Real Estate Sales Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Real Estate Sales Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

real estate sales Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

REAL ESTATE SALES FINANCIAL MODEL FOR STARTUP INFO

Highlights

Unlock the potential of your real estate venture with a comprehensive five-year financial modeling for properties tailored specifically for startups and entrepreneurs looking to impress investors and secure funding. This property investment model incorporates essential components such as real estate revenue projections, sales forecasting for real estate, and investment return analysis, helping you visualize your cash flow model and capital expenditure forecasting. With a focus on real estate market trends and property performance metrics, you'll gain insights into lease modeling techniques and operating expenses analysis to optimize your asset management strategies. This robust model also includes market risk assessment in real estate and sensitivity analysis to ensure you are well-prepared to navigate challenges. Use this powerful financial tool to enhance your real estate sales pipeline management and demonstrate your project’s viability to banks, angel investors, grants, and VC funds.

This ready-made financial model in Excel addresses common pain points faced by real estate investors by offering comprehensive property investment models that streamline real estate financial analysis. Users can easily generate accurate real estate revenue projections and conduct sales forecasting for real estate, ensuring informed decision-making based on reliable data. The template incorporates real estate cash flow models that simplify investment return analysis, allowing investors to assess their profitability through various real estate valuation methods. Additionally, the model includes features for capital expenditure forecasting and operating expenses analysis, which help in monitoring property performance metrics and refining asset management strategies. With built-in sensitivity analysis in real estate and market risk assessment tools, users can confidently navigate fluctuating market trends while optimizing their return on investment calculations and exploring diverse real estate financing options.

Description

The real estate financial analysis framework encapsulated in our 5-year financial projection template is designed to provide comprehensive insights for effective property investment modeling and real estate revenue projections. This dynamic model incorporates detailed sales forecasting for real estate, allowing users to assess capital expenditure forecasting while evaluating real estate market trends. With a focus on investment return analysis, the template features a robust real estate cash flow model and lease modeling techniques to track property performance metrics and operating expenses analysis. Additionally, it supports sensitivity analysis in real estate, enhancing market risk assessment through precise return on investment calculations, giving investors clarity on real estate financing options and asset management strategies. The user-friendly interface allows easy adjustments to the input sheet, ensuring that financial modeling for properties remains accurate and reflective of changing market conditions, providing essential reports like break-even analysis and projected balance sheets to guide investment decisions.

REAL ESTATE SALES FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive real estate financial analysis model equips startups with essential tools for successful investor meetings. This integrated property investment model features critical components such as financial assumptions, detailed accounting statements, and robust cash flow projections. Additionally, it presents crucial real estate revenue projections alongside insightful reports on market trends and operating expenses analysis, ensuring clarity and appeal to potential investors. With a focus on real estate profitability analysis, our financial plan is designed to effectively communicate your business strategy and enhance your investment return analysis. Elevate your pitch with a structured, investor-friendly presentation.

Dashboard

The financial projection features an intuitive dashboard that highlights key real estate financial analysis metrics at specified intervals. This dynamic interface presents essential indicators derived from cash flow modeling for properties, alongside profit and loss statements. Users can easily visualize monthly or annual revenue projections through engaging charts and graphs. This comprehensive overview enhances property performance metrics, enabling effective evaluation and informed decision-making in the realms of real estate investment return analysis and capital expenditure forecasting.

Business Financial Statements

In real estate, understanding financial modeling is crucial for comprehensive performance analysis. The profit and loss projection offers valuable insights into core operations driving revenue. Meanwhile, the balance sheet and cash flow forecasts emphasize effective capital management, detailing asset structure and liquidity. Integrating these elements enhances investment return analysis and real estate profitability analysis, allowing for informed decisions on property investment models and cash flow strategies. By utilizing real estate performance metrics and market risk assessments, investors can optimize their asset management strategies and navigate the complexities of the real estate market effectively.

Sources And Uses Statement

Our financial model template for business plans effectively showcases the transparency of fund deployment. By delineating both sources of financing and corresponding expenditures, it enhances clarity for stakeholders. This tool facilitates comprehensive real estate financial analysis, providing a robust property investment model. With insights into capital expenditure forecasting and real estate revenue projections, it supports informed decision-making. Moreover, it aids in investment return analysis and market risk assessment, ensuring that investors can evaluate property performance metrics and optimize asset management strategies. This model is essential for anyone navigating the complexities of real estate financing options.

Break Even Point In Sales Dollars

The break-even formula in Excel is essential for real estate financial analysis, allowing investors to determine the necessary sales volume to cover both fixed and variable costs. By utilizing a comprehensive financial modeling approach, our three-way model can create dynamic break-even charts that illustrate the sales required for profit generation. Once revenue surpasses this threshold, real estate profitability analysis can begin. This tool not only aids in evaluating return on investment calculations but also supports strategic decision-making in property investment and capital expenditure forecasting for enhanced asset management.

