Mineral Water Bottling Plant Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Mineral Water Bottling Plant Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

mineral water bottling plant Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MINERAL WATER BOTTLING PLANT FINANCIAL MODEL FOR STARTUP INFO

Highlights

A sophisticated 5-year financial projection template for mineral water production financing is essential, regardless of the size or stage of development of your bottling plant business. This model enables operators to assess operational costs of water plants, analyze market demand for mineral water, and develop a pricing strategy for bottled water. By incorporating elements such as revenue projections for mineral water, cost of goods sold in bottling, and breakeven analysis for facilities, users can effectively perform financial forecasting for bottling. The template also aids in managing bottling plant cash flow and evaluating ROI on bottling plant investments, while considering investment risks in water bottling. With minimal previous financial planning experience and basic Excel knowledge, users can engage in financial modeling for beverage companies to attract funding options from banks or investors. The unlocked nature of the model allows for custom edits to suit specific operational and financial needs, ensuring it serves as a reliable resource for those looking to achieve long-term profitability in the bottled water industry.

The financial model for a mineral water bottling plant addresses key pain points by streamlining the complexities of capital investment in bottling and operational costs of water plants, ensuring a clear understanding of fixed and variable costs in production. Users can easily adjust critical inputs related to revenue projections for mineral water and pricing strategies for bottled water, allowing for effective financial forecasting for bottling without the need for expensive consultancy services. The model incorporates breakeven analysis for facilities, enabling users to evaluate financial performance metrics and ROI on bottling plant investments while also managing cash flow effectively. By exploring various funding options for water plants and investment risks in water bottling, this comprehensive tool equips entrepreneurs with the insights needed for long-term profitability in bottling, all while simplifying water treatment capital expenses and cost of goods sold in bottling.

Description

The financial model for mineral water bottling plant production includes a comprehensive pro forma projection designed to facilitate effective financial planning and forecasting in the bottled water industry. This framework accounts for critical factors such as capital investment in bottling, operational costs of water plants, and revenue projections for mineral water, while also incorporating breakeven analysis and ROI on bottling plant investments. It contains detailed templates for monthly and yearly profit and loss statements, balance sheets, and cash flow management tailored for both startup and existing facilities. By analyzing fixed and variable costs in production alongside financial performance metrics, the model enhances decision-making processes regarding pricing strategy for bottled water and identifies funding options for water plants. Additionally, the integration of financial modeling for beverage companies enables users to assess investment risks in water bottling, ensuring long-term profitability and adequate management of cash flows linked to water source contract agreements.

MINERAL WATER BOTTLING PLANT FINANCIAL MODEL REPORTS

All in One Place

This comprehensive mineral water bottling plant startup pro forma template equips entrepreneurs with essential financial forecasting tools. It outlines key assumptions on operational costs, including fixed and variable expenditures, capital investment needs for water treatment and production facilities, and projected revenue from market demand. By analyzing the cost of goods sold and conducting a breakeven analysis, business owners can assess ROI on bottling plant investments. Additionally, the template evaluates funding options and provides insights into cash flow management, ensuring long-term profitability and strategic pricing for bottled water in a competitive industry.

Dashboard

To perform a thorough financial analysis for a mineral water bottling company, a comprehensive financial model is essential. This model should encompass revenue projections, operational costs, and the breakeven analysis for facilities. Utilizing visual data representations such as graphs and charts enhances the analysis process, making it easier to understand key metrics like ROI on bottling investments and cash flow management. By incorporating data on capital investment in bottling, pricing strategies, and financial forecasting, stakeholders can effectively assess investment risks and pursue long-term profitability in the bottled water industry.

Business Financial Statements

In crafting a financial model for the bottled water industry, it is essential to incorporate key components such as capital investment in bottling, operational costs of water plants, and revenue projections for mineral water. An intuitive spreadsheet should clearly outline funding options, pricing strategies, and breakeven analysis for facilities. Emphasizing metrics like ROI on bottling plant investments and cash flow management will enhance understanding. Additionally, consider the market demand for mineral water and the associated fixed and variable costs in production. This comprehensive approach will facilitate informed decision-making and long-term profitability in water bottling ventures.

Sources And Uses Statement

The financial forecasting template is an essential tool for assessing the profitability of mineral water production. It empowers investors to evaluate startup viability and make informed capital investment decisions. By analyzing revenue projections and operational costs, this tool facilitates breakeven analysis and cash flow management for bottling plants. With regular data input, it provides timely insights into financial performance metrics, guiding businesses on expansion opportunities. Ultimately, this template helps mitigate investment risks in the bottled water industry, ensuring accurate assessments for long-term profitability and effective pricing strategies.

