Property Development Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Property Development Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

property development Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

PROPERTY DEVELOPMENT FINANCIAL MODEL FOR STARTUP INFO

Highlights

This five-year property development financial projection is designed to assist startups and entrepreneurs in effective fundraising and business planning. By incorporating comprehensive property development valuation methodologies and real estate financial modeling techniques, the template provides key insights into cash flow forecasting in real estate and profitability analysis for real estate investments. Users can leverage residential and commercial property financial models to conduct thorough investment analysis for property development, including land acquisition financial evaluation and capital budgeting for real estate projects. Enhanced features like sensitivity analysis in property development and projected financial statements allow for informed decision-making and risk assessment, ensuring that the exit strategy for property investment aligns with the expected return on investment for property projects. Financial charts, summaries, and metrics are integrated to give a complete market analysis for real estate development, making it easier to secure funding from banks, angel investors, grants, and VC funds while unlocking the ability to edit all aspects of the template for tailored financial planning.

This ready-made financial model in Excel addresses key challenges faced by property developers, providing a comprehensive tool for effective investment analysis, including cash flow forecasting in real estate and detailed profitability analysis for real estate investments. With embedded methodologies for property development valuation, it streamlines capital budgeting for real estate projects by facilitating sensitivity analysis and cost estimation, ensuring accurate risk assessment during the development phase. Users can easily conduct market analysis, evaluate financing options, and assess return on investment for property projects while generating projected financial statements for development. This template simplifies feasibility studies, making land acquisition financial evaluations straightforward, thereby enhancing decision-making capability and ultimately increasing project success.

Description

The property development financial modeling framework is designed to be highly dynamic and flexible, integrating key valuation methodologies and enabling thorough investment analysis for property development. By utilizing this financial model, users can effectively assess cash flow forecasting in real estate, determine initial capital and working capital needs, and create comprehensive residential and commercial property financial models. The template supports profitability analysis, incorporating sensitivity analysis to evaluate project risks while facilitating cost estimation and financial ratios in real estate. With built-in features for market analysis, net present value evaluation, and projected financial statements over a 5-year horizon, the model aids in formulating an exit strategy for property investments and enhances capital budgeting practices. Ultimately, it streamlines the financial evaluation of land acquisition and provides insights into financing options for property developers, ensuring informed decision-making for successful project outcomes.

PROPERTY DEVELOPMENT FINANCIAL MODEL REPORTS

All in One Place

A thorough property development financial plan is essential for startups, encompassing various key aspects such as cost estimation and income projections. This comprehensive approach includes investment analysis, cash flow forecasting, and feasibility studies to ensure sound decision-making. By employing effective valuation methodologies and financial modeling techniques, developers can assess profitability and conduct sensitivity analysis for effective project risk assessment. Additionally, understanding available financing options and exit strategies enhances the likelihood of achieving a strong return on investment. This structured framework will provide a holistic view critical for the success of any property development venture.

Dashboard

To perform a comprehensive financial analysis for property development, a robust financial model is essential. This template encompasses key elements such as cash flow forecasting, pro forma income statements, and projected financial statements. By utilizing effective real estate financial modeling techniques, clients can visualize critical data through intuitive graphs and charts, enhancing decision-making efficiency. Incorporating methodologies like profitability analysis, sensitivity analysis, and net present value calculations ensures well-rounded investment analysis. Ultimately, this approach supports informed land acquisition financial evaluations and successful exit strategies for property investments, streamlining capital budgeting processes for developers.

Business Financial Statements

Our Excel financial model features pre-built consolidated financial statements, including a comprehensive P&L statement template, projected balance sheet, and cash flow chart. Designed for startups, these financial outputs can be generated on both a monthly and annual basis. Users can seamlessly integrate existing financial statements from QuickBooks, Xero, FreshBooks, and other accounting platforms, facilitating the creation of dynamic rolling forecasts. This tool is essential for conducting property development valuation methodologies and investment analysis, ensuring robust planning through effective cash flow forecasting and financial modeling techniques. Empower your projects with precise financial insights today.

Sources And Uses Statement

The Sources and Uses table in this financial model provides a clear overview of the revenue streams and expenditures for property development projects. This essential tool aids in investment analysis, allowing developers to evaluate financing options and conduct cash flow forecasting. By detailing capital budgeting allocations, it supports effective profitability analysis and informs development project risk assessments. Ultimately, this table is vital for assessing the net present value and determining an exit strategy, ensuring robust residential and commercial property financial models that drive successful outcomes in real estate investment.

Break Even Point In Sales Dollars

Curious about when your property development will turn profitable? A break-even sales calculator serves as an essential financial tool for pinpointing the sales volume required for profitability. This sophisticated model integrates property development valuation methodologies and cash flow forecasting in real estate, enabling you to assess investment analysis for property development accurately. By determining the sales necessary to cover all operating costs, you can refine your capital budgeting for real estate and enhance your exit strategy for property investment, ensuring a successful and lucrative development project.

