Customs Brokerage Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Customs Brokerage Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

customs brokerage Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CUSTOMS BROKERAGE FINANCIAL MODEL FOR STARTUP INFO

Highlights

The customs brokerage business plan excels in providing comprehensive financial modeling over a five-year period, specifically tailored for companies in the customs brokerage services niche. This template is beneficial for both startups and established customs brokerage firms, enabling them to effectively evaluate startup ideas, manage pre-launch expenses, and secure funding from banks, angel investors, and venture capitalists. By incorporating elements such as customs compliance costs, tariff classification strategies, and trade regulations compliance, this customizable financial plan aids in developing strong brokerage revenue streams and optimizing logistics costs. Additionally, it facilitates robust import export financial analysis and supports risk management in customs, ensuring that businesses navigate international trade finance efficiently while adhering to customs duties and taxes regulations.

The customs brokerage Excel financial plan template addresses critical pain points for buyers by offering an integrated solution for effective customs compliance costs management, allowing users to streamline operations related to trade regulations compliance and optimize logistics costs. This tool enables accurate import-export financial analysis and supports tariff classification strategies, ultimately improving customs duties and taxes management. With a focus on risk management in customs, the template incorporates features for customs audits and assessments, enhancing accountability and transparency in cross-border trade financials. Furthermore, its brokerage financial forecasting capabilities aid in establishing a clear customs brokerage pricing structure and identifying potential revenue streams, while the operations financial modeling aspect ensures users can effectively evaluate customs valuation methodologies and implement sound trade finance solutions.

Description

Our customs brokerage financial model is expertly crafted to empower your decision-making through precise reporting and analysis, encompassing important aspects such as customs compliance costs, tariff classification strategies, and logistics cost optimization. This comprehensive template facilitates import export financial analysis and integrates essential elements like brokerage revenue streams and freight forwarding financial models, enabling you to evaluate cross-border trade financials effectively. By focusing on trade regulations compliance and risk management in customs, our solution not only supports your operational financial modeling but also helps in understanding customs duties and taxes, ensuring you remain compliant while minimizing costs associated with customs audits and assessments. Ultimately, our customs brokerage services are geared towards enhancing your financial forecasting and supporting sustainable growth in the international trade finance landscape.

CUSTOMS BROKERAGE FINANCIAL MODEL REPORTS

All in One Place

Our customizable business plan financial projections template offers a robust solution tailored for diverse enterprises. Whether you're navigating customs brokerage services, optimizing logistics costs, or ensuring compliance with trade regulations, this flexible tool adapts seamlessly to your requirements. With the ability to add or remove assumptions, you can precisely align it with your operations. For seasoned Excel users, our five-year financial projection empowers you to model key metrics, whether you're focused on customs compliance costs or developing trade finance solutions. Streamline your cross-border trade financials and bolster your brokerage revenue streams with ease.

Dashboard

Unlock insights into your company's financial future with our intuitive dashboard, featuring a comprehensive five-year financial projection template. This tool enhances your import-export financial analysis, ensuring optimal customs brokerage services and logistics cost optimization. Share projections with stakeholders to gain support for tariff classification strategies that minimize customs duties and taxes. Leverage our trade finance solutions to automate customs compliance costs while adhering to trade regulations compliance. With robust operations financial modeling, you’ll enhance risk management in customs and strengthen your cross-border trade financials. Elevate your customs brokerage pricing structure and maximize revenue streams today.

Business Financial Statements

To craft an effective startup financial model, ensure it encompasses crucial components such as customs brokerage services, tariff classification strategies, and logistics cost optimization. An intuitive design is vital for clear communication, particularly when presenting to stakeholders. Incorporate financial metrics for customs, customs compliance costs, and brokerage revenue streams to ensure comprehensive analysis. Additionally, highlight trade finance solutions and risk management in customs to guide decision-making. This structured approach not only aids in customs audits and assessments but also optimizes cross-border trade financials, enhancing overall supply chain financial management.

Sources And Uses Statement

The sources and uses table in the financial model template provides a clear overview of capital origins (Sources) and expenditures (Uses), ensuring that total sources match total uses. This statement is essential for businesses engaged in customs brokerage services, especially during recapitalization, restructuring, or mergers & acquisitions (M&A). It aids in effective financial forecasting, offering insights into customs compliance costs, tariff classification strategies, and logistics cost optimization, ultimately enhancing supply chain financial management and aligning with trade regulations compliance. Leverage this tool for informed decision-making and streamlined cross-border trade financials.

