Retail Property Acquisition Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Retail Property Acquisition Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

retail acquisition refm Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

RETAIL ACQUISITION REFM FINANCIAL MODEL FOR STARTUP INFO

Highlights

Our comprehensive suite of tools includes a 5-year retail acquisition financial model, enabling detailed cash flow projections for retail, alongside a robust business plan cash flow template and financial dashboard. These resources facilitate a thorough retail merger analysis, allowing users to assess acquisition valuation methods and evaluate the financial performance analysis of potential investments. With a focus on retail acquisition trends and risk assessment in retail acquisitions, our platform supports users in conducting due diligence, ultimately enhancing post-acquisition integration strategies and ensuring a favorable return on investment in retail. The inclusion of core metrics in both GAAP and IFRS formats further empowers users to navigate the complexities of capital structure in retail and identify synergies in retail mergers effectively.

The retail acquisition strategy financial model in Excel offers comprehensive solutions to key pain points faced by buyers, facilitating effective cash flow projections for retail operations and enhancing overall financial performance analysis. Through detailed financial modeling for retail, this template enables accurate acquisition valuation methods, allowing users to evaluate potential investments with precision. By providing a robust framework for retail merger analysis, it supports due diligence in acquisitions and risk assessment, helping businesses identify synergies in retail mergers and align capital structure for optimal returns. The model also features a pro forma income statement for thorough financial forecasting for retail, ensuring that post-acquisition integration is seamless and aligned with the company's growth objectives, thus driving better return on investment in retail business ventures.

Description

The financial model developed for retail acquisition firms provides a comprehensive framework for evaluating potential investments through sophisticated financial modeling techniques tailored for the dynamic retail environment. This flexible model incorporates various revenue streams and expenses, facilitating detailed cash flow projections and financial forecasting for retail operations, while supporting acquisition valuation methods and risk assessments essential for due diligence in acquisitions. It allows users to conduct retail merger analysis, exploring potential synergies in retail mergers and assessing capital structure implications, thus enhancing retail investment evaluation and post-acquisition integration strategies. Overall, the model serves as a critical tool for understanding retail market analysis trends and optimizing return on investment in retail, equipping stakeholders with the necessary insights for effective decision-making.

RETAIL ACQUISITION REFM FINANCIAL MODEL REPORTS

All in One Place

Concerned about developing a robust financial model for your retail startup? Our expertly crafted projected cash flow statement template is designed for ease of use, equipped with essential retail financial metrics and tools. This intuitive resource simplifies financial forecasting for retail, empowering you to skillfully conduct acquisition valuation methods and assess investment opportunities. With our template, you'll navigate the complexities of retail market analysis, enabling you to confidently pursue growth strategies and enhance your retail acquisition strategy. Transform your approach to financial modeling today and position your business for success.

Dashboard

Our comprehensive financial modeling Excel template features an integrated all-in-one dashboard that streamlines retail acquisition strategy analysis. Users can effortlessly access detailed cash flow projections, a projected balance sheet, and a dynamic cash flow statement, with options for monthly or annual breakdowns. The dashboard provides clear insights through both numerical data and visual charts, facilitating informed retail investment evaluation and enhancing financial performance analysis. Empower your decision-making with our tool, designed for effective due diligence in acquisitions and robust risk assessment in retail acquisition ventures. Unlock growth potential with this essential resource for retail business growth strategies.

Business Financial Statements

Understanding a company's performance requires a multifaceted approach using key financial statements. The profit and loss statement reveals essential insights into operational earnings, pivotal in retail acquisition strategies. Meanwhile, the projected balance sheet and five-year cash flow projections emphasize capital structure and management, crucial for evaluating acquisition deal structures. Utilizing these tools enhances financial modeling for retail, aiding in risk assessment and post-acquisition integration. Together, they provide a robust framework for retail investment evaluation, ensuring informed decisions that align with growth strategies and optimize return on investment.

