Renewable Energy Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Renewable Energy Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

renewable energy Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

RENEWABLE ENERGY FINANCIAL MODEL FOR STARTUP INFO

Highlights

The five-year renewable energy investment model provides startups and entrepreneurs with a comprehensive financial framework designed to impress investors and secure funding. This template includes essential clean energy financial analysis tools, such as green energy cash flow projections and renewable project valuation metrics, enabling users to conduct thorough energy project financial forecasting. With a focus on sustainability investment strategy, the model incorporates solar energy project finance and wind farm economic evaluation features to enhance renewable project risk analysis. By utilizing this clean technology financing resource, businesses can effectively demonstrate their potential for return on investment and attract funding from banks, angels, grants, and VC funds while navigating the energy transition with robust decarbonization financial models.

The renewable energy investment model in our Excel template effectively addresses common pain points faced by buyers seeking clarity in financial projections and investment strategies. It simplifies clean energy financial analysis through comprehensive input tables and detailed charts, allowing for robust solar energy project finance insights and wind energy economic assessments. Our template enhances renewable project valuation by providing meticulous green energy cash flow projections and alternative energy financial metrics, ensuring users can confidently navigate decarbonization financial models. The framework also incorporates energy efficiency investment appraisals and renewable project risk analysis tools, helping to mitigate uncertainties while optimizing clean technology financing. With built-in financial forecasting capabilities, this model empowers users to generate reliable three financial statements—profit and loss, cash flow, and balance sheet—on both monthly and annual bases, combined with user-friendly features like sales analysis and a dynamic dashboard for effective decision-making.

Description

The financial model for your renewable energy project is crucial for establishing a robust business framework that integrates renewable energy investment models and clean energy financial analysis to ensure long-term sustainability. This comprehensive Excel template includes a five-year financial summary encompassing three key financial statements—profit and loss, pro forma balance sheet, and cash flow forecasting—facilitating renewable project valuation and providing vital metrics such as Free Cash Flows, Internal Rate of Return, and Discounted Cash Flow. By leveraging this model, you can conduct wind energy economic assessments and solar energy project finance evaluations, enabling precise green energy cash flow projections and a thorough renewable project risk analysis. Our aim is to equip you with a sustainable finance modeling tool that helps determine your initial capital investments and working capital needs while streamlining your energy project financial forecasting for optimal decision-making in your clean technology financing endeavors.

RENEWABLE ENERGY FINANCIAL MODEL REPORTS

All in One Place

This renewable energy financial model is expertly designed for user convenience, featuring a streamlined layout that simplifies clean energy financial analysis. All key financial assumptions are clearly outlined on a single sheet, and dynamic formulas ensure consistency across approximately 15 integrated sheets. By simply updating the highlighted parameters, you can effortlessly generate accurate cash flow projections and forecast income statements for your renewable energy venture. This tool supports robust project valuation and risk analysis, enhancing your sustainability investment strategy and paving the way for a successful energy transition.

Dashboard

Unlock the potential of your renewable energy investments with our intuitive dashboard, designed for comprehensive clean energy financial analysis. Easily access your company's three-statement model, empowering stakeholders with insights into renewable project valuation, cash flow projections, and economic assessments. Whether you’re involved in solar energy project finance or wind farm evaluations, our tool facilitates effective decision-making and enhances sustainability investment strategies. Share crucial data seamlessly and drive your energy transition with confidence, leveraging cutting-edge financial models and projections tailored for the clean technology landscape.

Business Financial Statements

Our startup financial model is designed for business owners committed to renewable energy investment. It includes customizable templates for clean energy financial analysis, facilitating solar energy project finance and wind energy economic assessments. The model provides robust energy project financial forecasting through visual graphs and charts, ensuring clarity when presenting to potential investors. Easily adaptable, it effectively conveys renewable project valuation and highlights cash flow projections, making it an essential tool for articulating your sustainability investment strategy and securing clean technology financing. Unlock the potential of sustainable finance modeling with our comprehensive approach.

Sources And Uses Statement

Our renewable energy investment model features a comprehensive sources and uses of cash statement, ensuring transparency in fund deployment. This critical tool outlines how company funding is sourced and allocated, enabling stakeholders to easily track expenditures. By integrating clean energy financial analysis, we facilitate informed decision-making, emphasizing sustainability investment strategies and renewable project risk analysis. This approach enhances renewable asset valuation and supports effective energy transition financial frameworks, ultimately driving successful projects in solar energy and wind energy sectors. Join us in advancing clean technology financing for a sustainable future.