Top Revenue

In real estate, understanding the top and bottom lines of financial performance is crucial. The top line represents gross revenues, while the bottom line reflects net profit. Investors and stakeholders meticulously analyze these figures through various methodologies, including property development valuation and cash flow forecasting. Key metrics, such as return on investment and net present value, guide informed decisions. By employing robust financial modeling techniques and conducting thorough market analysis, property developers can enhance profitability and strategically assess risks, ensuring effective capital budgeting and a successful exit strategy for their investment projects.

Business Top Expenses Spreadsheet

This pro forma template features a "Top Expenses" tab, highlighting your company's four primary expense categories while grouping remaining costs under "Other." This streamlined approach allows for efficient cash flow forecasting in real estate, facilitating a comprehensive analysis of financial ratios and net present value for property development. By utilizing this template, investors can enhance their investment analysis for property development, ensuring effective capital budgeting and risk assessment. This clarity aids in formulating robust exit strategies and evaluating potential financing options for property developers, ultimately enhancing profitability analysis and informed decision-making.

PROPERTY DEVELOPMENT FINANCIAL PROJECTION EXPENSES

Costs

A robust financial projection model is essential in property development, facilitating effective management and decision-making. By utilizing residential and commercial property financial models, developers can conduct thorough investment analysis, cash flow forecasting, and profitability assessments. These methodologies, including cost estimation and sensitivity analysis, provide insights into financial health, enabling informed capital budgeting and evaluating financing options. Furthermore, feasibility studies and risk assessments support strategic planning, ensuring a solid exit strategy for property investments. Ultimately, these tools enhance understanding of returns on investment, guiding successful project execution and financial stability.

CAPEX Spending

For successful property development, thorough capital budgeting is essential, as it ensures even and rapid growth while maximizing profits. Utilizing robust financial modeling techniques enables investors to conduct comprehensive investment analysis, incorporating cash flow forecasting and cost estimation. Analysts rely on financial ratios and net present value assessments to evaluate feasibility studies, guiding land acquisition financial evaluations. Meanwhile, sensitivity analysis helps identify risks, ensuring a solid exit strategy for property investments. Ultimately, a well-structured capex plan within projected financial statements is crucial for attracting financing options and enhancing overall project profitability.

Loan Financing Calculator

Our Excel financial model features a comprehensive loan amortization schedule designed to assist users in meticulously tracking all loan-related variables. Located in the 'Capital' tab, this template includes pre-built proformas with integrated formulas for precise internal calculations of loans, interest, and equity. This sophisticated approach facilitates effective investment analysis for property development, enhancing cash flow forecasting in real estate. Whether you are focused on residential property financial models or commercial property development analysis, this tool is essential for managing your financial planning and maximizing your return on investment for property projects.

PROPERTY DEVELOPMENT EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Enhance your company’s financial health and performance with key financial performance indicators (KPIs). Utilize a sophisticated three-way financial model to effectively visualize critical metrics related to property development, including cash flow forecasting, profitability analysis, and return on investment. By incorporating methodologies such as sensitivity analysis and net present value assessments, you can make informed decisions on land acquisition and investment strategies. These insights not only support comprehensive feasibility studies but also aid in crafting robust exit strategies, ensuring sustainable growth in real estate investments.

Cash Flow Forecast Excel

A cash flow projection template in Excel is crucial for property developers, providing insight into cash movement within a project. This key financial statement illustrates available cash balances, enabling effective capital budgeting and efficient handling of investor funding. By employing precise cash flow forecasting and profitability analysis, developers can assess their financial health and make informed investment decisions. This template also aids in evaluating financing options and developing robust residential or commercial financial models, ensuring alignment with return on investment goals and supporting effective risk assessment for property development initiatives.

KPI Benchmarks

Benchmarking serves as a crucial financial metric within the property development landscape, allowing developers to evaluate their performance against industry standards. By using key indicators such as profit margins, cost margins, and productivity ratios, real estate professionals can conduct thorough investment analysis for property development. This comparative analysis not only highlights areas for improvement but also informs cash flow forecasting and financial modeling techniques. Utilizing these insights, developers can make informed decisions regarding capital budgeting, land acquisition evaluations, and exit strategies, ultimately optimizing profitability and enhancing their competitive edge in the market.

P&L Statement Excel

The income statement is a critical component of financial projections, highlighting a company's bottom line and overall profitability. Effective cash flow forecasting in real estate relies on detailed monthly profit and loss statements. Without precise documentation, even booming businesses face uncertainty. Utilizing robust financial modeling techniques ensures that all investment analysis for property development is grounded in reality. Whether assessing residential or commercial properties, accurate projections empower developers to make informed decisions, evaluate financing options, and create effective exit strategies, all while conducting thorough feasibility studies to minimize risks and maximize returns on investment.

