Commercial Office Building Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Commercial Office Building Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

commercial office building Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

COMMERCIAL OFFICE BUILDING FINANCIAL MODEL FOR STARTUP INFO

Highlights

A sophisticated five-year financial projection model for commercial real estate office buildings is essential, regardless of your project's size or development stage. This office building investment analysis requires minimal previous financial planning experience and basic Excel skills, making it accessible for quick and reliable results. Utilizing an office space valuation model before purchasing a commercial property can guide your investment return calculations, ensuring you assess property cash flow projections, tenant income analysis, and operating expenses effectively. Consider employing a commercial property financing template to streamline your financial forecasting for commercial properties and improve your office portfolio performance metrics through comprehensive rent roll analysis and financial risk assessment in real estate. Unlock the potential of your investment with robust real estate capital budgeting tools and property development financial planning resources, allowing for an informed decision-making process.

The commercial office building financial model template addresses key pain points for investors and property managers by offering comprehensive tools for office building investment analysis that streamline cash flow projections and operating expense assessments. This ready-made Excel model simplifies the process of tenant income analysis and rent roll evaluation, enabling users to conduct detailed office leasing financial analysis with ease. With built-in capabilities for financial forecasting and performance metrics, this template assists in investment return calculations while facilitating effective capital budgeting and financial risk assessment. The user-friendly interface features dynamic dashboards and customizable input tables, allowing for quick adjustments in property valuation techniques and market analysis, ultimately supporting informed decisions in commercial property financing and asset management.

Description

This comprehensive commercial real estate financial model is expertly designed for office building investment analysis, providing a dynamic framework for property cash flow projection and financial forecasting for commercial properties. The tool includes a 5-year projection of financial statements, such as an income and expenditure template, cash flow projection, and balance sheet forecast, alongside essential components like a break-even analysis and diagnostic sheets. It performs investment return calculations for office buildings using DCF (Discounted Cash Flow) and Free Cash Flow methodologies, ensuring accurate office space valuation models and robust revenue projections informed by tenant income analysis for offices. Additionally, the financial model evaluates commercial property operating expenses and delivers real estate investment performance metrics to guide strategic decisions, making it an invaluable asset for commercial asset management and office portfolio performance assessment.

COMMERCIAL OFFICE BUILDING FINANCIAL MODEL REPORTS

All in One Place

Are you evaluating the potential of your office building investment? Our comprehensive commercial real estate financial model equips you with the tools needed for thorough property cash flow projection and investment return calculations. Easily customize your projections with editable tables, enabling detailed office leasing financial analysis and tenant income assessment. Utilize our robust financial forecasting template to analyze various scenarios, optimize operating expenses, and enhance your office space market analysis. Ensure effective real estate capital budgeting and financial risk assessment with our user-friendly solution, setting the stage for your investment success.

Dashboard

A comprehensive business plan is essential for evaluating a company's potential success, serving as a roadmap for financial forecasting. It integrates key components, such as property cash flow projections and office building investment analyses, to provide an insightful view of real estate investment performance metrics. Utilizing dashboards that display automated updates on financial data enhances oversight and control, crucial for navigating commercial property financing. By leveraging tools like rent roll analysis and financial risk assessments, professionals ensure effective management of operating expenses and tenant income, ultimately driving informed decisions in office portfolio performance and capital budgeting.

Business Financial Statements

This three-way financial model template includes a comprehensive financial summary that consolidates key data from various spreadsheets, such as the projected five-year balance sheet, monthly profit and loss statement, and cash flow analysis. Perfect for commercial real estate investment analysis, this summary is designed for seamless integration into your pitch deck. Utilize it to enhance your office building investment strategy, showcasing property cash flow projections and financial forecasting for commercial properties. Its professional presentation is essential for communicating investment return calculations and supporting your real estate capital budgeting decisions.

Sources And Uses Statement

In today's competitive landscape, a comprehensive financial model is essential for successful commercial real estate investment. Utilizing a robust office building financial projection model ensures accurate cash flow projections while enabling meticulous investment return calculations. A well-structured rent roll analysis, combined with property valuation techniques, provides insights into office space market dynamics. Furthermore, employing financial forecasting tools aids in assessing commercial property operating expenses and tenant income analysis. Ultimately, effective commercial asset management hinges on transparent data, allowing for informed decision-making in property development financial planning.

Break Even Point In Sales Dollars

The Break-Even Analysis is crucial for office building investment analysis, as it identifies the point where total costs equal total revenue. Employing a financial forecasting model, companies can determine the optimal sales price for office space by calculating the contribution margin—sales price per unit minus variable costs. This metric significantly influences profitability and guides commercial real estate financial modeling. Understanding rent roll analysis and property cash flow projections allows firms to assess financial risk and investment return calculations, ultimately enhancing office portfolio performance metrics and capital budgeting strategies for more effective asset management.

Top Revenue

Explore our robust financial projection model for commercial real estate, showcased in the Profit Loss Projection Top Revenue tab. This comprehensive template offers a detailed annual breakdown of revenue streams, enabling you to conduct in-depth office building investment analysis. With features like revenue depth and revenue bridge, you can refine your property cash flow projection and enhance your investment return calculations. Utilize our commercial property financing template to elevate your real estate investment performance metrics and streamline your financial forecasting for commercial properties. Unlock the full potential of your office portfolio with our strategic insights.

