Hotel Acquisition Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Hotel Acquisition Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

hotel acquisition Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

HOTEL ACQUISITION FINANCIAL MODEL FOR STARTUP INFO

Highlights

Develop a comprehensive five-year financial model in Excel tailored for hotel investment analysis, specifically designed for early-stage startups looking to impress investors and secure capital. This model should incorporate critical elements such as a hotel valuation model that emphasizes operating expense forecasting and revenue management techniques, while providing a thorough cash flow analysis for hotels. Additionally, ensure the inclusion of investment metrics for hotels, projected return on investment, and cap rate analysis for hospitality to strengthen the due diligence process for hotels. By detailing acquisition cost calculations and exploring various hotel acquisition financing options, the model will effectively support a robust real estate acquisition strategy, ultimately enhancing the appeal of the hotel operating model to potential investors.

This comprehensive hotel investment analysis model addresses key pain points for buyers of ready-made financial templates by providing a sophisticated hotel valuation model that incorporates critical elements such as capital stack optimization and operating expense forecasting. It facilitates revenue management techniques, allowing users to refine their hospitality financial projections while ensuring accurate cash flow analysis for hotels. The template streamlines the due diligence process for hotels, enhancing the underwriting of hotel investments and simplifying LOI (Letter of Intent) preparation. By offering robust acquisition cost calculations and financing hotel purchases options, it empowers users to make informed decisions aligned with their real estate acquisition strategy, all while focusing on projected return on investment and effective hotel asset management strategies to maximize investment metrics for hotels.

Description

A comprehensive hotel investment analysis is essential for any potential acquisition, as it provides a structured approach to hotel valuation models and better hospitality financial projections. This model encompasses crucial elements such as operating expense forecasting, revenue management techniques, and cash flow analysis for hotels, facilitating a robust real estate acquisition strategy. It highlights the importance of capital stack optimization, enabling investors to navigate financing hotel purchases effectively while conducting thorough due diligence throughout the process. By employing investment metrics for hotels, including cap rate analysis for hospitality and evaluating projected return on investment, stakeholders can make informed decisions and accurately forecast financial performance over a five-year horizon. The financial model ultimately serves as a guiding framework for underwriting hotel investments, streamlining acquisition cost calculations, and developing effective hotel asset management strategies to ensure sustainable growth and profitability.

