CRM Software Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

CRM Software Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

crm software Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CRM SOFTWARE FINANCIAL MODEL FOR STARTUP INFO

Highlights

Generate a comprehensive 5-year CRM software financial projection model that includes cash flow statements, a financial dashboard, and core metrics formatted in GAAP/IFRS. This template facilitates investment analysis for CRM software, enabling a clearer understanding of total cost of ownership and potential ROI calculation. Leverage customer relationship management analytics to enhance financial forecasting in CRM, optimize your profit margins, and assess customer lifetime value. Explore different pricing models, including feature-based and subscription pricing for CRM, to ensure you choose the best option for your business. Use the CRM software comparison tools to gauge the financial performance metrics and sales pipeline financial modeling needed to drive CRM revenue growth and effectively manage customer acquisition costs, leading to improved profitability analysis for CRM solutions that align with your strategic goals. This editable template is designed to help you secure funding from banks, angels, grants, and VC funds.

The financial model overview streamlines the process of financial forecasting in CRM by offering an adaptable framework that addresses critical pain points such as CRM implementation costs and customer acquisition costs. With the integration of customer relationship management analytics, users can easily conduct profitability analysis for CRM, allowing for a clear understanding of customer lifetime value and total cost of ownership in CRM. This model also simplifies the complexities of CRM software pricing models, enabling effective investment analysis and helping users derive accurate CRM software ROI calculations. Moreover, the feature-based pricing for CRM and subscription pricing structures are clearly delineated, facilitating informed comparisons of cloud-based CRM solutions. By leveraging predictive analytics in CRM and sales pipeline financial modeling, users can enhance their financial performance metrics and make data-driven decisions that support sustainable CRM revenue growth.

Description

Our CRM software financial model provides robust financial forecasting in CRM, enabling businesses to make informed decisions based on accurate reporting and analytics. This comprehensive template facilitates a clear CRM software pricing model, illustrating investment analysis for CRM software, and incorporates parameters for subscription pricing and feature-based pricing for CRM solutions. With a focus on customer lifetime value in CRM and profitability analysis for CRM, our tool enables users to calculate CRM software ROI and assess customer acquisition costs effectively. Additionally, users can engage in financial modeling for SaaS, conduct a CRM software comparison, and derive financial projections to support cloud-based CRM solutions, ultimately enhancing CRM revenue growth models and assessing total cost of ownership in CRM for improved financial performance metrics.

CRM SOFTWARE FINANCIAL MODEL REPORTS

All in One Place

Designing a financial model for your CRM software startup doesn’t require expert knowledge. With the right tools, you can effectively assess CRM software pricing models, analyze customer acquisition costs, and project financial performance metrics. Our comprehensive CRM startup pro forma template equips you with essential features, enabling you to conduct profitability analysis and refine your sales pipeline financial modeling. Unlock insights into customer lifetime value, revenue growth models, and financial forecasting in CRM, ensuring your business scales successfully in today’s competitive landscape. Embrace data-driven decision-making with our user-friendly solution.

