Mineral Water Plant Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Mineral Water Plant Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

mineral water plant Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MINERAL WATER PLANT STARTUP BUDGET INFO

Highlights

This comprehensive five-year financial modeling template for a mineral water plant in Excel includes prebuilt consolidated profit and loss statements, balance sheets, and cash flow pro forma, specifically designed to aid in the analysis of operational expenses in mineral water production and assess profit margins in bottled water. It features key financial charts, summaries, and metrics that are essential for conducting a mineral water plant feasibility study, allowing entrepreneurs to evaluate capital investment for water plants and develop a robust bottled water business plan. With a focus on water purification technology costs and water quality testing expenses, this model also incorporates break-even analysis for water plants, financial projections for bottling plants, and insights into supply chain management for bottled water, ensuring regulatory compliance in water bottling. Additionally, it explores sustainability practices in water production and the economic viability of water plants, providing a solid foundation for evaluating export potential for mineral water while addressing working capital requirements for water bottling.

This financial model template addresses key pain points for bottled water business operators by providing a comprehensive view of operational expenses, capital investment, and profit margins in mineral water production. By integrating financial projections and break-even analysis, users can realistically assess the economic viability of their water plants while effectively managing working capital requirements. The template simplifies water purification technology costs, equipment expenses, and regulatory compliance issues, allowing for focused supply chain management and strategic marketing approaches. Additionally, it includes insights for conducting a feasibility study and leveraging export potential, ensuring that businesses can capitalize on growth opportunities while maintaining sustainability practices in their operations.

Description

Our Mineral Water Plant Financial Model equips you with essential insights for making informed business and financial decisions, presenting you with a comprehensive business projection template that encompasses all critical inputs and data tables. Designed for both startups and existing businesses, this template provides accurate financial projections to evaluate the economic viability of your mineral water production, addressing elements such as mineral water production costs, operational expenses, and equipment costs for mineral water plants. Over a forecast period of up to 60 months, you can generate essential financial statements, including monthly profit and loss statements and cash flow analysis, while also gaining access to break-even analysis, supply chain management strategies for bottled water, and marketing strategies tailored for the mineral water market. With built-in feasibility study tools, financial projections for bottling plants, and a focus on regulatory compliance, our model ensures you understand the financial landscape and sustainability practices critical for success in the bottled water industry.

MINERAL WATER PLANT FINANCIAL PLAN REPORTS

All in One Place

Elevate your investor meetings with our integrated mineral water plant financial model template. This Excel tool streamlines financial modeling for water plants, featuring setup sheets for assumptions, detailed calculations, and cash flow analysis. Our pro forma template presents key business financials in an engaging, investor-friendly format. With this resource, you can effectively assess operational expenses, capital investment, and profit margins in the bottled water market, ensuring a thorough feasibility study and break-even analysis. Optimize your bottled water business plan and confidently navigate regulatory compliance while highlighting your economic viability and export potential.

Dashboard

The startup financial model features an intuitive dashboard that visually presents key financial metrics relevant to your bottled water business. It offers a comprehensive overview of cash flow, profit and loss statements, and revenue breakdowns—monthly or annually—all represented in clear charts and graphs. This enables you to effectively assess operational expenses, conduct a break-even analysis, and evaluate profit margins. With insights into capital investment, water purification technology costs, and regulatory compliance, the dashboard serves as a critical tool for strategic decision-making in mineral water production and supply chain management.

Business Financial Statements

Understanding financial statements is essential for evaluating a bottled water business's performance. The profit and loss statement sheds light on revenue-generating operations, crucial for analyzing profit margins in bottled water. Conversely, the projected balance sheet and cash flow forecast focus on capital investment for water plants, outlining asset management and structure. Incorporating financial modeling for water plants aids in assessing operational expenses and working capital requirements. Together, these tools facilitate comprehensive insights into the economic viability of mineral water production, guiding effective marketing strategies and regulatory compliance for long-term success.

Sources And Uses Statement

Utilizing a robust financial modeling tool is essential for evaluating the economic viability of a bottled water business. By integrating operational expenses, capital investment, and profit margins, stakeholders can assess financial projections and conduct break-even analysis for water plants. This comprehensive approach also facilitates effective supply chain management and ensures regulatory compliance. By regularly entering data, business owners can effortlessly generate accurate reports, supporting marketing strategies and water quality testing expenses. Ultimately, this methodology inspires confidence, enabling informed decisions on expansion and optimizing working capital requirements in the competitive mineral water market.

