Pizzeria Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Pizzeria Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

pizzeria Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

PIZZA RESTAURANT BUSINESS PLAN FINANCIAL MODEL INFO

Highlights

This comprehensive five-year financial model for a pizzeria includes essential elements such as a detailed pizzeria business plan, financial projections, and budgeting tools to effectively manage restaurant cash flow. With prebuilt financial statements—including a monthly profit and loss statement, balance sheet, and cash flow forecast—this template allows for rigorous analysis of pizzeria startup costs and ongoing operating expenses. The model also features pizzeria profit margin calculations, sales forecasting, and expense tracking, enabling users to evaluate their pizza shop revenue model and optimize their pricing strategy. By utilizing this resource, aspiring owners can conduct a thorough pizzeria break-even analysis and investment analysis, ensuring a clear path to financial sustainability and robust restaurant valuation models.

The ready-made financial model in our Excel template directly addresses common pain points for pizzeria entrepreneurs by simplifying the complexities of financial projections and cash flow management. It provides an intuitive structure for budgeting and expense tracking, enabling users to accurately assess startup costs and operating expenses with ease. The built-in pizzeria profit margin calculation and break-even analysis tools allow for effective sales forecasting and investment analysis, ensuring that prospective owners can confidently develop a pricing strategy that maximizes revenue while maintaining financial sustainability. Additionally, the model's automatic updates of financial ratios and key metrics make it straightforward to present a compelling case to investors, streamlining the process of securing funding for your pizza restaurant venture.

Description

A well-structured pizzeria business plan is essential for navigating the complexities of startup costs, cash flow management, and revenue models in the competitive restaurant landscape. This financial model incorporates detailed pizza restaurant financial projections and pizzeria operating expenses, allowing owners to conduct thorough food service financial analysis and pizzeria break-even analysis. By leveraging accurate sales forecasting and expense tracking, the model aids in establishing a solid pizzeria profit margin calculation while informing pricing strategy and investment analysis. Additionally, it encompasses critical financial metrics, including restaurant cash flow management and financial ratios, ensuring long-term financial sustainability and a comprehensive understanding of the pizzeria's income statement and overall performance.

FINANCIAL PLAN FOR PIZZA SHOP REPORTS

All in One Place

A comprehensive pizzeria business plan includes essential tools for strategic decision-making. Utilizing a professional startup financial model, you can generate projected financial statements, such as profit and loss, balance sheets, and cash flow analyses. This model also enables pizzeria sales forecasting and cash flow management, ensuring a clear understanding of startup costs and operating expenses. By analyzing financial ratios and calculating profit margins, you can refine your pricing strategy and drive financial sustainability. All these insights are visualized in a user-friendly dashboard, empowering you to make informed choices for your pizza restaurant's future.