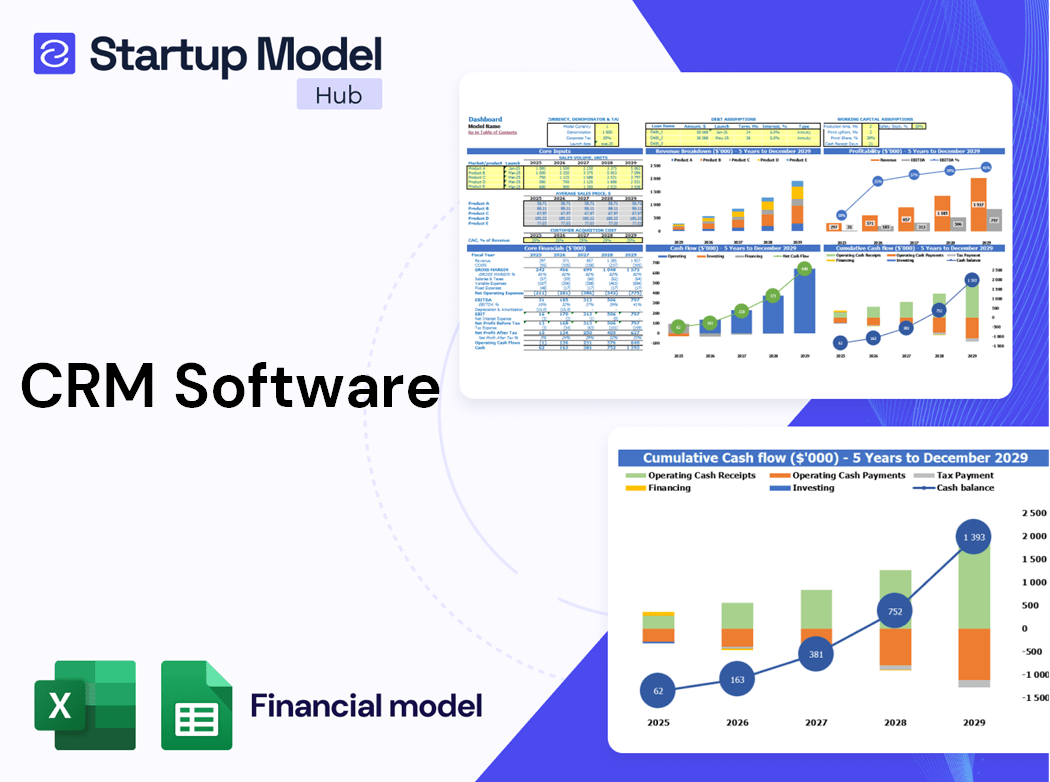

Dashboard

The Dashboard tab offers a comprehensive overview of financial indicators, including engaging graphs, insightful ratios, and dynamic charts. These visualizations provide essential startup financial statements, effortlessly facilitating your financial forecasting in CRM. Utilize these tools for in-depth profitability analysis, focusing on key metrics like customer lifetime value and acquisition costs. With our CRM software comparison, you can assess various pricing models, ensuring you select the most effective cloud-based CRM solution to drive revenue growth and optimize your investment analysis. Prepare your CRM financial projections for informed decision-making and enhanced financial performance.

Business Financial Statements

This Excel financial model template seamlessly integrates three essential business statements: the profit and loss statement, projected balance sheet, and cash flow statement. Spanning five years, this comprehensive tool not only links all financial data inputs from multiple spreadsheets but also enhances your financial forecasting in CRM. By utilizing this model, you can conduct profitability analysis for CRM, calculate CRM software ROI, and evaluate total cost of ownership. Perfect for those seeking to optimize CRM software pricing models and drive revenue growth through effective financial modeling.

Sources And Uses Statement

The five-year projection template includes a comprehensive sources and uses table, detailing capital sources alongside corresponding expenditures. This balanced approach simplifies financial modeling for SaaS, ensuring clarity in tracking investment analysis for CRM software. Essential for both internal and external stakeholders, this chart is particularly valuable during refinancing, restructuring, or mergers and acquisitions (M&A) scenarios. By focusing on these financial performance metrics, organizations can enhance their customer relationship management analytics and ultimately drive CRM revenue growth while optimizing customer lifetime value and acquisition cost.

Break Even Point In Sales Dollars

Our financial model template offers a comprehensive proforma, including a break-even revenue calculator. Companies leverage break-even analysis to establish optimal pricing strategies, ensuring that revenue meets or exceeds expenses. By integrating financial forecasting and predictive analytics in CRM, businesses can refine their customer relationship management analytics to maximize profitability. This approach not only aids in calculating CRM software ROI but also enhances understanding of customer lifetime value, ultimately supporting sustainable growth in CRM revenue and improving overall financial performance metrics.

