Personal Finance Webinars Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Personal Finance Webinars Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

personal finance webinars Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

PERSONAL FINANCE WEBINARS FINANCIAL MODEL FOR STARTUP INFO

Highlights

Our comprehensive personal finance education platform aims to empower individuals through a variety of offerings, including financial literacy workshops, budget planning seminars, and investment strategy webinars. Participants can enhance their knowledge with savings growth techniques and debt management courses, while also engaging in retirement planning sessions and financial goal-setting webinars. We focus on teaching wealth building strategies and tax optimization workshops, supplemented by cash flow management seminars and financial planning certifications. Additionally, our curriculum includes risk management in finance, personal budgeting tools, and credit score improvement webinars to support financial independence strategies. With a broad array of online finance courses, money management tactics, and estate planning webinars, we provide essential financial analysis techniques to help everyone achieve their financial aspirations.

The ready-made financial model in Excel addresses several pain points for buyers by offering a comprehensive solution for personal finance education, particularly for those in the pub business. It simplifies budget planning through intuitive input tables and charts that aid in financial goal-setting and cash flow management, ensuring users can effectively forecast revenue and expenses for up to 60 months. By generating essential financial statements—such as income and expenditure templates, cash flow projections, and balance sheets—on both monthly and annual bases, it alleviates the complexities of investment strategy and debt management. Additionally, the inclusion of diagnostic tools, sales analysis, and a dynamic dashboard empowers users with financial literacy, enabling them to implement wealth-building strategies and execute retirement planning sessions with confidence.

Description

Our personal finance education tools, including budget planning seminars and financial literacy workshops, are meticulously designed to empower individuals with essential skills for effective cash flow management and savings growth techniques. The comprehensive suite of resources, including investment strategy webinars and debt management courses, enables users to develop tailored financial independence strategies and robust investment plans while fostering credit score improvement. By integrating financial goal-setting webinars, retirement planning sessions, and wealth-building strategies, we provide a holistic approach to personal finance that supports informed decision-making and sustainable financial health, all reflected in our detailed pro forma income statement template.

PERSONAL FINANCE WEBINARS FINANCIAL MODEL REPORTS

All in One Place

A comprehensive startup costs spreadsheet integrates key financial statements: the income statement, cash flow statement, and balance sheet. This pro forma financial template offers a holistic view, capturing all changes over the accounting year. Regardless of the organization's size, it's essential to prepare these financial projections annually. By doing so, businesses can effectively leverage personal finance education, financial literacy workshops, and investment strategy webinars to ensure sound financial health. Emphasizing proper budget planning and cash flow management empowers organizations in their path to financial independence and robust growth.

Dashboard

Our financial model template features a comprehensive dashboard that enhances personal finance education and financial planning analysis. By offering dynamic charts and visual representations, this tool simplifies the review of key financial statements, ensuring precise insights into your company’s performance. It empowers stakeholders with essential data, facilitating informed decisions and enabling effective budgeting, investment strategy, and cash flow management. Ideal for financial literacy workshops or retirement planning sessions, this dashboard supports your journey towards financial independence and wealth-building strategies. Elevate your financial analysis techniques with our innovative template today!

Business Financial Statements

Our comprehensive financial planning toolkit empowers entrepreneurs to craft essential financial statements, complete with precise computations and forecasts. Designed for clarity, it enables users to generate compelling presentations featuring dynamic financial charts. These visual aids facilitate the effective communication of critical data and insights to stakeholders and potential investors. Through tailored financial literacy workshops and online finance courses, we equip startups with the knowledge and tools necessary for strategic budget planning, investment strategies, and ultimately, financial independence. Join us in mastering wealth-building strategies for a successful business journey.

Sources And Uses Statement

The sources and uses table is a vital element of your financial model template, offering a clear overview of funding sources and cash distribution. This component is essential for effective budget planning, enhancing financial literacy, and ensuring sound investment strategies. By incorporating financial goal-setting techniques and debt management insights, businesses can optimize their cash flow and improve overall financial health. Engaging in financial education workshops and utilizing personal budgeting tools will empower stakeholders to navigate their financial landscape with confidence, ultimately paving the way for sustainable growth and financial independence.

