Identity Verification Solutions Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Identity Verification Solutions Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

identity verification solutions Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

IDENTITY VERIFICATION SOLUTIONS FINANCIAL MODEL FOR STARTUP INFO

Highlights

The proposed identity verification solutions encompass a comprehensive approach to KYC compliance, integrating advanced customer due diligence processes and identity fraud prevention strategies. By leveraging real-time identity verification and biometric authentication solutions, these systems enhance user identity management and streamline online verification services. Additionally, the incorporation of AML risk assessment tools and transaction monitoring systems ensures robust fraud detection algorithms are in place to mitigate financial risks. This framework not only supports compliance with know your customer regulations but also utilizes data encryption methods to safeguard sensitive information, while financial modeling techniques and credit risk modeling techniques enable the evaluation of startup ideas and financial stability assessments to attract funding from banks, angel investors, grants, and venture capital.

The ready-made financial model in Excel template alleviates the pain points often faced by users with limited financial expertise, providing intuitive financial modeling techniques that require only basic Excel knowledge. It incorporates KYC compliance solutions and customer due diligence processes, ensuring adherence to know your customer regulations while streamlining identity verification methods and user identity management. By utilizing transaction monitoring systems and AML risk assessment tools, the template enhances fraud detection algorithms, offering advanced identity fraud prevention strategies through digital identity verification tools and biometric authentication solutions. It ultimately delivers clear insights into financial stability assessment and risk management strategies, allowing users to navigate the complexities of identity authentication frameworks and customer verification software with ease.

Description

Our comprehensive financial model for identity verification solutions encompasses an extensive 5-year forecast, tailored to support your business objectives regarding KYC compliance solutions, which include robust identity verification methods and customer due diligence processes. With features such as real-time identity verification, biometric authentication solutions, and effective identity fraud prevention strategies, this model equips users with essential financial statements and key performance indicators (KPIs) to facilitate data-driven decision-making. The template includes necessary reports like the projected balance sheet, monthly profit and loss template excel, and cash flow budgeting and forecasting, seamlessly integrating transaction monitoring systems and AML risk assessment tools. Designed for usability, it enables users to manage and update financial indicators effortlessly as input factors evolve, thereby supporting your financial stability assessment and enhancing overall risk management strategies.

IDENTITY VERIFICATION SOLUTIONS FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive identity verification solutions offer a robust financial forecast template tailored for startups and established businesses alike. This template includes essential reports such as monthly profit and loss statements, cash flow projections, and pro forma balance sheets. Additionally, it features performance reviews and summaries, ensuring compliance with key regulations like KYC and AML. By integrating advanced customer verification software and fraud detection algorithms, our tools enhance your identity authentication frameworks, safeguarding your financial modeling techniques with real-time insights for optimal risk management strategies. Experience the confidence of financial stability assessments today.

Dashboard

The comprehensive business plan serves as a vital resource, delivering in-depth insights into a company's financial landscape, including cash flow budgeting, forecasting, and monthly profit and loss projections. Enhanced with data visualization through charts and graphs, this tool ensures precise oversight and organization, critical for informed decision-making and sustainable growth. By integrating sophisticated financial modeling techniques, it supports compliance with know your customer (KYC) regulations and empowers effective risk management strategies, thereby strengthening the organization's financial stability and identity verification methods to prevent fraud.

Business Financial Statements

Understanding a business's performance requires analyzing three key financial statements. The projected income statement provides insights into core operations driving revenue. In contrast, the pro forma balance sheet focuses on capital management, examining asset allocation and financial structure. Cash flow projections further emphasize liquidity and operational efficiency. Together, these statements form a comprehensive picture, essential for financial modeling techniques and KYC compliance solutions, ensuring robust identity verification methods and effective risk management strategies for sustainable growth.

Sources And Uses Statement

A sources and uses of funds statement is essential for comprehensively tracking the origins of raised capital and its intended expenditures. This financial document enhances transparency and enables effective financial modeling techniques while ensuring compliance with know your customer (KYC) regulations. By integrating transaction monitoring systems and customer verification software, organizations can bolster their identity verification methods and fraud detection algorithms, thereby safeguarding against identity fraud. Ultimately, a well-structured statement supports robust risk management strategies, ensuring financial stability while facilitating user identity management and customer due diligence processes.

Break Even Point In Sales Dollars

The CVP chart in this financial projection highlights the break-even analysis, a crucial tool for assessing your company’s profitability timeline. It effectively illustrates the point at which your revenues surpass expenses, marking a pivotal moment for financial stability. By leveraging robust financial modeling techniques, businesses can navigate the complexities of risk management strategies, ensuring long-term success. Understanding this calculation is essential for informed decision-making, ultimately aiding in the development of effective KYC compliance solutions and AML risk assessment tools for enhanced user identity management and fraud prevention.

Top Revenue

The Top Revenue section of the profit and loss projection offers a comprehensive overview of your company's financial health. It meticulously categorizes revenue by product, providing clarity for strategic decision-making. Additionally, the Excel financial model presents an annual breakdown of diverse revenue streams, highlighting total revenue alongside essential supporting revenue bridges. This structured approach not only aids in financial stability assessment but also enhances your ability to implement effective risk management strategies. Embrace KYC compliance solutions and real-time identity verification to further secure your financial modeling techniques.