HOTEL ACQUISITION FINANCIAL MODEL REPORTS

All in One Place

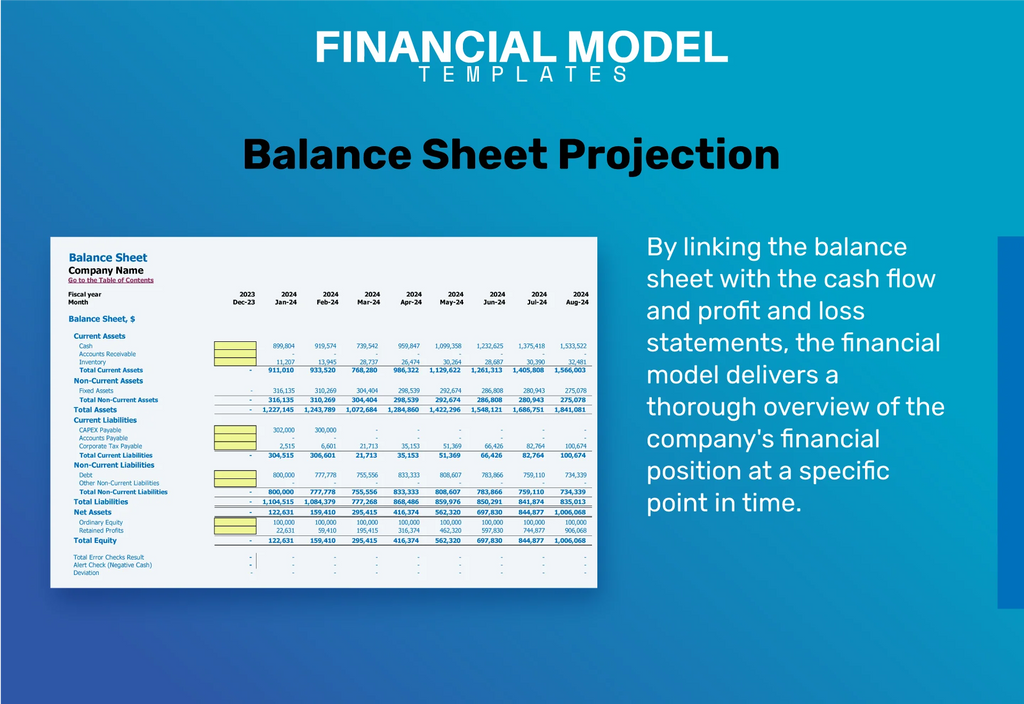

Our hotel investment analysis template offers a robust financial forecast, synthesizing your foundational financial statements, including profit and loss, balance sheet, and cash flow projections. Unlike simplified models relying on a single financial statement, our comprehensive approach enables effective scenario planning. This allows you to assess the impact of changes in your operating model on key metrics like revenue management techniques, operating expense forecasting, and projected return on investment. It ensures a thorough due diligence process for hotels, guiding strategic decisions in your real estate acquisition strategy and capital stack optimization.

Dashboard

Our financial dashboard, integrated within the feasibility study template, offers a sophisticated approach to hotel investment analysis and financial planning. Utilizing advanced charts and graphs, it ensures precise analytical operations, enhancing the due diligence process for hotels. This tool empowers clients to conduct thorough cash flow analysis for hotels, accurately forecast revenue, and present detailed profit and loss statements to stakeholders, illustrating the property’s potential. Additionally, it serves as an effective resource for operating expense forecasting and revenue management techniques, streamlining financial projections and supporting informed decision-making in hotel asset management strategies.

Business Financial Statements

In hotel investment analysis, three essential financial statements interlink to provide a comprehensive overview. The Income Statement details revenues and expenses, including depreciation and taxes. The Balance Sheet offers a snapshot of assets, liabilities, and equity, adhering to the equation: Assets = Liabilities + Equity. Lastly, the Cash Flow Statement outlines cash inflows and outflows across operations, investments, and financing activities, ensuring the ending balance aligns with the Balance Sheet. These components are vital for effective hotel valuation models, operating expense forecasting, and capital stack optimization, ultimately supporting strategic real estate acquisition and investment metrics for hotels.

Sources And Uses Statement

Our comprehensive financial projections template features a pre-built sources and uses of capital tab, essential for effective hotel investment analysis. This tool delineates primary funding sources and corresponding expenditure activities, aiding in capital stack optimization. Particularly beneficial for startups, it streamlines the due diligence process for hotels, facilitating planning, budgeting, and monitoring. By employing this template, you can enhance your revenue management techniques and ensure robust cash flow analysis for hotels, ultimately supporting informed decision-making in your real estate acquisition strategy.

Break Even Point In Sales Dollars

The Break-Even Excel model provides a clear visualization of profits across different sales levels, enabling effective revenue management techniques. Understanding your safety margin is crucial; it reveals the resilience of your hotel investment strategy against potential declines in revenue. This analysis is essential for accurate cash flow analysis and operating expense forecasting, which underpin sound hotel valuation models. By integrating these insights into your due diligence process for hotel acquisitions, you can enhance your real estate acquisition strategy and optimize your capital stack, ultimately maximizing projected return on investment.

Top Revenue

The Top Revenue tab empowers you to generate comprehensive demand reports for your Café offerings, incorporating vital hospitality financial projections. By utilizing the business plan financial template, you can delve into revenue depths and analyze revenue bridges effectively. This tool allows for tailored projections based on varying timeframes, such as weekdays or weekends. These insights facilitate informed decisions regarding resource allocation, ensuring optimal capital stack optimization and operating expense forecasting. Ultimately, leveraging these revenue reports enhances your strategic approach to hotel investment analysis and revenue management techniques, driving profitability and sustained growth.