Sources And Uses Statement

The cash sources and uses statement within the pro forma income statement template is essential for effective retail acquisition strategy. It delineates the funding sources available to the company while detailing expenditures, which is invaluable for financial modeling in retail. This statement aids in risk assessment during acquisitions, ensuring thorough due diligence. Understanding cash flow projections for retail enhances post-acquisition integration and informs acquisition valuation methods. Ultimately, it supports robust retail investment evaluation and fosters informed decision-making to drive business growth and improve financial performance across the retail sector.

Break Even Point In Sales Dollars

Our pro forma income statement template includes a break-even chart, an essential tool for retail acquisition strategy. By calculating the break-even point in unit sales, retail businesses can effectively determine pricing strategies that ensure revenue covers costs. This analysis is vital for financial modeling for retail, enabling companies to evaluate acquisition valuation methods and assess return on investment. Integrating this data into financial forecasting for retail and considering market analysis helps inform sound decision-making, ultimately enhancing post-acquisition integration and driving sustainable growth.

Top Revenue

In retail financial forecasting, the top and bottom lines of a profit and loss statement are pivotal. The top line indicates revenue growth, reflecting the company's sales performance, while the bottom line reveals profit, essential for analysts and investors. Monitoring these key retail financial metrics quarterly and annually is crucial to assess overall financial performance. Successful retail acquisition strategies hinge on these insights, guiding acquisition valuation methods and shaping post-acquisition integration efforts. Understanding revenue trends directly influences effective retail investment evaluation and enhances decision-making within the mergers and acquisitions framework.

Business Top Expenses Spreadsheet

The Top Expenses tab in the three-statement financial model Excel template provides a comprehensive overview of a company's annual expenditures, categorized into four distinct groups. This essential business plan tool offers a detailed breakdown of costs, including customer acquisition expenses and fixed overheads. By analyzing these financial metrics, businesses can enhance their retail acquisition strategy, ensuring effective cash flow projections and informed investment evaluations. A thorough understanding of spending origins lays the groundwork for efficient financial management and strategic growth, ultimately driving success in retail mergers and acquisitions.

RETAIL ACQUISITION REFM FINANCIAL PROJECTION EXPENSES

Costs

Our advanced financial modeling for retail empowers you to effectively manage costs and enhance performance. By leveraging comprehensive cash flow projections, expense monitoring, and analytics, you can proactively address challenges and drive agile solutions. This Excel template not only aligns with your retail acquisition strategy but also aids in presenting robust financial forecasting to investors. With our tool, you can evaluate retail investment opportunities, assess risk in acquisitions, and optimize your capital structure, ensuring informed decision-making that paves the way for sustainable business growth. Transform your retail operations with our strategic insights today.

CAPEX Spending

An effective capital expenditure (CAPEX) strategy is crucial for enhancing a retail company's overall financial position. By utilizing a structured capital expenditure plan, businesses can strategically allocate investments to meet their operational needs. This financial modeling for retail not only supports innovative management practices but also facilitates the integration of cutting-edge technology. Additionally, employing a robust retail acquisition strategy and thorough due diligence enables firms to maximize their return on investment, ensuring sustainable growth in a competitive market. Ultimately, aligning CAPEX with retail business growth strategies leads to improved financial performance and enhanced market presence.

Loan Financing Calculator

A loan amortization schedule is essential for managing a company's debt obligations, providing a clear timetable for repayment. This financial model incorporates a user-friendly amortization schedule, allowing for effective retail financial forecasting. It outlines critical details, including repayment dates, installment amounts, and the breakdown between principal and interest. Furthermore, the schedule encompasses key loan terms, such as interest rates and repayment frequency, facilitating accurate financial modeling for retail and supporting strategic retail acquisition trends and investment evaluations. By incorporating these elements, businesses can enhance their cash flow projections and overall financial performance analysis.

