Ev Manufacturing Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Ev Manufacturing Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

ev manufacturing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

EV MANUFACTURING FINANCIAL MODEL FOR STARTUP INFO

Highlights

The EV manufacturing financial model Excel template offers a comprehensive 5-year financial planning framework specifically designed for companies in the electric vehicle production sector. This versatile tool is ideal for both startup ventures and established small EV manufacturers, facilitating a detailed cost structure analysis that includes investment analysis for electric vehicles, capital expenditure planning, and operational expenses in EV production. By incorporating market demand estimation and revenue projections for EVs, users can enhance their profit margin forecasting and break-even analysis for EV manufacturing. Additionally, the template supports supply chain optimization and working capital requirements assessment, ensuring financial sustainability in the EV industry while providing insights into manufacturing efficiency metrics and enterprise resource planning. Unlock its full potential to refine your market pricing strategies for EVs and evaluate return on investment in electric vehicle technology before making any purchasing decisions.

The EV manufacturing financial model addresses critical pain points by providing comprehensive tools for cost structure analysis and revenue projections for electric vehicles, enabling users to navigate electric vehicle production costs with ease. By incorporating break-even analysis for EV manufacturing and investment analysis for electric vehicles, it supports effective capital expenditure planning and operational expenses management, enhancing financial sustainability in the EV industry. Additionally, the model facilitates market demand estimation and profit margin forecasting, allowing for efficient supply chain optimization and working capital requirements management. Users benefit from streamlined enterprise resource planning, along with robust financial risk assessment tools, ensuring a higher return on investment in electric vehicle technology while avoiding the need for costly external consultants or complex formula writing.

Description

The EV manufacturing financial model is structured to facilitate informed decision-making by providing comprehensive insights into electric vehicle production costs, capital expenditure planning, and operational expenses in EV production. This robust financial template encompasses vital elements such as revenue projections for EVs, profit margin forecasting, and cost structure analysis, all essential for effective automotive supply chain management. Key performance indicators (KPIs), break-even analysis for EV manufacturing, and financial risk assessment tools enable users to gauge financial sustainability in the EV industry. By allowing for flexibility in market demand estimation and adjustment of operational parameters, this model supports supply chain optimization and ensures that investment analysis for electric vehicles aligns with changing market conditions, ultimately enhancing the return on investment in electric vehicle technology.

EV MANUFACTURING FINANCIAL MODEL REPORTS

All in One Place

Leverage our EV manufacturing financial model template to enhance your financial forecasting and analysis. This robust tool streamlines the assessment of electric vehicle production costs, capital expenditure planning, and revenue projections for EVs. With built-in functionalities for cost structure analysis and supply chain optimization, it adapts effortlessly to your unique business scenarios. The customizable and scalable design ensures it evolves alongside your growth, facilitating break-even analysis and profit margin forecasting. Experience financial sustainability in the EV industry with this comprehensive solution, allowing you to focus on driving efficiency and innovation in your operations.

Dashboard

Discover our comprehensive startup costs template, featuring a dynamic financial dashboard that provides a snapshot of essential metrics for your electric vehicle manufacturing venture. Analyze revenue projections for EVs, operational expenses, and profit margin forecasting at a glance. This tool enables effective cost structure analysis and capital expenditure planning, ensuring your financial sustainability in the EV industry. Gain insights into break-even analysis, working capital requirements, and market demand estimation to optimize your automotive supply chain management and enhance manufacturing efficiency metrics. Leverage this resource for robust investment analysis and informed decision-making in the electric vehicle sector.

Business Financial Statements

This comprehensive financial model template for electric vehicle (EV) manufacturing automates essential annual financial reports. By simply updating the assumptions with your data, the template manages intricate calculations, including revenue projections for EVs, cost structure analysis, and investment analysis for electric vehicles. It aids in capital expenditure planning, break-even analysis, and profit margin forecasting, ensuring financial sustainability in the EV industry. Enhance your automotive supply chain management and optimize manufacturing efficiency metrics effortlessly, enabling sound market pricing strategies and robust financial risk assessments for superior return on investment in electric vehicle technology.

Sources And Uses Statement

The sources and uses of cash statement in the startup financial plan succinctly outlines capital origins (Sources) and allocations (Uses), ensuring a balanced overview. This analysis is vital for capital expenditure planning, particularly during recapitalization, restructuring, or mergers and acquisitions (M&A). By providing insights into investment analysis for electric vehicles, it aids in profit margin forecasting and financial sustainability in the EV industry. Ultimately, a robust understanding of this statement enhances operational expenses management and supports strategic decisions in automotive supply chain management and revenue projections for EV production.

