Investment Marketplace Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Investment Marketplace Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

investment marketplace Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

INVESTMENT MARKETPLACE STARTUP BUDGET INFO

Highlights

An investment platform designed for both startups and established companies can effectively utilize equity crowdfunding and venture capital marketplace strategies to raise capital while incorporating financial modeling techniques to assess funding requirements and make accurate cash flow projections. By leveraging financial forecasting tools and asset valuation methods, businesses can enhance their financial plans, ensuring they attract the right investors through private equity investments or syndicate investing. Additionally, implementing portfolio diversification strategies can mitigate financial risk, while investment analytics software aids in evaluating alternative investments like peer-to-peer lending or real estate investment models, optimizing overall investment return projections and aligning with robust capital raising strategies.

By utilizing our investment marketplace 3 statement financial model excel template, you can effectively alleviate the complexities and stress associated with launching an equity crowdfunding platform or a venture capital marketplace. This ready-made financial model addresses common pain points, such as accurate financial forecasting and risk analysis, by providing robust financial modeling techniques that facilitate startup investment opportunities and private equity investments. The template offers essential tools for capital raising strategies and wealth management solutions, enabling users to create detailed investment return projections and evaluate asset valuation methods. Additionally, it streamlines portfolio diversification strategies and integrates investment analytics software, ensuring a comprehensive approach to online trading and peer-to-peer lending while guiding users through the intricacies of real estate investment models and syndicate investing.

Description

Our investment platform offers a comprehensive financial modeling framework tailored for equity crowdfunding and alternative investments, enabling users to explore startup investment opportunities and assess the viability of peer-to-peer lending ventures. The platform integrates advanced financial forecasting tools and investment analytics software, allowing users to conduct financial risk analysis while implementing portfolio diversification strategies. Additionally, it provides robust asset valuation methods and investment return projections, which are essential for private equity investments, syndicate investing, and real estate investment models. By leveraging capital raising strategies within a venture capital marketplace, businesses can enhance their financial planning and ultimately drive growth, while ensuring a strong reputation and community presence.

INVESTMENT MARKETPLACE FINANCIAL PLAN REPORTS

All in One Place

Concerned about crafting your startup's financial model? Our expertly designed 5-year financial projection template simplifies the process. Equipped with essential financial forecasting tools and analytics software, it empowers you to explore equity crowdfunding and alternative investments with confidence. Whether you're evaluating startup investment opportunities or analyzing peer-to-peer lending options, our intuitive model supports your capital raising strategies. Enhance your financial risk analysis and asset valuation methods, positioning you for success in the venture capital marketplace. Achieve portfolio diversification and make informed investment return projections with ease. Build your financial future today!

