Petroleum Exploration Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Petroleum Exploration Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

petroleum exploration Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

PETROLEUM EXPLORATION FINANCIAL MODEL FOR STARTUP INFO

Highlights

The petroleum exploration financial model in Excel is a comprehensive tool designed for investment return analysis in the oil and gas sector, specifically tailored for companies engaged in hydrocarbon exploration. This 5-year financial planning template is ideal for both upstream petroleum economics startups and established ventures, enabling users to conduct an oil and gas feasibility study and assess exploration risk assessment. It facilitates detailed oilfield project financials evaluations, including petroleum revenue projections and exploration operating costs, making it valuable for potential petroleum project finance discussions or market assessments. With its focus on petroleum cash flow modeling and oil price sensitivity analysis, this template is a crucial asset for businesses aiming to optimize their royalty and production sharing agreements and enhance their overall energy market trends strategies.

This petroleum investment analysis Excel template addresses key pain points by providing a comprehensive oil and gas valuation model that integrates exploration risk assessment with upstream petroleum economics. Users can employ energy financial forecasting to analyze hydrocarbon exploration budgeting, while also evaluating oilfield project financials and drilling program financial models. The template includes features for petroleum cash flow modeling and projects petroleum revenue projections over a five-year horizon, effectively accommodating various oilfield economic evaluations. Users can customize inputs such as exploration operating costs and royalty and production sharing agreements to generate tailored results, facilitating an insightful oil price sensitivity analysis. By streamlining the oil and gas feasibility study process, the template empowers investors to make informed decisions backed by robust exploration and production metrics and investment return analysis.

Description

Our oil and gas valuation model serves as a comprehensive tool for petroleum investment analysis, enabling stakeholders to make informed decisions through precise reporting on financials. This energy financial forecasting template captures vital metrics, including exploration risk assessment and petroleum reserve valuation, ensuring all relevant statements are considered. Given the inherent vulnerabilities of the petroleum exploration industry, our model emphasizes effective hydrocarbon exploration budgeting and oilfield project financials to mitigate risks while building investor confidence. By utilizing our robust drilling program financial model, users can analyze petroleum cash flow modeling, assess exploration operating costs, and conduct oil price sensitivity analysis to enhance investment return analysis and project finance evaluations. The design allows for easy updates, automatically recalibrating projections for petroleum revenue, thereby streamlining the exploration and production metrics essential for strategic decision-making.

PETROLEUM EXPLORATION FINANCIAL MODEL REPORTS

All in One Place

This petroleum exploration five-year cash flow projection template serves as a comprehensive guide for professionals in the oil and gas sector. By incorporating essential elements of petroleum investment analysis and upstream petroleum economics, it enables users to assess exploration operating costs and optimize cash utilization rates. This tool supports informed decision-making, providing clarity on financial sustainability and potential achievements within the hydrocarbon landscape. Ultimately, it enhances understanding of energy market trends and investment return analysis, making it invaluable for start-ups and established firms alike aiming for successful project finance and economic evaluations.

Dashboard

Our 5-year projection plan serves as a robust tool for petroleum investment analysis, streamlining your Excel cash flow statement and ensuring meticulous organization. Clients benefit from tailored financial reports, available monthly or annually, enhancing oil and gas valuation models. The integrated dashboard feature consolidates vital insights from key financial statements, presenting them in visually engaging charts. This comprehensive approach supports energy financial forecasting and aids in exploration risk assessment, empowering informed decision-making in upstream petroleum economics and oilfield project financials. Elevate your petroleum project finance strategy with our innovative forecasting solutions.

Business Financial Statements

Our comprehensive financial projection model excels in delivering a fully-integrated proforma framework for oilfield project financials. It features profit and loss statements, pro forma balance sheets, and cash flow budgets tailored for the petroleum industry. This versatile tool supports exploration risk assessment and petroleum revenue projections, enabling users to adapt existing financial statements from platforms like QuickBooks, Xero, and Freshbooks. Monthly and annual reporting options enhance energy financial forecasting, while our model facilitates investment return analysis and oil price sensitivity analysis for robust decision-making in hydrocarbon exploration budgeting.

Sources And Uses Statement

This five-year financial projection template provides a detailed analysis of the sources and uses of funds, essential for informed decision-making in petroleum investment analysis. Users can explore the company's funding structure, allowing for comprehensive evaluation of oil and gas valuation models. By examining exploration operating costs and revenue projections, stakeholders gain insights into hydrocarbon exploration budgeting and drilling program financial models. This tool is invaluable for conducting oilfield economic evaluations and assessing investment returns within the dynamic landscape of energy market trends.