Break Even Point In Sales Dollars

Our financial forecasting model incorporates break-even analysis, essential for determining the sales volume needed to cover all fixed and variable costs in EV manufacturing. This critical tool evaluates your ability to achieve profitability, guiding investment analysis and operational decisions. By adjusting financial assumptions, you can refine revenue projections and enhance profit margin forecasting. This iterative process ensures that your business model remains adaptable, fostering financial sustainability in the competitive electric vehicle landscape. Optimize your automotive supply chain management and capital expenditure planning to enhance manufacturing efficiency and achieve favorable market pricing strategies for EVs.

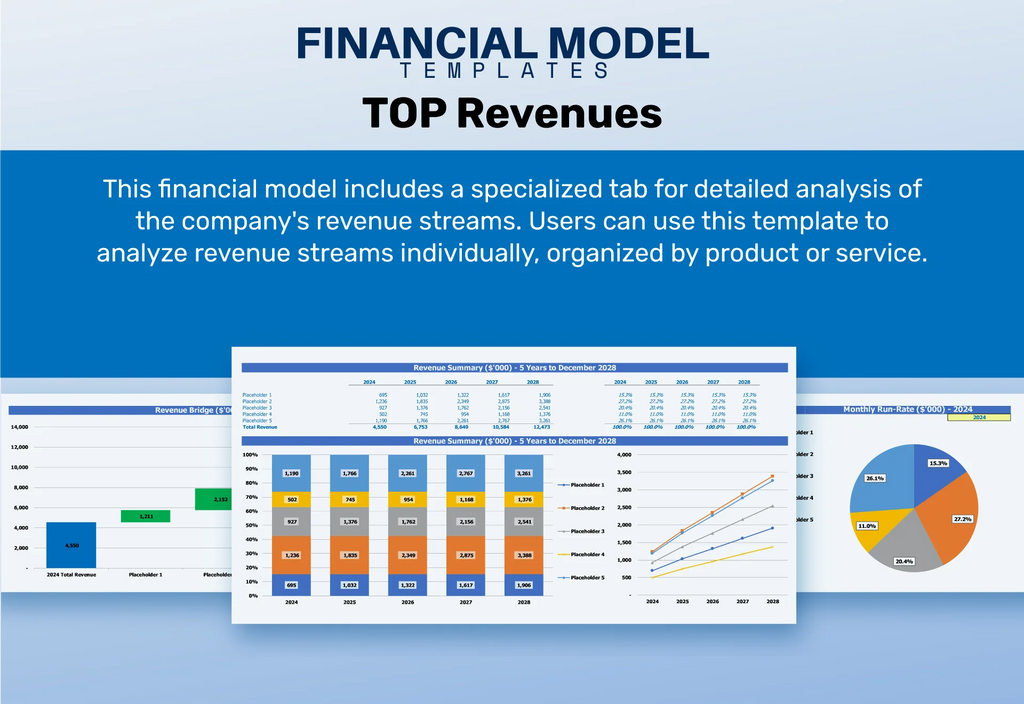

Top Revenue

In the Top Revenue tab of this startup financial model template, users can effectively forecast demand for products and services, simulating potential profitability in the electric vehicle manufacturing sector. This function enhances revenue projections for EVs by analyzing revenue depth and bridges. Additionally, it offers insights into operational expenses and capital expenditure planning, allowing for more accurate resource management—such as manpower and inventory—based on forecasted demand patterns. This comprehensive approach supports cost structure analysis and financial sustainability in the EV industry, ultimately aiding investment analysis for electric vehicles.

Business Top Expenses Spreadsheet

The Top Expenses tab of our financial model template provides a comprehensive overview of annual expenditures, categorized into four essential groups. This detailed cost structure analysis facilitates a bottom-up approach, allowing you to assess various expenses, such as customer acquisition and fixed costs. By understanding the foundations of your spending, you can optimize operational expenses and enhance manufacturing efficiency metrics. This strategic oversight ultimately supports financial sustainability in the EV industry, ensuring effective capital expenditure planning and robust profit margin forecasting. Gain control over your finances to effectively navigate the automotive supply chain management landscape.

EV MANUFACTURING FINANCIAL PROJECTION EXPENSES

Costs

Establishing a robust financial model is crucial for any EV manufacturing venture. Start-up costs accumulate prior to operations, necessitating early monitoring. Our EV manufacturing proforma business plan template is designed to streamline your capital expenditure planning, offering a clear breakdown of funding and expenses. This organized framework supports effective cost structure analysis, enabling you to manage operational expenses and budget accurately. By leveraging this tool, you can enhance your profitability forecasting and ensure financial sustainability in the electric vehicle industry, ultimately optimizing your investment analysis for maximum return.