Break Even Point In Sales Dollars

Utilizing a break-even graph in Excel enables clear visualization of profit potential across varying sales levels, essential for informed decision-making. Additionally, understanding the safety margin is crucial; it reflects the buffer a business has against downturns before facing losses. Integrating this analysis into your supply chain financial management, customs brokerage services, and import-export financial analysis lays the foundation for effective risk management in customs. This approach enhances your operational financial modeling, ensuring compliance with trade regulations while optimizing logistics costs and maximizing brokerage revenue streams.

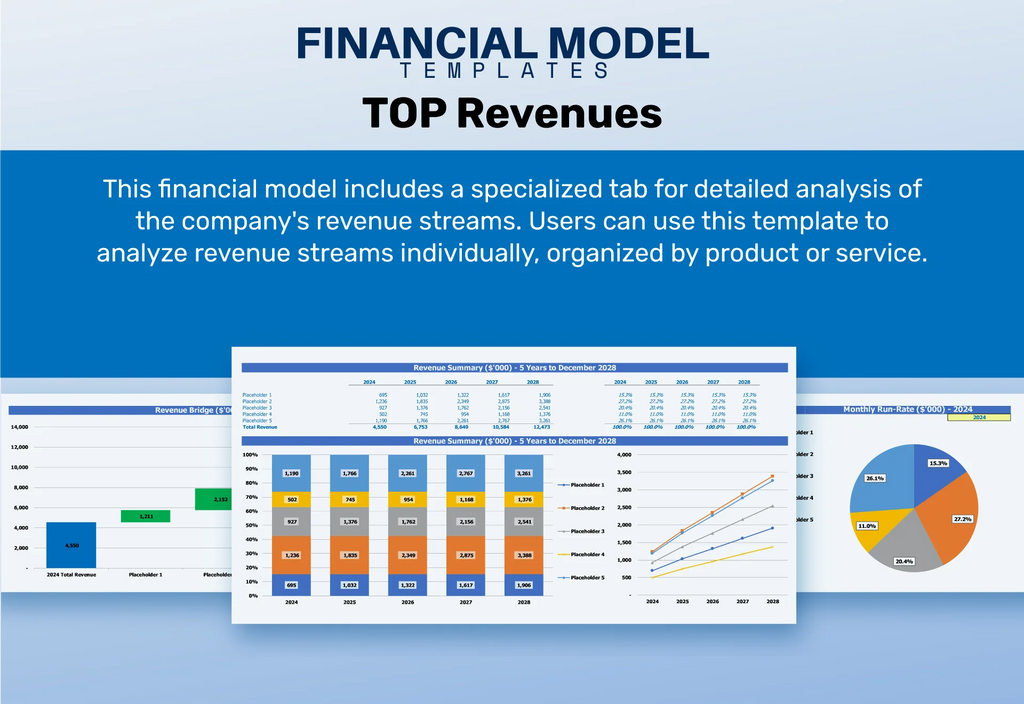

Top Revenue

In the realm of international trade finance, the top line represents a company's gross sales, while the bottom line reflects profits. Investors closely monitor these key financial metrics, such as customs brokerage services and logistics cost optimization, to gauge performance. 'Top-line growth' indicates an increase in revenues, signaling potential improvements in customs compliance costs and supply chain financial management. Effective tariff classification strategies and risk management in customs can further enhance profitability, making it crucial for businesses to focus on accurate financial analysis and robust customs valuation methodologies to thrive in a dynamic market.

Business Top Expenses Spreadsheet

Understanding customs compliance costs is essential for enhancing your Profit Loss Projection. By categorizing expenditures into four key areas, including annual customer acquisition costs, your financial forecasting becomes more precise. This structured approach encompasses all fixed and variable costs, including employee salaries. Incorporating customs brokerage services and logistics cost optimization further refines your operations financial modeling. By analyzing import-export financials and aligning them with tariff classification strategies, your company can effectively manage customs duties and taxes while maximizing revenue streams. This strategic framework supports compliance with trade regulations and enhances your overall financial health.

CUSTOMS BROKERAGE FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs play a vital role in accurate financial forecasting for any venture, especially in customs brokerage services. Our startup financial model template offers a streamlined proforma that allows businesses to monitor customs compliance costs and effectively manage cash flow. By regularly tracking these financial metrics, you can optimize logistics costs and mitigate risks associated with customs audits and assessments. This proactive approach enhances your brokerage revenue streams and ensures adherence to trade regulations compliance, positioning your business for sustainable growth in the competitive landscape of international trade finance.