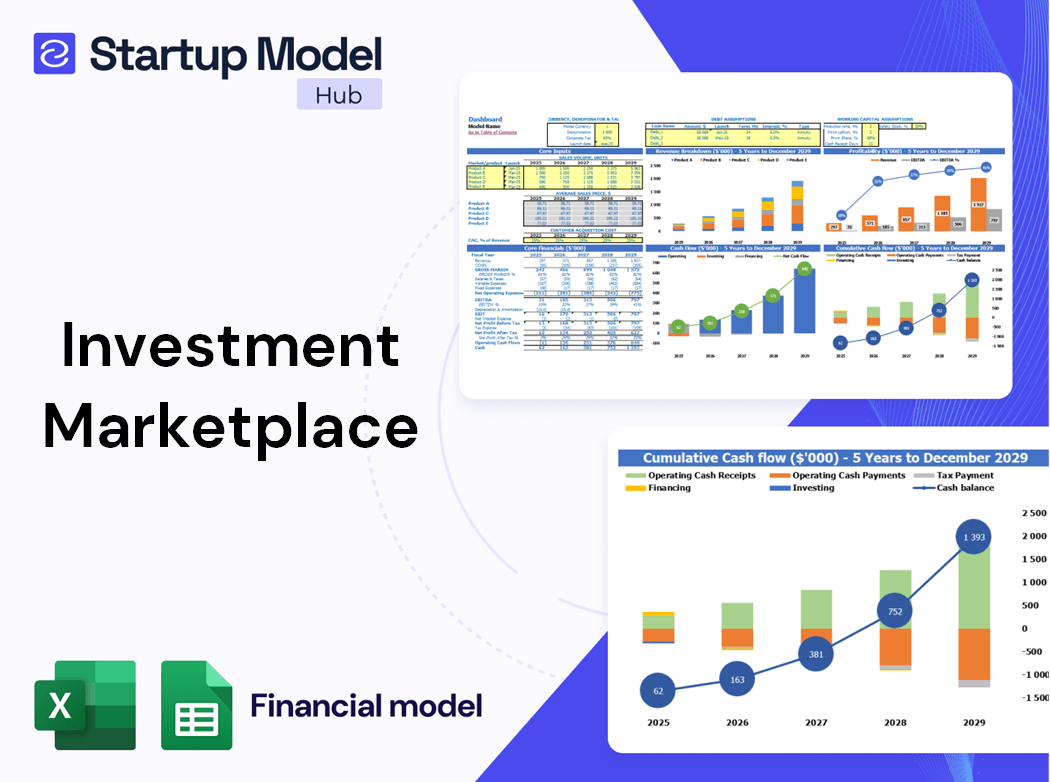

Dashboard

The all-in-one dashboard within our investment platform integrates essential financial modeling techniques and startup metrics, crucial for comprehensive financial analysis. It consolidates data from the Balance Sheet, profit and loss statements, and cash flow forecasts, empowering users to assess investment return projections. With dynamic visualizations like graphs and charts, you can easily interpret financial risk analysis and capital raising strategies. This innovative tool not only enhances portfolio diversification strategies but also supports informed decision-making in alternative investments and private equity investments. Experience streamlined financial management with our state-of-the-art online trading platform.

Business Financial Statements

The projected income statement, balance sheet, and cash flow forecasting models are vital tools for evaluating a company’s performance in the context of alternative investments. By employing financial modeling techniques, investors can gain insights into revenue-generating activities and capital management strategies. These templates facilitate a comprehensive financial risk analysis, enabling informed decisions on startup investment opportunities and private equity investments. In the ever-evolving landscape of syndicate investing and venture capital marketplaces, leveraging these financial forecasting tools enhances portfolio diversification strategies and improves investment return projections. Consider utilizing investment analytics software for optimal wealth management solutions.

Sources And Uses Statement

In the dynamic realm of startup investment opportunities, understanding cash flow is crucial. An effective sources and uses of cash statement empowers business owners to analyze financial performance, identify strengths, and mitigate weaknesses. By leveraging financial modeling techniques and investment analytics software, companies can avoid deficits and make informed decisions that align with their growth objectives. This foundational tool not only enhances capital raising strategies but also supports effective portfolio diversification. In today’s investment landscape, where peer-to-peer lending and equity crowdfunding are on the rise, a clear grasp of cash dynamics is essential for sustainable success.

Break Even Point In Sales Dollars

The break-even analysis is essential for any investment platform, as it identifies the sales volume needed to cover total costs. By utilizing financial modeling techniques, you can create an Excel chart that illustrates this crucial threshold. Understanding break-even sales in dollars allows investors to assess potential startup investment opportunities and gauge the timeline for achieving returns. This insight aids in informed decision-making, enhancing portfolio diversification strategies and capital raising efforts. With effective financial forecasting tools, your investment marketplace can navigate financial risks and optimize venture capital investments.

Top Revenue

When developing a pro forma template, revenue forecasting is crucial for determining a company's value. In a comprehensive cash flow projection, accurate revenue estimates are vital for effective financial modeling techniques. Analysts should integrate growth rate assumptions grounded in historical data to enhance investment return projections. Our startup costs spreadsheet offers essential components for prudent revenue stream planning, enabling users to navigate various startup investment opportunities. By leveraging investment analytics software, they can refine their financial risk analysis and implement robust capital raising strategies within a dynamic venture capital marketplace.