Top Revenue

When developing a startup financial plan, real estate revenue projections are crucial for establishing enterprise value. A comprehensive pro forma income statement should highlight effective strategies for estimating future income streams. Analysts must incorporate growth rate assumptions grounded in historical data to ensure accuracy. By leveraging a robust financial modeling for properties approach, including lease modeling techniques and capital expenditure forecasting, stakeholders can enhance their understanding of property performance metrics and investment return analysis. This diligent process ultimately supports informed decision-making and effective asset management strategies in an ever-evolving real estate market.

Business Top Expenses Spreadsheet

To achieve optimal profitability in real estate, it is essential to meticulously examine and control major expenses. Our Excel financial model features a comprehensive spending report that identifies the four largest expense categories while grouping lesser expenses as 'other.' This streamlined approach enables users to effectively track cost trends year-over-year. Consistent analysis and management of operating expenses are crucial for both startups and established businesses in maximizing real estate investment returns. By employing these financial modeling techniques, stakeholders can enhance asset management strategies and bolster overall property performance metrics.

REAL ESTATE SALES FINANCIAL PROJECTION EXPENSES

Costs

Streamline your real estate financial analysis with our intuitive pro forma financial statements template. Effortlessly project fixed operating expenses, including R&D and SG&A, while leveraging automated formulas for seamless updates. This tool enhances your property investment model by simplifying real estate revenue projections and cash flow assessments. Utilize it for sales forecasting, capital expenditure forecasting, and investment return analysis, ensuring that you stay ahead of market trends. Maximize your asset management strategies with accurate performance metrics and robust financial modeling for properties, enabling informed decision-making and optimized returns on investment.

CAPEX Spending

Start-up expenses encompass the total resources spent to enhance and grow real estate sales, intentionally excluding headcount and other operating costs. Our comprehensive financial analysis identifies key assets that warrant increased investment, based on their projected value. Understanding capital expenditures is crucial, as they differ across various property investment models. Incorporating this report into your business strategy enables effective operating expenses analysis and augments your investment return analysis, ensuring that you make informed decisions that drive profitability and align with current real estate market trends.

Loan Financing Calculator

Accurately calculating loan or mortgage payments is crucial for start-ups and real estate investors alike. However, many find this task challenging. Our 5-Year Financial Projection Template excels in simplifying this process, featuring an integrated loan amortization schedule and calculator. This tool not only aids in planning payments but also enhances your property investment model by integrating real estate revenue projections and capital expenditure forecasting. With robust financial modeling for properties, you can confidently assess market trends and optimize your return on investment calculations, ensuring your asset management strategies are both effective and profitable.

REAL ESTATE SALES EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a vital component of the comprehensive financial modeling for properties. It evaluates a property's operating performance by focusing on key income statement projections. By deducting operating expenses from projected real estate revenue, EBITDA offers valuable insights into profitability analysis and investment return analysis. This metric serves as a foundation for understanding cash flow models, enhancing real estate sales forecasting, and informing asset management strategies. Effectively incorporating EBITDA into your property investment model aids in accurate capital expenditure forecasting and robust market risk assessments.

Cash Flow Forecast Excel

An Excel cash flow statement is essential for effective financial modeling in real estate, aiding cash flow planning and forecasting for property investments. This template provides insights into revenue projections and operating expenses, helping you track monetary activity efficiently. By analyzing cash flow, you can identify opportunities to enhance capital turnover and increase income. For optimal asset management, consider implementing a 5-year cash flow projection. This approach not only supports sales forecasting and investment return analysis but also empowers you to navigate market trends and improve overall property performance metrics.

KPI Benchmarks

Our financial modeling for properties includes a robust benchmarking template that enables clients to input essential metrics for comprehensive analysis. By evaluating real estate revenue projections against industry competitors, clients gain valuable insights into their property performance metrics and overall market position. This process highlights areas for improvement, ensuring strategic asset management and enhanced investment return analysis. Ultimately, our tool empowers clients to strengthen their real estate profitability analysis and optimize their sales forecasting for real estate, paving the way for sustainable growth and success in a competitive landscape.

P&L Statement Excel

The Profit and Loss Statement, a vital component of your real estate financial analysis, provides stakeholders with a clear view of sales across key revenue streams and associated expenses. This financial modeling tool not only highlights profitability and the income-expense structure but also evaluates the capacity to service debt. By leveraging this template for financial forecasts, you can effectively analyze future revenue projections and assess overall property performance metrics. This enables informed investment return analysis and enhances asset management strategies, ensuring a robust understanding of market trends and operational efficiency.

