Power Purchase Agreement Services Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Power Purchase Agreement Services Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

power purchase agreement services Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

POWER PURCHASE AGREEMENT SERVICES FINANCIAL MODEL FOR STARTUP INFO

Highlights

The comprehensive services for power purchase agreements (PPAs) include the development of a robust financial model tailored for renewable energy projects, incorporating elements such as long-term energy contract analysis and risk assessment in power purchase agreements. This involves utilizing energy price forecasting methods and investment analysis for PPAs to create detailed cash flow models for energy agreements. Additionally, the financial modeling for renewable projects encompasses contract for difference financial analysis and electricity purchase agreement modeling, ensuring that solar and wind energy purchase agreements are thoroughly evaluated through performance metrics. By staying attuned to market trends in power purchase agreements and implementing hedging strategies in energy contracts, stakeholders can enhance their understanding of PPA structures and pricing models, ultimately leading to more effective project financing strategies.

The ready-made financial model in Excel effectively alleviates common pain points faced by buyers in the renewable energy sector by providing seamless integration of power purchase agreement financial modeling services. It includes comprehensive spreadsheets that facilitate risk assessment in power purchase agreements, enabling users to conduct electricity purchase agreement modeling with ease. The template offers robust energy price forecasting methods, allowing for accurate long-term energy contract analysis and investment analysis for PPAs. Additionally, it automates the aggregation of monthly and annual summaries on cash flow models for energy agreements, ensuring that users can quickly evaluate PPA performance evaluation metrics and assess the impact of market trends in power purchase agreements, all while simplifying the complexities of financing structures for renewable projects.

Description

Our comprehensive financial modeling for renewable projects focuses on power purchase agreement services, providing a robust three-statement model that enables informed decision-making through precise reporting. This financial projection model is tailored for those entering the PPA market, delivering critical insights for investment analysis and cash flow models for energy agreements, essential for gaining the confidence of lenders and investors. The tool encompasses startup summaries, detailed monthly and yearly projected income statements, and KPIs to measure business performance, while also offering in-depth analysis of long-term energy contracts and corporate power purchase agreements. With automated calculations for financial metrics, including risk assessments in power purchase agreements and energy revenue forecasting models, users gain valuable visibility into financing structures and market trends, ensuring a sound strategy for sustainable energy investment.

POWER PURCHASE AGREEMENT SERVICES FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive Excel financial model equips investors with essential tools for effective decision-making. It includes detailed financial assumptions, statements, and cash flow projections tailored for power purchase agreements (PPAs) and renewable energy projects. Enhanced with user-friendly interfaces, this model facilitates seamless presentations of your business plan and financial projections. Whether you're assessing risk in power purchase agreements or analyzing investment strategies, our template is designed for clarity and precision, ensuring a robust foundation for successful investor meetings. Unlock powerful insights into market trends and financial metrics that drive sustainable energy initiatives.

Dashboard

Developing a robust financial forecasting model is key to enhancing your business plan's attractiveness. Utilize our comprehensive Dashboard, featuring charts, graphs, and detailed financial reports tailored for power purchase agreements (PPAs) and renewable energy projects. Leverage advanced techniques in risk assessment, energy price forecasting, and cash flow modeling to refine your PPA structure and pricing strategies. By implementing these insights, you can effectively analyze investment metrics, align with market trends, and optimize financial outcomes for sustainable growth in the renewable energy sector.

Business Financial Statements

Our comprehensive financial modeling services empower business owners to develop robust projections and forecasts essential for renewable energy projects. Utilizing advanced techniques in PPA performance evaluation metrics and energy price forecasting methods, we facilitate precise communication of financial insights to stakeholders. Our visually engaging financial charts and graphs summarize key data, enhancing presentations for potential investors. By integrating contract for difference financial analysis and risk assessment in power purchase agreements, we ensure that our clients are well-equipped to navigate market trends and secure favorable financing structures for renewable initiatives.

Sources And Uses Statement

This comprehensive 5-year cash flow projection template includes a detailed sources and uses of cash statement. Users can easily track the origins of funds utilized to support business activities, ensuring transparency and informed decision-making. By integrating renewable energy financial modeling, this tool enhances your understanding of financial metrics related to power purchase agreements (PPAs) and investment analysis for renewable projects. Leverage this template for effective risk assessment and cash flow models, optimizing your long-term energy contract analysis while navigating market trends in power purchase agreements.

