Cocoa Processing Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Cocoa Processing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

cocoa processing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

COCOA PROCESSING STARTUP BUDGET INFO

Highlights

This five-year financial analysis cocoa industry model template is tailored for startups and entrepreneurs in the cocoa processing sector, designed to impress investors and secure funding. It includes essential metrics such as cocoa processing costs, profitability analysis cocoa processing, and operational efficiency cocoa processing to provide a comprehensive overview of the investment analysis cocoa processing. The model features built-in charts and summaries for cocoa processing cash flow analysis and cocoa processing revenue streams, aiding in strategic cocoa supply chain management and cocoa value addition process. Additionally, the template facilitates cocoa processing yield calculations and break-even analysis, ensuring a thorough understanding of the cost structure cocoa production and cocoa manufacturing overhead costs. With insights into cocoa market trends and the growing demand for cocoa products, this tool serves as a vital resource for financial forecasting cocoa sector and assessing cocoa industry risk.

This cocoa processing financial model effectively addresses common pain points by providing a comprehensive framework for financial analysis within the cocoa industry, including cocoa processing costs and profitability analysis. It streamlines cocoa supply chain management through detailed cash flow analysis and break-even assessments, allowing users to identify and optimize revenue streams while evaluating investment opportunities and equipment costs. By integrating cocoa bean pricing models and processing yield calculations, users can stay informed on market trends and conduct thorough risk assessments, ultimately enhancing operational efficiency and facilitating better financial forecasting within the growing demand for cocoa products. Furthermore, this versatile template requires minimal Excel and finance expertise, enabling users to make real-time adjustments that automatically update critical financial metrics, ensuring that cocoa producers can meet their financial objectives with confidence.

Description

Our cocoa processing financial modeling Excel template provides essential tools for a comprehensive financial analysis of the cocoa industry, facilitating informed decision-making through precise reporting on cost structures and profitability analysis. It effectively addresses cocoa processing costs, including equipment, operational efficiency, and manufacturing overheads, allowing users to conduct break-even analysis and revenue stream assessments within a streamlined cocoa supply chain management framework. With built-in cocoa bean pricing models and yield calculations, this model supports investment analysis, enabling businesses to gauge financial forecasting and navigate market trends driven by the growing demand for cocoa products. Furthermore, the template generates essential financial statements—such as profit loss statements, cash flow projections, and pro forma balance sheets—over 60 months, supplemented by sales analysis and diagnostic tools to enhance strategic planning and performance monitoring.

COCOA PROCESSING FINANCIAL PLAN REPORTS

All in One Place

A comprehensive financial model is essential for any cocoa processing startup, encompassing key elements such as cocoa processing costs, revenue streams, and profitability analysis. This template provides insights into cost structures, operational efficiency, and cash flow analysis, ensuring a robust framework for financial forecasting. By integrating cocoa bean pricing models and processing yield calculations, businesses can navigate the growing demand for cocoa products while effectively managing risks. Unlock the potential of the cocoa export market with this detailed guide, tailored to enhance your cocoa supply chain management and investment analysis.