Business Top Expenses Spreadsheet

The "Top Expenses" tab in our commercial real estate financial model offers a comprehensive breakdown of office building operating expenses, categorized for clarity. This sophisticated Excel template features an annual expense chart that highlights crucial costs tied to client acquisition and employee compensation. It seamlessly integrates fixed and variable costs, ensuring accurate property cash flow projections. Utilize this template for robust office space valuation and investment return calculations, enhancing your real estate investment performance metrics and financial forecasting for commercial properties. Elevate your office portfolio performance with meticulous financial planning and analysis.

COMMERCIAL OFFICE BUILDING FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive financial forecasting template for commercial real estate equips you to develop detailed office building investment analyses. This tool allows for in-depth property cash flow projections over 60 months, incorporating varied operating expenses and accounting treatments. Pre-built expense forecasting curves enhance your understanding of cost dynamics, illustrating expenses as a percentage of revenue. Easily categorize costs—such as COGS, fixed or variable expenses, and CAPEX—for streamlined office leasing financial analysis. Elevate your investment return calculations and tenant income analysis with our robust commercial property financing template, designed to optimize real estate capital budgeting and improve asset management performance.

CAPEX Spending

Capital expenditure (CapEx) plays a crucial role in commercial real estate financial models, particularly for office building investment analysis. A well-structured start-up budget allows businesses to effectively monitor investments in fixed assets, encompassing property, plant, and equipment (PPE). Key CapEx activities include managing depreciation and analyzing additions or disposals. Comprehensive calculations also reflect the impact of asset expansion on property cash flow projections. By integrating CapEx into your office space valuation model, you can enhance investment return calculations and ensure accurate financial forecasting for commercial properties, promoting informed decision-making in a competitive market.

Loan Financing Calculator

Our loan amortization schedule template efficiently tracks repayment schedules aligned with your financing terms. Integrated within our commercial real estate financial model, this tool features robust formulas to monitor each loan's details, including terms and repayment dates. It accommodates diverse loan structures—monthly, quarterly, or annually—making it ideal for comprehensive office building investment analysis. Leverage this template to enhance your property cash flow projection, ensuring accurate financial forecasting for commercial properties while streamlining your investment return calculations for office buildings. Achieve greater precision in your real estate capital budgeting with our dynamic solution.

COMMERCIAL OFFICE BUILDING EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Gross profit margin plays a vital role in the pro forma projection of commercial properties, serving as a key indicator of financial health. This ratio illustrates the gap between revenue and the cost of sales, making it essential for office building investment analysis and property cash flow projections. An improving gross profit margin signals better expense management or rising revenues, which benefits overall investment return calculations. Utilizing financial forecasting for commercial properties can enhance your office space valuation model, driving informed investment decisions and effective asset management strategies in today's competitive market.

Cash Flow Forecast Excel

A pro forma cash flow projection is essential for commercial real estate financial modeling, showcasing the cash movement within an office building investment. This spreadsheet effectively illustrates available cash balances for strategic development and liability management. Moreover, it highlights the efficiency of capital deployment and tenant income analysis, crucial for assessing investment return calculations. By incorporating financial forecasting for commercial properties, this tool aids in evaluating office space valuation and operating expenses, ultimately enhancing real estate investment performance metrics and fostering informed decision-making for asset management and property development financial planning.

KPI Benchmarks

This office building financial projection model includes a comprehensive comparative financial analysis tab, allowing for a detailed examination of investment performance metrics among similar companies. By evaluating property cash flow projections and operating expenses, clients gain valuable insights into their financial standing. The model facilitates informed decision-making through effective tenant income analysis for offices and robust rent roll analysis for commercial properties. Enhance your investment return calculations with this professional tool, ensuring strategic financial forecasting for commercial properties and optimizing office portfolio performance metrics. Embrace smart commercial asset management for your office space investments.

P&L Statement Excel

For investors in commercial real estate, an effective financial model is crucial. While profit and loss forecasts provide insights into potential profitability, they often omit critical details such as assets and liabilities that influence cash flow. To ensure comprehensive office building investment analysis, integrating tools like cash flow projections, tenant income analysis, and rent roll assessments is essential. These elements enhance financial forecasting and allow for accurate investment return calculations, ensuring that your commercial portfolio performs optimally and aligns with targeted metrics for success. Don’t overlook the importance of a holistic approach to property valuation and financial risk assessment.