Top Revenue

In financial forecasting, the top line represents a company's gross sales, while the bottom line reflects net earnings. Investors scrutinize these metrics closely, tracking fluctuations quarterly and annually. Growth in the top line signals an increase in revenues, driving positive impacts on overall financial performance. For organizations leveraging CRM software, understanding customer lifetime value, customer acquisition costs, and the ROI of CRM investments is vital. Effective use of predictive analytics can enhance sales pipeline modeling, inform profitability analysis, and support informed decision-making in CRM implementation, ultimately contributing to sustainable revenue growth and improved financial projections.

Business Top Expenses Spreadsheet

Our financial model template features a dedicated tab for basic expenses, categorized into four distinct areas. This structured approach allows for clearer insights into your CRM software implementation costs and overall financial projections. The remaining expenses are systematically classified as "other," enabling easy tracking and analysis. By utilizing this template, you can streamline your investment analysis for CRM software, ensuring accurate financial forecasting and a comprehensive understanding of your customer acquisition costs and lifetime value. Empower your decision-making process with our user-friendly financial modeling for SaaS solutions.

CRM SOFTWARE FINANCIAL PROJECTION EXPENSES

Costs

Incorporating a strategic financial forecasting template enhances your CRM software investment. This tool enables businesses to analyze current and projected expenditures, ensuring effective budgeting and prioritization of funds. A comprehensive three-way financial model aids in evaluating overall CRM software ROI calculation, supporting long-term profitability analysis. By aligning your cost budget with your business plan, you enhance communication with potential investors and creditors. Moreover, understanding customer acquisition cost and customer lifetime value in CRM helps in refining your financial projections, ultimately driving revenue growth through informed decision-making and efficient allocation of resources.

CAPEX Spending

This financial projection model template offers a comprehensive solution for automatic calculations of capital expense budgets and funding strategies. Utilizing a detailed cash flow waterfall, it incorporates various equity and debt tranches with flexible funding priorities. By integrating predictive analytics and financial modeling techniques, this template enhances your investment analysis for CRM software, helping assess potential ROI and total cost of ownership. Moreover, it aligns with CRM software pricing models, ensuring informed decisions that optimize customer lifetime value and revenue growth. Experience streamlined financial forecasting and profitability analysis tailored for cloud-based CRM solutions.

Loan Financing Calculator

Start-ups and growing businesses must effectively manage their loan repayment schedules, detailing amounts, maturity terms, and other key factors. Integrating this loan payback plan into cash flow analysis is crucial, as interest expenditures directly influence cash flow budgeting and financial forecasting. Additionally, the closing debt level appears in the pro forma balance sheet. By utilizing CRM software that includes financial forecasting, companies can enhance their cash flow projections and overall financial performance metrics. This holistic approach not only aids in managing debt but also contributes to informed investment analysis and improved customer acquisition strategies.

CRM SOFTWARE EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The gross margin ratio (GPM) quantifies a company's profitability by expressing gross margin as a percentage of net sales. Calculated by dividing gross profit by net sales, GPM serves as a critical financial performance metric in customer relationship management (CRM). Understanding GPM aids in effective financial forecasting in CRM, allowing businesses to enhance investment analysis for CRM software and optimize their sales pipeline through predictive analytics. By monitoring this ratio, organizations can make informed decisions to improve their CRM software ROI and drive sustainable revenue growth.

Cash Flow Forecast Excel

In today's financial landscape, a robust cash flow forecasting model is essential for effective financial management. Utilizing advanced analytics, businesses can achieve accurate insights into cash inflows and outflows. By integrating customer relationship management (CRM) analytics with financial forecasting, companies can enhance their profitability analysis and improve their CRM software ROI calculations. This strategic approach not only optimizes cash flow but also facilitates better investment analysis and long-term financial projections, ultimately driving revenue growth and maximizing customer lifetime value. Embrace cloud-based CRM solutions for a comprehensive view of your financial performance metrics.

KPI Benchmarks

The financial benchmarking study tab in this startup costs template enables businesses to evaluate performance against industry averages. By leveraging customer relationship management analytics, companies can identify areas for improvement in their CRM software ROI calculation. This thorough analysis highlights productivity metrics and informs strategic decisions, allowing businesses to optimize CRM implementation costs and enhance customer lifetime value. Ultimately, utilizing benchmarking methods empowers business owners to set new operational standards and address shortcomings, facilitating rapid progress with minimal financial impact. Every entrepreneur should embrace benchmarking as a critical component of their growth strategy.