CAPEX Spending

A company's startup budget reflects its financial commitment to enhancing business performance through strategic investments. This often includes expenditure on new equipment and the adoption of advanced management and analysis methodologies. These funds facilitate the expansion of products and services, ultimately bolstering competitive positioning in the market. Capital expenditures appear on the pro forma balance sheet, represented as depreciated assets over time. By focusing on customs brokerage services and logistics cost optimization, businesses can improve their operations financial modeling and identify new brokerage revenue streams, ensuring robust growth in cross-border trade financials.

Loan Financing Calculator

Our startup financial plan features an integrated loan amortization schedule, utilizing advanced formulas for clarity and precision. This tool enables you to effortlessly distinguish between loan principal and interest calculations. Instantly see your company's obligations with detailed breakdowns of principal repayments, interest payments, and repayment frequency. By incorporating these elements, we enhance financial metrics for customs and optimize your logistics cost optimization strategy. This comprehensive approach supports informed decision-making in international trade finance and risk management in customs, ensuring compliance with trade regulations while maximizing efficiency in cross-border trade financials.

CUSTOMS BROKERAGE EXCEL FINANCIAL MODEL METRICS

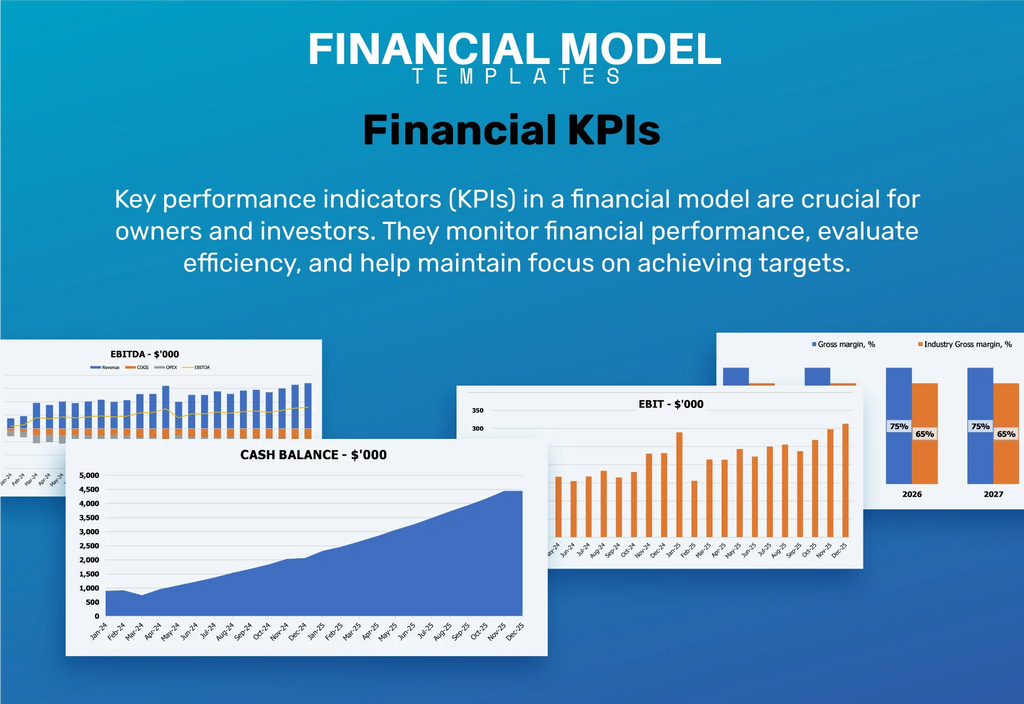

Financial KPIs

Return on investment (ROI) is a critical financial metric utilized in operations financial modeling, particularly for customs brokerage services. It measures the relationship between cash inflows and outflows associated with investment activities. By analyzing gains from net investments against total investment costs, businesses can optimize customs compliance costs and enhance their brokerage revenue streams. This invaluable insight supports effective risk management in customs and aids in logistics cost optimization, ultimately fostering sustainable trade finance solutions and improved international trade finance strategies.

Cash Flow Forecast Excel

Effective cash flow projections are essential for managing financial forecasting in customs brokerage services. A robust financial model demonstrates your ability to optimize cash streams, ensuring sufficient liquidity to meet liabilities, including customs duties and taxes. Banks seek confidence in your operations financial modeling, emphasizing that your analysis must provide assurance of adequate funds to cover loan obligations. Prioritizing customs compliance costs and implementing tariff classification strategies can enhance trade finance solutions, strengthening your position in international trade finance and minimizing risk in customs. Cultivating these financial metrics is crucial for successful cross-border trade financials.