Break Even Point In Sales Dollars

This break-even sales report highlights the annual revenue required to cover total variable and fixed costs. Understanding this financial analysis technique is crucial for effective budget planning and achieving financial independence. By recognizing break-even points, businesses can implement money management tactics and optimize their investment strategies. For those seeking to enhance their financial literacy, consider participating in financial literacy workshops or online finance courses that focus on cash flow management and risk management in finance. Equip yourself with the knowledge to set financial goals and develop wealth-building strategies for long-term success.

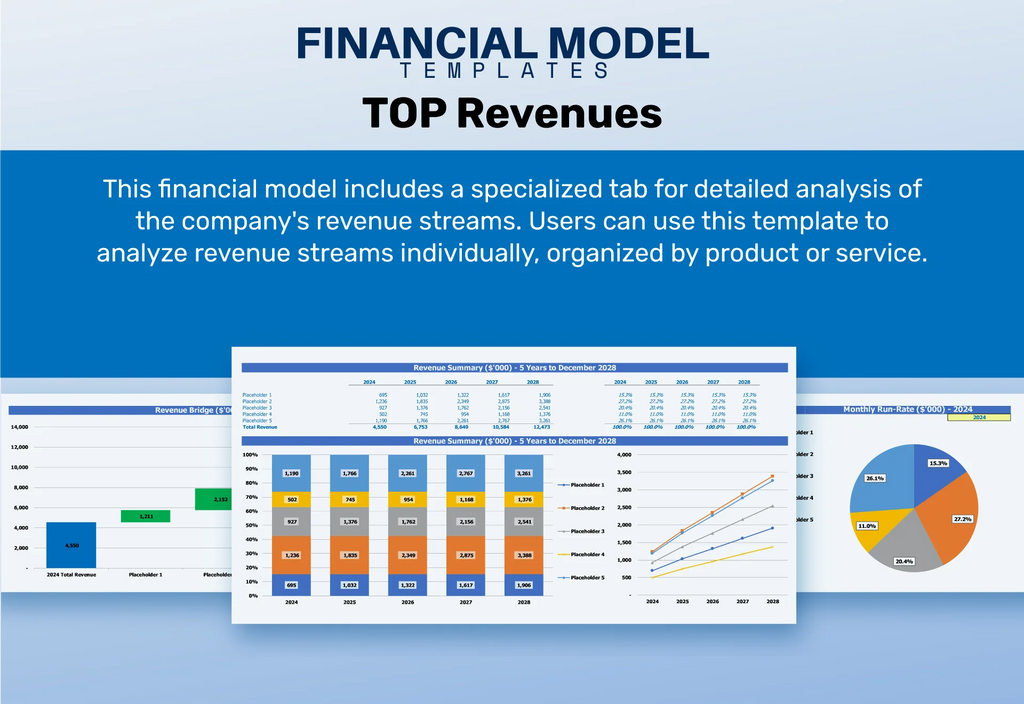

Top Revenue

Revenue is a cornerstone of any successful business, essential for sustainable growth and profitability. Our five-year projection plan emphasizes the importance of diverse revenue streams, crucially reflected in a comprehensive financial model. Financial analysts must focus on accurately forecasting revenue structures based on robust historical data. Our profit and loss projection incorporates necessary assumptions to enhance revenue forecasts. Discover effective financial analysis techniques and strategic planning tools in our business projection template, designed to help you achieve financial independence and optimal growth through informed decision-making and thorough financial literacy workshops.

Business Top Expenses Spreadsheet

In the “Top Expenses” section of our Excel financial model, you’ll find key cost categories clearly defined. The “Other” category allows you to specify any additional expenses vital to your company. Enhance your financial oversight with our financial forecast template, enabling you to monitor your performance over five years. This tool complements your personal finance education, linking seamlessly to concepts from financial literacy workshops, debt management courses, and investment strategy webinars. Elevate your financial planning, effectively applying cash flow management techniques and wealth building strategies for long-term success.

PERSONAL FINANCE WEBINARS FINANCIAL PROJECTION EXPENSES

Costs

This intuitive financial planning template streamlines your budgeting process, allowing users to effortlessly project total operating expenses, including R&D and SG&A. With clearly organized cost details, this user-friendly tool enhances your financial literacy and supports effective budget planning. Its automated formulas eliminate the need for constant manual adjustments, ensuring precision and ease. Perfect for those seeking financial education through online courses or workshops, this template lays the foundation for successful financial goal-setting and savvy investment strategies. Elevate your money management tactics with this essential tool for achieving financial independence and stability.