Break Even Point In Sales Dollars

In the context of petroleum investment analysis, a CVP chart facilitates a comprehensive evaluation of revenue and sales metrics. It's crucial to distinguish between sales, revenue, and profit within the financial planning framework. Revenue represents the total income generated from hydrocarbon exploration, while profit is derived by subtracting both fixed and variable costs. This differentiation is vital for robust oil and gas valuation models and effective exploration risk assessment, ensuring accurate petroleum revenue projections and informed investment return analysis for sustainable project finance in the energy sector.

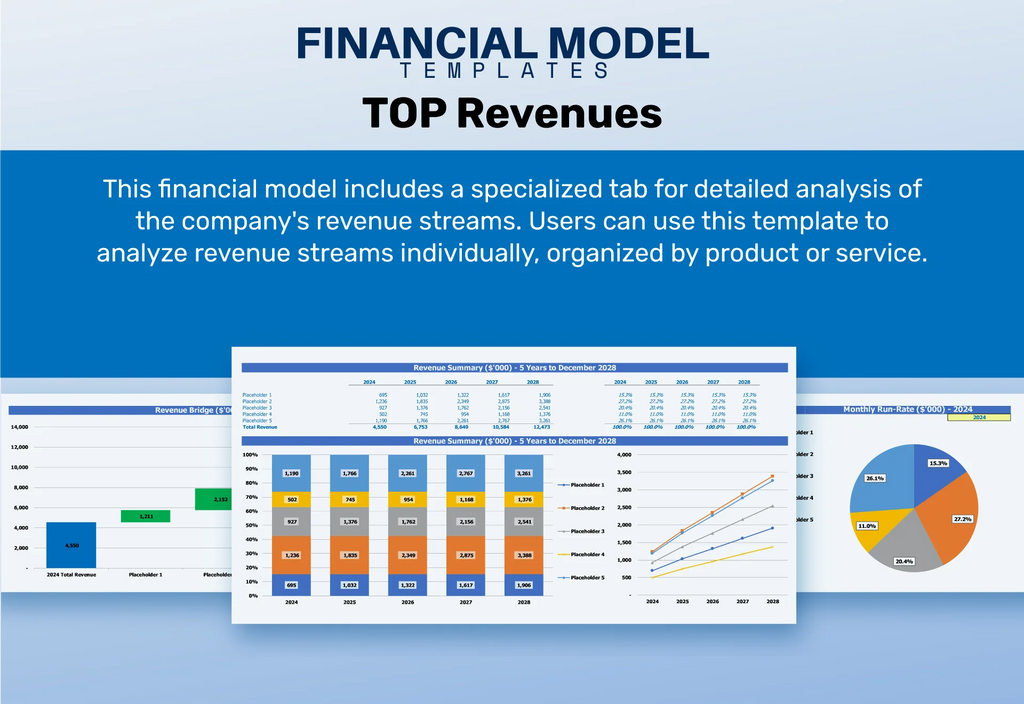

Top Revenue

In petroleum investment analysis, understanding both top-line and bottom-line metrics is crucial. The top line, representing gross revenues from oil and gas operations, signals growth potential, while the bottom line indicates net income and profitability after expenses. Analysts closely examine these figures in oil and gas valuation models and energy financial forecasting to gauge the viability of exploration projects and drilling programs. Effective petroleum cash flow modeling and exploration risk assessments ensure that investment return analysis aligns with energy market trends, optimizing hydrocarbon exploration budgeting and enhancing overall project finance strategies.

Business Top Expenses Spreadsheet

The top expenses section of the feasibility study template excels in summarizing critical costs associated with oilfield project financials. This financial model offers a comprehensive analysis of your major expenses, including customer acquisition and fixed costs. By understanding these elements, you enhance your petroleum investment analysis and can better assess exploration operating costs. This clarity positions you to manage your finances effectively, optimize profitability, and improve your overall petroleum revenue projections. With informed decision-making, you can navigate the complexities of upstream petroleum economics and capitalize on emerging energy market trends.

PETROLEUM EXPLORATION FINANCIAL PROJECTION EXPENSES

Costs

A robust petroleum investment analysis framework is essential for managing oilfield project financials effectively. This financial model not only identifies challenges within a company's operations but also aids in decision-making amidst complex issues. By integrating key elements such as exploration operating costs and petroleum cash flow modeling, stakeholders can gain insights into their financial health. Additionally, the model supports oil and gas feasibility studies, facilitating effective energy financial forecasting and investment return analysis. Ultimately, it enables proactive management of drilling program financials and enhances understanding of exploration risk assessment and petroleum revenue projections.