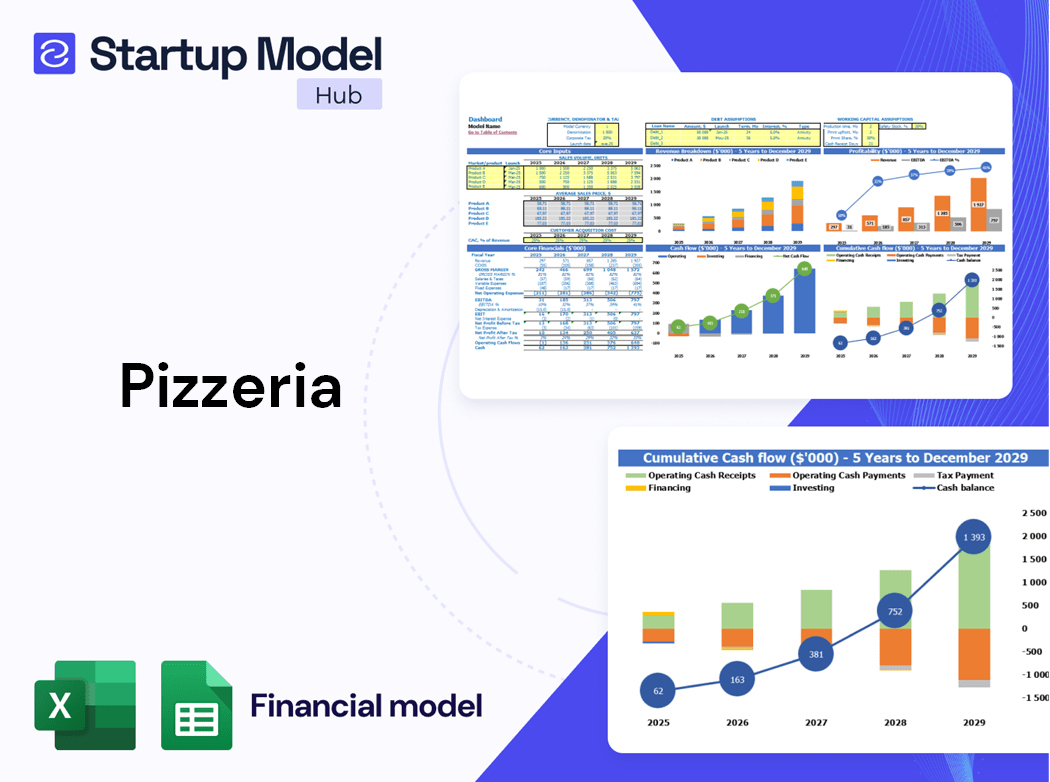

Dashboard

Unlock the potential of your pizzeria with our comprehensive financial reporting tools. Our intuitive charts provide a clear overview of your pizza restaurant's financial projections, growth trends, and key metrics. Transform your pizzeria startup costs and operating expenses into visually engaging insights that elevate your business planning. With streamlined expense tracking and robust income statements, you can confidently forecast sales, analyze profit margins, and develop effective pricing strategies. Elevate your pizzeria business plan today and ensure financial sustainability with ease. Prepare to impress stakeholders with polished, ready-to-present financial insights!

Business Financial Statements

In developing a robust pizzeria business plan, understanding accounting statements is crucial to evaluate performance comprehensively. The pizzeria income statement reveals insights into core operating activities and profit margin calculations, while the projected balance sheet offers a long-term view of assets and liabilities. Pro forma cash flow analysis is vital for effective restaurant cash flow management, highlighting cash inflows and outflows over time. Together, these financial tools aid in pizzeria sales forecasting, budgeting, and evaluating financial sustainability, ensuring your pizza restaurant is positioned for success in a competitive market.

Sources And Uses Statement

The pizzeria profit and loss forecast template provides a comprehensive overview of your pizza restaurant's financial landscape. By incorporating a sources and uses section, it clearly outlines various funding sources, enhancing your pizzeria business plan. This framework not only streamlines funding but also aids in effective cash flow management. Leveraging this tool enables accurate pizza shop revenue modeling and expense tracking, ensuring informed financial sustainability. With detailed insights into pizzeria startup costs and operating expenses, this template empowers restaurant owners to make strategic decisions and achieve optimal profitability in a competitive market.

Break Even Point In Sales Dollars

The CVP (Cost-Volume-Profit) chart is essential for any pizzeria business plan, especially for startups. This financial tool helps owners analyze their pizza restaurant financial projections and evaluate their revenue model. Utilizing a 5-year cash flow projection template, businesses can assess the impact of their decisions on financial sustainability. The break-even analysis reveals the required revenue level to cover operating expenses and taxes. Once this threshold is met, the pizzeria starts generating profits, indicating a successful investment strategy. Proper budgeting and financial analysis are crucial for achieving a healthy pizzeria profit margin and ensuring long-term success.

Top Revenue

The financial insights for your pizzeria are conveniently organized in the financial excel template's Top Revenue tab. This comprehensive tool provides an annual breakdown of your pizza restaurant's revenue streams, enabling you to analyze revenue depth and bridge effectively. By leveraging this financial model template, you can refine your pizzeria business plan, enhance your sales forecasting, and achieve long-term financial sustainability. Gain clarity on pizzeria startup costs and optimize your financial projections for informed decision-making, ensuring your pizza shop thrives in a competitive market.