RETAIL ACQUISITION REFM EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a critical metric in financial modeling for retail. This key indicator allows for a comprehensive assessment of operating performance and is essential for retail acquisition strategies. By utilizing acquisition valuation methods and conducting thorough retail merger analysis, businesses can evaluate potential investments effectively. Understanding cash flow projections and implementing post-acquisition integration plans are vital for maximizing synergies in retail mergers. Ultimately, leveraging such financial metrics enhances decision-making, informing retail business growth strategies to drive long-term value and return on investment.

Cash Flow Forecast Excel

A cash flow projections template in Excel is essential for crafting an effective retail acquisition strategy. By utilizing this tool, businesses can manage financial flows meticulously and enhance their forecasting capabilities. Accurate cash flow statements provide insights into potential financial transactions, enabling retailers to assess their financial performance and investment evaluation. Furthermore, they serve as a critical component in due diligence during acquisitions, allowing for comprehensive risk assessment and aiding in post-acquisition integration. Ultimately, these projections can significantly impact the success of mergers and acquisitions, driving retail business growth and optimizing return on investment.

KPI Benchmarks

The financial benchmarking feature in this pro forma template enables companies to evaluate their key performance indicators (KPIs) against industry standards. Benchmarking involves comparing your business's financial metrics with those of peers to identify improvement opportunities. By leveraging best practices from successful firms, businesses can enhance their operational efficiency and financial performance. This essential tool is particularly valuable for start-ups, providing insights into retail acquisition strategies, capital structure, and post-acquisition integration to drive sustainable growth and improve return on investment in retail.

P&L Statement Excel

The monthly profit and loss template in Excel empowers retail businesses to model expenses and revenues dynamically. Unlike the statement of cash flows, which captures actual cash movements, the pro forma profit and loss statement offers essential insights by incorporating non-cash items like depreciation. These items are crucial for financial modeling in retail, allowing for robust acquisition valuation methods and accurate financial forecasting. By integrating this template into your retail acquisition strategy, you can enhance your risk assessment and drive post-acquisition integration, ultimately supporting informed decision-making and improved return on investment.

