Multi Family Housing Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Multi Family Housing Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

multi family housing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MULTI FAMILY HOUSING FINANCIAL MODEL FOR STARTUP INFO

Highlights

The five-year multifamily housing investment strategy for startups and entrepreneurs is designed to impress investors and secure funding through comprehensive financial projections for apartments. This plan incorporates key components of real estate financial modeling, including cash flow projection multifamily, rental income forecasting, and operating expenses multifamily, ensuring a robust investment analysis multifamily. With an emphasis on capital expenditure budgeting and occupancy rates analysis, the plan addresses critical aspects such as apartment complex financing, debt service coverage ratio, and property yield calculations. Additionally, it features market rent assessment and lease-up period financial modeling to optimize returns on equity investment in multifamily assets. This structured approach facilitates real estate development feasibility and enhances the potential for successful multifamily asset management, ultimately paving the way for securing funding from banks or investors.

The multi-family housing investment strategy provided by this Excel template alleviates key pain points for investors by delivering a comprehensive financial model that incorporates multi-family property valuation, cash flow projections, and rental income forecasting, ensuring that users can effectively assess the viability of their investments. With detailed analyses of operating expenses and occupancy rates, this tool simplifies the complexity of debt service coverage ratios and capital expenditure budgeting, enabling informed decisions on apartment complex financing. The template offers robust investment analysis multifamily capabilities, allowing for accurate property yield calculations and real estate cash flow analysis, while also supporting financial projections for apartments over a five-year period. By streamlining lease-up period financial modeling and real estate development feasibility, it empowers users to optimize their equity investment in multifamily assets, ultimately enhancing return on investment and securing long-term financial success.

Description

Our financial model for multi-family housing provides a robust framework for real estate financial modeling, tailored to assist in making informed business and investment decisions through precise reporting. This startup financial model includes comprehensive projections for cash flow, encompassing apartment complex financing, operating expenses multifamily, and capital expenditure budgeting, ensuring a thorough investment analysis multifamily that accounts for occupancy rates analysis and market rent assessment. With features for rental income forecasting and debt service coverage ratio calculations, this model supports property yield calculations and equity investment in multifamily, enhancing your real estate cash flow analysis. The Excel template facilitates financial projections for apartments over a 60-month period, generating detailed income statements and KPI measurements essential for multifamily asset management, all while enabling lease-up period financial modeling to assess development feasibility and return on investment multifamily effectively.

MULTI FAMILY HOUSING FINANCIAL MODEL REPORTS

All in One Place

A comprehensive financial plan for a startup encompasses an income statement, cash flow statement, and balance sheet, essential for multi-family housing investment strategy. Utilizing a robust 5-year cash flow projection template allows for holistic insights into rental income forecasting and operating expenses. The annual startup costs template should reflect all financial activities, ensuring accuracy in multifamily property valuation and investment analysis. Furthermore, developing a detailed business plan with financial projections is crucial for informed decision-making, enhancing your equity investment in multifamily assets and optimizing return on investment through effective market rent assessment and occupancy rates analysis.

Dashboard

This five-year cash flow projection template includes a dedicated section for critical financial indicators derived from your three main financial statements. It offers a detailed annual revenue breakdown, an Excel-based startup cash flow statement, and comprehensive financial projections. This dashboard is essential for assessing overall financial health and cash flow dynamics. It equips you with vital insights for crafting a robust multifamily housing investment strategy, facilitating effective debt service coverage analysis, and optimizing rental income forecasting—all pivotal for successful multifamily asset management and achieving a favorable return on investment.

Business Financial Statements

When developing a robust financial model for your multi-family housing investment strategy, it's essential to include key components such as cash flow projections, operating expenses analysis, and debt service coverage ratios. An intuitive five-year projection template ensures ease of use and collaboration among stakeholders. Incorporating multifamily property valuation, rental income forecasting, and capital expenditure budgeting into your investment analysis enhances clarity and precision. This comprehensive approach not only facilitates effective multifamily asset management but also supports informed decisions during the lease-up period, optimizing your return on investment and ensuring long-term financial success.