Break Even Point In Sales Dollars

Break-even analysis is essential for understanding the interplay between fixed and variable costs and revenue in renewable energy projects. By determining the break-even point, companies can evaluate the viability of power purchase agreements (PPAs) and assess their financial modeling for renewable projects. This analysis informs investment decisions, allowing stakeholders to gauge risks and forecast energy revenues effectively. Emphasizing the evaluation of various PPA structures and pricing models enhances the strategic approach to project financing and long-term energy contracts, ensuring companies align with market trends and optimize cash flow for sustainable growth.

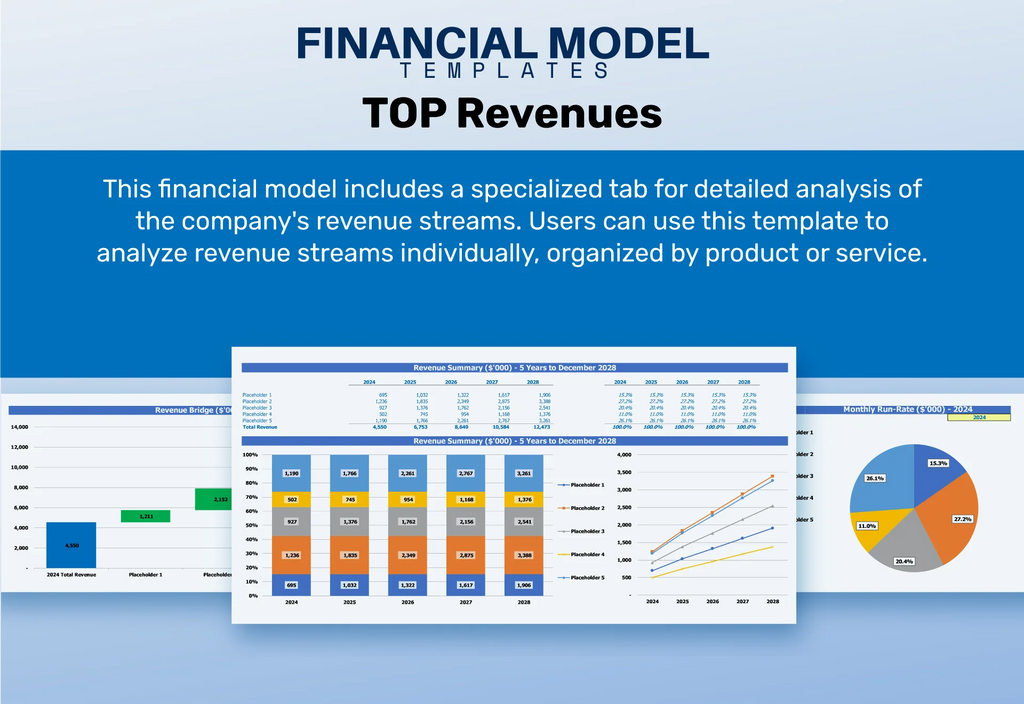

Top Revenue

This comprehensive P&L Excel template includes a dedicated tab for in-depth analysis of the company’s revenue streams. It meticulously dissects revenue by product or service, enabling refined insights into financial performance. Ideal for renewable energy projects, this tool supports cash flow models and investment analysis for power purchase agreements (PPAs). Users can leverage it for contract for difference financial analysis and assess PPA structure and pricing models, ensuring alignment with market trends in power purchase agreements. Enhance your financial modeling for renewable projects with this structured and insightful approach to revenue evaluation.

Business Top Expenses Spreadsheet

The pro forma template outlines annual expenses categorized into four key areas essential for effective financial modeling in renewable energy projects. Our comprehensive financial forecast template details specific costs tailored to the company’s unique needs, including customer acquisition, unforeseen expenses, and employee salaries. By leveraging advanced financial modeling for renewable projects, organizations can enhance their investment analysis for power purchase agreements (PPAs) and optimize cash flow models. Utilizing robust PPA structure and pricing models ensures informed decision-making and strategic alignment with market trends in electricity purchase agreements and long-term energy contracts.

POWER PURCHASE AGREEMENT SERVICES FINANCIAL PROJECTION EXPENSES

Costs

A robust financial model is essential for business planning, particularly in the context of power purchase agreements (PPAs). It helps identify expenses and assess their viability, ensuring effective risk assessment in energy contracts. Furthermore, comprehensive financial modeling for renewable projects can uncover potential challenges, enabling strategic solutions. By analyzing long-term energy contracts and employing energy revenue forecasting models, businesses can optimize investment strategies and enhance their overall financial health. Ultimately, these insights facilitate informed decision-making and attract funding, driving sustainable growth in the renewable energy sector.

