Real Estate Broker Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Real Estate Broker Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

real estate broker Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

REAL ESTATE BROKER FINANCIAL MODEL FOR STARTUP INFO

Highlights

A comprehensive five-year horizon three-statement model template tailored for early-stage real estate broker startups can significantly impress investors and facilitate capital raising. By utilizing a robust real estate investment model that incorporates detailed real estate financial metrics, including brokerage revenue streams and expected cash flow projections, entrepreneurs can effectively showcase their brokerage business valuation. The model should emphasize real estate commission structure and transactional revenue modeling, while also accounting for brokerage operational expenses and profit margins. Additionally, incorporating real estate market trends and sales forecasting will provide insights into preferred listing strategies, allowing for informed real estate portfolio management and risk assessment. This strategic financial planning tool will not only attract funding from banks or investors but also enhance overall brokerage growth strategies.

The ready-made financial model in Excel addresses several critical pain points for real estate brokers, offering a comprehensive solution for financial analysis and planning. By integrating real estate cash flow projections and sales forecasting, users can enhance their understanding of brokerage profit margins and operational expenses, enabling informed decision-making on revenue streams and expense tracking. The model's adaptability allows brokers to customize financial metrics, ensuring alignment with current real estate market trends and performance indicators. With capabilities for brokerage valuation and risk assessment, it provides crucial insights into the effectiveness of listing strategies and growth strategies, ultimately guiding brokers toward improved financial outcomes and optimized financial planning without the need for extensive Excel expertise.

Description

This real estate broker financial model is an essential tool for effective financial planning and analysis within the brokerage sector, providing a robust five-year projection framework designed to support strategic decisions. It includes vital components like cash flow projections, profit margins, and brokerage operational expenses, while also leveraging real estate performance indicators to gauge financial health. The model enables users to evaluate brokerage revenue streams and implement a thorough real estate investment model, alongside forecasting sales and managing expenses effectively. By incorporating an agent commission calculator and analyzing real estate commission structures, it offers insights into the brokerage's growth strategies, risk assessment, and overall business valuation, ensuring a comprehensive approach to real estate portfolio management.

REAL ESTATE BROKER FINANCIAL MODEL REPORTS

All in One Place

Assessing your business idea's potential in real estate has never been easier. Our real estate broker financial analysis template offers a comprehensive investment model to evaluate needs for funding or growth. With customizable inputs, you can project monthly sales, expenses, and capital requirements effectively. This professional tool streamlines your brokerage business valuation and enhances your financial planning. Utilize essential real estate financial metrics and performance indicators to refine your listing strategy, improve cash flow projections, and optimize your brokerage revenue streams. Elevate your brokerage growth strategies today with our efficient financial model.

Dashboard

To conduct a comprehensive financial analysis for your real estate brokerage, a robust five-year financial projection template is essential. It organizes vital data and enables detailed cash flow projections, pro forma balance sheets, and income statement forecasts. By leveraging this tool, clients can visualize financial performance through customizable graphs and charts, facilitating informed decision-making. Incorporating real estate financial metrics and performance indicators enhances your real estate investment model, leading to improved brokerage growth strategies and effective sales forecasting. Streamline your financial planning and elevate your brokerage's revenue streams today.

Business Financial Statements

Incorporating real estate financial metrics into your feasibility study is vital. Utilizing historical and projected financial statements enhances your analysis and provides a clearer picture of potential success. To effectively convey this information to investors, our Excel template features automated financial charts, illustrating essential elements like cash flow projections and brokerage revenue streams. These visual representations facilitate strategic discussions on real estate market trends, sales forecasting, and operational expenses, ultimately supporting informed decision-making in your brokerage growth strategies. Elevate your presentations and enhance your real estate investment model with our comprehensive tools.

Sources And Uses Statement

The sources and uses table in this business forecast template offers a comprehensive overview of the funding sources and their allocations. By integrating real estate financial metrics, such as cash flow projections and brokerage operational expenses, brokers can effectively assess their revenue streams and investment models. This strategic tool aids in enhancing brokerage profit margins, enabling informed decision-making for real estate performance indicators and sales forecasting. For optimal financial planning, utilizing this table can streamline your brokerage growth strategies, ensuring a balanced approach to expense tracking and risk assessment.

Break Even Point In Sales Dollars

This Excel pro forma template features a break-even point analysis tab, essential for real estate brokers aiming to enhance their financial planning. By utilizing forecasted revenue streams and operational expenses, it calculates the timeline for achieving profitability. This tool not only simplifies revenue modeling but also serves as a critical component in assessing brokerage growth strategies. The break-even revenue calculator provides insights into when overall revenues surpass costs, guiding real estate professionals in their investment decisions and cash flow projections for a successful brokerage business valuation.

Top Revenue

In real estate, understanding top-line and bottom-line metrics is crucial for financial analysis. The top line reflects gross sales and revenue streams, indicating market trends and growth potential. Increasing top-line figures signal positive performance in brokerage business valuation. Conversely, the bottom line represents net income, showcasing profitability after accounting for operational expenses. Monitoring these financial metrics helps brokers and investors gauge the effectiveness of their real estate investment model and commission structures, ultimately informing strategic decisions in real estate portfolio management and cash flow projections for enhanced profitability.