Sources And Uses Statement

The sources and uses of cash statement in this financial model template provides a comprehensive overview of the funding sources for your multi-family housing investment strategy, alongside detailed insights into expenditures. This essential document ensures precise tracking of all cash flows related to apartment complex financing, operating expenses, and capital expenditures. By analyzing these financial projections, investors can effectively assess rental income forecasting and occupancy rates, ultimately enhancing the investment analysis multifamily and improving return on investment. This clarity in cash flow allows for informed decision-making in the realm of multifamily asset management and real estate development feasibility.

Break Even Point In Sales Dollars

The 5-year financial projection template includes a comprehensive break-even analysis feature, enabling management to gauge the timeline for profitability. This sophisticated financial modeling tool automatically calculates break-even timing, units, and dollar amounts. By leveraging insights from this analysis, stakeholders can make informed decisions regarding multi-family housing investment strategies, enhancing cash flow projections and overall investment analysis. This template is essential for evaluating rental income forecasting, operating expenses, and capital expenditure budgeting, ensuring a robust approach to achieving optimal returns on investment in multifamily properties.

Top Revenue

In multifamily housing investment, understanding key metrics is crucial for successful investment analysis. Top-line figures, representing total rental income, indicate revenue growth, which positively affects overall financial projections for apartments. Conversely, the bottom line reflects net income, showcasing profitability after accounting for operating expenses and capital expenditures. Investors must pay attention to these indicators to assess cash flow projections and optimize occupancy rates. By utilizing real estate financial modeling, including debt service coverage ratio and property yield calculations, stakeholders can enhance their equity investment strategies and ensure long-term success in multifamily asset management.

Business Top Expenses Spreadsheet

Our three-year financial projection template excel offers a highly efficient way to track operating expenses in multi-family housing investments. It features four primary sections for detailed reporting, alongside an 'Other' category for additional data entry. For an in-depth analysis of your company's financial trajectory, consider utilizing the startup costs spreadsheet, which provides valuable insights on how activities will evolve over a five-year period. This tool is essential for effective rental income forecasting and capital expenditure budgeting in multifamily real estate.

MULTI FAMILY HOUSING FINANCIAL PROJECTION EXPENSES

Costs

For any successful multifamily housing investment strategy, accurately forecasting startup costs is crucial. These initial expenses set the foundation for your real estate financial modeling and can significantly impact your investment analysis. Our financial projection template includes a comprehensive proforma that captures essential expense and financing data, facilitating effective cash flow projection and capital expenditure budgeting. By managing startup costs diligently, you can enhance occupancy rates analysis and ensure a robust return on investment in your multifamily projects, ultimately leading to improved asset management and market rent assessment.

CAPEX Spending

This comprehensive three-statement model excels in providing an in-depth analysis of a company's revenue streams, essential for effective multi-family housing investment strategy. The template meticulously categorizes revenue by product and service, streamlining your investment analysis multifamily processes. Enhanced with real estate financial modeling features, it enables precise cash flow projections, market rent assessments, and operating expenses multifamily evaluations. This tool is invaluable for ensuring robust financial projections for apartments and optimizing your equity investment in multifamily properties, fostering informed decision-making for sustainable rental income forecasting and property yield calculations.

Loan Financing Calculator

A loan amortization schedule provides stakeholders with a clear overview of periodic payments on an amortizing loan, detailing how the principal is reduced over time. Typically, these payments remain consistent throughout the loan term. In a robust financial planning model, a pre-built amortization calculator incorporates the initial loan amount, payment terms, and interest rate. By utilizing this schedule, companies can enhance their investment analysis, monitor cash flow projections, and strategically plan their debt service coverage ratio, ensuring effective management of operating expenses and capital expenditure budgeting. This approach is vital for multifamily housing investment strategies.