CAPEX Spending

CAPEX expenses play a vital role in a three-statement financial model, particularly in renewable energy projects. Financial specialists meticulously evaluate the startup budget and monitor investments to ensure optimal performance. Understanding initial expenses is crucial for maintaining financial health and facilitating cash flow management. By accurately estimating capital expenditures through comprehensive cash flow models, companies can make informed decisions that positively impact financial stability. A responsible approach to budgeting is essential for the success of any venture, especially in energy markets where power purchase agreements and project financing strategies are paramount.

Loan Financing Calculator

Start-ups and growing businesses must meticulously manage loan repayment schedules, which detail amounts, maturity terms, and other vital factors. Integrating this plan into a robust cash flow analysis is crucial, as interest expenses directly impact financial health. Effective financial modeling for renewable projects, particularly under power purchase agreements (PPAs), enhances cash flow forecasting and risk assessment. By utilizing strategies like PPA structure and pricing models, companies can optimize their financing structures and ensure sustainable growth while navigating market trends in energy contracts. This approach fosters informed investment analysis and improves overall financial stability.

POWER PURCHASE AGREEMENT SERVICES EXCEL FINANCIAL MODEL METRICS

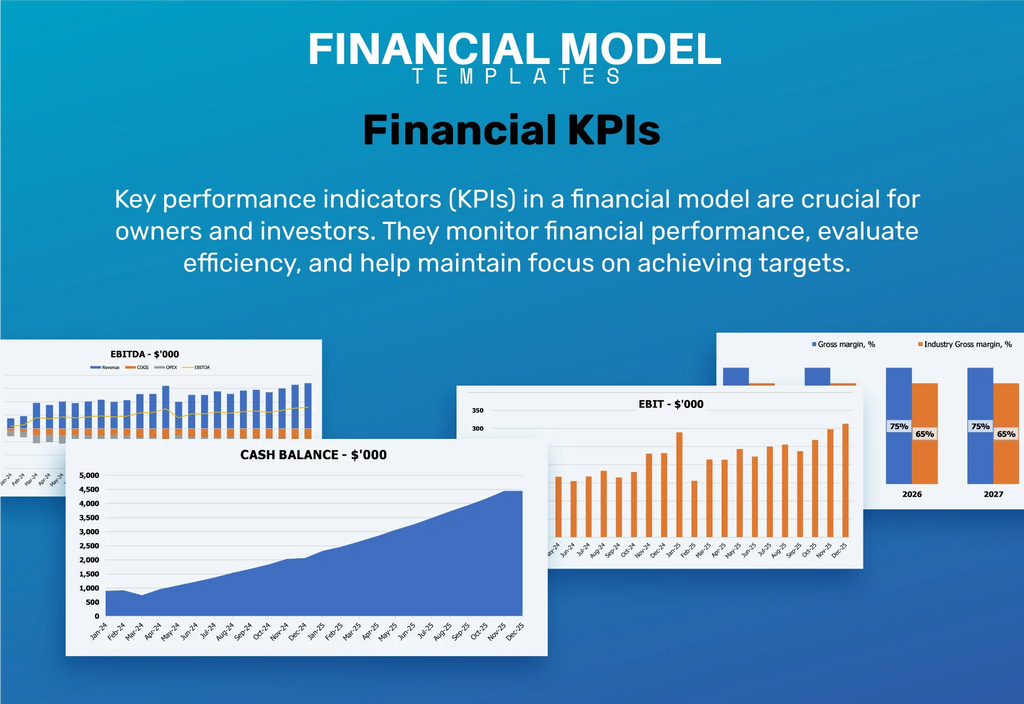

Financial KPIs

Earnings Before Interest and Taxes (EBIT), often referred to as operational income, serves as a critical indicator of a company's profitability. By highlighting the difference between revenues and operational expenses—including sales costs, interest, and taxes—EBIT reflects the company's ability to generate profit. This metric, synonymous with operational earnings, is vital for financial modeling for renewable projects and assessing power purchase agreements (PPAs). Understanding EBIT empowers stakeholders to analyze risks and develop effective financing structures for renewable projects, ultimately enhancing investment analysis and driving strategic decisions in energy markets.

Cash Flow Forecast Excel

To maximize profitability, effective cash flow budgeting and forecasting are essential. These financial reports provide valuable insights into how a company manages its cash inflows and expenses, reflecting its overall financial health. In the context of renewable energy, employing financial modeling for PPA structures and investment analysis can significantly enhance decision-making. By analyzing long-term energy contracts and implementing cash flow models, businesses can align their strategies with market trends, ensuring sustainable growth and risk mitigation in power purchase agreements. Engaging in comprehensive energy revenue forecasting further strengthens financial stability and profitability in the renewable sector.