CAPEX Spending

A company's initial startup costs reflect its financial commitment to enhancing business performance through capital expenditure planning. This encompasses investments in new equipment and innovative management approaches aimed at driving manufacturing efficiency and optimizing the automotive supply chain. These funds not only facilitate product expansion but are also crucial for financial sustainability in the EV industry. Capital expenditures appear on the pro forma balance sheet as depreciation over time, highlighting the long-term value of investment analysis for electric vehicles and the strategic importance of asset management in achieving favorable profit margin forecasting.

Loan Financing Calculator

Start-ups and emerging businesses must expertly navigate their loan repayment schedules, detailing amounts, maturity terms, and other specifics. This plan is integral to cash flow analysis, influencing projections and operational expenses. Interest payments on debt impact cash flow forecasts, while closing debt levels appear on projected balance sheets. Additionally, principal repayments feature prominently in cash flow projections, ensuring effective financial sustainability. Careful capital expenditure planning and cost structure analysis further enhance revenue projections for electric vehicles, optimizing supply chain management and refining market pricing strategies in the rapidly evolving EV landscape.

EV MANUFACTURING EXCEL FINANCIAL MODEL METRICS

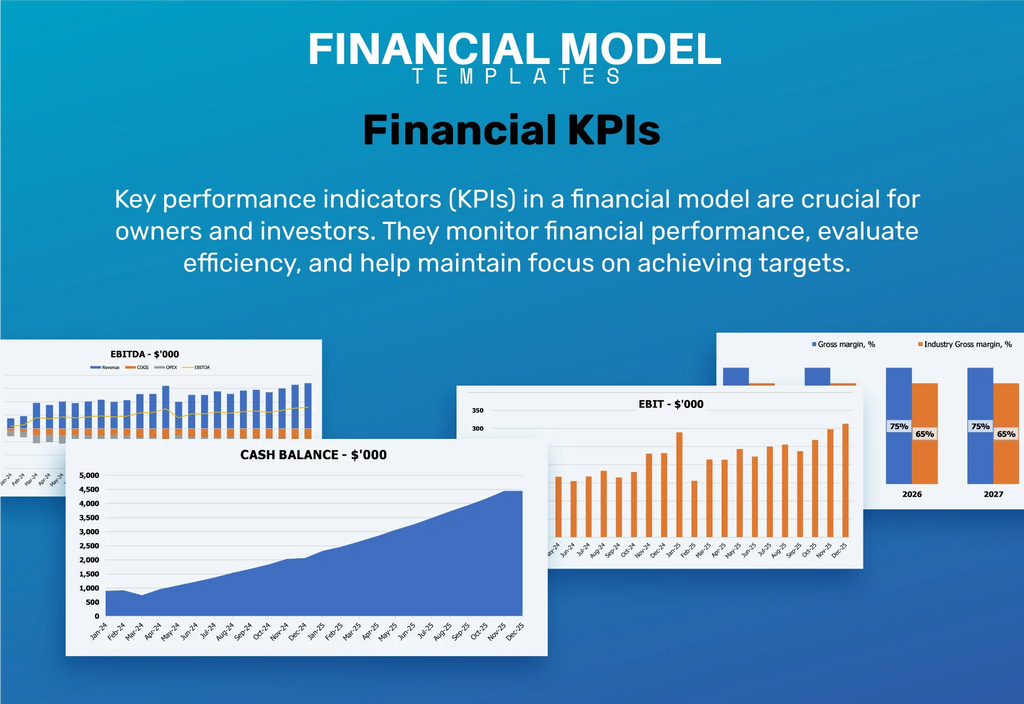

Financial KPIs

Operating income, represented as EBIT (Earnings Before Interest and Taxes), serves as a vital profitability metric within the EV manufacturing financial model. By subtracting operational expenses, including cost of sales, interest payments, and taxes, EBIT provides a clear view of a company's profit-generating potential. This metric is essential for cost structure analysis and profit margin forecasting, allowing businesses to assess financial sustainability and optimize their automotive supply chain management. Understanding EBIT enables effective capital expenditure planning and investment analysis, ultimately supporting revenue projections for electric vehicles and enhancing overall manufacturing efficiency.

Cash Flow Forecast Excel

Profit generation is a fundamental objective for any business. The cash flow proforma serves as a crucial financial statement, detailing how effectively a company maneuvers its cash inflows. By analyzing electric vehicle production costs and operational expenses, businesses can assess their cost structure and optimize supply chain management. This evaluation enables accurate revenue projections for EVs, informs investment analysis, and supports capital expenditure planning. Ultimately, a robust cash flow analysis enhances financial sustainability, allowing companies to forecast profit margins and assess financial risks in the dynamic electric vehicle industry.

