Izakaya Restaurant Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Izakaya Restaurant Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

izakaya restaurant Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

IZAKAYA RESTAURANT FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year financial projection template is tailored specifically for izakaya restaurant startups, providing essential tools for strategic business planning and impressing potential investors. By incorporating restaurant profit margins and an effective menu pricing strategy, this model assists in optimizing food and beverage cost control while ensuring healthy operating expenses for izakaya. It also emphasizes the importance of labor cost management and inventory turnover ratio to improve cash flow management, along with robust sales forecasting for restaurants. Additionally, the template focuses on location analysis for restaurants and customer demographics for izakaya to enhance marketing strategies, ultimately leading to better financial projections for izakaya, increased revenue streams, and effective risk management in restaurant finance. Use this resource to secure capital investment in your izakaya venture and be prepared to achieve a solid break-even analysis for sustainable growth.

The izakaya financial analysis model addresses key pain points for restaurant owners by offering a comprehensive tool for understanding crucial metrics such as restaurant profit margins, food and beverage cost control, and operating expenses for izakayas. By implementing effective labor cost management and an inventory turnover ratio, users can improve profitability and cash flow management, while the strategic business planning aspect aids in crafting an effective menu pricing strategy tailored to customer demographics for izakaya. Enhanced sales forecasting for restaurants and a robust restaurant break-even analysis allow proprietors to make informed decisions regarding capital investment in restaurants and potential revenue streams, ultimately supporting sound financial projections for izakaya. This template also streamlines cash management in restaurants, ensuring that performance metrics for izakaya are continually monitored and risk management in restaurant finance is prioritized, thus fostering sustainable growth and long-term success.

Description

The Izakaya Restaurant Financial Model provides a comprehensive framework for understanding essential financial metrics, empowering entrepreneurs to navigate the complexities of restaurant profit margins, operating expenses for izakaya, and food and beverage cost control. This financial projection template enables startups to perform a detailed restaurant break-even analysis, facilitating effective cash management in restaurants and strategic business planning. By incorporating elements such as menu pricing strategy and sales forecasting for restaurants, the model ensures accurate financial projections for izakaya over a 60-month period. Additionally, it emphasizes the importance of inventory turnover ratio and labor cost management while offering insights into customer demographics for izakaya and location analysis for restaurants, ultimately aiding in securing capital investment and optimizing restaurant revenue streams.

IZAKAYA RESTAURANT FINANCIAL MODEL REPORTS

All in One Place

A robust financial planning model integrates projected profit and loss statements, balance sheets, and cash flow projections into a cohesive forecast. While simplified models may focus solely on profit and loss, they fail to provide a comprehensive financial perspective. Utilizing a three-statement financial model allows izakayas to conduct effective scenario planning, assessing how shifts in the business model affect key metrics like restaurant profit margins, cash flow management, and operating expenses. This holistic approach empowers restaurant operators to make informed strategic decisions, enhancing performance metrics and optimizing food and beverage cost control for sustainable growth.

Dashboard

Sharing access to a comprehensive cash flow statement dashboard can significantly enhance your izakaya's financial analysis. By making this resource available to stakeholders, you foster transparency and collaborative decision-making. This practice not only aids in refining your financial projections but also streamlines operations like cash management, operating expenses, and labor cost management. With engaged stakeholders, you can develop a robust menu pricing strategy and optimize inventory turnover, ultimately driving improved profit margins. Embracing shared insights will empower strategic business planning and elevate your izakaya’s overall performance metrics.

Business Financial Statements

This financial projection offers a comprehensive Excel template package, including a forecast income statement, projected balance sheet, and cash flow statement tailored for izakaya and other restaurants. Users can customize these templates for monthly or annual reporting, enhancing strategic business planning and financial analysis. Additionally, the templates seamlessly integrate company financial reports from popular accounting software like Quickbooks, Xero, and Freshbooks. Optimize your restaurant's performance metrics, cash management, and revenue streams with this user-friendly tool, ensuring effective financial control and robust operating expenses management for improved profit margins.