Business Top Expenses Spreadsheet

To maximize profitability in your brokerage, conducting a thorough financial analysis is essential. Utilizing our real estate investment model, you can effectively track operational expenses and identify key financial metrics. The top expenses tab highlights the most significant costs, allowing for targeted strategies to improve brokerage profit margins. Consistent expense tracking and sales forecasting will enable both startups and established firms to refine their real estate listing strategy and enhance cash flow projections. By implementing these brokerage growth strategies, you can optimize your revenue streams and ensure sustainable profitability in a competitive market.

REAL ESTATE BROKER FINANCIAL PROJECTION EXPENSES

Costs

A robust five-year financial projection template for real estate brokers serves as a vital tool for effective financial planning and operational management. This comprehensive model not only identifies potential issues within a brokerage's financial operations but also aids in decision-making related to growth strategies and expense tracking. By analyzing real estate commission structures, cash flow projections, and revenue streams, brokers can assess profitability and refine their listing strategies. Ultimately, this template fosters a deeper understanding of financial metrics, enhancing the overall health and performance of the brokerage in a dynamic real estate market.

CAPEX Spending

Planned capital expenditures are crucial for effective real estate financial planning and cash flow projections. These investments represent significant outflows and indicate the future operational quality of the brokerage. By analyzing historical capital expenditures in your cash flow forecast and pro forma balance sheet, you gain valuable insights into budgetary responsibilities. This analysis not only informs brokerage business valuation but also aids in strategic decision-making, ensuring robust brokerage growth strategies and improved performance indicators. Ultimately, diligent expense tracking and forecasting empower real estate professionals to enhance profitability and sustainably manage their investment portfolios.

Loan Financing Calculator

Monitoring loan repayment schedules is crucial for startups and growing companies, as they encompass details about principal amounts, terms, maturity periods, and interest rates. These schedules directly influence cash flow analysis, affecting pro forma cash flow statements and balance sheets. Integrating these repayments into real estate cash flow projections enhances financial planning, allowing firms to track performance indicators effectively. By assessing brokerage operational expenses and utilizing an agent commission calculator, businesses can refine their real estate investment models and strengthen their brokerage growth strategies, ultimately supporting better profitability and sustainable financial health.

REAL ESTATE BROKER EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our comprehensive financial projection template offers a detailed breakdown of revenue through an interactive Pro-forma chart. This visual tool highlights monthly income from multiple revenue streams, tailored for your real estate brokerage. You can easily adjust the financial analysis period or incorporate additional revenue sources, enhancing your real estate investment model. Utilize this resource to optimize cash flow projections, refine your brokerage growth strategies, and effectively track operational expenses. Harness these insights for improved sales forecasting and to ensure robust performance indicators for your brokerage's financial planning.

Cash Flow Forecast Excel

The operating cash flow statement is essential for assessing the financial viability of a real estate brokerage. It highlights the cash generated from core business operations, excluding secondary revenue sources like interest or investments. This analysis aids in real estate financial planning and performance evaluation, laying the groundwork for accurate cash flow projections and informed decision-making. By focusing on operational efficiency, brokers can better understand their brokerage revenue streams and optimize their listing strategy to enhance profitability and growth. Effective brokerage risk assessment and expense tracking further contribute to robust financial metrics for sustained success in a dynamic market.

KPI Benchmarks

This comprehensive financial model features a dedicated section for comparative financial analysis, allowing clients to assess key real estate financial metrics. By evaluating brokerage business valuations against industry benchmarks, clients gain valuable insights into their financial standing. The analysis encompasses real estate market trends, operational expenses, and revenue streams, enabling informed decision-making. Ultimately, this approach enhances brokerage growth strategies, ensuring clients are well-equipped for effective real estate financial planning and performance optimization.

P&L Statement Excel

A well-crafted income statement is essential for understanding your brokerage's financial health. By utilizing a pro forma financial statements template, you can assess key real estate financial metrics, including gross profitability and net profit margins. This analytical tool not only enhances your confidence in real estate financial planning but also reveals insights into brokerage growth strategies and performance indicators. By leveraging financial analysis for cash flow projections and expense tracking, you can identify revenue streams and refine your real estate listing strategy, ultimately positioning your brokerage for success in a competitive market.