Business Top Expenses Spreadsheet

Our comprehensive financial model allows you to efficiently track major expenses, categorized into four key segments, with an adaptable 'other' category for personalized adjustments. This versatile tool supports your startup investment opportunities by reflecting historical data or creating a robust five-year business financial model. By leveraging advanced financial forecasting tools and asset valuation methods, you can enhance your investment analytics software and make informed decisions. Utilize this model to explore alternative investments, optimize portfolio diversification strategies, and elevate your capital raising strategies within the venture capital marketplace.

INVESTMENT MARKETPLACE FINANCIAL PROJECTION EXPENSES

Costs

Effective financial modeling techniques are essential for businesses aiming to achieve their goals and optimize investment opportunities. Utilizing a robust business financial model template enables users to assess initial asset and expense estimates critically. This proactive approach identifies potential weaknesses, allowing for strategic adjustments to mitigate risks in areas like equity crowdfunding or private equity investments. By addressing concerns early, businesses can refine their capital raising strategies and enhance their overall financial forecasting. Elevate your decision-making with investment analytics software to drive successful outcomes in the venture capital marketplace and beyond.

CAPEX Spending

The Top Revenue tab in your startup's financial model offers a clear and concise overview of your product and service revenue streams. This feature provides a summarized annual breakdown, highlighting key elements such as revenue depth and revenue bridge. By leveraging advanced financial modeling techniques, startups can effectively prepare for equity crowdfunding and secure investment opportunities, enhancing capital-raising strategies. This vital tool not only aids in financial risk analysis but also supports informed decision-making for portfolio diversification in a dynamic venture capital marketplace. Harness the power of investment analytics software to project returns and optimize wealth management solutions.

Loan Financing Calculator

Effectively monitoring and managing loan profiles, repayment schedules, and the allocation of proceeds is crucial for startups and growing enterprises. Utilizing an advanced investment platform with financial analytics software is vital for tracking outstanding amounts, maturity dates, and maintenance ratios. A comprehensive repayment schedule should detail interest and principal milestones, directly influencing cash flow forecasting and budgeting. Additionally, the debt balance must seamlessly integrate with the balance sheet, ensuring a clear understanding of regular loan expenses and their impact on cash flow. This approach enables robust financial risk analysis and strengthens capital raising strategies for sustainable growth.

INVESTMENT MARKETPLACE INCOME STATEMENT METRICS

Financial KPIs

The startup financial model template in Excel effectively calculates EBIT (Earnings Before Interest and Taxes) based on your input assumptions. This crucial metric illuminates your business's profit-generating potential, essential for attracting private equity investments and exploring startup investment opportunities. By employing robust financial modeling techniques, you can enhance your investment return projections and optimize capital raising strategies. Whether you're evaluating equity crowdfunding or navigating the venture capital marketplace, a solid understanding of EBIT is vital for informed decision-making and effective portfolio diversification strategies. Unlock your business's true potential with this invaluable tool in your investment analytics software.

Cash Flow Forecast Excel

The cash flow forecast spreadsheet is essential within any investment platform's financial modeling techniques. This five-year cash flow projection template enables users to input operating, investing, and financing cash flows, ensuring accurate financial risk analysis. It includes a projected balance sheet comparison over five years, crucial for evaluating startup investment opportunities and alternative investments. The detailed line items also integrate seamlessly with other sections of the financial model, allowing for precise portfolio diversification strategies and investment return projections. An accurate cash flow forecasting model is vital for successful capital raising strategies and informed decision-making in the venture capital marketplace.

KPI Benchmarks

Our investment platform features an advanced financial modeling tool, complete with a benchmarking template. This allows clients to assess their firm's performance against industry standards and identify top competitors. By utilizing this tool, you can pinpoint areas for improvement, ensuring your investment strategies—whether in equity crowdfunding, private equity, or real estate—achieve optimal results. Leverage our financial forecasting tools to enhance your capital raising strategies and maximize your startup investment opportunities, all while promoting effective portfolio diversification. Harness these insights to elevate your wealth management solutions and drive successful investment return projections.

