Multiple Property REFM Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Multiple Property REFM Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

multiple properties real estate Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MULTIPLE PROPERTIES REAL ESTATE FINANCIAL MODEL FOR STARTUP INFO

Highlights

To effectively implement a multiple properties investment strategy, utilizing a sophisticated 5-year pro forma financial statements template in Excel can significantly enhance real estate portfolio optimization. This tool aids in property cash flow analysis, allowing investors to conduct multi-property valuation methods with minimal prior financial planning experience. By leveraging investment property analysis tools and real estate cash flow modeling, one can generate accurate real estate financial projections and assess portfolio risk effectively. Enhanced with property acquisition financial models and tenant rental income modeling, this template empowers users to perform thorough commercial real estate modeling and execute property expense management strategies. Ultimately, it facilitates informed decision-making through real estate financial forecasting and investment return on equity calculations, ensuring sustainable growth in a diverse real estate portfolio.

The multiple properties investment strategy financial model offers a robust solution for real estate portfolio optimization, enabling investors to conduct comprehensive property cash flow analysis and leverage multi-property valuation methods effectively. This Excel template facilitates real estate financial projections, ensuring accurate investment property analysis through advanced investment return on equity calculations and real estate cash flow modeling. It helps users evaluate capitalization rates and implement portfolio risk assessment techniques while also providing insights into property market trend analysis. By incorporating property management financial metrics and tenant rental income modeling, this model enhances decision-making for property acquisition financial models and strategizes property expense management. Ultimately, it streamlines real estate financial forecasting, making investment decisions more informed and calculations of real estate cash returns straightforward.

Description

For entrepreneurs diving into a multiple properties investment strategy, a well-structured financial model is crucial for visualizing future goals and evaluating business performance. Our dynamic Excel pro forma financial statements template facilitates real estate portfolio optimization by incorporating real estate cash flow modeling and property cash flow analysis, enabling comprehensive multi-family investment analysis and commercial real estate modeling. This model supports real estate financial projections with detailed calculations, including tenant rental income modeling, property expense management strategies, and capitalization rate evaluation, all of which contribute to a robust investment return on equity framework. With effective investment property analysis tools and portfolio risk assessment features, you can generate essential financial ratios and conduct property market trend analysis, allowing for informed decision-making and strategic financial forecasting over a five-year horizon.

MULTIPLE PROPERTIES REAL ESTATE FINANCIAL MODEL REPORTS

All in One Place

Elevate your investment strategy with our comprehensive multiple properties real estate financial model. This adaptable tool facilitates detailed property cash flow analysis and portfolio risk assessment, allowing for optimized real estate portfolio performance. Leverage multi-property valuation methods and robust investment property analysis tools to enhance your capital allocation decisions. With features like tenant rental income modeling and property expense management strategies, you can forecast financial projections and assess capitalization rates effectively. Transform your startup's approach to real estate by utilizing this model as a foundational guide for robust business strategies.

Dashboard

Our business plan financial template features a unique dashboard tailored for precise financial modeling and reporting. This tool empowers stakeholders to make informed decisions based on accurate data, significantly impacting success. It allows users to conduct property cash flow analysis, optimize their real estate portfolio, and assess investment performance through robust metrics. With capabilities like tenant rental income modeling and portfolio risk assessment, this dashboard enhances strategic planning and financial forecasting. Reliable and efficient, it transforms complex calculations into actionable insights, ultimately driving growth for startups and established enterprises alike.