P&L Statement Excel

To make informed decisions, utilizing a reliable projected P&L statement template is essential for effective financial forecasting in CRM. This tool enables a thorough analysis of your business's financial performance metrics, helping you identify strengths and weaknesses. By integrating predictive analytics, you can enhance your CRM software ROI calculation and optimize customer acquisition costs. Implementing these strategies leads to better customer lifetime value and a deeper understanding of your sales pipeline. Ultimately, this empowers you to boost revenue growth and make sound investment choices regarding CRM software solutions.

Pro Forma Balance Sheet Template Excel

The comprehensive 5-year financial projection integrates your pro forma cash flow, projected income statement, and essential inputs, offering a holistic view of your current financial model. This includes an analysis of assets, liabilities, and equity accounts, ensuring informed decision-making. Utilizing customer relationship management analytics and financial forecasting in CRM enhances your understanding of customer lifetime value and acquisition costs. By evaluating the total cost of ownership in CRM and conducting a profitability analysis, you can optimize your CRM software ROI calculation, driving revenue growth and strategic financial modeling for your SaaS business.

CRM SOFTWARE FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This CRM software startup's financial plan integrates two robust valuation methods: discounted cash flow (DCF) and weighted average cost of capital (WACC). These methodologies empower businesses to generate accurate financial projections, enhancing investment analysis and overall financial performance metrics. By utilizing these approaches, organizations can effectively assess their customer acquisition costs and the total cost of ownership in CRM. This strategic financial modeling not only supports profitability analysis but also aids in driving revenue growth through informed decision-making and predictive analytics within the customer relationship management landscape.

Cap Table

The five-year financial projection template, featuring an equity cap table, is crucial for startups. It provides a comprehensive view of the company's ownership structure, detailing equity shares, preferred shares, options, and stakeholders' investment amounts. This tool is essential for performing profitability analysis for CRM software, aiding in CRM software pricing models, and enhancing financial forecasting in CRM. With insights from customer relationship management analytics, startups can effectively evaluate customer lifetime value in CRM, ensuring strategic decision-making that drives revenue growth and optimizes CRM implementation costs.

KEY FEATURES

Implementing a robust financial model for CRM enhances decision-making by accurately forecasting costs and driving profitable customer relationships.

A robust financial modeling for SaaS empowers you to optimize CRM software ROI, enhancing focus on products and customer growth.

A robust financial model for CRM software empowers you to effectively demonstrate repayment capability for the loan you requested.

Utilizing financial forecasting in CRM enhances loan approval chances by clearly demonstrating repayment plans and strengthening your financial credibility.

Optimize your CRM strategy with predictive analytics, enhancing customer lifetime value and enabling informed financial decision-making for sustained growth.

A comprehensive financial model enhances CRM software ROI calculation and profitability analysis, ensuring informed decision-making for revenue growth.

Implementing a robust financial model enhances CRM software ROI calculation, ensuring informed decisions and maximizing profitability for investors.

Unlock investor interest effortlessly with a CRM software financial projection plan that showcases your business's growth potential.

Implementing a robust financial model enhances confidence in CRM software ROI and accurately projects future profitability and revenue growth.

Our financial model empowers you to effectively plan and forecast cash flow, ensuring strategic growth and risk management.

ADVANTAGES

Utilizing a robust financial model enhances CRM software ROI calculations, providing valuable insights for external stakeholders like banks.

Implementing a robust financial model in CRM enables accurate predictions of cash flow, enhancing financial stability and decision-making.

Effective financial modeling for CRM empowers businesses to accurately forecast revenue growth and optimize customer acquisition costs.

A comprehensive financial model highlights your ability to repay loans, enhancing confidence in your CRM software investment.

Reduce risk by leveraging CRM software financial modeling to enhance decision-making and optimize customer acquisition costs effectively.