Break Even Point In Sales Dollars

A break-even sales calculator is crucial for financial modeling in the bottled water industry. It distinguishes between sales, revenue, and profit, guiding effective decision-making. Revenue represents the total income generated from bottled water sales, while profit accounts for all operational expenses, including capital investment and equipment costs. Understanding these dynamics aids in crafting a robust bottled water business plan and conducting feasibility studies. By analyzing profit margins and break-even points, companies can optimize supply chain management and develop strategic marketing plans, ensuring economic viability and sustainability in water production.

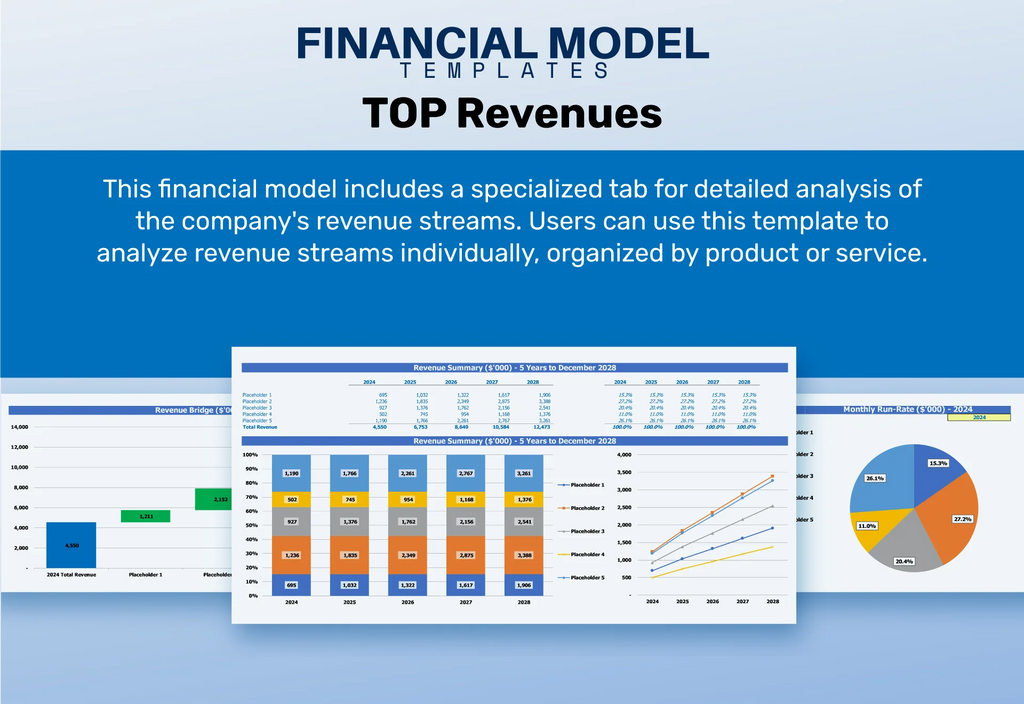

Top Revenue

In the bottled water industry, top-line revenue and bottom-line profits are crucial for assessing financial health. Stakeholders closely monitor these metrics, with an emphasis on revenue growth as a driver of enhanced profitability. A comprehensive bottled water business plan incorporates components like operational expenses, capital investment, and effective supply chain management. By conducting a thorough feasibility study and break-even analysis, companies can better understand cost structures, including water purification technology costs and working capital requirements. Strategic marketing and sustainability practices further bolster profit margins, positioning your mineral water plant for long-term success.

Business Top Expenses Spreadsheet

In the bottled water industry, effective cost management is essential for maximizing profit margins. Our financial modeling for water plants includes a comprehensive expense report that highlights the largest operational expenses in mineral water production. This streamlined approach allows businesses to easily monitor year-on-year changes, focusing on key areas such as equipment costs and regulatory compliance. By conducting a mineral water plant feasibility study, companies can optimize capital investment, manage working capital requirements, and employ targeted marketing strategies to enhance sustainability practices and explore export potential. Ultimately, this analysis supports informed decision-making for enhanced economic viability.

MINERAL WATER PLANT FINANCIAL PROJECTION EXPENSES

Costs

Our financial model template for mineral water production empowers your bottled water business plan with precise budgeting tools. Forecast operational expenses, mineral water production costs, and capital investments over 60 months, all while ensuring regulatory compliance. With our detailed expense forecasting curves, analyze profit margins and track changes as costs evolve. Easily categorize expenses—such as COGS, fixed, and variable costs—while integrating equipment costs and water quality testing expenses. Optimize your financial projections and break-even analysis for water plants, ensuring your venture’s economic viability and sustainability practices thrive in a competitive market.