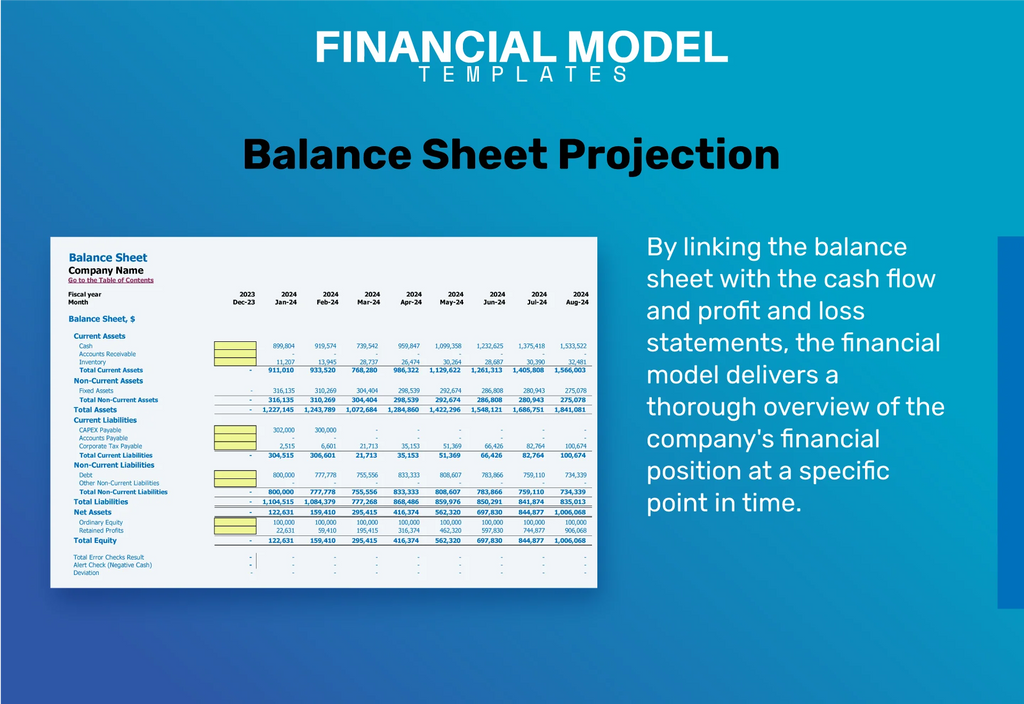

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet provides a comprehensive snapshot of a brokerage's financial position, detailing assets and liabilities at a given moment. In parallel, a P&L statement template captures the operational performance over a specified period, essential for evaluating brokerage profit margins. Meanwhile, a projected balance sheet template calculates net worth, highlighting the relationship between equity and debt. Together, these core financial statements inform real estate financial planning, allowing brokers to analyze liquidity and turnover ratios, which are critical performance indicators for effective real estate investment modeling and portfolio management.

REAL ESTATE BROKER FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive five-year financial projection template includes a robust valuation analysis for conducting a Discounted Cash Flow (DCF) analysis. Users can effectively evaluate real estate financial metrics, including residual value, replacement costs, and market comparables. This tool is essential for real estate brokers focused on financial analysis and developing strategic brokerage growth strategies. Enhance your understanding of cash flow projections and improve your brokerage profit margins by leveraging this invaluable asset to inform your real estate investment model and sales forecasting. Streamline your financial planning and decision-making processes today.

Cap Table

The cap table within an Excel financial model template is an essential resource for start-ups and early-stage ventures. It provides a comprehensive overview of company securities, detailing investor shares, their value, and dilution over time. This tool is vital for real estate brokers seeking to understand their brokerage revenue streams and financial metrics, aiding in effective financial planning and performance analysis. By incorporating a cap table, brokers can enhance their operational strategies, assess risks, and forecast cash flows, ultimately driving informed investment decisions in the dynamic real estate market.

KEY FEATURES

Unlock growth with a robust real estate investment model that enhances financial analysis and boosts brokerage profit margins efficiently.

Utilizing a real estate investment model streamlines cash flow forecasts, freeing you to focus on customers and business growth.

Implementing a robust real estate investment model enhances stakeholder trust through transparent financial analysis and accurate cash flow projections.

A robust real estate investment model fosters stakeholder confidence, enhancing trust and facilitating increased investment opportunities through clear cash flow projections.

A robust real estate investment model enhances financial planning, optimizing cash flow projections and improving brokerage profit margins for sustainable growth.

A robust cash flow forecast enables strategic decisions, ensuring optimal financial planning and maximizing brokerage profit margins for growth.

A robust real estate investment model enhances financial planning and boosts profitability by optimizing cash flow projections and minimizing operational expenses.

Unlock your brokerage's potential with a proven financial model for accurate forecasting and strategic growth at an affordable price.

Utilizing a real estate investment model enhances financial analysis, ensuring accurate cash flow projections and improved revenue stream management.

Implementing a financial model enhances real estate cash flow projections, enabling proactive management of outstanding invoices for improved revenue.

ADVANTAGES

The Real Estate Broker Proforma Business Plan Template enhances financial planning by providing detailed cash flow projections and expense tracking for informed decision-making.

Maximize your brokerage’s value with a real estate financial model that enhances revenue streams and drives strategic growth.

A robust financial model enhances real estate decision-making, making it essential for attracting external stakeholders like banks.

Utilizing a real estate investment model allows brokers to predict cash flow shortfalls and enhance financial planning strategies effectively.

Utilizing a real estate investment model improves financial analysis, ensuring robust cash flow projections and enhanced brokerage growth strategies.