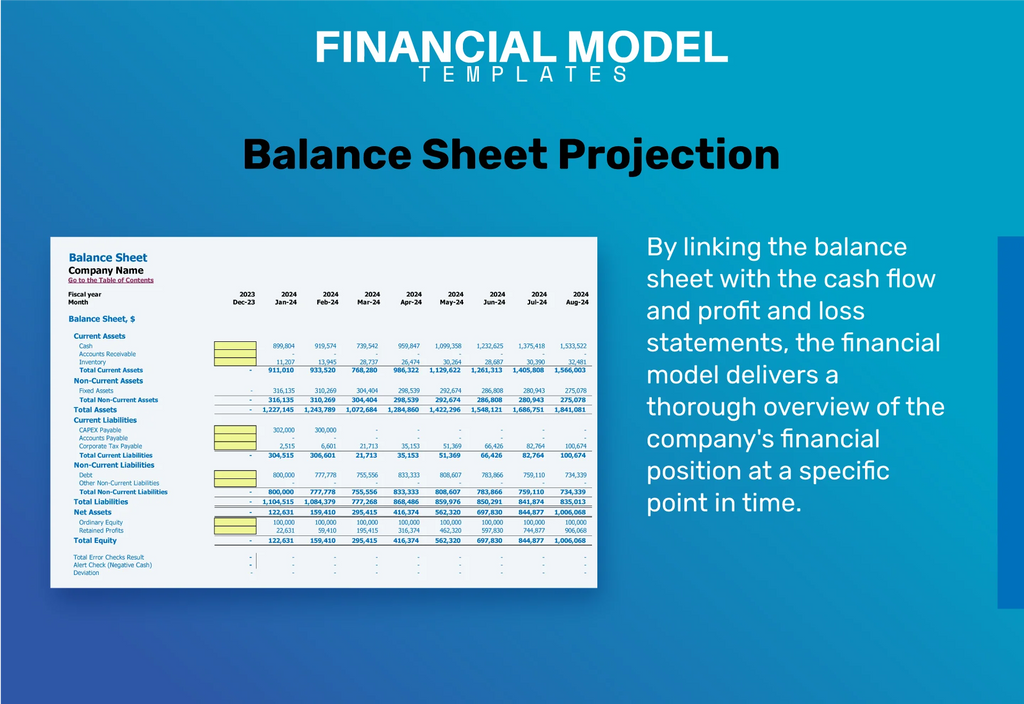

Pro Forma Balance Sheet Template Excel

This financial projections spreadsheet seamlessly integrates monthly and annual pro forma balances with cash flow forecasting and profit-loss statements. This cohesive setup ensures that the pro forma financial statements provide a comprehensive overview of assets, liabilities, and equity, aligning with broader financial modeling techniques. By utilizing these robust valuation methodologies, users can effectively conduct investment analysis for property development, evaluate financing options, and analyze profitability. Ultimately, this tool empowers property developers to enhance their capital budgeting processes and refine their exit strategy for successful real estate investments.

PROPERTY DEVELOPMENT FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The pre-revenue startup spreadsheet incorporates crucial financial metrics, such as Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC serves as a vital risk assessment tool, breaking down capital costs into equity and debt proportions, essential for lenders during financing evaluations. Meanwhile, DCF calculations reveal the present value of anticipated cash flows, providing key insights for investment analysis in property development. Together, these methodologies enhance strategic decision-making and profitability analysis, driving informed choices in real estate ventures.

Cap Table

A well-structured equity cap table is crucial for start-ups, serving as a foundational tool in property development valuation methodologies. It outlines the ownership structure, detailing equity shares, preferred shares, and options held by stakeholders. This transparency is essential for investment analysis and cash flow forecasting in real estate. By accurately representing ownership percentages and security values, the cap table aids in capital budgeting decisions, ensuring that developers can assess profitability and return on investment effectively. Ultimately, it plays a vital role in strategic planning and the success of property projects.

KEY FEATURES

Effective residential property financial models enable precise cash flow forecasting, enhancing investment analysis and optimizing return on investment.

A cash flow forecast empowers managers to strategically reinvest surplus funds, optimizing financial stability and growth opportunities in property development.

Utilizing robust financial modeling techniques enhances investment analysis for property development, ensuring accurate cash flow forecasting and informed decision-making.

Our comprehensive financial model equips property developers with essential tools for robust investment analysis and informed decision-making.

Effective financial models enhance investment analysis for property development, minimizing cash flow problems and maximizing return on investment.

Effective cash flow forecasting empowers property developers to anticipate financial gaps, enabling timely decisions that foster sustainable growth.

Robust financial models for property development enhance investment analysis, facilitating accurate cash flow forecasting and attracting essential external financing.

A robust property development financial model enhances investment analysis, ensuring informed decisions and satisfying bank requirements for loans.

Utilizing residential property financial models enhances budget management and ensures informed investment analysis for successful property development projects.

Utilizing a cash flow forecasting model enables precise future planning and performance comparison, enhancing investment analysis for property development.

ADVANTAGES

Leverage pro forma financial statements to enhance cash flow forecasting and improve investment analysis for property development projects.

Effective financial models enhance investment analysis for property development, ensuring precise cash flow forecasting and improved decision-making.

A robust property development financial model enhances clarity, enabling informed investment analysis and effective cash flow forecasting for successful projects.

A robust financial model empowers property developers to effectively forecast cash flow and optimize investment analysis for successful projects.

A robust financial model enhances profitability analysis, empowering property developers to make informed investment decisions and optimize returns.