Break Even Point In Sales Dollars

This breakeven analysis report provides a comprehensive overview of the annual revenue necessary for a bottling plant to achieve profitability. By factoring in both fixed and variable costs, this tool enables precise financial forecasting for mineral water production. Additionally, the report can be adjusted to reveal the time frame required to reach breakeven, assisting in effective cash flow management. Such insights are crucial for capital investment decisions and assessing ROI on bottling plant investments, ultimately driving informed pricing strategies and enhancing long-term profitability in the bottled water industry.

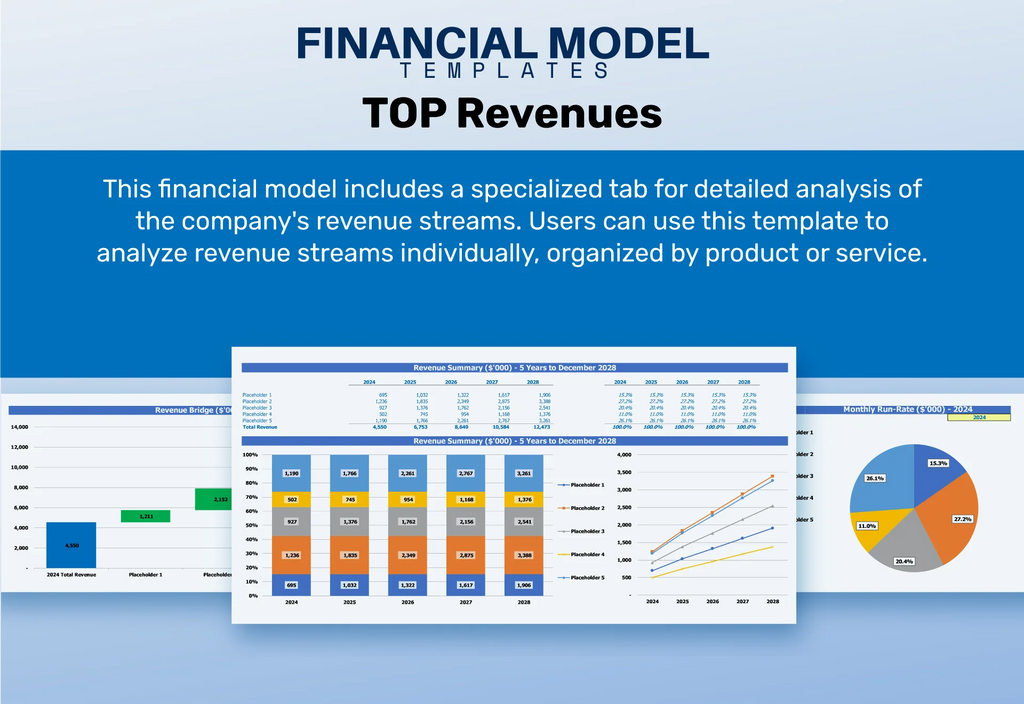

Top Revenue

In developing a five-year financial projection for a mineral water bottling enterprise, revenue is paramount. As a key driver of enterprise value, financial analysts must meticulously strategize revenue streams while considering historical data to project growth rates. This involves evaluating variables such as operational costs, pricing strategies, and market demand for mineral water. Effective financial modeling encompasses analyzing capital investment in bottling, breakeven points, and ROI on investments. By incorporating insights on funding options and cost of goods sold, management can enhance cash flow and long-term profitability, ensuring robust financial performance metrics and a sustainable business model.

Business Top Expenses Spreadsheet

In the bottled water industry, effective cost management is essential for maximizing profitability. Our startup financial plan template highlights the largest expense categories, integrating insights from mineral water production financing and operational costs of water plants. By focusing on revenue projections for mineral water and employing strategic financial forecasting for bottling, businesses can optimize expenses such as water treatment capital expenses. This streamlined approach enhances cash flow management and supports pricing strategy for bottled water, ultimately paving the way for long-term profitability and informed investment decisions. Embrace a data-driven approach to unlock your bottling plant's potential.

MINERAL WATER BOTTLING PLANT FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are pivotal in the bottled water industry, influencing long-term profitability and operational efficiency. Effective monitoring of these costs is essential for securing adequate financing and mitigating unexpected expenses. Our comprehensive five-year financial projection template offers detailed proforma models, enhancing your ability to manage capital investments in bottling. With insights into financial forecasting for bottling, including breakeven analysis and ROI on bottling plant investments, you can establish a robust pricing strategy while optimizing cash flow management. Strategically navigate funding options and forecast revenue projections to ensure sustainable growth in the mineral water market.

