Jewelry Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Jewelry Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

jewelry Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

JEWELRY STARTUP BUDGET INFO

Highlights

Develop a comprehensive jewelry business plan that includes a detailed jewelry market analysis and a strategy for managing startup costs, ensuring a solid jewelry revenue model. Incorporate jewelry sales forecasting and a jewelry cash flow statement to project future income and expenses accurately. Additionally, execute a jewelry profitability analysis, determining the jewelry cost structure and conducting a break-even analysis to identify the minimum sales needed to cover expenses. Utilize jewelry expense tracking and establish a well-defined jewelry pricing strategy that aligns with market trends. This framework will also support jewelry financial projections, allowing for precise jewelry investment analysis and informed decisions on funding options while considering tax implications and operational budgets.

The jewelry proforma business plan template alleviates common pain points for buyers by providing a comprehensive financial model that simplifies the complexities of jewelry startup costs, revenue modeling, and expense tracking. Users can easily perform jewelry sales forecasting and financial projections without any prior experience in financial modeling, as the template includes essential reports such as a cash flow statement, break-even analysis, and operating budget. It also features detailed jewelry market analysis and profitability analysis, ensuring users have all the financial statements needed for informed decision-making. Furthermore, this ready-made excel template mitigates risks associated with jewelry business valuation and funding options, allowing users to seamlessly incorporate a pricing strategy and manage jewelry inventory effectively without the need for extensive edits, thus streamlining the path to financial success.

Description

The jewelry startup financial model is critical for successfully launching and operating your business, as it helps track jewelry startup costs and provides a comprehensive overview of your financial health. This template enables you to conduct jewelry market analysis and sales forecasting, ensuring that you can identify key revenue models and manage your cash flow statement effectively. By performing a jewelry cost structure assessment and break-even analysis, you'll gain insights into your pricing strategy and expense tracking, allowing you to optimize your operating budget. Additionally, the template offers jewelry financial projections and profitability analysis, equipping you with the necessary tools for jewelry business valuation and informed financial decision-making while considering tax considerations and funding options like bank loans or equity investments.

FINANCIAL PLAN FOR JEWELLERY BUSINESS REPORTS

All in One Place

Our comprehensive jewelry business plan incorporates a sophisticated financial model designed for investor presentations. This Excel tool seamlessly integrates key components, including financial projections, an operating budget, and a detailed cash flow statement. With a focus on jewelry startup costs and revenue models, our template simplifies jewelry sales forecasting and expense tracking while ensuring transparency through financial statements and break-even analysis. Tailored to meet investor expectations, this professional resource enhances your jewelry investment analysis and market analysis, paving the way for successful funding options and profitability analysis.

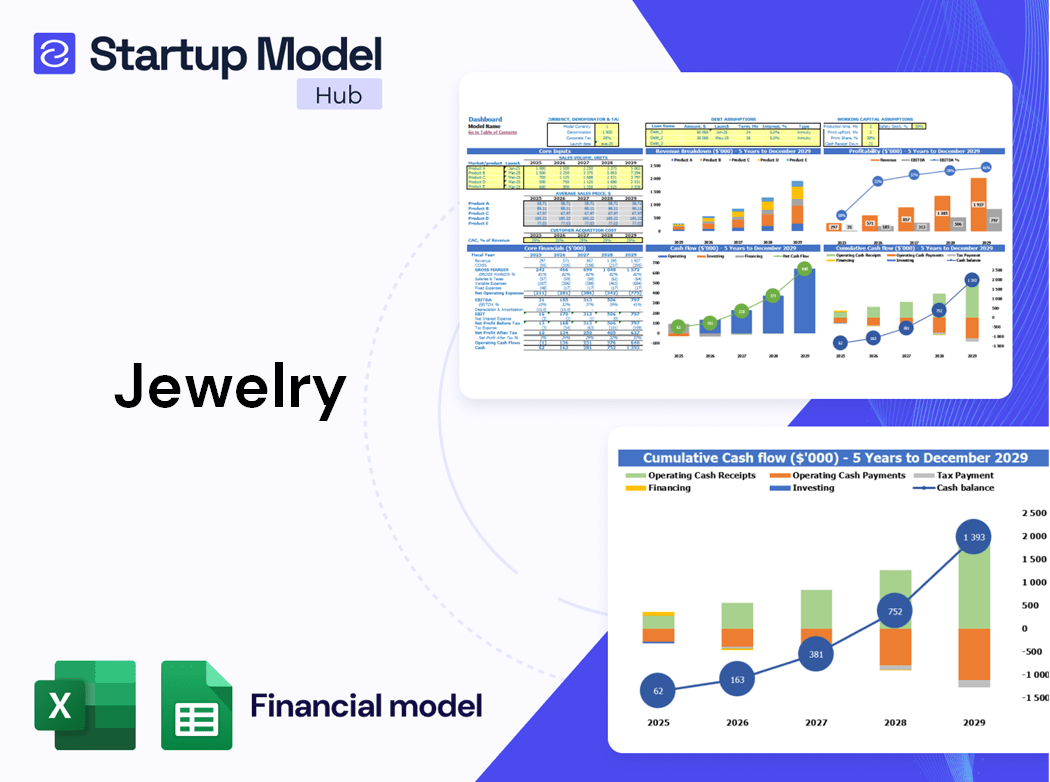

Dashboard

The financial dashboard in your jewelry business plan serves as an essential tool for tracking financial performance. It consolidates key performance indicators (KPIs), enabling effective cash flow management and detailed oversight of expenses, sales, and profits against business goals. By utilizing this financial plan in Excel, you gain an intuitive overview of your jewelry startup’s financial health, complete with critical insights into your jewelry revenue model, pricing strategy, and operating budget. This dashboard is not only informative but also shareable with stakeholders, enhancing transparency and support for your business initiatives.