CAPEX Spending

Capital expenditure (CapEx) is a crucial component in petroleum investment analysis and oilfield project financials. Financial professionals utilize CapEx to evaluate investments in fixed assets, ensuring thorough monitoring of depreciation, acquisitions, and disposals related to property, plant, and equipment (PPE). This calculation encompasses both direct asset acquisitions and assets under financial leasing, providing a comprehensive overview for robust oil and gas valuation models. Accurate CapEx projections are essential for effective petroleum revenue projections, exploration risk assessment, and financial forecasting to navigate energy market trends successfully.

Loan Financing Calculator

Start-ups and growing companies must diligently manage their loan repayment schedules, which detail amounts, maturity terms, and other critical factors. This schedule is integral to the company's petroleum cash flow modeling and overall financial forecasting. Interest expenses from the debt schedule significantly influence the five-year cash flow projection, while closing debt balances directly affect the balance sheet. Additionally, principal repayments are key components in the cash flow projection, reflecting the organization’s financial health and capacity for upstream petroleum economics, ultimately shaping investment return analysis and oilfield project financials.

PETROLEUM EXPLORATION EXCEL FINANCIAL MODEL METRICS

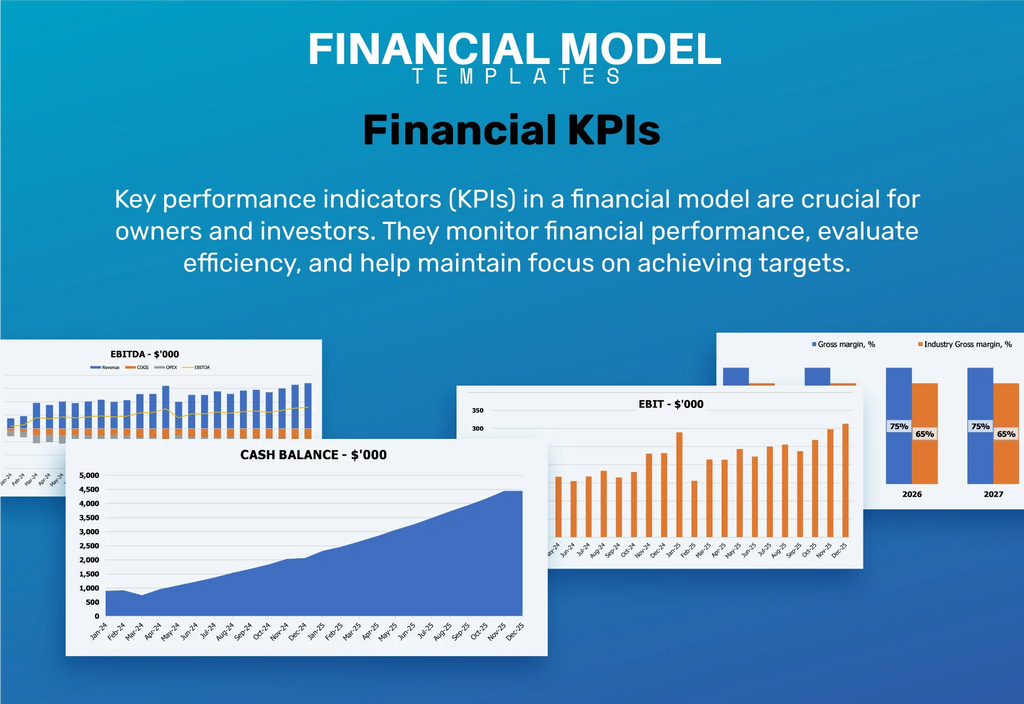

Financial KPIs

Return on Equity (ROE) is a key profitability metric that evaluates a company's ability to generate profits from shareholder investments. This ratio reveals how effectively each dollar of equity translates into profit, providing insights into financial health. In the context of petroleum investment analysis, accurate calculations of ROE can enhance oil and gas valuation models and inform drilling program financial models. By utilizing projected balance sheets and monthly profit and loss templates, companies can conduct thorough investment return analyses, ensuring informed decision-making in an ever-evolving energy market landscape.

Cash Flow Forecast Excel

A comprehensive cash flow projection is crucial for demonstrating your company's capacity to meet financial obligations. From a banking perspective, an effective investment return analysis and detailed oilfield project financials are essential. These elements should encompass an accurate oil and gas valuation model and incorporate exploration risk assessment to ensure reliable budgeting. By integrating petroleum cash flow modeling with robust energy financial forecasting, you can confidently showcase your ability to generate sufficient revenue, thereby aligning with the expectations of lenders and stakeholders interested in your upstream petroleum economics.