Break Even Point In Sales Dollars

This financial projections spreadsheet offers a comprehensive break-even analysis over a five-year horizon, utilizing an Excel formula for precision. It effectively combines numeric calculations with intuitive chart visualizations, facilitating a clear understanding of your renewable energy investment model. This tool is invaluable for clean energy financial analysis, helping to evaluate the sustainability investment strategy for solar and wind projects. By incorporating green energy cash flow projections, this resource supports effective decision-making in clean technology financing, ensuring robust renewable project valuation and economic assessment.

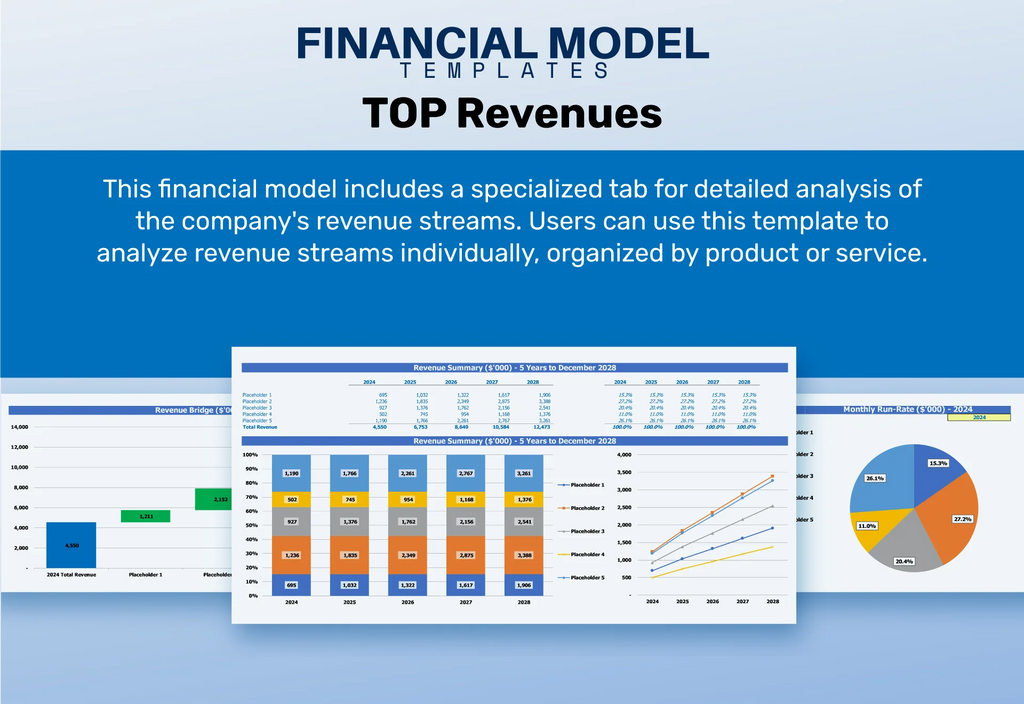

Top Revenue

The Top Revenue tab in our renewable energy investment model offers comprehensive insights into your clean energy project's financial performance. This section provides an annual breakdown of revenue projections, highlighting key metrics such as revenue depth and revenue bridge. By integrating clean energy financial analysis, our template enables users to assess solar energy project finance and wind energy economic assessments effectively. This robust framework not only supports renewable project valuation but also assists in developing sustainable finance modeling for optimal investment strategies. Elevate your financial forecasting with our clean technology financing approach.

Business Top Expenses Spreadsheet

In the dynamic landscape of renewable energy, effective cost management is essential for maximizing profitability. Our renewable energy investment model includes a comprehensive expense report that highlights the largest cost categories, streamlining clean energy financial analysis. By tracking these key expenses year-on-year, businesses can optimize their sustainability investment strategy, identify potential savings, and enhance cash flow projections. This proactive approach supports informed decision-making in solar energy project finance, wind farm economic evaluations, and overall energy transition financial frameworks, ensuring that organizations remain competitive in the evolving clean technology financing market.

RENEWABLE ENERGY FINANCIAL PROJECTION EXPENSES

Costs

Initial startup costs are crucial for any company, particularly within the renewable energy sector. An effective renewable energy investment model should account for these expenses to ensure a robust financial projection framework. Our Excel pro forma template offers a specialized cost management tool that enhances financial forecasting and supports sustainability investment strategies. By integrating clean energy financial analysis, it helps mitigate potential financial losses, allowing you to focus on growth while optimizing green energy cash flow projections and ensuring successful project finance in solar and wind energy initiatives.