KPI Benchmarks

The projected cash flow statement's benchmark tab provides essential key performance indicators (KPIs) for comparative analysis in customs brokerage services and international trade finance. These financial metrics enable businesses to assess their positioning against industry standards, particularly in customs compliance costs and tariff classification strategies. For startups, this benchmarking process delivers valuable insights into best practices within cross-border trade financials, aiding strategic planning and operations financial modeling. By leveraging these insights, companies can optimize logistics costs, enhance risk management in customs, and refine their customs brokerage pricing structure for sustainable growth.

P&L Statement Excel

Crafting a monthly profit and loss forecast is essential for any robust financial model, particularly within customs brokerage services. This crucial step lays the foundation for five-year projections, driving insights into customs compliance costs, operations financial modeling, and brokerage revenue streams. Accurate forecasting impacts your pro forma balance and cash flow statements, enabling effective risk management in customs and fostering trade finance solutions. By integrating these financial metrics, businesses can optimize logistics cost and enhance overall international trade finance outcomes, ensuring compliance with trade regulations and customs duties effectively.

Pro Forma Balance Sheet Template Excel

A projected balance sheet is crucial for any five-year forecast in international trade finance. It seamlessly integrates with the profit and loss statement and cash flow model, offering insights into customs brokerage services and compliance costs. While income statements draw investor interest, the balance sheet helps assess profitability ratios like return on equity and return on invested capital. This financial analysis is essential for effective customs compliance, risk management, and logistics cost optimization, ultimately refining supply chain financial management and enhancing cross-border trade financials. Understanding these metrics ensures informed decision-making and strategic growth.

CUSTOMS BROKERAGE FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This customs brokerage financial projections spreadsheet features a comprehensive valuation analysis tab. Users can perform a robust Discounted Cash Flow (DCF) valuation and efficiently compile critical financial metrics, including residual value, replacement costs, and market comparables. This tool supports effective customs compliance costs assessment and enhances logistics cost optimization strategies. By integrating these features, it empowers professionals to navigate international trade finance and refine their brokerage revenue streams while ensuring adherence to trade regulations compliance. Ultimately, this tool is essential for informed decision-making in cross-border trade financials and risk management in customs.

Cap Table

In the financial model, including a comprehensive cap table is essential for effective customs brokerage services. It details a company's securities—common stock, preferred stock, options, and warrants—clarifying ownership structures. This organization empowers business owners to make informed decisions regarding fundraising, employee equity options, and acquisition opportunities. By integrating import-export financial analysis and logistics cost optimization insights, companies can enhance their brokerage revenue streams and navigate customs compliance costs effectively. Maintaining accurate records ensures preparedness for customs audits and assessments, fostering robust risk management in customs and compliance with trade regulations.

KEY FEATURES

Our freight forwarding financial model enhances logistics cost optimization, ensuring efficient customs compliance and maximizing profitability in international trade.

Implementing a comprehensive customs brokerage financial model enhances decision-making and minimizes risk in cross-border trade operations.

Our logistics cost optimization financial model enhances customs compliance costs efficiency, delivering great value for money in international trade finance.

Utilize our proven customs brokerage financial projection model for clear insights, enhancing decision-making and optimizing profitability in international trade.

Effective logistics cost optimization through financial modeling enhances customs compliance, reduces duties, and boosts profitability in international trade.

Our detailed customs brokerage startup costs spreadsheet enhances financial forecasting accuracy, streamlining customs compliance and optimizing logistics cost management.

Our freight forwarding financial model optimizes customs compliance costs, enhancing profitability and streamlining operations for international trade finance.

Our comprehensive financial model optimizes customs brokerage pricing structures, enhancing profitability and ensuring compliance in international trade finance.

Implementing a robust freight forwarding financial model enhances logistics cost optimization and streamlines customs compliance for international trade.

A robust financial model empowers businesses to optimize cash flow through scenario analysis, enhancing strategic decision-making in customs brokerage.

ADVANTAGES

Evaluate asset acquisitions using a customs brokerage profit-loss projection to optimize financial performance and ensure compliance with trade regulations.

Documenting your customs brokerage revenue model enhances financial forecasting accuracy and optimizes customs compliance costs in international trade.

Implementing a robust financial model enhances customs brokerage services by optimizing logistics costs and improving customs compliance management.

A robust financial model optimizes customs brokerage pricing, ensuring adequate cash flow for suppliers and employees in international trade.

An effective freight forwarding financial model enhances logistics cost optimization and supports informed decision-making in international trade finance.