KPI Benchmarks

Utilize our comprehensive proforma business plan template to conduct a precise benchmarking analysis. This tool features a dedicated tab for comparing key financial and operational indicators with those of industry peers, enhancing your petroleum investment analysis. By evaluating metrics such as cash flow modeling, exploration operating costs, and oilfield project financials, you can gauge your company's competitiveness and profitability. This comparative assessment empowers stakeholders to make informed decisions based on oil and gas valuation models and energy market trends, ensuring strategic alignment in hydrocarbon exploration budgeting and project finance.

P&L Statement Excel

Introducing our advanced P&L Excel template, designed specifically for petroleum investment analysis. This comprehensive financial model enables users to project profits and losses over the next 60 months. It effectively tracks key metrics, including revenue, operating expenses, and gross and net profits. By integrating industry averages, this tool allows for in-depth oilfield economic evaluations and empowers energy financial forecasting. Enhance your hydrocarbon exploration budgeting and investment return analysis with real-time insights into exploration operating costs and petroleum cash flow modeling for informed decision-making in the ever-evolving energy market.

Pro Forma Balance Sheet Template Excel

We have incorporated a projected balance sheet template in Excel, essential for every oil and gas venture. This report comprehensively outlines both current and long-term assets, liabilities, and equity. Through this balance sheet forecast, stakeholders gain invaluable insights necessary for conducting petroleum investment analysis and assessing the financial viability of oilfield projects. It further facilitates critical calculations, such as key ratios, supporting informed decision-making in upstream petroleum economics and energy financial forecasting. Leverage this tool to enhance your exploration risk assessment and investment return analysis, staying ahead in dynamic energy market trends.

PETROLEUM EXPLORATION FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive petroleum exploration cash flow projection template offers an indispensable tool for performing investment return analysis through Discounted Cash Flow (DCF) methodology. It allows users to evaluate oil and gas valuation models while generating key financial metrics, including residual value and replacement costs. Enhanced by features for market comparables and recent transaction benchmarks, the template supports informed decision-making in upstream petroleum economics and hydrocarbon exploration budgeting. Streamline your oilfield project financials and optimize exploration risk assessment with this expertly designed resource for petroleum project finance.

Cap Table

An equity cap table serves as an essential tool for start-ups, detailing company shares, ownership distribution, and investor pricing. This financial model not only highlights each investor's percentage of ownership but also illustrates potential dilution effects. Similarly, in the context of petroleum investment analysis, understanding share dynamics is vital for evaluating oilfield project financials and performing accurate petroleum cash flow modeling. By integrating exploration risk assessment and oil price sensitivity analysis, stakeholders can better navigate energy market trends, ensuring informed investment return analysis and robust hydrocarbon exploration budgeting.

KEY FEATURES

Petroleum cash flow modeling enhances decision-making by optimizing investment returns and effectively managing surplus cash in volatile markets.

Effective petroleum cash flow modeling empowers managers to strategically reinvest surplus cash and seize new market opportunities.

Our oilfield project financial model enhances decision-making by providing accurate petroleum cash flow projections and risk assessments.

Our user-friendly petroleum exploration financial model delivers reliable results, ensuring informed decisions and maximizing returns across all development stages.

Our oilfield project financial model enhances decision-making by providing accurate petroleum cash flow projections and risk assessments.

Our user-friendly petroleum exploration financial model delivers reliable results, enhancing investment return analysis for any project size and stage.

Our oilfield project financial model enhances investment return analysis by accurately projecting cash flows and assessing exploration risks.

The petroleum investment analysis model boosts investor confidence, making it easier to secure financing for exploration and production projects.

Our all-in-one financial model streamlines petroleum investment analysis, enhancing decision-making with accurate revenue projections and exploration risk assessments.

Our comprehensive financial model enhances petroleum investment analysis by delivering precise forecasts, profit-loss projections, and performance summaries for informed decision-making.

ADVANTAGES

A robust oilfield project financial model enhances decision-making by accurately forecasting costs and evaluating investment returns in petroleum exploration.

The petroleum exploration startup costs spreadsheet enables precise scenario analysis, optimizing financial decisions and enhancing investment return potential.

A robust financial model enhances petroleum investment analysis, leading to more accurate decision-making and improved exploration risk assessment.

A robust oilfield project financial model enhances decision-making by accurately forecasting petroleum revenue projections and managing exploration risks.

The oilfield project financial model provides invaluable insights into cash flows, enhancing investment decision-making and risk management strategies.