CAPEX Spending

A meticulously crafted startup budget is crucial in shaping a robust projected income statement. Financial specialists conduct a clean energy financial analysis to determine initial expenditures, ensuring efficient management of investments. Understanding these startup costs is vital for the company’s growth and sustainable cash flow projections. This responsible approach informs capital expenditures in the energy transition financial framework, influencing overall project valuation. Prioritizing effective renewable energy investment models and strategies can significantly enhance the organization’s financial outlook and drive successful decarbonization initiatives.

Loan Financing Calculator

The loan amortization schedule is a crucial tool for tracking repayment commitments in clean energy projects. This comprehensive three-way financial model template incorporates an automated loan amortization schedule, enhancing usability with built-in formulas. It outlines repayment dates, installment amounts, and the breakdown of principal versus interest. Additionally, it captures vital loan terms, including the duration, interest rate, and repayment frequency. Integrated within a renewable energy investment model, this schedule aids in effective financial forecasting and sustainable finance modeling, promoting informed decisions in renewable project valuation and clean technology financing.

RENEWABLE ENERGY EXCEL FINANCIAL MODEL METRICS

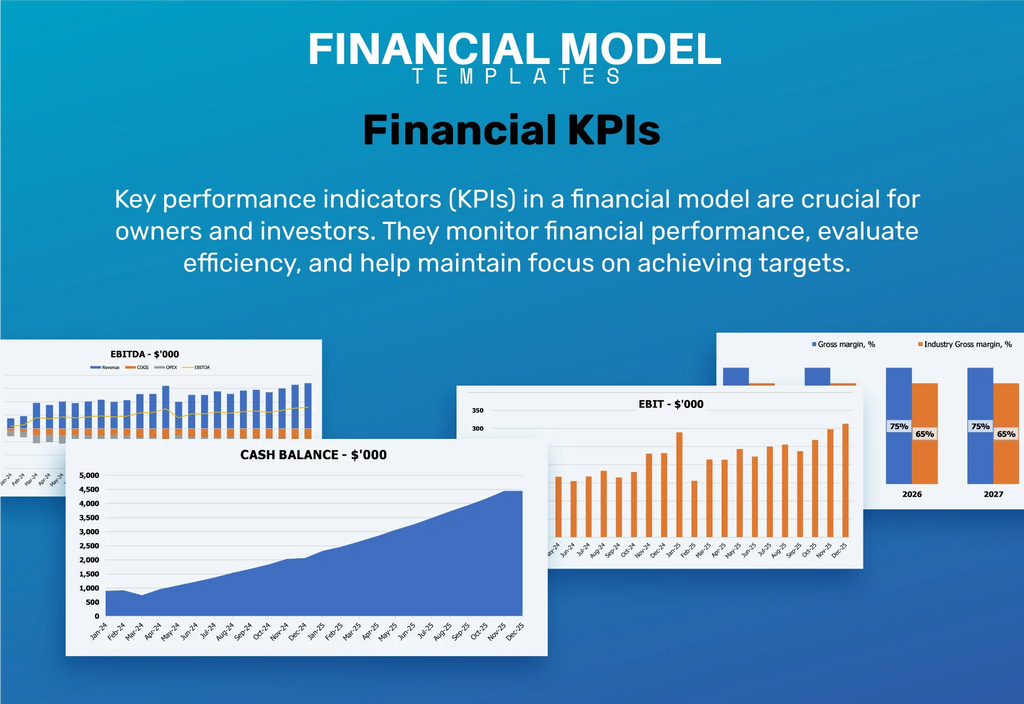

Financial KPIs

The gross profit margin (GPM) represents a company’s profitability by calculating the percentage of gross profit relative to net sales. This financial metric is essential within the renewable energy investment model, as it aids in assessing the viability of clean energy projects. By analyzing cash flow projections and conducting rigorous economic assessments of solar and wind energy ventures, stakeholders can effectively evaluate investment returns. Incorporating sustainability investment strategies and financial forecasting ensures a comprehensive understanding of renewable project valuation and risk analysis, driving informed decisions in the transition to a greener economy.