CAPEX Spending

In the Top Revenue tab of this proforma business plan template, users can generate demand reports for each product or service offered, providing insights into mineral water production financing. This analytical tool allows for a comprehensive financial forecasting for bottling, helping to simulate profitability and assess investment risks in water bottling. By examining revenue projections and operational costs, including fixed and variable costs in production, you can optimize resource allocation—such as manpower and inventory—based on demand fluctuations, enhancing overall cash flow management and long-term profitability.

Loan Financing Calculator

Start-ups in the bottled water industry must meticulously manage loan repayment schedules, detailing amounts, maturity terms, and associated costs. Integrating this repayment plan into cash flow analysis is crucial for accurate financial forecasting for bottling operations. Interest expenses directly impact cash flow projections, while the remaining debt reflects on balance sheets. Effective cash flow management ensures that operational costs, fixed and variable expenses, and revenue projections for mineral water are aligned, ultimately supporting investment risks and enhancing long-term profitability. Monitoring these financial performance metrics is vital for securing funding options and optimizing pricing strategies in the competitive market.

MINERAL WATER BOTTLING PLANT EXCEL FINANCIAL MODEL METRICS

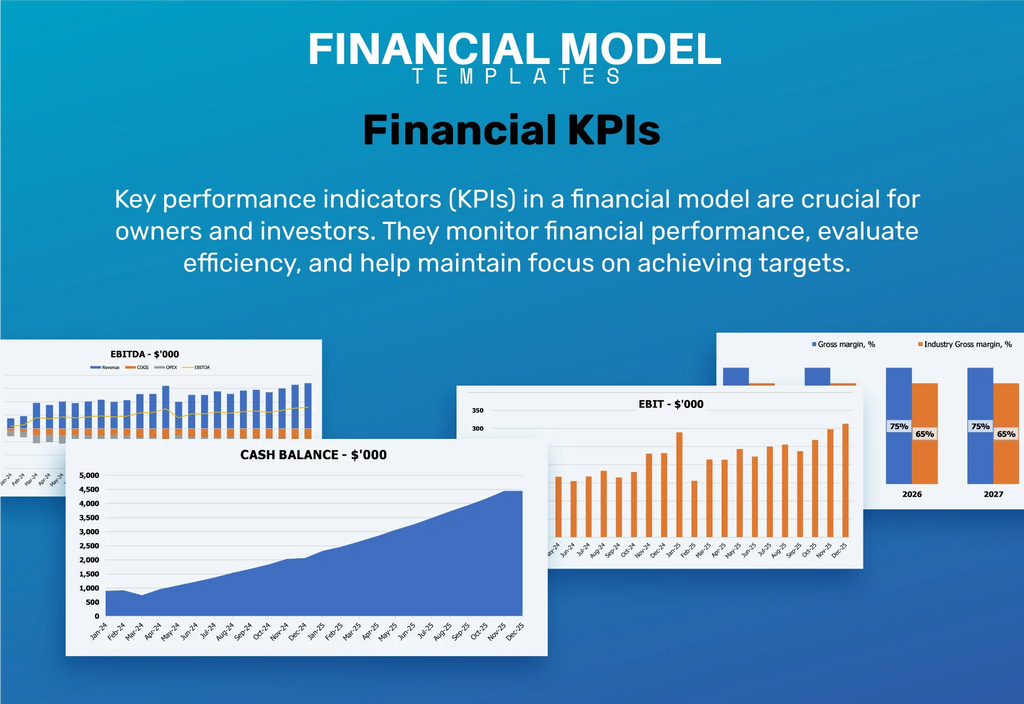

Financial KPIs

Enhance your company's financial health with strategic financial key performance indicators (KPIs). Utilize our business plan financial projections template to visually represent essential performance metrics through engaging graphs. This tool supports operational cost analysis, including fixed and variable costs in production, and aids in revenue projections for mineral water. Successfully navigate investment risks in water bottling while optimizing ROI on bottling plant investments and cash flow management. Adopt a robust financial modeling approach to leverage funding options and boost long-term profitability in the bottled water industry. Elevate your operational efficiency and market demand response today.