KPI Benchmarks

The financial model for EV manufacturing incorporates benchmark key indicators to assess company performance. By comparing average values of these metrics with industry peers, we conduct a thorough performance evaluation. This comparative analysis proves essential for startups, guiding strategic planning and enhancing financial sustainability in the EV sector. Leveraging insights from market demand estimation and cost structure analysis, businesses can optimize supply chain management and enhance profitability. These key performance indicators are critical for informed decision-making, enabling effective investment analysis and facilitating efficient capital expenditure planning for electric vehicle production.

P&L Statement Excel

In the context of EV manufacturing, a well-structured financial model is pivotal for assessing profitability and sustainability. The zero-based budget spreadsheet showcases critical metrics such as revenue projections for EVs, capital expenditure planning, and operational expenses. Without meticulous preparation of this report, even substantial revenues can obscure the true financial health of the business. Comprehensive analysis, including cost structure and profit margin forecasting, ensures that companies can effectively navigate automotive supply chain management and achieve positive outcomes, thereby solidifying their position in the growing electric vehicle market.

Pro Forma Balance Sheet Template Excel

The projected balance sheet template serves as a vital financial tool, summarizing an entity's total assets, liabilities, and equity at a specific time. Our 5-year forecast in Excel highlights essential insights for EV manufacturing, focusing on capital expenditure planning, revenue projections, and cost structure analysis. By comparing historical data, it enables precise market demand estimation and supports financial sustainability in the electric vehicle industry. This template aids in break-even analysis, investment analysis, and working capital assessments, ultimately enhancing automotive supply chain management and operational efficiency metrics for informed decision-making.

EV MANUFACTURING FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our EV manufacturing business plan financial template equips you with essential tools for accurate valuation. It features two sophisticated forecasting methods: discounted cash flow (DCF) analysis and weighted average cost of capital (WACC) calculations. By integrating these approaches, you can effectively assess market demand estimation, revenue projections for EVs, and investment analysis for electric vehicles. This comprehensive model enhances cost structure analysis and aids in supply chain optimization, ultimately supporting your journey toward financial sustainability in the thriving EV industry.

Cap Table

A cap table is essential for startups and companies to assess their equity structure and analyze securities distribution among investors. It aids in calculating shares based on monetary contributions, which is crucial for strategic decision-making. Understanding the implications of investment analysis, market demand estimation, and capital expenditure planning on financial sustainability enhances profitability. By integrating operational expenses in EV production with revenue projections for EVs, companies can optimize their cost structure and profitability forecasting, ensuring a robust financial framework that supports manufacturing efficiency and supply chain optimization in the dynamic electric vehicle industry.

KEY FEATURES

A robust EV manufacturing financial model enhances profitability forecasting and optimizes capital expenditure, driving sustainable growth in the electric vehicle industry.

Elevate your investment strategy with our strategic EV manufacturing financial model, optimizing costs and enhancing revenue projections for sustained growth.

A robust financial model enhances revenue projections and investment analysis, crucial for attracting external stakeholders like banks.

A robust EV manufacturing financial model enhances investment analysis and profitability by optimizing cost structures and forecasting revenue effectively.

A robust EV manufacturing financial model enhances revenue projections, optimizes supply chain management, and ensures financial sustainability in the industry.

The EV manufacturing financial model streamlines report generation, simplifying capital expenditure planning and enhancing financial sustainability in the industry.

A robust EV manufacturing financial model enhances market demand estimation and operational efficiency, saving time and reducing costs significantly.

The EV manufacturing financial model streamlines planning, empowering startups to focus on growth without complex technical barriers.

The financial model enhances revenue projections for EVs, ensuring informed decision-making and improved operational efficiency in manufacturing.

A cash flow forecasting model empowers EV manufacturers to optimize financial sustainability by analyzing payment patterns and enhancing cash flow management.

ADVANTAGES

A robust EV manufacturing financial model enables precise revenue projections and cost structure analysis, attracting investors for sustainable growth.

The ev manufacturing financial model simplifies cash flow forecasting, enhancing decision-making for sustainable growth in the electric vehicle industry.

Leverage the financial model for accurate revenue projections and optimized capital expenditure planning in electric vehicle manufacturing.

The financial model enhances investment analysis for electric vehicles, ensuring optimal cash balance management and minimizing potential shortfalls in production.

The three-way financial model enhances forecasting accuracy, ensuring sustainable cash flow management for electric vehicle manufacturing.