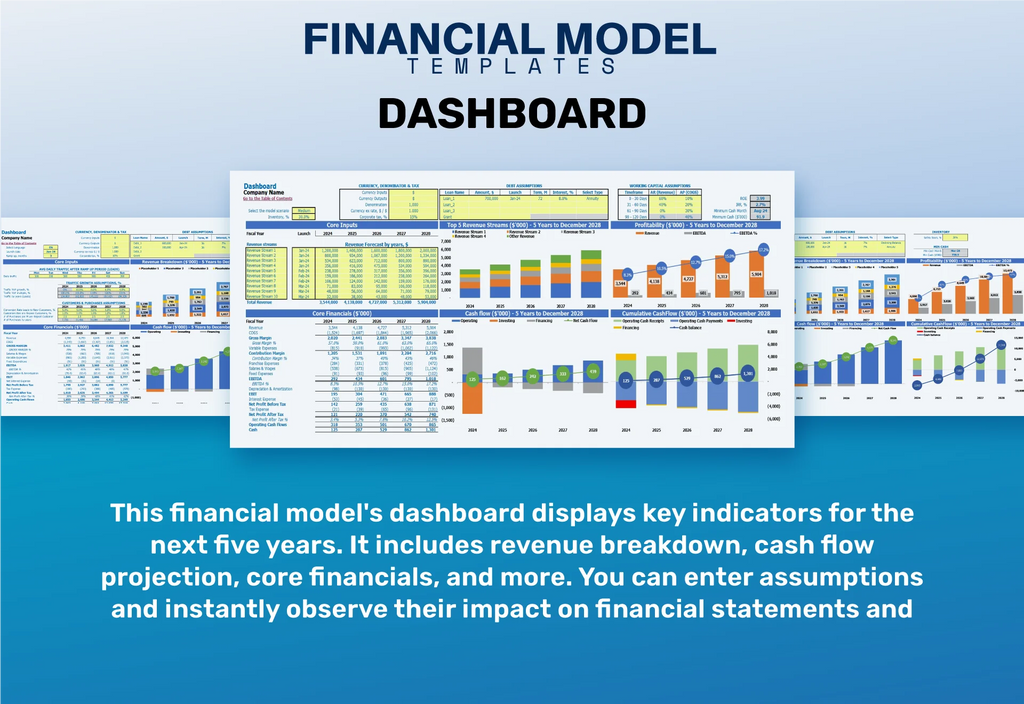

Dashboard

The Excel financial model serves as an essential tool for SaaS companies, enabling detailed cash flow and balance sheet forecasts. It allows users to analyze recurring revenue projections and assess financial KPIs, such as customer acquisition cost and churn rate calculations. The model can generate insightful breakdowns over any time frame—monthly or annually—and presents data in both numerical formats and visually engaging charts. By leveraging predictive analytics for SaaS, businesses can optimize their SaaS pricing strategies and enhance their valuation, driving growth through effective financial forecasting tools.

Business Financial Statements

Our SaaS financial model effortlessly generates essential annual business financial statements. By utilizing financial forecasting tools, you can easily update key assumptions—such as customer acquisition costs and churn rate calculations—to reflect your company's unique circumstances. This dynamic model will adjust recurring revenue projections and monthly recurring revenue, ensuring you have the most accurate financial insights. Leverage predictive analytics for SaaS to refine your pricing strategies and boost user engagement metrics. Experience seamless financial planning and stay ahead in the competitive SaaS landscape.

Sources And Uses Statement

The sources and uses table in the Excel financial model provides a clear overview of capital sourcing and allocation. Each Source aligns with its corresponding Use, ensuring balance and clarity. This critical statement is essential for both internal assessments and external evaluations, particularly in scenarios involving refinancing, restructuring, recapitalization, or mergers & acquisitions (M&A). By leveraging this data, SaaS companies can enhance their financial forecasting, optimize pricing strategies, and better understand key metrics like customer acquisition cost and churn rate, ultimately driving growth and maximizing the lifetime value of their customers.

Break Even Point In Sales Dollars

Conducting a break-even analysis provides a clear view of profit generation across varying sales levels, essential for effective financial forecasting. Additionally, understanding your safety margin is crucial; it indicates the range within which your business can absorb revenue fluctuations before incurring losses. This insight enhances your SaaS financial model, aiding in strategic decisions related to customer acquisition costs and churn rate calculations. By leveraging predictive analytics for SaaS, you can refine your monthly recurring revenue projections and better navigate SaaS pricing strategies to ensure sustainable growth and profitability.

Top Revenue

Dive deep into your revenue streams with our free startup financial model template. Tailored for SaaS businesses, it features specialized tabs for detailed analysis, allowing you to segment revenue by product or service category. Enhance your SaaS metrics analysis by examining monthly recurring revenue, customer acquisition cost, and churn rate calculation. Leverage this tool to optimize your SaaS pricing strategies and improve your financial KPIs. Whether you're forecasting revenue or exploring funding strategies, our template empowers you to make informed decisions and boost overall user engagement metrics.