MULTI FAMILY HOUSING EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The five-year financial projection template effectively calculates the gross profit margin, essential for assessing the profitability of your multifamily housing investment strategy. By dividing gross profit by net sales, this metric provides valuable insights for investment analysis. Understanding this margin enhances your real estate financial modeling, allowing for accurate cash flow projections and operating expenses evaluation. With precise data, you can better forecast rental income and assess property yield calculations, ultimately driving informed decisions in multifamily asset management and capital expenditure budgeting for sustainable growth.

Cash Flow Forecast Excel

The cash flow projection plan is essential for successful multifamily housing investment strategies. It provides clarity on expenditures and income, enabling investors to enhance their financial modeling and optimize operations. This analysis aids in forecasting rental income, managing operating expenses, and budgeting for capital expenditures. By accurately assessing occupancy rates and the debt service coverage ratio, real estate professionals can improve property yield calculations and cash flow analysis. Entrepreneurs in the multifamily sector should leverage these projections to maximize return on investment and streamline asset management for sustained growth.

KPI Benchmarks

Our financial plan template serves as a vital tool for benchmarking multifamily housing investment strategies. By leveraging industry and financial benchmarks, clients gain valuable insights into their real estate performance and compare it against successful peers. This analytical approach allows for precise multifamily property valuation, including cash flow projection and rental income forecasting, ensuring optimal investment analysis. Identifying areas for improvement can significantly enhance returns on investment and streamline capital expenditure budgeting, ultimately leading to more informed decision-making and superior financial projections for apartments in a competitive market.

P&L Statement Excel

Leverage our projected profit and loss statement template to develop a comprehensive financial overview for your multi-family housing investment strategy. Our reliable monthly profit and loss template in Excel empowers you to make informed management decisions. Utilizing our advanced three-way financial model, you can effectively analyze multifamily property valuation and manage cash flow projections. This essential tool equips you to assess your investment analysis and diagnose financial activities, ensuring you understand your property's strengths and weaknesses for optimal performance in apartment complex financing and asset management.

