Real Estate Investment Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Real Estate Investment Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

real estate investment Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

REAL ESTATE INVESTMENT FINANCIAL MODEL FOR STARTUP INFO

Highlights

This five-year financial model template in Excel for real estate investment features prebuilt three statements, including a consolidated projected income statement, balance sheet, and cash flow proforma, all designed with the complexities of real estate investment analysis in mind. It provides essential tools for evaluating property investment returns, assessing operating expenses in real estate, and conducting cap rate analysis. With built-in financial charts, summaries, and real estate financial projections, this model aids in forecasting real estate revenues and assessing the return on investment (ROI) for real estate ventures. Whether you're planning a buy and hold strategy or exploring multifamily investment analysis, this real estate investment calculator offers the flexibility to edit all components, making it an invaluable resource for your real estate investment strategy and risk assessment needs.

The ready-made financial model in Excel template addresses critical pain points for investors by providing a comprehensive, fully-integrated framework for real estate investment analysis, encompassing detailed monthly profit and loss statements, cash flow projections, and a balanced sheet for a five-year horizon. By facilitating cap rate analysis and cash-on-cash return calculations, it enables users to easily evaluate property investment returns while forecasting real estate revenues and assessing operating expenses. Furthermore, the automatic aggregation of annual summaries in the financial summary report enhances decision-making processes, allowing investors to effectively strategize their buy and hold approach or explore multifamily investment analysis opportunities while mitigating risks associated with real estate market trends. This streamlined approach not only supports real estate valuation techniques but also simplifies ROI calculations, making it indispensable for those employing a real estate syndication model or commercial real estate financial models.

Description

Our real estate investment financial model in Excel is crafted to facilitate informed principal business and financial decisions through accurate reporting and analysis. This comprehensive three-statement financial model encompasses all critical inputs and tables, allowing you to effectively conduct real estate investment analysis, evaluate property investment returns, and assess cash flow from investment properties. With a focus on real estate valuation techniques and cap rate analysis, the model supports forecasting real estate revenues and operating expenses, ensuring you have a robust real estate investment strategy. It is tailored for both startup and existing businesses, generating detailed financial projections, including profit and loss forecasts, cash flow budgets, and projected balance sheets, all while incorporating essential tools for multifamily investment analysis and commercial real estate financial modeling, making it an invaluable resource for assessing return on investment (ROI) and real estate risk assessment.

REAL ESTATE INVESTMENT FINANCIAL MODEL REPORTS

All in One Place

This comprehensive three-statement financial model template for real estate empowers entrepreneurs to input key assumptions regarding costs and income. By synthesizing this data, it presents a clear and compelling financial overview to potential investors. Utilizing advanced real estate valuation techniques, investment property cash flow analysis, and robust forecasting methods, this model enhances decision-making. With a focus on property investment returns and risk assessment, it equips users with the insights needed for a successful real estate investment strategy, ensuring clarity and confidence in their financial projections.

Dashboard

Experience streamlined efficiency with our comprehensive financial projection Excel template. Featuring an integrated dashboard, it provides a clear overview of crucial elements, including real estate investment analysis, projected cash flow, and balance sheets for startups. Users can easily customize views to display financial statements monthly or annually, and present data in either numerical or chart formats. This tool is essential for evaluating property investment returns, conducting cap rate analysis, and enhancing your real estate investment strategy, all in one convenient location. Maximize your investment potential today!

Business Financial Statements

A comprehensive understanding of a company's financial performance requires analyzing its profit and loss statement, pro forma balance sheet, and forecast cash flow statement together. The profit and loss statement reveals essential insights into core operating activities and property investment returns. In contrast, the pro forma balance sheet and cash flow statement emphasize capital management, offering vital data for real estate investment analysis. This multifaceted approach enhances forecasting real estate revenues and evaluating investment property cash flow, ultimately informing robust real estate investment strategies and maximizing return on investment (ROI).

Sources And Uses Statement

The sources and uses tab within the financial projections template is essential for effective real estate investment analysis. It details how funds are sourced and allocated, highlighting primary funding avenues accessible to the company while illustrating expenditure patterns. This capital statement is invaluable for start-ups, as it ensures clarity in financial modeling for real estate ventures. By understanding the flow of funds, investors can make informed decisions, enhancing their property investment returns and optimizing cash flow for sustainable growth. It plays a crucial role in forecasting real estate revenues and assessing overall investment strategy.

Break Even Point In Sales Dollars

Curious about the milestones necessary for your real estate investment to become profitable? The Break-Even Point Excel tool is essential for conducting a thorough financial modeling for real estate. It precisely calculates the sales volume required for your investment property cash flow to cover all operating expenses. This financial projection model simplifies the process, automatically determining the sales levels needed for your revenues to exceed costs. By utilizing such tools, you can enhance your real estate investment strategy and make informed decisions about maximizing property investment returns.