Cash Flow Forecast Excel

The operating cash flow budget template in Excel provides a comprehensive analysis of cash generated from core business operations, excluding secondary revenue sources like interest or investments. This financial modeling tool is essential for mineral water production financing, helping stakeholders evaluate operational costs of water plants and assess capital investment in bottling. It facilitates effective cash flow management, supports revenue projections for mineral water, and aids in breakeven analysis for facilities, ultimately informing pricing strategies and investment decisions in the bottled water industry for long-term profitability.

KPI Benchmarks

The financial benchmarking feature in this model is crucial for companies in the bottled water industry. By comparing key performance indicators (KPIs) against industry standards, businesses can enhance their operational efficiency and financial forecasting for bottling. Benchmarking enables companies to adopt best practices, improving revenue projections for mineral water and optimizing their pricing strategy. This tool aids in managing fixed and variable costs, assessing ROI on bottling plant investments, and evaluating market demand for mineral water, ultimately paving the way for long-term profitability and effective cash flow management in water production financing.

P&L Statement Excel

Financial forecasting is crucial for entrepreneurs in the bottled water industry, helping them evaluate business models before committing resources. A well-designed income statement template can illuminate revenue projections for mineral water, offering insights into operational costs, pricing strategies, and the cost of goods sold in bottling. This financial modeling enables effective cash flow management and breakeven analysis for facilities. By understanding fixed and variable costs, along with investment risks in water bottling, entrepreneurs can confidently navigate funding options and long-term profitability, ultimately enhancing their investment decisions in capital-intensive water treatment ventures.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet, also known as the statement of financial position, offers critical insights into a company's financial health by detailing assets, liabilities, and stockholders' equity at a specific moment. When combined with profit and loss forecasts, it helps assess the necessary capital investment in bottling and operational costs of water plants. This analysis is crucial for evaluating revenue projections and cash flow management strategies in the bottled water industry, ultimately guiding funding options and pricing strategies to maximize long-term profitability while mitigating investment risks in mineral water production.

MINERAL WATER BOTTLING PLANT FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The pre-money valuation startup spreadsheet includes essential financial modeling tools like Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC serves as a key risk assessment metric, crucial for banks when evaluating capital investment in bottling, particularly in the bottled water industry. DCF analysis highlights future cash flows, aiding in revenue projections for mineral water and assessing market demand. Together, these calculators facilitate a comprehensive breakeven analysis, ensuring informed decision-making about funding options, pricing strategies, and operational costs to maximize long-term profitability in water bottling ventures.

Cap Table

The financial model Excel template, along with the equity cap table, efficiently consolidates essential investor details, outlining their ownership stakes and investment contributions in the mineral water production venture. This framework is crucial for capital investment in bottling, enabling precise financial forecasting for bottling operations. By analyzing fixed and variable costs in production, it informs the pricing strategy for bottled water and supports revenue projections for mineral water. Ultimately, this comprehensive approach enhances cash flow management and aids in assessing ROI on bottling plant investments, ensuring long-term profitability for stakeholders.

KEY FEATURES

A robust financial model demonstrates your project’s viability and ensures lenders of your ability to repay the requested loan.

A robust financial model enhances loan applications by demonstrating clear repayment strategies and reinforcing confidence in long-term profitability.

Effective financial modeling for beverage companies enhances ROI, reduces operational costs, and ensures long-term profitability in the bottled water industry.

Unlock profitability in the bottled water industry with our streamlined financial modeling, eliminating the need for complex programming and consultants.

A robust financial model enables accurate revenue projections and minimizes investment risks in the bottled water industry.

A robust financial model simplifies investment decisions by providing essential calculations for mineral water production and bottling profitability.

A robust financial model for mineral water production enhances revenue projections and minimizes investment risks, driving long-term profitability.

A robust cash flow forecasting model enhances decision-making, revealing optimal funding options and driving long-term profitability in mineral water production.

Implementing a robust financial model enhances revenue projections and optimizes cash flow management in the mineral water bottling industry.

A robust financial model enhances decision-making, guiding managers on optimizing cash surplus for investments and debt repayment strategies in bottling.

ADVANTAGES

The financial modeling template streamlines capital investment analysis, enhancing ROI and reducing risks in mineral water production financing.

Utilizing a robust financial model enhances ROI and mitigates investment risks in the mineral water production industry.

A robust financial model for mineral water production enhances strategic decision-making, ensuring profitability and effective capital investment management.

A robust financial model enhances understanding of ROI, breakeven analysis, and revenue projections for mineral water production investments.

The five-year financial model effectively identifies potential cash flow shortfalls, ensuring robust planning for mineral water production financing.