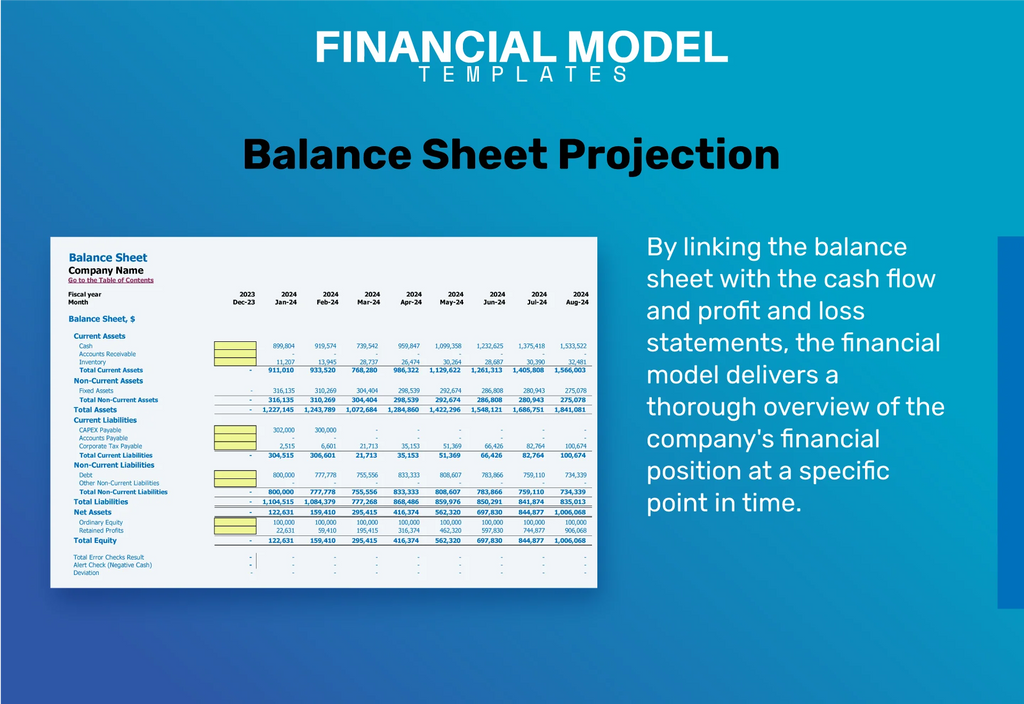

Pro Forma Balance Sheet Template Excel

A projected balance sheet serves as a crucial financial modeling tool, summarizing an organization’s assets, liabilities, and shareholders’ equity for a specific period. This report is essential in retail acquisition strategy, offering insights into financial performance analysis and acquisition valuation methods. By leveraging a pro forma balance sheet for retail investment evaluation, stakeholders can assess the organization’s financial health, aiding due diligence in acquisitions and enhancing cash flow projections for retail. Utilize this template to navigate post-acquisition integration and evaluate potential synergies in retail mergers, ultimately driving informed decision-making for sustainable business growth.

RETAIL ACQUISITION REFM FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our retail acquisition feasibility study template provides a robust valuation framework, essential for informed investment evaluations. Key financial metrics, such as the weighted average cost of capital (WACC), highlight minimum return expectations for capital investments. Additionally, free cash flow (FCF) offers insights into available cash within the company, while discounted cash flow analysis captures the present value of anticipated future cash flows. This comprehensive approach supports effective due diligence and lays the groundwork for successful post-acquisition integration, ultimately enhancing financial forecasting and optimizing return on investment in retail.

Cap Table

Our startup costs template features a comprehensive capitalization table in a dedicated Excel spreadsheet, outlining ownership distribution over various timeframes. This cap table is essential for investors, providing clear insights into potential returns on investment should they choose to exit. By integrating robust financial modeling for retail, it supports effective acquisition valuation methods and enhances post-acquisition integration efforts. With detailed cash flow projections and financial performance analysis, this tool serves as a vital component of your retail acquisition strategy, reinforcing transparency and informed decision-making in the dynamic landscape of retail investments.

KEY FEATURES

A robust financial modeling for retail enhances acquisition valuation methods, driving informed decisions and optimizing returns on investment.

A robust financial model empowers retail investors to streamline acquisition evaluations and enhance strategic decision-making without costly consultations.

A robust financial model enhances retail acquisition strategies by providing accurate cash flow projections and optimizing post-acquisition integration outcomes.

Implementing a robust financial model for retail enhances decision-making, mitigates risks, and supports sustainable business growth strategies.

Leverage a robust financial model to enhance retail acquisition strategy and optimize cash flow projections for superior investment returns.

This robust financial model empowers retail acquisition strategies by providing precise metrics for effective risk assessment and integration planning.

Effective financial modeling for retail enhances investment evaluation, ensuring accurate projections and maximizing return on investment in acquisitions.

Unlock investor interest effortlessly with a robust financial model, driving confidence in your retail acquisition strategy and growth potential.

A robust financial model enhances retail acquisition strategy by providing accurate cash flow projections and improving risk assessment in acquisitions.

This powerful financial modeling tool enhances retail acquisition strategies by providing accurate projections for effective decision-making and risk assessment.

ADVANTAGES

Utilizing financial modeling for retail enhances acquisition strategies by providing accurate cash flow projections and risk assessments for informed decision-making.

A robust financial modeling template enhances retail acquisition strategies by providing clear insights into competition and potential synergies.

Utilizing a robust financial model enhances retail acquisition strategies by providing accurate cash flow projections and improving risk assessment.

Using a robust financial model for retail enhances acquisition valuation methods, ensuring informed decisions and maximizing return on investment.

A robust financial modeling for retail enhances decision-making by providing insights into acquisition valuation methods and cash flow projections.