Business Top Expenses Spreadsheet

In the Top Expenses section of our SaaS financial model template, you can meticulously analyze your expenditures. We categorize expenses into four key areas, while also providing an 'Other' category for you to input any relevant data that aligns with your specific needs. This flexibility supports comprehensive cost structure analysis, enhancing your recurring revenue projections and overall financial forecasting. Utilize this insightful feature to better understand your customer acquisition cost and improve your SaaS pricing strategies, ultimately optimizing your financial KPIs for sustained growth.

SAAS ACTUALS OPT IN FINANCIAL PROJECTION EXPENSES

Costs

Our SaaS financial model template provides an essential foundation for monitoring startup costs, critical for maintaining optimal funding levels. This comprehensive pro forma incorporates key metrics such as customer acquisition cost and churn rate calculation, enabling effective financial forecasting and revenue recognition standards. With five-year recurring revenue projections, this template empowers users to manage expenses and refine SaaS pricing strategies. Utilize the predictive analytics for SaaS to enhance user engagement metrics and conversion rate optimization, ensuring sustained growth and robust valuation of your SaaS company. Achieve financial clarity with our specialized tools tailored for successful SaaS businesses.

CAPEX Spending

CapEx, or capital expenditures, encompass a company's investments in acquiring or building assets, reflecting long-term value. These significant expenditures are not fully recognized in a single reporting period; instead, they influence recurring revenue projections and financial forecasting tools over time. When analyzing a SaaS financial model, understanding the cost structure and its impact on metrics such as customer acquisition cost and churn rate is crucial. Ultimately, this strategic approach supports the valuation of SaaS companies and informs effective SaaS pricing strategies, ensuring sustainable growth and enhanced user engagement.

Loan Financing Calculator

Our five-year cash flow projection template includes a loan amortization schedule, utilizing pre-built formulas for efficiency. This tool provides a clear breakdown of scheduled repayments, detailing principal and interest amounts for each month, quarter, or year. By integrating this with our SaaS financial model, you can enhance financial forecasting accuracy, optimize customer acquisition costs, and improve monthly recurring revenue projections. Leverage this comprehensive resource to gain valuable insights into your cost structure and strengthen the valuation of your SaaS company. Elevate your financial KPIs and support strategic decision-making with predictive analytics for SaaS.

SAAS ACTUALS OPT IN EXCEL FINANCIAL MODEL METRICS

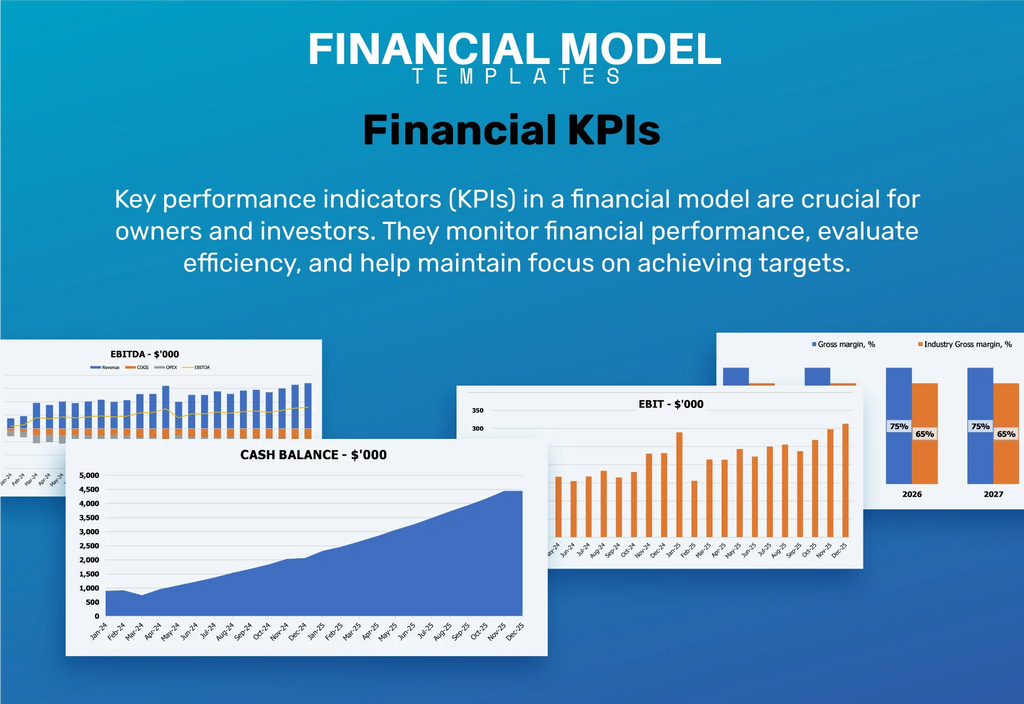

Financial KPIs

The return on assets (ROA) metric, derived from projected balance sheets and income statements, reveals a company's profitability relative to its asset value. This essential financial KPI offers insights for investors and business owners regarding asset efficiency. By analyzing ROA alongside other SaaS metrics—such as customer acquisition cost, churn rate, and lifetime value of a customer—companies can refine their SaaS financial model. Leveraging financial forecasting tools enhances strategic decision-making, ultimately driving sustainable growth and optimizing SaaS pricing strategies.