Business Financial Statements

An effective jewelry business plan includes comprehensive financial statements, both historical and projected, which are crucial for a robust startup financial model. Incorporating essential elements into visual charts enhances clarity for jewelry investment analysis and presentations to potential investors. Our Excel template automates the creation of these financial charts, providing key insights into jewelry revenue models, sales forecasting, and cash flow statements. This streamlined approach not only simplifies expense tracking and inventory management but also aids in your jewelry profitability analysis and break-even assessments, ensuring informed decision-making for your jewelry venture.

Sources And Uses Statement

A sources and uses of funds statement is crucial in a jewelry business plan. The "Sources" section outlines the financing avenues, such as business loans, investments, and share issuance, highlighting how funds will be secured. Conversely, the "Uses" section details essential expenditures like start-up costs, equipment purchases, and operational expenses. This transparency is vital for stakeholders, aiding in effective jewelry investment analysis and ensuring a clear understanding of the cash flow statement. Ultimately, this statement supports robust financial projections and a well-structured jewelry revenue model, guiding the startup toward profitability.

Break Even Point In Sales Dollars

Break-even analysis is a crucial tool for any jewelry business plan, as it identifies when your venture will cover all expenses and start generating profit. To calculate your break-even point, assess your fixed and variable costs. Fixed costs, like rent and salaries, remain constant regardless of sales, while variable costs—such as inventory purchases and shipping—fluctuate with sales volume. Understanding these cost structures not only enhances your jewelry financial projections but also aids in optimizing your pricing strategy and overall jewelry profitability analysis. A thorough break-even analysis positions your jewelry startup for sustainable success.

Top Revenue

In this financial model template for your jewelry business plan, the Top Revenue tab enables precise sales forecasting and demand analysis by product or service. It facilitates an in-depth jewelry profitability analysis, simulating potential financial outcomes. Users can explore revenue depth and bridge dynamics while assessing forecasted demand across different periods, such as weekdays versus weekends. This insight supports effective resource scheduling, including jewelry inventory management and manpower allocation, ensuring your startup is well-prepared to meet market demands and optimize your operating budget.

Business Top Expenses Spreadsheet

Our Excel financial forecast template includes a dedicated tab for basic expenses, organized into four distinct categories. This structured approach simplifies jewelry expense tracking and enhances your jewelry business plan. Additional costs and data are categorized as "other," ensuring clarity in your jewelry cash flow statement. This streamlined method supports effective jewelry financial projections, providing insight into your jewelry startup costs and facilitating accurate jewelry sales forecasting. By utilizing this template, you can refine your jewelry pricing strategy and improve overall profitability analysis, ultimately driving informed decision-making for your venture.

JEWELRY FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive jewelry business plan incorporates a startup costs spreadsheet to facilitate financial projections and budget management for up to five years. Utilizing this financial projection template allows you to analyze cost variations over time, factoring in key elements such as income percentages, payroll, and recurring expenses. By categorizing costs into Variable or Fixed Expenses, COGS, Wages, and capital expenditures, you ensure efficient jewelry inventory management. This jewelry financial model is invaluable, enabling effective sales forecasting and expense tracking, which ultimately leads to a clearer understanding of your financial health and funding options.

CAPEX Spending

The CAPEX schedule is an essential tool for managing startup costs in your jewelry business. It effectively outlines capital expenditures, credit costs, and initial investments, providing a clear view of how these expenditures contribute to growth. Utilizing a comprehensive three-way financial model enables accurate capital expenditure forecasting, ensuring your jewelry venture remains financially sound. By integrating this tool with your financial projections and revenue models, you can enhance expense tracking and make informed decisions that drive profitability and investment potential in the competitive jewelry market.

Loan Financing Calculator

In the jewelry business, mastering loan profiles and repayment schedules is vital for startups and growing enterprises. Effective jewelry financial projections depend on robust infrastructure and software that deliver detailed insights into outstanding amounts, maturity dates, and key covenants. A well-structured loan repayment schedule should outline interest expenses and principal milestones, directly influencing the company's cash flow statement. Additionally, this information must seamlessly integrate with financial statements, ensuring clarity on how regular loan repayments impact financial obligations. Proper management of these elements is crucial for a successful jewelry business plan and sustainable profitability.