Business Top Expenses Spreadsheet

Understanding your expenditure origins is crucial for effective hotel investment analysis and maintaining financial control. The financial model's Top Expenses tab allows stakeholders to examine annual operating expenses, segmented into categories such as customer acquisition costs and fixed costs. This detailed breakdown enables hotel asset management strategies to identify key drivers of expense structures, facilitating informed decision-making in underwriting hotel investments and optimizing the capital stack. Implementing effective operating expense forecasting empowers stakeholders to enhance their real estate acquisition strategy and maximize projected return on investment.

HOTEL ACQUISITION FINANCIAL PROJECTION EXPENSES

Costs

Managing a hotel requires meticulous financial oversight, particularly regarding start-up costs that accrue before operations begin. Our financial model Excel template is designed to enhance your hotel investment analysis by providing robust tools for operating expense forecasting and cash flow analysis for hotels. With built-in pro forma statements, you'll effectively navigate capital stack optimization and budget management. This comprehensive approach ensures you maintain financial health and avoid premature deficits, positioning your hotel for successful revenue management and strategic acquisitions. Elevate your investment metrics for hotels and ensure a strong return on investment with our cutting-edge solution.

CAPEX Spending

The CAPEX budget reflects total investment in a hotel's property, plant, and equipment, essential for enhancing operational competitiveness. Our report details planned capital expenditures and their impact on efficiency, highlighting which assets improve with specific CAPEX forecasts. It's crucial to note that this analysis excludes salaries and general operating costs. Given the variability of capital expenditures across the hospitality sector, understanding these nuances is key when evaluating diverse hotel investment models and their financial projections. Effective capital stack optimization ensures a strategic approach to maximizing projected return on investment.

Loan Financing Calculator

Effectively monitoring loan profiles and repayment schedules is crucial for companies, particularly start-ups and growing enterprises. This requires robust infrastructure and software that provides detailed insights into outstanding amounts, maturity dates, and key covenants. A well-structured loan repayment schedule should clearly outline interest expenses and principal repayments, directly influencing the cash flow analysis for hotels. Additionally, the closing debt balance must be integrated into the balance sheet. Transparency in how regular loan repayments affect cash flow statements enables stakeholders to better understand financial obligations, ultimately supporting informed decisions in hospitality financial projections and hotel investment analysis.

HOTEL ACQUISITION EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Elevate your hotel investment analysis with our intuitive financial projection tool. Choose from forecasting periods of 24 months to 5 years to suit your needs. This comprehensive pro forma template in Excel includes vital metrics such as EBITDA to assess operational performance, detailed cash flow analysis for hotels to monitor inflows and outflows, and cash balance tracking to ensure liquidity. With these hospitality financial projections, you'll be equipped to optimize your capital stack, enhance your revenue management techniques, and maximize your projected return on investment. Transform your hotel acquisition financing strategies with confidence!

Cash Flow Forecast Excel

In today's competitive landscape, effective cash flow analysis for hotels is crucial for successful hotel investment analysis. Utilizing a well-designed cash flow forecasting model can illuminate costs and profits, enabling accurate financial distribution across all business needs. By optimizing your capital stack and adopting robust revenue management techniques, you can enhance your hospitality financial projections. This strategic approach not only simplifies accounting but also strengthens your real estate acquisition strategy, paving the way for sustainable growth and attractive projected returns on investment. Embrace these hotel asset management strategies to elevate your startup’s financial health.

KPI Benchmarks

A benchmarking study is vital for a comprehensive hotel investment analysis, offering an objective assessment of potential returns. By evaluating key financial metrics—such as operating expense forecasting, revenue management techniques, and profit margins—against industry standards, investors gain insights into unit costs and productivity. This strategic comparison not only enhances the due diligence process for hotels but also informs the hotel valuation model. Leveraging these insights enables effective capital stack optimization and shapes robust financial projections, ultimately driving informed decision-making in hotel acquisition financing and asset management strategies.