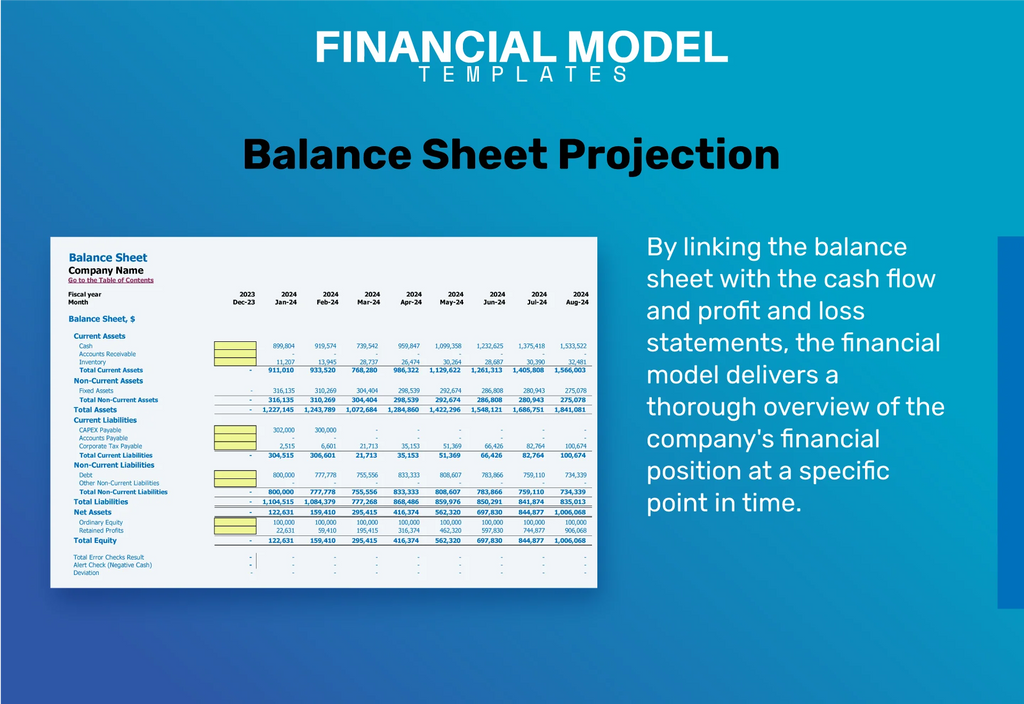

Pro Forma Balance Sheet Template Excel

Our real estate financial analysis template features a comprehensive pro forma balance sheet, designed to provide stakeholders with a clear understanding of the company’s financial position. This model illustrates the connections between assets, liabilities, and owners' equity, while highlighting how operational performance influences these elements. For instance, effective sales forecasting for real estate will directly affect revenue projections in the profit and loss forecast, thereby impacting the balance sheet's asset section. Utilize this tool for insightful investment return analysis and enhanced property performance metrics.

REAL ESTATE SALES FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The startup valuation model Excel spreadsheet features essential tools for real estate financial analysis, including calculations for Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC serves as a market risk assessment tool, guiding banks in evaluating financing options and determining loan approvals. Meanwhile, the DCF analysis provides insights into real estate revenue projections, crucial for effective property investment models. By utilizing these financial modeling techniques, investors can enhance their investment return analysis and make informed decisions regarding property performance metrics and cash flow management.

Cap Table

Our five-year financial projection template incorporates a comprehensive cap table model, essential for property investment analysis. This spreadsheet outlines the ownership structure of your real estate venture, detailing shares and options alongside investor contributions. By integrating real estate cash flow models and revenue projections, this tool supports informed investment return analysis and cash flow forecasting. It provides insights into market trends, enabling effective asset management strategies and sensitivity analysis for optimal decision-making. Utilize this cap table to enhance your real estate profitability analysis and drive strategic growth within your sales pipeline management.

KEY FEATURES

A robust real estate financial analysis enhances investment return calculations, enabling stakeholders to confidently manage risks and secure financing.

A robust real estate financial analysis enhances profitability by providing accurate revenue projections and sales forecasting for optimal investment decisions.

A robust real estate cash flow model enhances investment return analysis, enabling strategic management of surplus cash for optimal profitability.

A robust real estate cash flow model empowers managers to strategically reinvest surplus funds, optimizing growth and ensuring financial stability.

A robust property investment model empowers investors with precise cash flow projections and enhances decision-making through comprehensive market risk assessment.

Enhance investor confidence and secure funding faster with robust financial modeling that clarifies real estate revenue projections and profitability analysis.

A robust real estate financial analysis empowers startups to make informed investment decisions and optimize property performance with confidence.

The financial model enhances investment return analysis, enabling precise real estate revenue projections and informed decision-making for property investments.

A robust real estate financial analysis enhances investment return calculations, ensuring informed decisions and mitigating potential cash flow problems.

A robust cash flow forecasting model enables proactive decision-making, ensuring financial stability and growth in property investment ventures.

ADVANTAGES

The financial model effectively identifies the break-even point, optimizing investment returns through precise real estate revenue projections.

A robust property investment model enhances financial analysis, enabling accurate revenue projections and informed decision-making for real estate ventures.

Leverage our real estate financial analysis model to enhance investment return calculations and minimize market risk exposure effectively.

Enhance your investment decisions with a robust real estate financial model that optimizes cash flow and forecasts market trends effectively.

Utilizing a real estate financial analysis model enhances accuracy in revenue projections and boosts investment return potential.