Business Top Expenses Spreadsheet

To ensure financial sustainability in your pizzeria business plan, it's crucial to analyze and optimize startup costs and operating expenses. Our feasibility study template includes a detailed expense report, highlighting key categories alongside "other" expenses for streamlined monitoring. This tool aids in effective cash flow management by tracking trends in costs year over year. By prioritizing expense tracking and developing a solid pizza restaurant budgeting strategy, both startups and established pizzerias can maintain high profit margins and improve their financial projections. Consistent oversight enables restaurants to thrive in a competitive market while ensuring profitability.

PIZZA BUSINESS PROFIT MARGIN EXPENSES

Costs

Launching a pizzeria involves significant upfront investment, making effective financial management essential. To avoid premature deficits, it’s crucial to meticulously track startup costs before operations begin. Our Excel-based financial model simplifies this process, offering built-in pro forma statements for accurate budgeting and expense tracking. With tools for pizzeria financial projections, cash flow management, and profit margin calculations, you can confidently navigate your financial landscape and ensure sustainable growth. Transform your pizzeria business plan into a reality with our comprehensive financial analysis and forecasting tools.

CAPEX Spending

A comprehensive pizzeria business plan begins with an analysis of startup costs, often referred to as 'CAPEX.' This table outlines capitalized expenses, such as equipment and renovations, which appear on the pro forma balance sheet but are not immediately reflected in the monthly profit and loss statement. These investments are crucial for the restaurant's growth and financial sustainability. By effectively managing cash flow and tracking expenses, owners can enhance their pizzeria's profitability and strengthen their financial projections, ensuring a solid foundation for long-term success in the competitive food service industry.

Loan Financing Calculator

A loan amortization schedule is essential for pizzeria business planning, detailing periodic payments for an amortizing loan. This table outlines the principal reduction over the loan's life, enabling effective cash flow management. By incorporating an amortization calculator within your startup financial model, you can easily track initial amounts, terms, and interest rates. This tool aids in pizzeria financial sustainability by providing insights into outstanding balances and repayment strategies, ultimately enhancing your pizza restaurant's budgeting and financial forecasting. Ensure a solid grasp of pizzeria operating expenses and profit margins to achieve long-term success.

BUSINESS PLAN PIZZERIA EXCEL METRICS

Financial KPIs

A crucial indicator of a pizzeria's operational success is its earnings before interest, taxes, depreciation, and amortization (EBITDA). This financial metric provides insights into the pizza restaurant's profitability and efficiency, allowing owners to assess performance amidst expenses and revenue. Incorporating comprehensive elements like pizzeria business plans, financial projections, and cash flow management enables a robust financial analysis. By focusing on factors such as operating expenses, pricing strategy, and sales forecasting, restaurant owners can ensure sustainability and optimize the pizzeria's profit margin, paving the way for long-term success in a competitive food industry.

Cash Flow Forecast Excel

A robust pizzeria business plan is essential for establishing a successful pizza restaurant. Utilizing a cash flow management template enables effective oversight of financial flows and aids in forecasting transactions. By tracking pizzeria operating expenses and revenue, owners can enhance their financial sustainability. Implementing a pizzeria pricing strategy and conducting thorough sales forecasting will improve profit margins and support financial projections. Additionally, a comprehensive income statement and expense tracking give valuable insights into restaurant valuation models and investment analysis, ensuring a lucrative pizza shop revenue model and long-term success.

KPI Benchmarks

The pizzeria business plan relies on precise financial modeling to establish crucial performance indicators (KPIs). These KPIs enable a pizzeria startup to evaluate its financial projections against industry benchmarks, aiding in expense tracking and cash flow management. By conducting a pizzeria break-even analysis and assessing operating expenses, owners can develop a robust pizza shop revenue model. This benchmarking process offers invaluable insights, particularly for new ventures, guiding them in budgeting, pricing strategy, and ensuring financial sustainability. Ultimately, understanding these metrics equips pizzeria owners to make informed decisions, enhancing their restaurant’s profitability and growth potential.