P&L Statement Excel

For an investment platform to achieve profitability, leveraging an income and expenditure Excel template is essential. This financial modeling technique effectively forecasts potential profits and losses, crucial for any startup eyeing substantial future gains. By utilizing this business plan Excel template, you can generate comprehensive annual reports that capture every detail. This ensures you have clear insights into after-tax balances and net profits, enabling informed decision-making in the venture capital marketplace. With proven financial forecasting tools at your disposal, you can enhance capital raising strategies and optimize investment return projections for sustainable growth.

Pro Forma Balance Sheet Template Excel

The financial plan for a startup business integrates critical elements such as cash flow projections, profit and loss forecasts, and other key inputs to deliver a comprehensive overview. This monthly and yearly projected balance sheet effectively showcases your assets, liabilities, and equity accounts, facilitating informed decision-making. By leveraging advanced financial modeling techniques and investment analytics software, you can identify lucrative startup investment opportunities and implement robust portfolio diversification strategies. This holistic approach not only enhances your financial risk analysis but also positions you favorably within the competitive landscape of alternative investments and capital raising strategies.

INVESTMENT MARKETPLACE INCOME STATEMENT VALUATION

Startup Valuation Model

The five-year cash flow projection template offers a powerful tool for evaluating investment return projections, future equity shares, and cash burn rates. This financial modeling technique simplifies performance analysis, enabling startups to effectively showcase their potential to attract investors. Leveraging insights from investment analytics software, companies can enhance their capital raising strategies and present compelling startup investment opportunities. By utilizing such tools, businesses can navigate the venture capital marketplace with confidence and optimize their approach to portfolio diversification, ultimately capturing the interest of discerning investors in today's dynamic financial landscape.

Cap Table

Simple Cap Table provides a comprehensive overview of a company's financial health, showcasing its ownership structure. It details equity shares, preferred shares, options, and other financial instruments, enabling investors to understand their stake and the total capital invested. This tool is essential for anyone exploring startup investment opportunities, facilitating informed decision-making in the landscape of equity crowdfunding or alternative investments. By integrating asset valuation methods and financial modeling techniques, Simple Cap Table enhances investment analytics, ensuring clarity for effective portfolio diversification strategies and capital raising approaches.

KEY FEATURES

Implementing effective financial modeling techniques enhances investment return projections and supports strategic decision-making for future growth.

A robust financial model empowers businesses to strategically plan for growth, optimize expenses, and achieve their financial objectives efficiently.

Leverage robust financial modeling techniques to enhance investment return projections and unlock lucrative startup investment opportunities on our platform.

Unlock your startup’s potential with a user-friendly investment platform that delivers sophisticated financial modeling for reliable investment projections.

Leverage advanced financial modeling techniques to enhance investment return projections and effectively mitigate cash flow problems across diverse portfolio strategies.

Effective cash flow forecasting empowers businesses to proactively address financial gaps, enhancing growth potential and operational stability.

Unlock the potential of a dynamic financial model that enhances investment return projections for diversified startup opportunities.

Leverage our advanced investment marketplace financial modeling template to effectively strategize and optimize your startup investment opportunities and capital raising efforts.

Effective financial modeling techniques enhance investment decision-making, providing insights into startup investment opportunities and portfolio diversification strategies.

Our investment platform's financial model streamlines reporting, ensuring compliance with lender demands and simplifying your investment analysis process.

ADVANTAGES

Unlock growth potential with our investment marketplace business projection template, enhancing financial forecasting and investment return projections for success.

Utilizing financial modeling techniques in the investment platform enhances informed decision-making and maximizes returns for alternative investments.

The financial forecasting tools in our investment platform enhance asset valuation methods, ensuring robust projections for startup investment opportunities.

The three-statement financial model streamlines assumption management, enhancing clarity and precision for informed investment decisions.

A robust financial model enhances credibility, attracting investors by showcasing serious startup investment opportunities and effective capital raising strategies.