CAPEX Spending

Capital expenditures (CapEx) represent substantial investments essential for a startup's growth. These expenses, aimed at enhancing operational efficiency and upgrading technology, should be meticulously documented in your pro forma balance sheet and profit and loss statements. Their impact extends to cash flow management, as they significantly influence financial planning. Effectively managing these expenditures is crucial for achieving financial independence and implementing sound wealth-building strategies. Understanding CapEx through financial analysis techniques will empower entrepreneurs to optimize their budgets and align their investments with long-term financial goals. Consider participating in financial literacy workshops for deeper insights.

Loan Financing Calculator

Effective loan repayment schedules are crucial for startups and growing businesses. They detail essential information such as principal amounts, terms, maturity periods, and interest rates. Monitoring these schedules aids in cash flow management, as timely repayments directly affect cash flow analysis. Additionally, the principal debt appears on the balance sheet and is integral to forecasting cash flow statements. By understanding these dynamics, companies can better navigate financial planning and set strategic goals, enhancing their overall financial literacy and stability. Engage in financial literacy workshops or online finance courses to refine your money management tactics for long-term success.

PERSONAL FINANCE WEBINARS EXCEL FINANCIAL MODEL METRICS

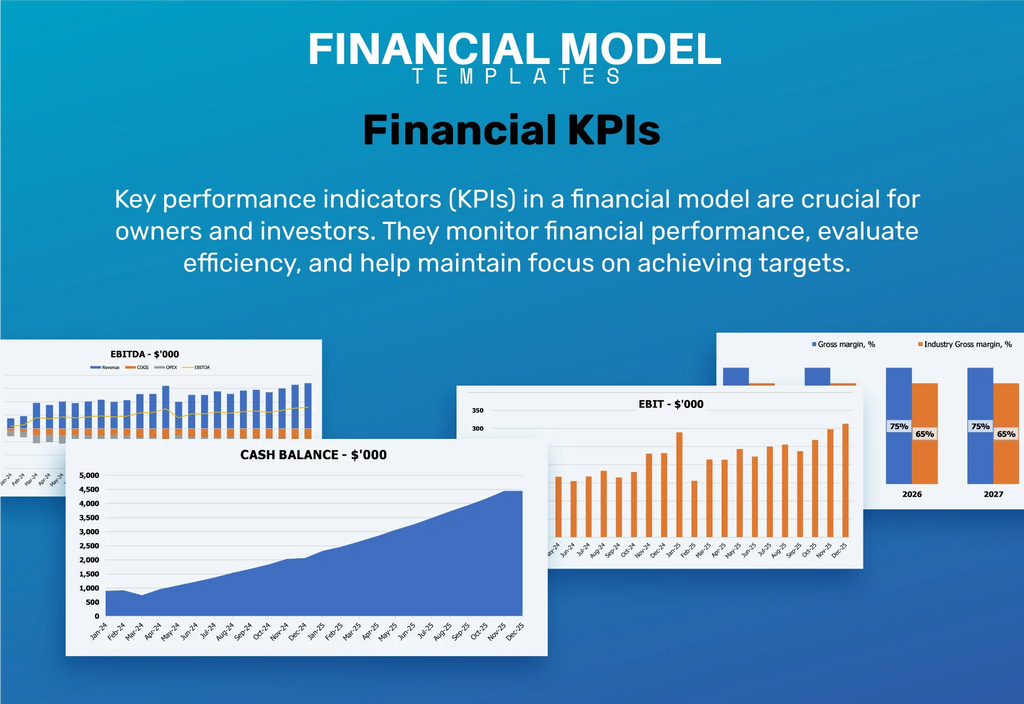

Financial KPIs

Return on equity (ROE) is a vital metric for assessing a startup's financial performance. It quantifies the relationship between earnings and equity—essentially the investment used to generate profits. By analyzing projected balance sheets alongside profit and loss forecasts, entrepreneurs can gauge the effectiveness of their capital utilization. Understanding ROE is crucial for financial literacy and can be further explored in investment strategy webinars and budget planning seminars. Strengthening this knowledge supports informed decision-making and financial independence strategies. Embrace this powerful financial analysis technique to enhance your personal finance education and achieve your financial goals.