KPI Benchmarks

The 3-statement model includes a benchmark tab that calculates critical financial indicators to assess company performance. By comparing these metrics with industry peers, businesses can evaluate their relative standing and identify strategic opportunities. For start-ups, these benchmarks are crucial in formulating effective project financing strategies, particularly in the context of renewable energy. Utilizing these comparative analyses enhances strategic management, guiding informed decisions. Accurate calculations and thorough documentation of key indicators empower organizations to refine their approaches and optimize outcomes in power purchase agreements and other energy contracts.

P&L Statement Excel

To ensure precise profit and loss projections, utilizing Excel sheets is essential for effective financial modeling in renewable energy projects. Our comprehensive five-year financial projection template facilitates monthly or yearly income statements, highlighting key metrics in performance evaluation. It enables accurate analysis of profits, losses, and cash flow, while providing invaluable insights to identify areas requiring immediate attention. By integrating energy revenue forecasting models and risk assessment in power purchase agreements (PPAs), this tool empowers stakeholders to navigate the complexities of corporate power purchase agreements and enhance investment strategies for sustainable growth.

Pro Forma Balance Sheet Template Excel

Our projected balance sheet template, also known as the statement of financial position, offers a comprehensive snapshot of your organization’s assets, liabilities, and equity at a specific moment. This vital tool is essential for evaluating the financial health of your startup. With our financial modeling services tailored for renewable energy projects, you gain insights into power purchase agreements (PPAs), investment analysis, and energy revenue forecasting. Seamlessly assess your financial stance and strategic opportunities with our ready-to-use balance sheet forecast template, designed to support your growth in the dynamic energy market.

POWER PURCHASE AGREEMENT SERVICES FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This three-year financial projection template excels in facilitating comprehensive analysis for renewable energy projects. Featuring a pre-money valuation startup analysis, it enables users to conduct a Discounted Cash Flow (DCF) valuation and assess critical financial metrics, including residual value and replacement costs. Additionally, the template supports market comparables and recent transaction analyses, aligning with best practices in power purchase agreement financial modeling. By integrating energy revenue forecasting methods and risk assessments, users can effectively navigate the complexities of PPAs and project financing strategies, ensuring informed investment decisions in the dynamic renewable energy landscape.

Cap Table

A cap table template is essential for startups and companies to effectively assess their share distribution among investors. By providing a clear overview of securities and monetary contributions, it facilitates informed investment analysis for power purchase agreements (PPAs). Integrating renewable energy financial modeling and risk assessment in PPAs, the template enhances decision-making regarding financing structures for renewable projects. Moreover, it supports energy revenue forecasting models, ensuring transparency in long-term energy contract analysis and maximizing stakeholder confidence in electricity purchase agreement modeling. Ultimately, a robust cap table fosters strategic planning and successful capital allocation.

KEY FEATURES

Effective financial modeling for renewable projects enables informed decision-making and risk management, maximizing benefits from power purchase agreements.

A comprehensive cash flow model enables precise forecasting of financial impacts, enhancing decision-making for renewable energy projects and power purchase agreements.

A robust financial model enhances investment analysis for renewable projects, optimizing cash flow and risk assessment in long-term agreements.

Our financial model streamlines power purchase agreement projections, enhancing clarity and accuracy in long-term energy contract analysis.

Our renewable energy financial modeling services empower stakeholders to optimize investments, ensuring profitable and sustainable power purchase agreements.

Utilizing cash flow models for energy agreements reveals optimal funding strategies, enhancing renewable project growth and financial stability.

Our financial modeling services for renewable energy optimize PPAs, saving time and money while maximizing investment returns.

Leverage our power purchase agreement financial model to streamline your planning and maximize business growth effortlessly.

Our financial modeling for renewable projects simplifies risk assessment and enhances decision-making in power purchase agreements, driving efficient investment strategies.

Our financial modeling services for power purchase agreements provide quick, reliable insights, regardless of your business's size or developmental stage.

ADVANTAGES

A robust financial model for power purchase agreements enables precise profit loss projections, enhancing decision-making and financial strategy alignment.

A robust financial model enhances risk assessment and optimizes cash flow for power purchase agreements, ensuring sustainable project viability.

A comprehensive financial model for power purchase agreements ensures precision in risk assessment and enhances alignment among project stakeholders.

Our financial model for power purchase agreements enables precise scenario analysis, optimizing investment decisions and enhancing project viability.

A robust financial model for power purchase agreements enables precise projections, enhancing investment decisions and risk management strategies.