Cash Flow Forecast Excel

An effective monthly cash flow statement in Excel demonstrates your startup's ability to manage cash streams and sustain financial health. It’s crucial for showcasing recurring revenue projections and evaluating customer acquisition costs. This not only reassures banks about your five-year financial forecasting but also highlights your commitment to maintaining positive cash flow. By incorporating SaaS metrics analysis, including churn rate calculation and lifetime value of a customer, you can strengthen your valuation strategy, ensuring robust financial KPIs that attract potential funding. Prioritizing these elements is key to securing the growth your SaaS business model demands.

KPI Benchmarks

A three-year financial projection template in Excel includes a benchmarking tab that calculates key performance indicators (KPIs) and compares them against industry averages. This process is crucial for startups, as it leverages insights from established SaaS companies to refine their business models and optimize financial strategies, such as customer acquisition cost and churn rate calculation. By analyzing metrics like monthly recurring revenue and the lifetime value of a customer, startups can enhance their SaaS pricing strategies and drive growth. Employing financial forecasting tools helps in establishing effective SaaS funding strategies and improves overall valuation.

P&L Statement Excel

An essential component of the SaaS financial model is the income statement, which effectively outlines profitability by tracing the journey from monthly recurring revenue to final net profit. A meticulously crafted pro forma income statement is crucial for establishing credibility; stakeholders often rely on it to gauge the success of your journey. Moreover, this statement supports critical SaaS metrics analysis, including customer acquisition cost, churn rate calculation, and lifetime value of a customer, enabling informed decision-making regarding pricing strategies and financial forecasting tools for sustained growth.

Pro Forma Balance Sheet Template Excel

A projected balance sheet, or statement of financial position, provides a snapshot of a startup's assets, liabilities, and shareholders’ equity at a given moment. This essential document enables analysis of what the organization owns versus what it owes. Our financial forecasting tools offer a pro forma balance sheet template, empowering you to easily assess your startup's financial health. By incorporating key SaaS metrics, such as recurring revenue projections and customer acquisition costs, you can strategically align your SaaS business model and funding strategies for sustained growth and profitability.

SAAS ACTUALS OPT IN FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The SaaS valuation calculator provides critical insights through a sophisticated financial model, allowing stakeholders to assess Weighted Average Cost of Capital (WACC), Discounted Cash Flow (DCF), and Free Cash Flow (FCF). These metrics are vital for evaluating recurring revenue projections, customer acquisition costs, and the overall valuation of SaaS companies. Understanding WACC aids in risk assessment for investors, while DCF offers a glimpse into future cash flows, essential for informed decision-making in SaaS pricing strategies and funding. By leveraging financial forecasting tools, businesses can optimize their growth metrics and enhance user engagement.

Cap Table

Cap Table serves as a vital tool for evaluating the impact of stock structures on your company's financial health. By systematically entering and analyzing data, it offers actionable insights for SaaS financial modeling. This enhances recurring revenue projections and optimizes customer acquisition costs, while also informing churn rate calculations and lifetime value assessments. Leveraging financial forecasting tools, you can streamline your SaaS pricing strategies and improve revenue recognition standards, ultimately bolstering your SaaS growth metrics. Engage with Cap Table for informed decision-making and robust SaaS business model canvas construction.

KEY FEATURES

A robust SaaS financial model enhances stakeholder trust by providing clear insights into recurring revenue projections and sustainable growth.

A clear SaaS financial model enhances stakeholder confidence, facilitating investment by showcasing robust recurring revenue projections and growth potential.

A robust SaaS financial model enhances recurring revenue projections, optimizes customer acquisition costs, and drives strategic growth decisions.

A robust SaaS financial model empowers your business to accurately forecast cash flows and optimize strategic decisions for growth.

A robust SaaS financial model enhances predictive analytics, optimizing recurring revenue projections and attracting investor interest.

With the SaaS financial model, you'll enhance your recurring revenue projections and attract investors with confidence.

A robust SaaS financial model enhances valuation accuracy and optimizes recurring revenue projections, attracting investors and driving strategic growth.

A robust SaaS financial model enhances decision-making by providing insights into recurring revenue projections and customer acquisition costs.

A robust SaaS financial model enables precise recurring revenue projections and effective cost structure analysis for sustainable growth over five years.

The robust SaaS financial model enhances revenue forecasts, providing clarity on monthly recurring revenue and customer lifetime value.

ADVANTAGES

Leverage our SaaS financial model to optimize recurring revenue projections and enhance your customer acquisition strategy effectively.

A robust SaaS financial model enhances revenue projections and attracts top talent by showcasing strong growth potential and stability.

A robust SaaS financial model enhances recurring revenue projections and aids in effective customer acquisition cost management.

Leverage our SaaS financial model to enhance revenue projections and optimize customer acquisition costs for sustainable growth.

A robust SaaS financial model enhances forecasting accuracy, driving strategic decisions for revenue growth and effective resource allocation.