Sources And Uses Statement

The cash flow statement within this business plan's Excel financial template offers a comprehensive overview of the izakaya's funding sources and expenditure allocations. By analyzing these financial metrics, including operating expenses, food and beverage cost control, and labor cost management, we can strategically enhance restaurant profit margins. This essential component not only aids in cash management but also supports informed decision-making for menu pricing strategies and capital investment in restaurants. Furthermore, it lays the groundwork for effective financial projections and risk management in restaurant finance, ensuring a robust foundation for future growth and sustainability.

Break Even Point In Sales Dollars

Break-even analysis is crucial for izakaya financial analysis, determining the sales volume needed to cover both fixed and variable costs. Achieving this threshold signifies that your restaurant will neither profit nor lose. Once sales surpass this point, your izakaya can start generating profits. Our customizable financial model template enables you to create a break-even chart, detailing the sales needed to cover costs. A comprehensive five-year break-even assessment enhances investor confidence, indicating the potential for profitability and the timeline for recouping capital investment. By effectively employing this strategy, you can optimize your restaurant cash flow management and enhance overall performance metrics.

Top Revenue

In the context of izakaya financial analysis, the projected income statement highlights two critical aspects: the top line and bottom line. Investors closely monitor sales revenue—reflecting the profitability of the restaurant. A strong top-line growth signifies an increase in gross sales, ultimately enhancing overall performance metrics. Effective restaurant profit margins hinge on strategic menu pricing, food and beverage cost control, and managing operating expenses. Additionally, understanding customer demographics for izakaya informs targeted marketing strategies, while diligent cash flow management and inventory turnover ratio contribute to sustainable financial projections and risk management in restaurant finance.

Business Top Expenses Spreadsheet

Evaluate your expenditures with our financial plan template, focusing on the Top Expenses section, which categorizes costs into four key groups. Additionally, the 'Other' category allows for tailored entries, ensuring you can capture any relevant financial metrics specific to your izakaya. By utilizing this tool, you can enhance your financial analysis, optimize food and beverage cost control, and refine your menu pricing strategy. Effective cash management in restaurants is crucial; this template supports your strategic business planning and helps identify opportunities for improving restaurant profit margins and overall financial health.

IZAKAYA RESTAURANT FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are critical in any izakaya's financial analysis, marking the foundation of your restaurant's financial model. Consistently monitoring these expenses prevents underfunding and potential losses. Our business plan Excel template features a tailored pro forma that provides clear insights into your capital investment and funding levels. By utilizing this pro forma regularly, izakaya owners can enhance their menu pricing strategy, optimize operating expenses, and improve cash flow management. This proactive approach supports strategic business planning and enables effective sales forecasting, ensuring robust performance metrics that drive profitability and success.

CAPEX Spending

Capital expenditures are essential for the growth and agility of izakayas. These investments, focused on adopting innovative technologies and optimizing offerings, significantly impact overall financial health. By strategically managing capital allocation, izakayas can enhance operational efficiency and strengthen their market position. A well-planned CAPEX budget ensures financial stability, enabling effective cash management in restaurants while aligning with performance metrics. This proactive approach not only facilitates accurate sales forecasting and risk management but also supports sustainable profit margins through informed menu pricing strategies and optimal location analysis.

Loan Financing Calculator

Effectively managing loan profiles, repayment schedules, and proceeds is vital for izakayas and growing restaurants. A robust financial infrastructure, supported by comprehensive software, provides detailed insights into outstanding amounts, maturity dates, and key covenants. A well-structured loan repayment schedule highlights interest expenses and principal repayments, influencing cash flow management. It's crucial that closing debt balances are accurately reflected on the balance sheet, ensuring transparency in how regular loan repayments impact overall cash flow. By monitoring these financial metrics, izakayas can strategically plan operations, optimize profit margins, and enhance long-term financial stability.