JEWELRY BUSINESS PLAN TEMPLATE METRICS

Financial KPIs

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) serves as a critical metric for evaluating the operating performance of your jewelry business. This financial projection aids in assessing profitability by calculating profit loss, derived from the formula: Revenue – Expenses. When crafting your jewelry business plan, focus on accurate expense tracking and revenue modeling. Understanding your jewelry startup costs, alongside a detailed jewelry cash flow statement, ensures a robust financial foundation. Utilize this analysis to refine your jewelry pricing strategy and achieve sustainable growth in the competitive market.

Cash Flow Forecast Excel

An operating cash flow statement is essential for your jewelry business plan, as it illustrates the cash generated from core operations. This financial projection focuses solely on revenues from jewelry sales, excluding external income such as interest or investments. Utilizing Excel for this calculation allows for precise jewelry expense tracking and effective inventory management. By highlighting the company's cash flow, you can conduct a thorough jewelry profitability analysis, identify funding options, and strategically evaluate your jewelry revenue model to ensure sustainable growth and financial stability.

KPI Benchmarks

The financial model's startup benchmark tab evaluates key performance metrics, contrasting them with industry averages to inform your jewelry business plan. This benchmarking analysis is vital for startups, providing insights into best practices within the jewelry market. By utilizing these average metrics, you can refine your jewelry financial projections, optimize your pricing strategy, and enhance your revenue model. This strategic approach not only aids in jewelry investment analysis but also helps in developing a robust operating budget and cash flow statement, positioning your business for sustainable profitability and informed decision-making.

P&L Statement Excel

A projected profit and loss statement is essential for any jewelry business plan, enabling owners to track financial performance and estimate revenue and expenses for the coming years. Utilizing monthly data allows for detailed jewelry sales forecasting, helping to shape a robust revenue model and pricing strategy. This forecasting aids in jewelry profitability analysis and informs inventory management decisions. By assessing jewelry startup costs and analyzing cash flow statements, business owners can identify funding options and establish a clear path to financial success. Embrace these tools to effectively navigate your jewelry venture and maximize growth potential.

Pro Forma Balance Sheet Template Excel

A well-crafted jewelry business plan hinges on accurate financial projections, including a projected balance sheet. This essential component, alongside the pro forma profit and loss statement and cash flow analysis, provides a comprehensive view of your startup's financial health. While it may not shine as brightly as sales forecasts, it enables investors to assess the realism of net income projections and profitability ratios, like return on equity. Effective jewelry inventory management, pricing strategy, and expense tracking further support a robust jewelry revenue model, ensuring smart investment decisions and sustainable growth.

JEWELRY BUSINESS PLAN TEMPLATE VALUATION

Startup Valuation Model

Our pre-seed valuation spreadsheet simplifies the valuation process by organizing key calculations, including the Weighted Average Cost of Capital (WACC) and Discounted Cash Flows (DCF). WACC reflects the average financing cost, considering both equity and debt proportions, crucial for risk assessment and funding options. DCF evaluates future cash flows in present terms, serving as a vital tool for jewelry financial projections and investment analysis. These tools support developing a robust jewelry business plan, enhancing your understanding of profitability, cost structure, and overall market viability.

Cap Table

An equity cap table is a crucial tool for your jewelry business plan, providing insights into investments and shareholder roles. It effectively aids in jewelry investment analysis and financial projections, helping you evaluate your funding options and optimize your revenue model. By analyzing equity structures, you can streamline your jewelry startup costs and enhance your financial statements. Utilize the cap table to inform your jewelry pricing strategy and accurately forecast sales, ensuring robust expense tracking and cash flow statements. Ultimately, it is essential for determining your jewelry business valuation and guiding effective decision-making.

KEY FEATURES

A well-structured jewelry financial model enhances profitability analysis, guiding your pricing strategy and improving cash flow management.

Our sophisticated jewelry business plan template streamlines financial modeling, ensuring accurate projections and insights for informed decision-making.

A robust jewelry financial model enhances decision-making by predicting cash flow, optimizing pricing strategies, and ensuring sustainable profitability.

A robust financial model allows jewelry startups to analyze funding options and forecast cash flow for strategic decision-making.

A robust jewelry business plan enhances stakeholder trust by providing clear financial projections and a sound investment analysis.

A robust jewelry financial model enhances stakeholder confidence, facilitating investment and fostering strategic growth in your jewelry business.

A comprehensive jewelry financial model enhances decision-making by accurately projecting revenue, optimizing costs, and ensuring sustainable growth.

Implementing a jewelry financial model enables informed decisions, minimizes risk, and supports sustainable growth for your business.

A robust jewelry business plan enhances profitability through informed financial projections and effective expense tracking for sustainable growth.

A clear financial model enhances your jewelry business plan by providing detailed insights into profitability and funding options.

ADVANTAGES

Start your jewelry business confidently using a financial model to streamline budgeting, forecasting, and investment analysis.

A robust financial model streamlines communication with attorneys and consultants, enhancing your jewelry business plan and decision-making process.

A robust financial model reveals necessary adjustments, such as expense reduction, ensuring your jewelry business remains profitable and sustainable.

A robust jewelry financial model allows you to run different scenarios, enhancing decision-making and optimizing your startup’s success.

A well-structured jewelry financial model enhances tax planning and ensures informed decision-making for your jewelry business.