Business Top Expenses Spreadsheet

To achieve financial stability, it is crucial for startups and established companies to effectively monitor and manage costs. Our financial modeling techniques include a comprehensive top expense report, categorizing major expenses and aggregating others for streamlined oversight. By utilizing KYC compliance solutions and transaction monitoring systems, businesses can enhance their risk management strategies and optimize expenditures. Employing identity verification methods and fraud detection algorithms further ensures robust customer due diligence processes, supporting long-term profitability and growth. Continuous analysis of expenses empowers organizations to adapt to trends and maintain a competitive edge in today’s dynamic marketplace.

IDENTITY VERIFICATION SOLUTIONS FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are crucial for any business, and our identity verification solutions financial modeling techniques excel in managing them. Our five-year cash flow projection template ensures financial stability by tracking expenses and investments, helping you avoid the pitfalls of high costs. By utilizing our customer verification software, you can seamlessly assess your financial situation, adjust cash flows, and forecast the future. Empower your venture with KYC compliance solutions and real-time identity verification tools to enhance user identity management and maintain strong financial health.

CAPEX Spending

Capital expenditures (CapEx) are critical for securing long-term value through investments in assets such as property, plant, and equipment. Our startup costs template features a dedicated CapEx tab, designed to assist users in evaluating growth and expansion plans necessitating substantial investments. Understanding the interplay between CapEx, depreciation, and financial reports is essential for business owners and financial professionals alike. Ensuring KYC compliance and implementing robust financial modeling techniques can further enhance strategic decision-making, supporting the sustainable growth of the company while mitigating risks associated with identity fraud through effective identity verification methods.

Loan Financing Calculator

Our advanced financial modeling techniques include a comprehensive loan amortization schedule template that streamlines repayment processes. This model features pre-built formulas, allowing organizations to easily track monthly, quarterly, or yearly installments. It ensures accurate calculations of principal and interest, facilitating compliance with know your customer regulations and enhancing KYC compliance solutions. By incorporating real-time identity verification and customer due diligence processes, companies can strengthen their fraud detection algorithms and identity fraud prevention strategies, ultimately fostering financial stability and effective risk management.

IDENTITY VERIFICATION SOLUTIONS EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings Before Interest and Taxes (EBIT), often referred to as operational income, serves as a key profit indicator in projected income statements. This metric highlights the difference between a company's revenues and operational expenses, including sales costs, interest, and taxes. By analyzing EBIT, businesses can gauge their financial stability and operational efficiency. This valuable insight into operating profit illustrates the company's ability to generate profits, informing effective risk management strategies and supporting robust financial modeling techniques for sustainable growth.

Cash Flow Forecast Excel

A Cash Flow Analysis Template for your professional business plan is an essential tool for effectively managing finances. Utilizing advanced financial modeling techniques, this Excel model facilitates streamlined cash inflow and outflow management. Coupled with robust KYC compliance solutions and digital identity verification tools, it ensures adherence to know your customer regulations. Implementing transaction monitoring systems and identity fraud prevention strategies enhances your risk management strategies, safeguarding financial stability and supporting thorough customer due diligence processes. Elevate your financial oversight and ensure responsible fiscal health with this comprehensive approach.

KPI Benchmarks

The financial benchmarking tool within the pro forma template empowers business owners to conduct competitive analyses efficiently. By assessing your company's performance against industry peers through metrics such as losses, you gain valuable insights. This process not only highlights your strengths and weaknesses but also informs strategic focus areas for growth. Understanding these key financial indicators is essential for fostering financial stability and driving your start-up toward sustained success. Effective benchmarking is integral to refining your risk management strategies and enhancing your overall business performance in a competitive landscape.

P&L Statement Excel

This five-year projection template, designed in Excel, offers accurate forecasts for income statements and integrates seamlessly with your startup's financial statements. Ideal for monthly and long-term projections, it allows for real-time adjustments to assumptions, ensuring a fluid exchange of financial data across documents. By utilizing this comprehensive tool, you can make informed management decisions backed by robust financial modeling techniques. Enhance your KYC compliance solutions and identity verification methods through precise financial assessments, ensuring a secure and stable business environment while maintaining adherence to necessary regulations.

Pro Forma Balance Sheet Template Excel

A projected balance sheet template in Excel is an essential tool for evaluating a company's financial health. This report provides a comprehensive overview of assets, liabilities, and equity over a specified period. It enables businesses to monitor funding and expenditures through detailed financial modeling techniques. Our Excel business plan template generates balance sheet forecasts, empowering organizations to assess performance monthly or annually. By integrating KYC compliance solutions and identity verification methods, companies can enhance customer due diligence processes and mitigate risks associated with identity fraud. Leverage this template to support robust risk management strategies and ensure financial stability.