Cash Flow Forecast Excel

A cash flow projection is an essential tool in personal finance education, illustrating the evolution of cash balances over a specified period. It effectively highlights the inflow and outflow of funds, allowing individuals and businesses to make informed financial decisions. By utilizing this technique, participants in financial literacy workshops can better understand their financial health, enabling efficient budget planning and strategic investment management. Mastering cash flow projections is a key component of financial goal-setting webinars, helping to pave the way toward financial independence and wealth building strategies.

KPI Benchmarks

This pro forma projection includes a dedicated tab for financial benchmarking studies, which involve a detailed financial analysis of performance. By comparing key financial indicators with industry peers, users can gain valuable insights into a company's competitiveness and efficiency. This analytical approach not only enhances budget planning but also informs investment strategy and risk management in finance. By understanding where a company stands in relation to its competitors, stakeholders can better implement wealth building strategies and make informed decisions that drive long-term financial growth and stability.

P&L Statement Excel

The profit and loss (P&L) statement template in Excel is a crucial tool for investors and financial analysts, illustrating a business's profitability against operational costs. While it offers a quick overview of profit-generating potential, it lacks insights into cash flows, capital structure, and balance sheet positions. For a comprehensive financial understanding, integrating the P&L statement with other financial reports is essential. This holistic approach is vital for effective budget planning, investment strategies, and overall financial literacy, empowering businesses to achieve their long-term financial goals and build sustainable wealth.

Pro Forma Balance Sheet Template Excel

The projected balance sheet for your personal finance education initiatives, formatted in Excel, outlines your assets—both cash and non-cash—alongside liabilities and capital at a specific point in time. This comprehensive financial statement also includes any owned buildings and equipment. When applying for a loan, banks will review this pro forma balance sheet to assess the associated risk. By participating in financial literacy workshops and utilizing personal budgeting tools, you can enhance your financial strategy and ensure your projections are robust and credible.

PERSONAL FINANCE WEBINARS FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our startup's financial model features an intuitive valuation tab designed for ease of use. It enables users to conduct a Discounted Cash Flow analysis effortlessly. By simply inputting key metrics, such as the Cost of Capital, users can navigate this sophisticated calculation with confidence. This tool supports personal finance education, equipping users with essential skills in financial literacy, investment strategies, and budgeting techniques. Explore our model to enhance your financial acumen and empower your journey toward financial independence.

Cap Table

The free Excel startup financial model template, along with its cap table, effectively summarizes vital investor information, detailing their ownership stakes and contributions. This structured approach aids in enhancing financial literacy, making it an invaluable resource for entrepreneurs. To further develop your financial acumen, consider participating in financial literacy workshops or investment strategy webinars. These experiences, paired with practical tools for personal budgeting and wealth-building strategies, can significantly boost your financial independence and long-term success. Explore additional resources like online finance courses for a comprehensive understanding of money management tactics and cash flow optimization.

KEY FEATURES

Enhance your financial literacy through engaging workshops that equip you with essential budgeting and investment strategies for lasting wealth.

Our comprehensive financial model offers essential tools for informed decision-making, enhancing your financial literacy and planning strategies.

Unlock financial success with engaging workshops that enhance your financial literacy and empower you to achieve your goals effortlessly.

This comprehensive financial model empowers users to achieve rapid, reliable results in personal finance education and strategic financial planning.

Enhance your financial independence by mastering effective cash flow management strategies through our engaging online finance courses.

A cash flow forecast empowers managers to strategically reinvest surplus cash, ensuring sustainable growth and financial stability for their business.

Enhancing cash flow through effective accounts receivable management empowers businesses to achieve financial independence and long-term growth.

Implementing a cash flow projection model empowers you to strategically manage late payments and optimize your financial planning.

Enhance your financial literacy through engaging workshops and webinars, empowering you to achieve financial independence and smart money management.

Utilizing a cash flow forecast empowers businesses to make informed decisions and enhance financial strategy through scenario analysis and adjustments.

ADVANTAGES

Reassessing assumptions with personal finance webinars enhances financial literacy and empowers informed decision-making for long-term wealth building.

The feasibility study template excel enhances financial literacy by identifying strengths and weaknesses for effective personal finance education.

Enhance your financial literacy through engaging personal finance education, empowering you to achieve financial independence and confidently manage your wealth.

Regularly updated financial projections enhance credibility with banks and support informed decision-making in personal finance management.

Calculate startup expenses for personal finance webinars to ensure effective budget planning and maximize your financial literacy efforts.