IZAKAYA RESTAURANT EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on assets (ROA) is a critical performance metric for izakaya financial analysis, reflecting a restaurant's profitability relative to its total assets. This ratio reveals how effectively the business manages its resources to generate profits. A higher ROA indicates efficient operations and strong financial health, while a lower ROA suggests potential areas for improvement in aspects like operating expenses and capital investment. By incorporating ROA into financial projections, izakaya operators can refine their menu pricing strategy, optimize inventory turnover, and enhance overall cash flow management for sustained growth.

Cash Flow Forecast Excel

Effective cash flow management is essential for izakaya success, as it provides insights into operating expenses and revenue streams. Utilizing a cash flow projections template enables detailed analysis of annual changes in the pro forma balance sheet. This approach allows for robust financial projections, ensuring accurate forecasting when informed by reliable assumptions. By integrating performance metrics, strategic business planning, and inventory turnover ratios, operators can optimize menu pricing strategies and enhance food and beverage cost control. Ultimately, sound financial analysis supports labor cost management and risk management, paving the way for sustainable profitability in the restaurant industry.

KPI Benchmarks

This financial model features a dedicated benchmarking tab for comprehensive izakaya financial analysis. By comparing key performance metrics with industry peers, it evaluates productivity, efficiency, and overall performance within the restaurant sector. This strategic business planning tool aids in understanding restaurant profit margins, cash flow management, and operating expenses for izakaya. Through this detailed analysis, operators can refine menu pricing strategy, enhance inventory turnover ratio, and optimize marketing strategies, ultimately leading to informed financial projections and improved risk management in restaurant finance.

P&L Statement Excel

Navigating the future of your izakaya requires a thorough analysis of past performance. Our projected income statement template is essential for assessing future financial viability. By utilizing our five-year financial projection template in Excel, you can explore key metrics such as net income margins and gross margin percentages. This comprehensive overview will illuminate the factors driving profitability and enhance your strategic business planning. Ultimately, understanding these dynamics enables better cash flow management, optimized menu pricing strategies, and improved risk management, positioning your restaurant for sustained growth and success.

Pro Forma Balance Sheet Template Excel

Our financial forecast template excels in providing a comprehensive pro forma balance sheet, enabling users to construct an insightful financial statement for their izakaya. This tool effectively showcases total assets, total liabilities, and shareholders' equity, offering stakeholders a clear picture of financial health. By leveraging strategic business planning and financial projections for izakaya, operators can better manage cash flow, optimize operating expenses, and enhance profitability through informed decision-making. Empower your restaurant’s success with robust analysis and effective cash management strategies, ensuring a sustainable future in the dynamic food and beverage industry.