CAPEX Spending

This business plan template includes financial projections tailored for mineral water production, offering automated calculations for initial startup costs and funding. It employs a cash flow waterfall model to evaluate various capital investments and operational expenses. By integrating break-even analysis and financial modeling for water plants, this tool serves as a comprehensive guide for assessing profitability and exploring market opportunities. Additionally, it supports regulatory compliance and supply chain management, ensuring a sustainable and economically viable venture in the bottled water industry.

Loan Financing Calculator

Calculating loan payments is crucial for start-ups in the bottled water industry. However, many find this process challenging. Our financial projections spreadsheet simplifies this with a loan amortization schedule and calculator, enabling effective financial modeling for water plants. This tool aids in assessing capital investment, operational expenses, and working capital requirements for mineral water production. By utilizing accurate forecasts, businesses can improve their bottled water business plan and enhance profit margins. Understanding these elements is key to ensuring economic viability and regulatory compliance in water bottling operations.

MINERAL WATER PLANT INCOME STATEMENT METRICS

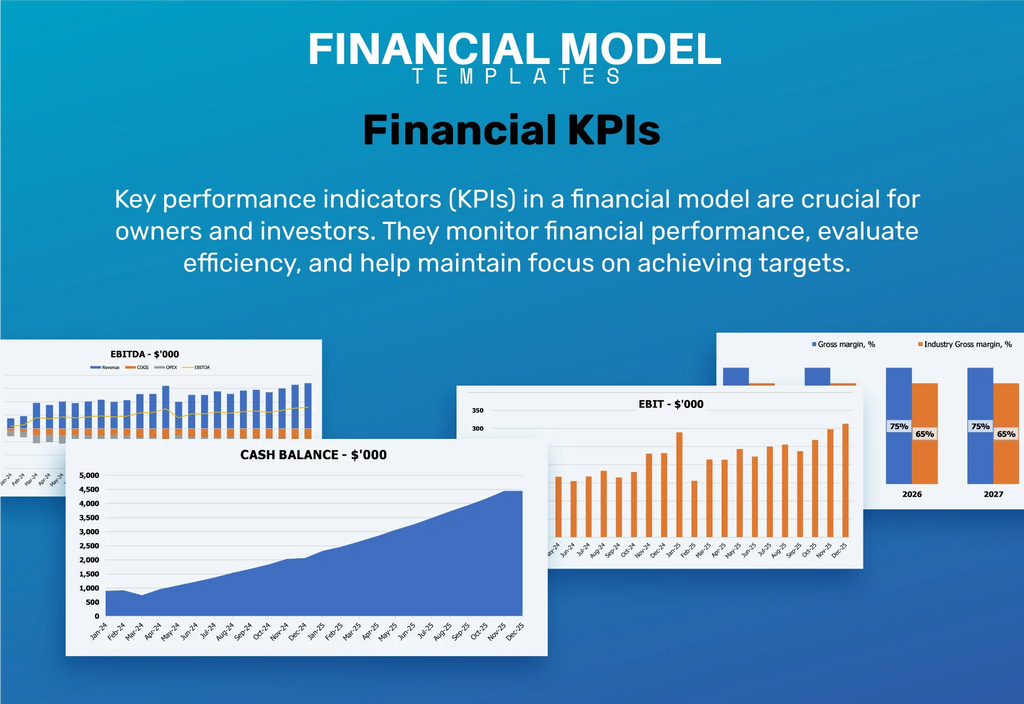

Financial KPIs

Unlock your bottled water business potential with our comprehensive financial projection template. This tool features key financial indicators, such as revenue growth rate, profit margins, and operational expenses, tailored for mineral water production. Customize KPIs to align with industry standards and your unique business needs, including cash flow analysis and working capital requirements. Streamline your feasibility study and break-even analysis, ensuring robust financial modeling for water plants. With insights into equipment costs and regulatory compliance, you can confidently navigate the economic viability of your venture while implementing effective marketing strategies and sustainability practices.

Cash Flow Forecast Excel

Cash flow budgeting and forecasting is essential for developing a robust three-statement, five-year financial projection plan for mineral water plants. Utilizing an Excel cash flow sheet, you can systematically input and analyze operating, investing, and financing cash flows, ensuring comprehensive financial modeling for water plants. This reconciles changes in the pro forma balance sheet year-over-year. Each component of the cash flow statement aligns with other model spreadsheets, making accurate projections vital for assessing the economic viability and profitability of your bottled water business plan. Effective cash flow management is key to achieving sustainable growth and regulatory compliance.