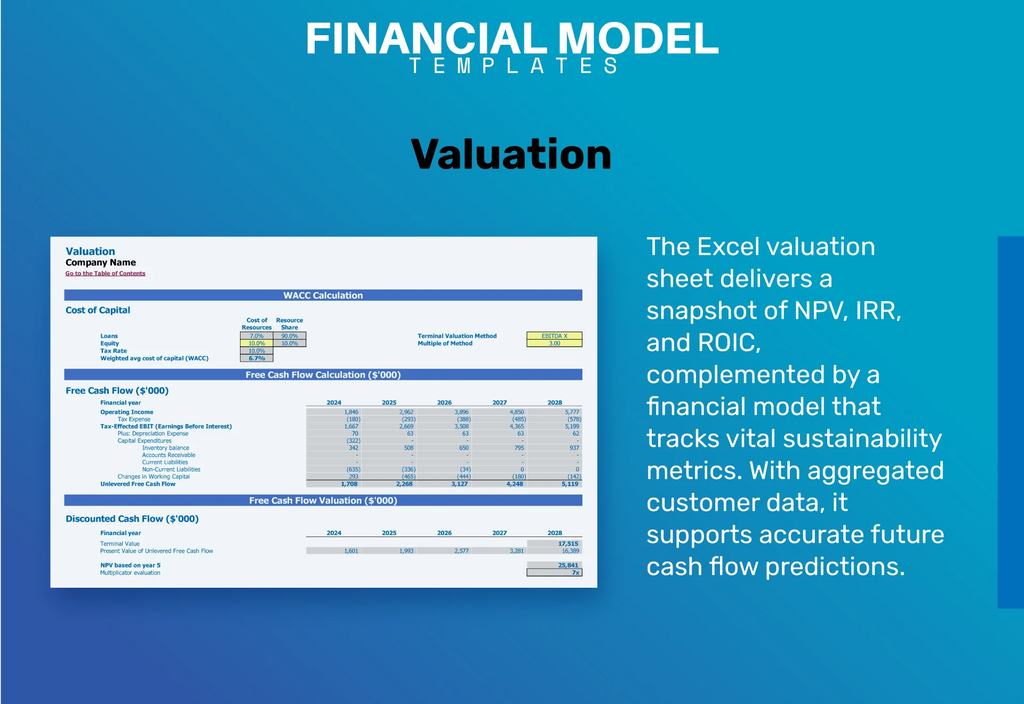

IDENTITY VERIFICATION SOLUTIONS FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The financial modeling Excel template enhances analysis by calculating key metrics such as Return on Investment, future equity shares, and cash burn rates. These advanced assessment tools empower organizations to capture potential investors effectively, ensuring robust financial stability. By integrating KYC compliance solutions and customer due diligence processes, companies can mitigate risks through identity verification methods and fraud detection algorithms. Utilizing online verification services and real-time identity verification further strengthens user identity management, fostering trust and transparency in financial transactions. This comprehensive approach not only attracts investment but also reinforces sound risk management strategies.

Cap Table

A capitalization table is vital for financial modeling in startups, illustrating the company's ownership structure, including equity shares, preferred shares, and options. It details stakeholder valuations, essential for KYC compliance solutions. By integrating identity verification methods and transaction monitoring systems, startups can enhance their user identity management and fraud detection algorithms. This ensures robust customer due diligence processes while adhering to know your customer (KYC) regulations. Understanding the cap table not only aids in financial stability assessment but also strengthens risk management strategies, providing a clear view of ownership and investment opportunities.

KEY FEATURES

Robust financial modeling techniques enhance KYC compliance solutions, driving growth through effective risk management and identity fraud prevention strategies.

Utilizing robust financial modeling techniques reveals optimal funding options, enhancing cash flow and supporting sustainable business growth strategies.

Our convenient all-in-one dashboard streamlines KYC compliance solutions and enhances identity verification methods for improved financial stability assessment.

Our comprehensive financial model includes detailed forecasts and key performance indicators to enhance decision-making and ensure financial stability.

Implementing robust financial modeling techniques enhances decision-making and ensures compliance with KYC regulations while mitigating fraud risks.

Leverage our 5-year financial modeling techniques to enhance KYC compliance solutions, ensuring robust identity verification for greater financial stability.

Implementing robust financial modeling techniques enhances forecasting accuracy, ensuring compliance with KYC regulations and fostering trust with external stakeholders.

Effective financial modeling techniques enhance KYC compliance solutions, ensuring robust identity verification methods for securing bank loans.

Effective financial modeling techniques enhance KYC compliance solutions, ensuring robust identity verification methods and reducing fraud risk for future growth.

Cash flow projections in Excel empower businesses to strategize growth by accurately anticipating expenses and sales changes.

ADVANTAGES

A robust financial model enhances KYC compliance solutions by enabling precise forecasting of expenses and income, ensuring informed decision-making.

Effective financial modeling techniques enhance the planning and stability of costs for identity verification solutions and operational activities.

Utilizing advanced identity verification methods enhances KYC compliance solutions and ensures financial stability through robust risk management strategies.

A regularly updated financial planning model enhances KYC compliance solutions, ensuring robust risk management strategies for external stakeholders like banks.

Implementing KYC compliance solutions enhances customer due diligence processes, ensuring robust identity verification and reducing risk in financial modeling.