P&L Statement Excel

A Profit and Loss Statement (Income Statement) is vital for stakeholders, showcasing your pizzeria's primary revenue streams and key expense categories. This financial document helps assess profitability, expense structure, and loan repayment capacity. Utilizing financial projections for a pro forma income statement allows you to estimate future profitability, guiding your pizzeria business plan. Incorporating elements like startup costs, operating expenses, and sales forecasting ensures a comprehensive view of financial sustainability. By analyzing these metrics, you can refine your pricing strategy, enhance cash flow management, and optimize your pizzeria’s overall financial performance.

Pro Forma Balance Sheet Template Excel

Our financial model Excel template offers a comprehensive overview of your pizzeria business plan, seamlessly integrating the pro forma balance sheet with cash flow and income statement components. This cohesive framework ensures precise pizzeria financial projections and aids in effective restaurant cash flow management. With a focus on essential metrics like pizzeria profit margin calculation and break-even analysis, you can strategically assess startup costs and operating expenses. Enhance your pizza shop revenue model and investment analysis, ensuring financial sustainability for your restaurant while optimizing your pricing strategy and sales forecasting.

BUSINESS PLAN PIZZERIA EXCEL VALUATION

Startup Valuation Model

Our financial plan excels by integrating two robust valuation methodologies: discounted cash flow (DCF) and the weighted average cost of capital (WACC). This dual approach provides a comprehensive analysis of your pizzeria business plan, projecting cash flow management and financial sustainability. By utilizing these metrics, we can effectively assess pizzeria startup costs, operating expenses, and profit margins, ensuring you have a clear understanding of your pizza restaurant's financial projections. This insightful framework supports informed decision-making for budgeting, pricing strategy, and sales forecasting, ultimately driving your pizzeria's success in a competitive market.

Cap Table

Are you curious about the simplicity of a cap table? This essential tool streamlines financial analysis for your pizzeria business plan, offering insights into cash flow management and investment analysis. It helps you navigate the complexities of startup costs, revenue models, and operating expenses while aiding in budgeting and expense tracking. Employing a cap table fosters transparency, allowing for effective forecasting and sustainable financial health. Ultimately, it empowers you to make informed decisions regarding profit margin calculations and pricing strategy to ensure your pizza restaurant thrives in a competitive market.

KEY FEATURES

A robust pizzeria business plan enhances financial sustainability, ensuring precise budgeting and effective cash flow management for long-term success.

Our comprehensive financial model equips pizzeria owners with essential reports for effective budgeting and increased profitability.

A robust pizzeria business plan enhances financial projections and ensures sustainable growth, instilling confidence in investors and lenders alike.

Leverage precise financial projections to attract investors, streamline funding, and enhance your pizzeria's operational efficiency and profitability.

A comprehensive pizzeria business plan ensures effective budgeting and precise financial projections, enhancing your restaurant's profitability and sustainability.

A robust pizzeria financial model streamlines cash flow management, freeing time for product innovation and enhancing customer relationships.

A robust pizzeria business plan empowers you to identify cash gaps and surpluses before they occur, ensuring financial sustainability.

Effective financial modeling helps pizzerias anticipate cash flow challenges, enabling proactive solutions to ensure sustainable growth and profitability.

A robust pizzeria business plan enhances financial sustainability by improving cash flow management and optimizing your pizza restaurant's revenue model.

A robust cash flow forecast enables timely identification of late payments, enhancing your pizzeria's financial sustainability and operational efficiency.

ADVANTAGES

A robust financial model empowers pizzeria owners to accurately project startup costs and enhance long-term profitability through informed decision-making.

A comprehensive pizzeria business plan enhances financial sustainability and improves cash flow management for successful operations and growth.

Optimize your pizzeria business plan with robust financial projections to ensure sustainable growth and effective cash flow management.

A robust financial model enhances your pizzeria business plan by optimizing budgeting, forecasting, and identifying profitable pricing strategies.

Utilizing a pizzeria projected cash flow statement template excel enhances financial sustainability and enables effective cash flow management for your restaurant.