Top Revenue

In the realm of real estate investment analysis, understanding financial metrics such as the top line and bottom line is crucial. Stakeholders closely monitor gross revenue and net profit, as these figures reveal property investment returns and overall market performance. Key metrics like cash-on-cash return, cap rate analysis, and operating expenses in real estate provide insights into investment property cash flow and valuation techniques. Employing a robust real estate investment strategy, including forecasting revenues and conducting risk assessments, can enhance the return on investment (ROI) and drive successful outcomes in multifamily and commercial ventures.

Business Top Expenses Spreadsheet

The Top Expenses page of our startup financial plan template enables you to meticulously track yearly operating expenses, categorized for clarity. This comprehensive cost analysis, including customer acquisition and fixed costs, is crucial for real estate investment analysis. By understanding your financial outflows, you can enhance cash flow management and refine your investment strategy. Effective financial modeling for real estate not only aids in forecasting revenues but also empowers you to assess risks and optimize property investment returns. Stay informed and in control of your finances for superior decision-making in today's dynamic real estate market.

REAL ESTATE INVESTMENT FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive cost report caters to diverse individual and group budgets, seamlessly integrating salary costs for full-time and part-time employees. This synchronization enhances your real estate investment analysis, allowing precise tracking of operating expenses. Just like our pro forma template, all data effortlessly flows through the three-way financial model, ensuring accurate real estate financial projections. With this streamlined approach, you can effectively gauge investment property cash flow, evaluate property investment returns, and optimize your real estate investment strategy for maximum ROI. Experience a new level of clarity in forecasting real estate revenues and managing your portfolio.

CAPEX Spending

The automated capital expenditure budget integrates insights from the cash flow analysis template, emphasizing its role in forecasting property investment returns. It also includes valuable data on alternative income sources, critical for a comprehensive real estate investment strategy. By leveraging financial modeling for real estate, investors can enhance their understanding of operating expenses and optimize their return on investment (ROI). This tool is essential for conducting real estate investment analysis, ensuring informed decision-making in line with current market trends.

Loan Financing Calculator

Our loan amortization schedule template provides a clear overview of repayment timelines aligned with individual loan terms. Integrated within our comprehensive financial modeling for real estate, this Excel template features advanced formulas to track each loan's details, including terms and repayment dates. It accommodates various loan structures—monthly, quarterly, or annually—ensuring a thorough analysis of investment property cash flow and operating expenses. By utilizing this tool, real estate investors can enhance their financial projections and effectively implement their investment strategies. Stay informed and optimize your property investment returns effortlessly!

REAL ESTATE INVESTMENT EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings growth is a critical metric in real estate investment analysis. Our comprehensive Excel financial model assesses financial metrics, including net income growth and return on investment (ROI) for real estate. By utilizing a detailed profit and loss forecast, we can effectively track sales and revenue trends, ensuring the investment property cash flow aligns with our buy-and-hold strategy. This approach empowers investors to make informed decisions while evaluating real estate valuation techniques and market trends, ultimately bolstering profitability and long-term growth potential.

Cash Flow Forecast Excel

Forecasting the cash flow statement marks the culmination of an iterative process in developing a pro forma template for real estate investment analysis. This vital step reflects the dynamic interplay between the balance sheet projections and specific non-cash items on the income statement. By integrating these elements, investors can effectively assess property investment returns and analyze cash flow for investment properties. Employing robust financial modeling for real estate allows stakeholders to make informed decisions based on accurate financial projections, enhancing their overall investment strategy and understanding of market trends.

KPI Benchmarks

A benchmarking study is an essential financial modeling tool for real estate investment analysis, enabling startups to evaluate performance against industry peers. By focusing on key indicators such as ROI, operating expenses, and cash-on-cash return, businesses can gain valuable insights into their property investment returns. This process allows firms to assess their financial projections and identify areas for improvement. By comparing metrics like cap rates and cash flow with those of top-performing competitors, startups can refine their investment strategies, ensuring they align with market trends and best practices in real estate development.

P&L Statement Excel

The Profit and Loss (P&L) statement is a crucial financial document that showcases a property's monetary performance in real estate investment analysis. Accuracy in this report is vital, as it influences key metrics such as cash-on-cash return and return on investment (ROI). However, while the pro forma income statement provides valuable insights, it may not adequately reflect all assets, liabilities, or cash flow. Consequently, a comprehensive analysis, including cash flow projections and operating expenses, is essential for informed property investment decisions and effective real estate financial modeling.