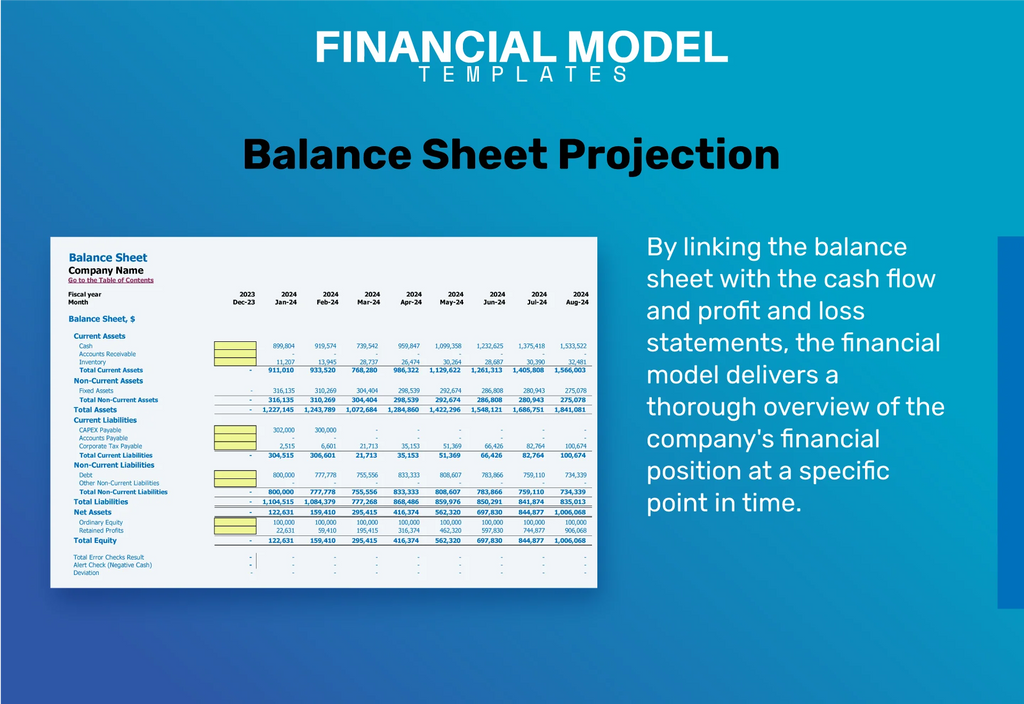

Business Financial Statements

Financial statements are essential for evaluating real estate investments, segmented into three key components: 1. **Income Statement** - This highlights the property cash flow analysis, detailing income and expenditures, including depreciation and taxes. 2. **Balance Sheet** - A snapshot of assets, liabilities, and shareholders' equity, maintaining the equilibrium of assets = liabilities + equity. 3. **Cash Flow Statement** - This crucial analysis tracks cash inflows and outflows, critical for real estate financial projections, determining the profitability of your investments. Together, these statements facilitate informed investment property analysis, guiding multi-property valuation methods and overall portfolio optimization.

Sources And Uses Statement

The sources and uses template in a financial model is essential for pinpointing funding sources and identifying cash flow leakages. Implementing an effective multiple properties investment strategy enhances real estate portfolio optimization, while property cash flow analysis ensures robust financial projections. Utilizing investment property analysis tools enables precise multi-property valuation methods and effective capitalization rate evaluation. By focusing on property expense management strategies and tenant rental income modeling, investors can achieve optimal returns. Ultimately, thorough property market trend analysis and portfolio risk assessment guide informed decision-making for a profitable real estate investment landscape.

Break Even Point In Sales Dollars

Breakeven analysis is essential for determining when your investment will generate profit. To create a breakeven chart, identify fixed costs—like property management expenses—and variable costs that fluctuate with occupancy rates, such as maintenance and utilities. Understanding these costs supports your property cash flow analysis and real estate portfolio optimization. Effective breakeven modeling enhances your multi-property valuation methods, ensuring you make informed decisions. By evaluating these financial metrics, you can strategize effectively, maximizing your investment return on equity while minimizing portfolio risk.

Top Revenue

In a company’s profit and loss statement, the top line signifies revenue growth, reflecting the health of your real estate portfolio. An increase in sales indicates robust market performance and enhances financial projections, impacting critical metrics like investment return on equity and cash flow analysis. Investors and analysts closely monitor these figures quarterly and annually, as top-line growth influences property management financial metrics and overall portfolio optimization. Understanding these dynamics is essential for effective investment property analysis and ensuring sustainable profitability across multiple properties.