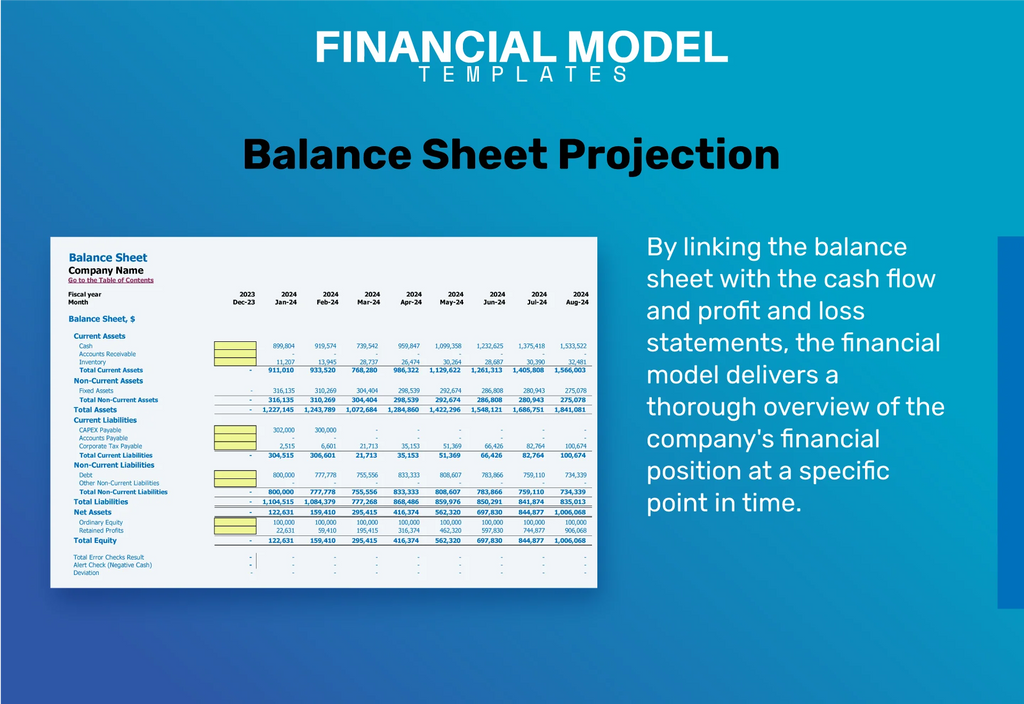

Pro Forma Balance Sheet Template Excel

In the realm of multifamily housing investment strategy, a comprehensive financial model is essential. By integrating cash flow projections, operating expenses analysis, and capital expenditure budgeting, investors gain a clear view of projected financial health. While a balance sheet may seem less captivating than profit and loss statements, it is vital for showcasing cash utilization and supporting rental income forecasting. Enhanced by metrics like the debt service coverage ratio and return on investment, this holistic approach enables accurate multifamily property valuation and informed investment analysis, ultimately guiding strategic decision-making for sustainable growth.

MULTI FAMILY HOUSING FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive financial model offers an in-depth analysis of your multi-family housing investment strategy. By integrating cash flow projections, operating expenses calculations, and occupancy rates analysis, we provide a clear picture of your potential returns. Each revenue stream and cost is meticulously accounted for, ensuring precise financial projections for apartments. Additionally, our model considers the timing of each cash flow, enhancing your investment analysis multifamily. Leverage our insights to make informed decisions about your equity investment in multifamily properties and maximize your return on investment.

Cap Table

Are you curious about the cap table model? This essential tool plays a vital role in multi-family housing investment strategies, providing crucial insights into cash flow projections and investment analysis. By leveraging detailed financial modeling techniques, it enables real estate professionals to assess occupancy rates, forecast rental income, and evaluate operating expenses. With a comprehensive understanding of equity investment and capital expenditure budgeting, you can optimize your multifamily asset management approach and enhance your return on investment. Empower your decision-making with robust data to drive successful apartment complex financing and market rent assessments.

KEY FEATURES

Our financial modeling for multi-family housing enables precise cash flow projections and enhances investment analysis, maximizing your returns.

Our financial model streamlines multifamily housing investment analysis, ensuring accurate projections and maximizing rental income without the hassle of complicated formulas.

A simple-to-use financial model enhances multifamily housing investment strategy through accurate cash flow projections and insightful rental income forecasting.

This sophisticated financial model empowers multifamily investors to achieve quick, reliable projections essential for informed decision-making.

A robust real estate financial model enhances stakeholder trust by accurately projecting cash flow and maximizing return on investment in multifamily housing.

A robust financial model enhances investor confidence by clearly showcasing future cash flow projections and strategic multi-family housing investment insights.

Unlock valuable insights with a robust financial model to optimize your multifamily housing investment strategy and enhance cash flow projections.

This comprehensive financial model empowers your multi-family housing investment strategy with precise projections and insights for optimal profitability.

A robust financial model enhances multifamily investment analysis by accurately predicting cash flow and optimizing property yield calculations.

Utilizing financial modeling for cash flow projections enhances visibility into customer payment behaviors, enabling timely actions for debt recovery.

ADVANTAGES

Maximize returns with our multifamily housing financial projection template, enhancing investment analysis and cash flow forecasting for optimal profitability.

A robust financial model enhances multifamily housing investment strategy, enabling accurate rental income forecasting and improved cash flow projections.

Utilizing a multifamily housing proforma business plan template streamlines financial modeling, enhancing investment analysis and maximizing return on investment.

Maximize your investment returns with a robust financial model that enhances multifamily property valuation and cash flow forecasting.

A robust financial model enhances multifamily housing investment strategies by accurately forecasting rental income and optimizing cash flow projections.