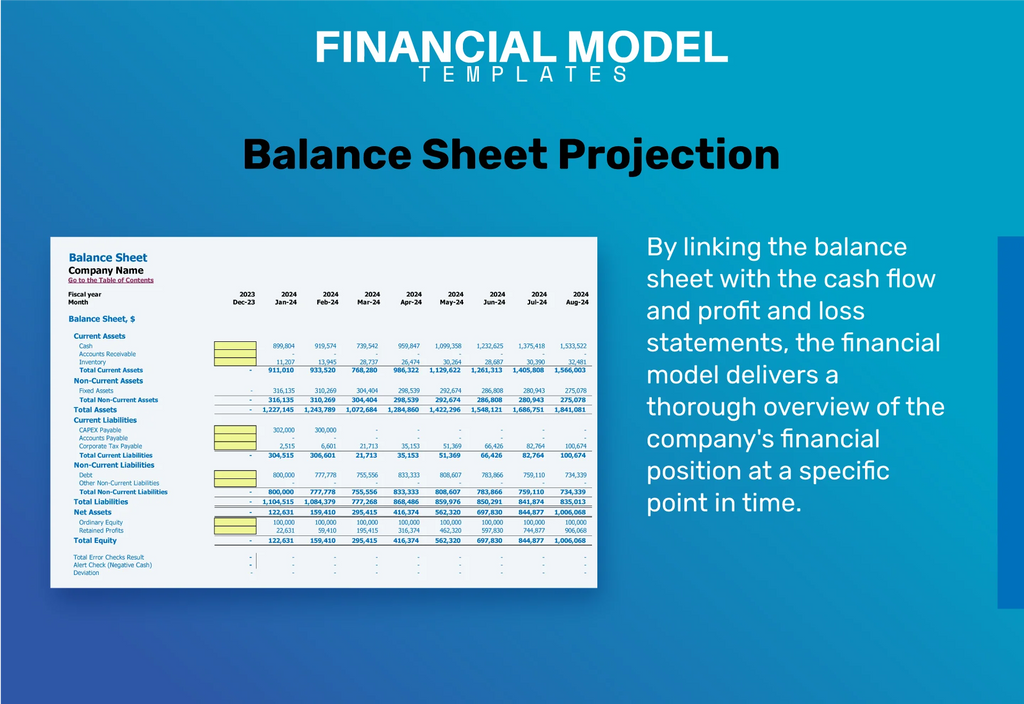

Pro Forma Balance Sheet Template Excel

Forecasting the pro forma balance sheet is crucial in financial modeling for real estate, as it ensures coherence among the balance sheet, profit and loss statement, and cash flow statement. While investors often focus on income statements, a well-structured pro forma balance sheet significantly impacts long-term cash flow projections. This framework not only aids in assessing the viability of property investment returns but also allows investors to evaluate profitability ratios, such as return on equity and return on investment (ROI). Ultimately, it enhances the overall real estate investment strategy, ensuring informed decision-making and effective risk assessment.

REAL ESTATE INVESTMENT FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Unlock the potential of your real estate investment with our comprehensive seed stage valuation template. Equipped with essential financial modeling tools, this Excel template provides critical data for investors. Utilize the weighted average cost of capital (WACC) to showcase the minimum expected returns on investment. Free cash flow analysis highlights available funds for stakeholders, while discounted cash flow techniques reflect future valuations. Elevate your real estate investment strategy with precise market trends and financial projections, ensuring effective risk assessment and maximizing property investment returns. Transform your investment vision into reality today.

Cap Table

The cap table serves as a vital tool for assessing a company's share capital and market value, crucial for informed financial decisions. By utilizing this table, investors can accurately evaluate the market value of prospective real estate investments. Our comprehensive financial modeling for real estate includes detailed proformas and essential calculations, enabling thorough investment property cash flow analysis and risk assessment. Equip yourself with our robust budget financial model, designed to enhance your real estate investment strategy, optimize property investment returns, and forecast revenues effectively. Invest wisely today!

KEY FEATURES

Effective financial modeling for real estate enhances investment property cash flow predictions, optimizing returns and mitigating risks in market fluctuations.

Effortlessly adapt your financial model to enhance real estate investment projections, optimizing returns throughout your business lifecycle.

A simple-to-use real estate financial model enhances investment property cash flow forecasting, ensuring optimal property investment returns and informed decisions.

This advanced real estate financial model empowers startups with minimal Excel knowledge to achieve quick, reliable investment insights.

A robust financial modeling for real estate allows investors to assess scenarios, maximizing property investment returns and minimizing risks.

A financial model enables precise cash flow forecasting, allowing real estate investors to assess the impact of various financial variables effectively.

A robust financial model empowers investors to accurately forecast returns and assess risks, maximizing property investment opportunities.

Unlock comprehensive insights into property investment returns with our robust financial model, featuring detailed forecasts and essential financial ratios.

A robust financial model for real estate streamlines investment analysis, enhancing decision-making and maximizing property investment returns efficiently.

A robust financial model for real estate empowers investors to optimize cash flow and maximize property investment returns efficiently.

ADVANTAGES

A robust financial model for real estate reveals strengths and weaknesses, enhancing investment strategies and forecasting property investment returns.

A robust financial model enhances real estate investment analysis, optimizing property investment returns and improving cash flow forecasting.

Utilizing a robust financial modeling for real estate enhances forecasting accuracy, proving your repayment capability to potential lenders.

Utilize a real estate investment cash flow projection model to accurately forecast property investment returns and enhance decision-making.

Leverage our real estate investment financial model to make informed hiring decisions and optimize property investment returns.