Business Top Expenses Spreadsheet

This free startup financial model template includes a dedicated tab for in-depth revenue stream analysis. By categorizing revenue by product or service, it enables investors to conduct property cash flow analysis effectively. Leveraging investment property analysis tools, users can optimize their real estate portfolio while assessing multi-property valuation methods. The template supports real estate financial projections and cash flow modeling, helping stakeholders evaluate potential returns and manage risks adeptly. It’s an essential resource for understanding capital allocation in the context of investment return on equity and property market trends.

MULTIPLE PROPERTIES REAL ESTATE FINANCIAL PROJECTION EXPENSES

Costs

An effective startup financial plan serves as a crucial tool for optimizing your real estate portfolio. It enables property cash flow analysis, forecasts financial ratios, and assesses risks associated with multiple properties investment strategies. By modeling tenant rental income and operating expenses, this plan highlights areas requiring focused attention to mitigate potential losses and enhance performance. Moreover, comprehensive projections attract investors by demonstrating sound property acquisition financial models. With robust real estate financial forecasting, you can confidently navigate market trends and achieve long-term investment success.

CAPEX Spending

Startup expenses represent the initial investment needed for business development and competitive enhancement, excluding staff salaries and operating costs. To foster real estate portfolio optimization, it’s essential to evaluate these costs alongside multiple properties investment strategies. By employing investment property analysis tools and property cash flow analysis, stakeholders can identify advantageous investment avenues. Incorporating capital expenditure insights into the business model description enhances financial forecasting and aids in property expense management strategies, ultimately guiding informed decisions in property management and multi-family investment analysis for sustained profitability.

Loan Financing Calculator

A loan amortization schedule is essential for managing financial commitments within a real estate portfolio. This comprehensive business plan template features a user-friendly schedule, streamlined with built-in formulas for convenience. It outlines key details, including repayment dates, installment amounts, and principal versus interest breakdowns. Additionally, it defines loan terms such as repayment periods, interest rates, and payment frequency. Integrating this schedule supports effective property cash flow analysis and enhances your investment strategy, ultimately contributing to robust real estate financial projections and optimized portfolio performance.

MULTIPLE PROPERTIES REAL ESTATE EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net Present Value (NPV) is a crucial metric in real estate financial forecasting, reflecting the present value (PV) of future cash flows from investments. It addresses essential questions like, "What is the current worth of a $1 expected years from now?" By calculating the sum of discounted cash flows across multiple properties, NPV serves as a vital tool for multi-property valuation methods. Utilizing effective investment property analysis tools enhances property cash flow analysis, enabling real estate portfolio optimization and informed decision-making. Ultimately, NPV aids in evaluating the potential return on equity and guides strategic property acquisition financial models.

Cash Flow Forecast Excel

The cash flow statement is a vital component of real estate financial forecasting, streamlining property cash flow analysis for multi-property investment strategies. By accurately inputting cash transactions—operating, investing, or financing—into this Excel template, investors can enhance their real estate portfolio optimization. The results seamlessly integrate with other financial analysis tools, informing property market trend analysis and tenant rental income modeling. For effective portfolio risk assessment, ensure your cash flow projections reconcile with pro forma balances annually, as they are essential for maintaining balanced investment property analysis and facilitating insightful multi-family investment analysis.

KPI Benchmarks

A financial model benchmark tab evaluates key performance indicators (KPIs) against industry averages to enhance real estate portfolio optimization. By leveraging investment property analysis tools, companies can identify best practices and conduct comparative analyses that inform property cash flow analysis and multi-family investment analysis. This benchmarking process is vital for real estate financial forecasting, enabling firms to refine their financial strategies, assess portfolio risk, and enhance property management financial metrics. Ultimately, these insights drive more informed decisions in property acquisition and capital allocation, ensuring a robust investment return on equity.