Pro Forma Balance Sheet Template Excel

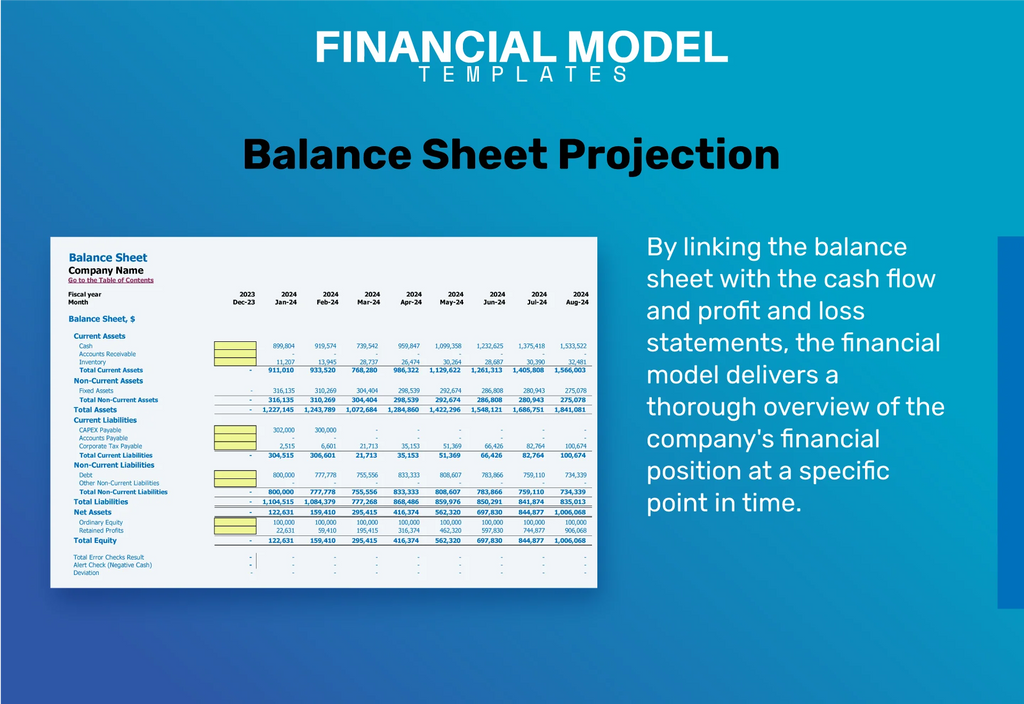

The Monthly and Yearly projected balance sheet, spanning five years in Excel format, seamlessly integrates with the projected cash flow statement, pro forma profit and loss statement, and essential inputs. This comprehensive startup costs template equips users with a holistic view of their commercial real estate financial model, detailing Assets, Liabilities, and Equity Accounts. By utilizing robust property cash flow projection and financial forecasting for commercial properties, investors can efficiently assess office building investment analysis, enhance tenant income analysis, and refine their investment return calculations for office buildings.

COMMERCIAL OFFICE BUILDING FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Unlock the potential of your office building investment with our commercial real estate financial model. Our comprehensive template offers all necessary data for investors, including detailed tenant income analysis and rent roll insights. Utilize our financial forecasting tools to determine WACC and assess investment return calculations for office buildings. Achieve accurate property cash flow projections and evaluate operating expenses to ensure optimal performance metrics. With our office space valuation model, stakeholders gain clear visibility into future cash flows, enabling informed decisions in commercial property financing and capital budgeting. Elevate your real estate strategy today!

Cap Table

An Equity Cap Table serves as a vital tool for evaluating the influence of stocks on a company's financial health. By systematically entering and analyzing data, it yields insightful metrics for commercial real estate financial modeling, including office building investment analysis and tenant income analysis for offices. This approach enhances financial forecasting for commercial properties, facilitating informed decisions on investment return calculations. Utilize property valuation techniques and commercial property financing templates to optimize your office space market analysis and bolster your office portfolio performance metrics, ensuring robust financial risk assessment in real estate.

KEY FEATURES

Unlock potential with our commercial real estate financial model, enabling precise cash flow projections and informed investment decisions.

Leveraging a commercial real estate financial model enhances decision-making by clearly illustrating potential cash flow impacts and investment outcomes.

Unlock accurate investment insights with our office building financial model, enhancing cash flow projections and maximizing returns over a five-year horizon.

Unlock insights with our integrated commercial office building financial model, enabling precise projections and informed investment decisions.

Unlock accurate investment return calculations for office buildings with our commercial real estate financial model, enhancing decision-making and profitability.

The office building investment analysis model enhances decision-making by providing accurate cash flow projections and investment return calculations.

Utilizing a commercial real estate financial model enhances investment return calculations, ensuring informed decisions for office building investments.

A comprehensive office building financial model enhances investment decision-making through accurate cash flow projections and robust performance metrics.

Utilizing a commercial real estate financial model enhances investment decision-making through accurate cash flow projections and scenario analysis.

A comprehensive commercial real estate financial model empowers investors to optimize cash flow and evaluate various investment scenarios effectively.

ADVANTAGES

The commercial real estate financial model enhances decision-making by providing accurate cash flow projections and investment return calculations for office buildings.

A comprehensive commercial real estate financial model enhances investment decision-making through accurate property cash flow projections and robust performance metrics.

Leverage our commercial real estate financial model to enhance investment return calculations and streamline your office building analysis.

The commercial real estate financial model enhances investment decision-making by providing accurate property cash flow projections and risk assessments.

The financial model enhances office building investment analysis by providing precise cash flow projections and insightful performance metrics for informed decisions.