P&L Statement Excel

For successful hotel investment analysis, implementing a monthly financial plan for startup projections is essential. This approach enhances transparency during the due diligence process for hotels and ensures all financial transactions are meticulously tracked. With its simplicity and affordability, managers can efficiently utilize operating expense forecasting and revenue management techniques to refine their hotel valuation model. This proactive strategy supports informed decision-making, optimizing capital stack and acquisition cost calculations, ultimately maximizing projected return on investment. Embrace this method to enhance hospitality financial projections and elevate your hotel acquisition financing options.

Pro Forma Balance Sheet Template Excel

In hotel investment analysis, your acquisition’s key assets, such as buildings and equipment, are clearly represented within the pro forma balance sheet template. This essential tool also outlines liabilities and the company’s capital at a specific date. A robust loan security metric is crucial in this context, serving as a fundamental requirement for banks during the loan application process. By integrating capital stack optimization and accurate operating expense forecasting, you can enhance your hospitality financial projections and ultimately strengthen your investment metrics for hotels.

HOTEL ACQUISITION FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive hotel valuation model, integrated within a three-way financial framework, equips you with essential data for both investors and stakeholders. The weighted average cost of capital (WACC) provides insights into the minimum expected return on invested funds, while free cash flow valuation reveals the available cash for all parties involved, including shareholders and creditors. Additionally, our discounted cash flow analysis illustrates the present value of future cash flows, enhancing your understanding of projected returns on investment. This data-driven approach supports effective hotel investment analysis and informed decision-making in your real estate acquisition strategy.

Cap Table

In our hotel investment analysis, we utilize a comprehensive hotel valuation model that outlines the ownership structure through a detailed capital stack optimization. This includes financing hotel purchases and acquisition cost calculations. By incorporating hospitality financial projections and operating expense forecasting, we ensure accurate cash flow analysis for hotels. Our due diligence process for hotels encompasses revenue management techniques and cap rate analysis for hospitality, allowing for informed decisions. Ultimately, we focus on robust hotel asset management strategies to achieve projected returns on investment while employing strategic investment metrics for hotels.

KEY FEATURES

Effective hotel valuation models streamline investment metrics, enhancing decision-making and maximizing returns while saving time and money.

Utilizing our hotel valuation model simplifies financial analysis, empowering you to focus on strategy while optimizing investment metrics for hotels.

Our hotel valuation model enhances decision-making with precise cash flow analysis, optimizing investment metrics for profitable acquisitions.

The hotel valuation model streamlines investment analysis, enabling efficient decision-making and maximizing projected returns without complex calculations.

A robust hotel valuation model enhances decision-making by providing precise financial projections and optimizing your real estate acquisition strategy.

Utilizing our sophisticated hotel valuation model enhances decision-making, ensuring reliable financial projections and optimized acquisition strategies for successful investments.

A robust hotel valuation model enhances investment metrics for hotels, ensuring informed decisions and maximizing projected return on investment.

Unlock successful hotel investments with our proven financial model, ensuring accurate projections and optimized acquisition strategies at an affordable price.

Utilizing a hotel valuation model helps identify potential cash shortfalls early, ensuring strategic financial planning and investment success.

The hotel valuation model serves as a vital tool for forecasting financial performance and optimizing investment decisions in hospitality.

ADVANTAGES

A robust hotel valuation model enhances investment metrics for hotels, guiding informed financial decisions and optimizing revenue management techniques.

A comprehensive hotel valuation model reveals strengths and weaknesses, enhancing investment metrics for informed decision-making in hotel acquisitions.

The hotel valuation model enhances confidence in financing by demonstrating projected returns and optimizing capital stack strategies for investors.

Optimize your hotel investment analysis with a robust financial model to enhance revenue management and maximize projected returns.

A robust hotel acquisition financial model enhances investment metrics, ensuring accurate valuation and optimizing financing options for successful projects.