KPI Benchmarks

Conduct a thorough benchmarking analysis using our 5-year cash flow projection template, which includes a dedicated benchmarking tab. This tool allows users to evaluate financial metrics and operational indicators against comparable companies in the bottled water industry. By analyzing key factors such as mineral water production costs, operational expenses, and profit margins, stakeholders can gain insights into their competitive positioning. This comprehensive approach not only highlights areas for improvement but also enhances strategic planning and financial projections, ensuring greater economic viability and operational efficiency in the bottled water market.

P&L Statement Excel

Today's pro forma income statement is crucial for evaluating the financial performance of a mineral water plant. This essential tool outlines projected income and operational expenses, offering insights into profit margins and capital investment needs. Monthly reporting allows for long-term financial modeling, aiding in strategic planning for revenue growth. By incorporating a thorough feasibility study and break-even analysis, business owners can effectively navigate supply chain management, regulatory compliance, and equipment costs. Ultimately, these financial projections help ensure the economic viability and sustainability of the bottled water business.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet offers insights into the assets and liabilities of a mineral water plant, while the P&L statement outlines operational income and expenses. Over specific periods, the profit-loss statement reveals profitability trends, crucial for assessing profit margins in bottled water. Key financial indicators—liquidity, solvency, and turnover ratios—are derived from these projections, informing capital investments and operational expenses. A comprehensive financial model aids in evaluating the economic viability of water plants, supporting effective supply chain management, regulatory compliance, and sustainable practices to enhance profitability in the bottled water industry.

MINERAL WATER PLANT INCOME STATEMENT VALUATION

Startup Valuation Model

Optimize your mineral water venture with our comprehensive three-statement financial model template. It incorporates robust forecasting methods, including discounted cash flow (DCF) and weighted average cost of capital (WACC) calculations. With this tool, you can effectively analyze capital investment requirements, operational expenses, and profit margins in bottled water. Additionally, it aids in conducting a mineral water plant feasibility study and break-even analysis, ensuring your business plan is both strategically sound and economically viable. Leverage these insights to navigate regulatory compliance and enhance supply chain management for a successful bottled water business.

Cap Table

Our financial modeling template for startups in the bottled water industry offers a versatile capital table designed to illustrate the relationship between tangible assets, operational expenses in mineral water production, and profit margins. By incorporating key metrics such as equipment costs, working capital requirements, and regulatory compliance, this tool provides a comprehensive overview of financial projections. It assists in conducting break-even analysis, assessing the economic viability of water plants, and crafting a robust bottled water business plan, ensuring investors are well-informed about potential returns as the market evolves.

KEY FEATURES

A robust financial model for water plants ensures accurate projections, optimizing operational expenses and maximizing profit margins in bottled water.

A robust financial model for mineral water production enhances funding success by providing clarity on costs and profit potential.

A robust financial model for mineral water production enhances external stakeholder confidence by providing reliable forecasts and showcasing economic viability.

A robust financial model ensures profitability and compliance, essential for securing bank loans for your mineral water plant.

A robust financial model enhances investor confidence by demonstrating profitability and sustainability in the mineral water production business.

A comprehensive financial model enhances decision-making by clearly showcasing profitability, costs, and investment potential in the bottled water industry.

A robust financial model enhances investment decisions, ensuring profitability and sustainability in mineral water production and bottling operations.

A robust financial model enhances decision-making by clearly outlining profit margins, operational expenses, and capital investment needs for water plants.

A robust financial model for mineral water plants ensures adherence to budget, maximizing profit margins while minimizing operational expenses.

A robust financial model for water plants enhances decision-making by accurately forecasting cash flows and assessing profitability amidst rising operational costs.

ADVANTAGES

Utilizing a financial model for mineral water plants allows easy cash flow forecasting, enhancing decision-making and investment strategies.

A robust financial model enhances decision-making by accurately forecasting costs, profit margins, and operational expenses in mineral water production.

Optimize your bottled water business plan with a comprehensive financial model to enhance profitability and ensure sustainability.

A robust financial model for mineral water plants enhances decision-making and secures investment by detailing cost structures and profit potential.

Utilizing a robust financial model enhances trust among stakeholders by providing clear insights into projected income and profitability for water plants.