Cash Flow Forecast Excel

The cash flow statement is crucial for demonstrating your business's capacity to generate sufficient funds for meeting liabilities and operational expenses. In the realm of renewable energy investment models, this financial analysis becomes even more vital. Banks rely on detailed cash flow projections to assess your project's viability and to ensure repayment capabilities for any financing secured. By incorporating renewable project valuation and risk analysis, you can enhance your approach to clean technology financing and sustainable finance modeling, ultimately facilitating a smoother energy transition.

KPI Benchmarks

A pro forma financial statements template with a benchmarking tab calculates key performance indicators and compares them against industry averages. This benchmarking analysis is vital for financial planning, especially for startups in the renewable energy sector. By utilizing metrics from successful clean energy projects, companies can evaluate their performance against best practices, enhancing their sustainability investment strategy. This strategic management tool aids in effective financial forecasting, enabling firms to refine their renewable project valuation and assess potential returns on investment within the evolving energy transition financial framework.

P&L Statement Excel

Today's projected pro forma profit and loss statement is crucial for business owners in the renewable energy sector. It not only captures the financial performance of clean energy initiatives but also forecasts income and expenses over the coming years. By regularly analyzing these reports, stakeholders can refine their sustainability investment strategies and enhance green energy cash flow projections. This approach enables informed decision-making, ultimately driving revenue growth and optimizing renewable project valuation. Embracing this financial framework is essential for navigating the energy transition and achieving robust returns on investment in the clean technology landscape.

Pro Forma Balance Sheet Template Excel

The pro forma balance forecast is pivotal in the renewable energy investment model, complementing essential financial projections like profit and loss statements and cash flow analyses. While it may lack the allure of an income statement, this projected balance sheet is crucial for crafting a robust business plan. Investors prioritize its insights for evaluating net income realism and measuring key profitability ratios, including return on equity and return on invested capital. It serves as a foundation for clean energy financial analysis, supporting sustainability investment strategies and enhancing renewable project valuation efforts.

RENEWABLE ENERGY FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our renewable energy investment model provides a comprehensive financial analysis for your solar or wind energy projects. This Excel template details the weighted average cost of capital (WACC), illustrating the minimum return required by investors. It also includes free cash flow projections, showcasing the cash available beyond operational expenses. With discounted cash flow calculations, you can effectively assess the present value of future cash flows. Leverage this sustainable finance modeling tool to enhance your renewable project valuation and attract clean energy funding strategies, ensuring robust decision-making in your energy transition financial framework.

Cap Table

The cap table is a crucial instrument for businesses navigating their shareholder ownership dynamics and dilution. It encapsulates essential data on ownership limits and incorporates four distinct funding rounds, which can be utilized independently or in combination for comprehensive financial forecasting. By integrating this with a renewable energy investment model, businesses can enhance their clean energy financial analysis, ensuring robust projections that align with their sustainability investment strategy and support effective decision-making for future funding in renewable projects.

KEY FEATURES

A robust renewable energy investment model enhances decision-making by providing precise cash flow projections and return on investment insights.

Implementing a renewable energy investment model enhances financial forecasting accuracy, enabling better decision-making and cash flow management for sustainable projects.

The renewable energy investment model facilitates accurate cash flow projections, ensuring profitable solar and wind projects align with sustainability goals.

A robust renewable energy investment model enhances decision-making through precise cash flow projections and risk analysis for sustainable projects.

Our renewable energy investment model excels in providing accurate cash flow projections, driving informed decisions for sustainable project financing.

Unlock your renewable energy investment potential effortlessly with our comprehensive financial forecasting model, designed for seamless analysis and strategic insights.

The renewable energy investment model enables precise cash flow projections, enhancing decision-making for sustainable finance and risk mitigation.

A renewable energy investment model enables precise cash flow forecasting, enhancing decision-making for sustainable projects and optimizing financial performance.

Our renewable energy investment model streamlines financial forecasting, ensuring optimal returns and informed decision-making for sustainable projects.

Utilizing a renewable energy investment model enables more efficient cash flow forecasting, freeing time for product innovation and customer engagement.

ADVANTAGES

The renewable energy investment model simplifies clean energy financial analysis by consolidating all assumptions for efficient project evaluation.

The renewable energy investment model enables precise forecasting, enhancing decision-making for sustainable finance and driving effective clean energy project funding.

The renewable energy investment model streamlines financial forecasting, enabling smarter decisions and maximizing returns in green energy projects.

Unlock future cash flow potential with our innovative renewable energy investment model, designed for accurate financial forecasting and sustainability.

The renewable energy investment model ensures robust cash flow projections, vital for timely payments to suppliers and employees.