P&L Statement Excel

One of the essential components of managing a successful real estate portfolio is accurate profit and loss forecasting. Our advanced Excel template simplifies this process, enabling you to perform comprehensive property cash flow analysis and make informed investment property decisions. By incorporating multi-property valuation methods and real estate financial projections, you can enhance your investment strategy. This tool allows for effective tenant rental income modeling and streamlined property expense management strategies, ensuring your portfolio optimization is both efficient and profitable. Unlock the potential of your investments with precise financial metrics and reliable forecasting today!

Pro Forma Balance Sheet Template Excel

A pro forma balance sheet outlines a corporation's assets and liabilities, providing a snapshot of financial health. In conjunction with a profit and loss projection, it offers a comprehensive view of operational results and financial positioning over time. This template enables real estate portfolio optimization by highlighting key indicators, such as liquidity and solvency, essential for evaluating investment properties. By utilizing property cash flow analysis and financial ratios, investors can assess potential returns while effectively managing risks associated with multi-property investments. Ensure robust property acquisition financial models to enhance decision-making and overall portfolio performance.

MULTIPLE PROPERTIES REAL ESTATE FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our five-year cash flow projection template utilizes two robust valuation methods to enhance your multiple properties investment strategy. The discounted cash flow (DCF) method offers detailed insights into real estate financial forecasting, while the weighted average cost of capital (WACC) method aids in thorough investment property analysis. Together, they facilitate optimal real estate portfolio optimization and provide clarity on property cash flow analysis. This powerful combination equips you with essential tools for effective capital allocation and risk assessment, ensuring informed decisions and strong financial performance in your real estate ventures.

Cap Table

A well-structured cap table is essential for summarizing investor data, calculating equity shares, and tracking the funds invested in property assets. In the context of a multiple properties investment strategy, it provides clarity for real estate portfolio optimization and investment return on equity. By integrating property cash flow analysis and real estate financial ratios, investors can enhance capital allocation. This tool also aids in conducting multi-property valuation methods and forecasting financial performance, ensuring thorough property expense management strategies and accurate tenant rental income modeling for sustainable growth.

KEY FEATURES

Optimize your real estate portfolio with advanced financial models to save time and money while maximizing property cash flow.

Unlock seamless real estate portfolio optimization with our financial model, eliminating costly consultants while enhancing your investment strategy's effectiveness.

Utilizing a robust property acquisition financial model enhances investment strategy, ensuring optimal cash flow and maximizing returns across multiple properties.

Impress bankers and investors with a reliable real estate financial model that optimizes cash flow and enhances portfolio performance.

Optimize your real estate portfolio with effective financial modeling to maximize cash flow and enhance investment returns.

Implementing a robust financial model enables precise cash flow forecasting, empowering strategic reinvestment decisions and optimizing real estate portfolio performance.

Implementing a robust financial model enhances property cash flow analysis, ensuring informed decisions for optimizing your real estate portfolio.

Using a cash flow budget template empowers informed decision-making by clearly forecasting financial impacts of potential investments or changes.

Utilizing property acquisition financial models enhances better decision-making through precise real estate portfolio optimization and investment return analysis.

Enhance your operational decisions with cash flow modeling, confidently forecasting impacts on your financial health when evaluating investments.

ADVANTAGES

Optimize your real estate portfolio with investment property analysis tools that enhance cash flow forecasting and risk assessment.

The multi-property financial model enhances clarity in forecasting cash flow and optimizing returns for a robust real estate portfolio.

Optimize your real estate portfolio with our financial model, enhancing investment strategies through precise cash flow analysis and forecasting.

A robust financial model enables investors to accurately assess multiple properties, enhancing cash flow and maximizing real estate portfolio performance.

The financial model empowers investors to preemptively identify cash flow issues within their real estate portfolio through precise forecasting.