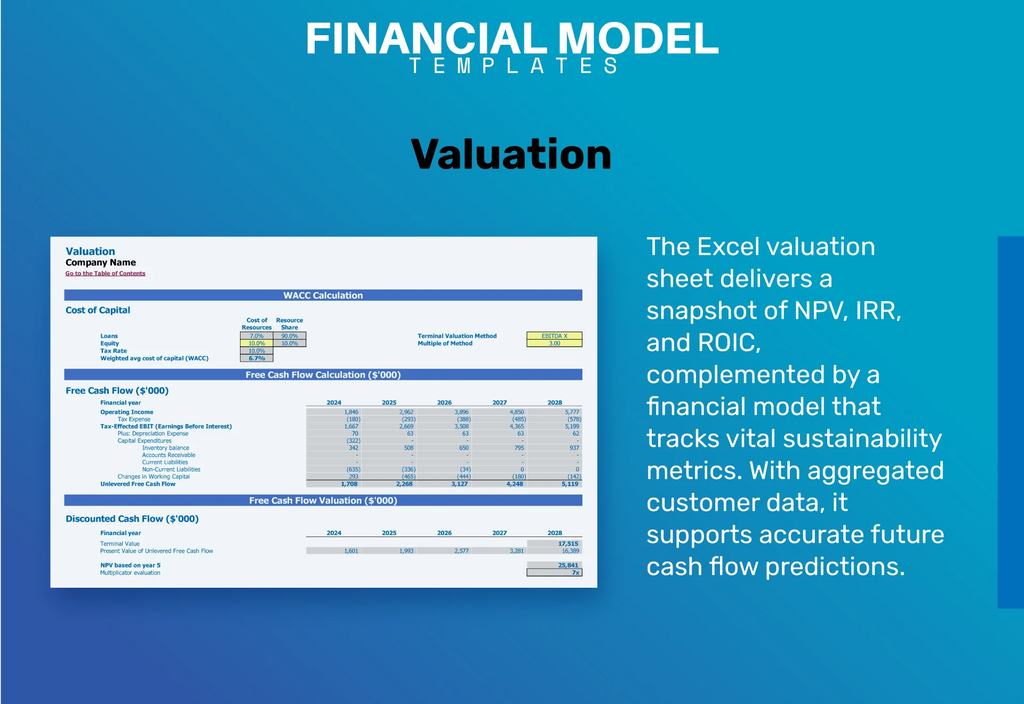

IZAKAYA RESTAURANT FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive business plan forecast template equips you with essential financial analysis tools for your izakaya. By highlighting the weighted average cost of capital (WACC), stakeholders can assess the minimal returns on capital investments. Additionally, free cash flow valuation provides insights into cash available for all investors, while discounted cash flow analysis illustrates the value of future cash flows in relation to current assets. This strategic framework not only enhances restaurant cash flow management but also guides effective menu pricing strategies and risk management, ensuring sustainable profitability and growth.

Cap Table

Our financial planning model features a detailed cap table encompassing four financing rounds. This table effectively illustrates how new share issuances to investors influence overall investment income. Post-financing, it provides a clear view of the ownership structure and percentage changes, highlighting dilution impacts. Understanding these dynamics is crucial for strategic business planning, enabling informed decisions on capital investment in izakaya. By assessing various performance metrics, stakeholders can optimize cash management, enhance profit margins, and tailor marketing strategies, ultimately ensuring sustainable growth and robust financial projections for the restaurant.

KEY FEATURES

An effective financial model streamlines cash flow management and enhances restaurant profit margins through informed strategic business planning.

Effective financial modeling enhances cash flow management, freeing you to focus on customer engagement and product innovation.

Implementing a robust financial model enhances profit margins and cash flow management for izakayas through informed strategic planning and analysis.

Our comprehensive izakaya financial model simplifies cash flow management and ensures your projections meet lenders' requirements effortlessly.

Effective financial analysis enhances izakaya profit margins through improved cost control and strategic pricing, optimizing cash flow management.

Utilizing a cash flow model enhances strategic business planning by forecasting financial impacts of operational changes in izakaya management.

A robust financial model enhances cash management, ensuring your izakaya maintains profitability while effectively controlling operating expenses and labor costs.

Using cash flow projections enables precise planning of future inflows and outflows, enhancing financial forecasting and strategic decision-making.

Effective financial analysis enhances restaurant profit margins, optimizing cash flow management and strategic planning for sustainable growth in izakaya.

Izakaya restaurant financial modeling enhances cash flow management and mitigates risks, increasing your chances of securing vital funding.

ADVANTAGES

Effective financial modeling enhances izakaya restaurant revenue forecasting and expense management, optimizing profit margins and cash flow.

Implementing a robust financial model enhances cash flow management and boosts profit margins for your izakaya restaurant.

Implementing a pro forma projection for izakaya enhances strategic business planning and optimizes restaurant profit margins effectively.

Utilizing financial projections enhances cash management, ensuring optimal restaurant profit margins and effective risk management strategies for izakayas.

Implementing a robust financial model enhances cash flow management and boosts profit margins for your izakaya restaurant.