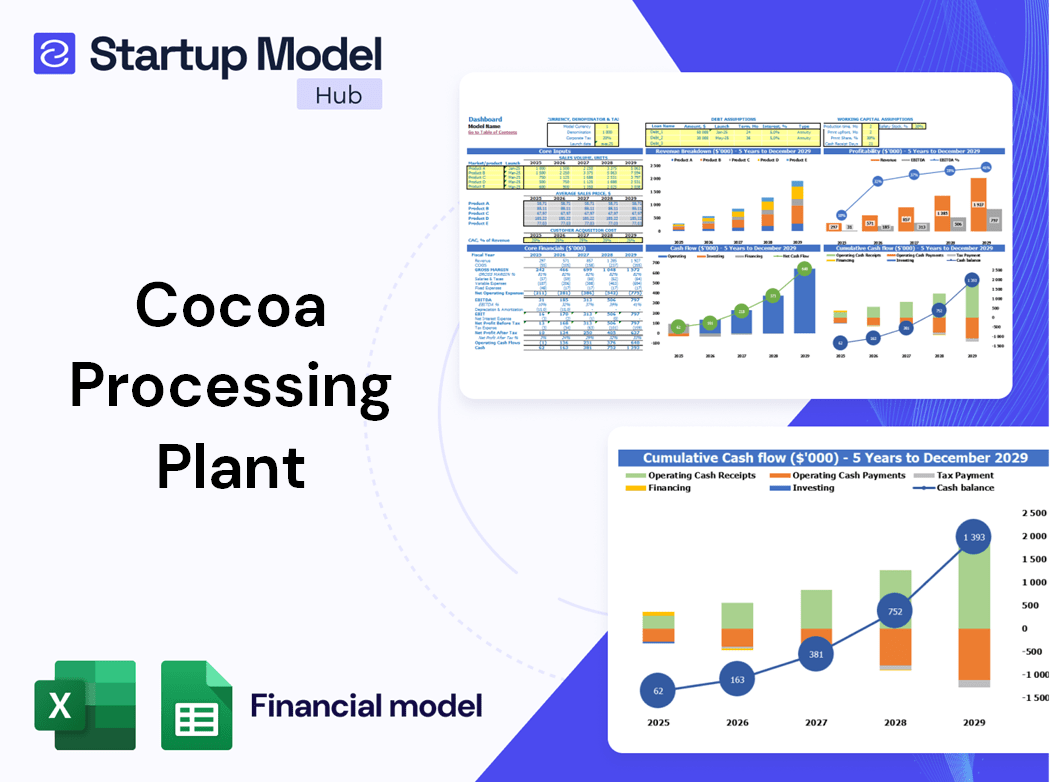

Dashboard

Our financial model features an intuitive dashboard that highlights key indicators specific to distinct timeframes. This includes a pro forma cash flow projection, detailed annual revenue breakdowns, and profitability forecasts, essential for strategic decision-making in the cocoa processing industry. By integrating financial analysis and operational efficiency metrics, we empower stakeholders to assess the cocoa supply chain's cost structure and revenue streams effectively. With insights into cocoa processing yield calculations and market trends, our model supports informed investment analysis and highlights opportunities for value addition within the ever-evolving cocoa sector.

Business Financial Statements

Our advanced financial forecasting model streamlines cocoa processing financial analysis with pre-built, consolidated reports, including monthly profit and loss statements, pro forma balance sheets, and cash flow projections tailored for the cocoa industry. Users can seamlessly integrate existing financial statements from QuickBooks, Xero, or FreshBooks, enabling accurate rolling forecasts. This tool enhances operational efficiency and supports profitability analysis, aiding in cocoa supply chain management and investment analysis. Leverage these insights to navigate cocoa market trends and optimize revenue streams in the growing demand for cocoa products.

Sources And Uses Statement

A comprehensive sources and uses of funds statement in an Excel financial model is essential for effective financial analysis in the cocoa sector. It not only identifies funding sources but also delineates critical expenditure points, such as cocoa processing equipment costs and operational efficiency. The business plan template captures diverse cost structures, including manufacturing overheads and processing yields, while highlighting revenue streams from growing demand for cocoa products. This strategic overview aids in investment analysis and financial forecasting, ensuring informed decision-making for profitability within the cocoa supply chain.

Break Even Point In Sales Dollars

A break-even sales calculator is crucial for effective financial analysis in the cocoa industry, allowing businesses to evaluate revenue and sales dynamics. Distinguishing between sales, revenue, and profit is vital in financial planning. Revenue represents the total income generated from cocoa product sales, while profit is calculated by subtracting all fixed and variable costs from that revenue. Understanding these elements aids in profitability analysis and enhances cocoa processing cash flow analysis, ultimately supporting informed decision-making regarding investment and operational efficiency in the cocoa supply chain.

Top Revenue

This proforma business plan template includes a comprehensive revenue tab, enabling a thorough financial analysis of your cocoa processing operations. With this template, you can categorize and assess revenue streams generated by various cocoa products, facilitating insights into profitability analysis and operational efficiency. It serves as an invaluable tool for cocoa supply chain management, helping to identify cost structures and enhance cocoa processing yield calculations. Leverage these insights to navigate market trends, conduct investment analysis, and ensure robust financial forecasting for sustainable growth in the growing demand for cocoa products.

Business Top Expenses Spreadsheet

In the cocoa industry, financial analysis is crucial for effective cost management and profitability. Our Excel financial plan template includes a comprehensive expense report that focuses on the four largest cost categories, highlighting trends and year-on-year variations. By optimizing cocoa processing costs and enhancing operational efficiency, businesses can better monitor their cash flow and revenue streams. This strategic approach to cocoa supply chain management and investment analysis not only helps identify key areas for cost reduction but also positions companies to capitalize on the growing demand for cocoa products and maximize profitability.

COCOA PROCESSING FINANCIAL PROJECTION EXPENSES

Costs

Effective expense management, particularly in cocoa processing, hinges on accurate financial forecasting. Our startup costs template empowers users to project expenses for up to five years, while a three-year financial projection tool monitors cost variations over time. Key parameters include income percentages, payroll, and recurring costs, categorized as Variable or Fixed Expenses, COGS, Wages, and CAPEX. This structured approach enhances cocoa industry financial analysis, aiding in profitability analysis, cost structure assessments, and ensuring operational efficiency. Leverage these insights to navigate market trends and boost revenue streams in the growing cocoa sector.

CAPEX Spending

Capital expenditures (CapEx) are crucial for long-term value in the cocoa industry, impacting equipment costs and operational efficiency. Our financial projection model includes a dedicated CapEx tab to streamline calculations, essential for evaluating growth strategies in cocoa processing. Understanding the interplay between CapEx, depreciation, and overall financial statements is vital for cocoa industry stakeholders. This insight aids in financial forecasting, investment analysis, and profitability assessments, ensuring informed decisions in a market characterized by growing demand for cocoa products. Optimize your cocoa processing revenue streams with a clear grasp of your cost structure and CapEx planning.

Loan Financing Calculator

Our Excel financial model includes a comprehensive loan amortization schedule, designed to enhance your cocoa processing operations. This pre-built template efficiently calculates each installment, detailing the principal and interest repayment over monthly, quarterly, or annual periods. By integrating this tool, you can better manage your cocoa processing costs, assess profitability, and optimize cash flow. Utilize this resource to improve operational efficiency and navigate the financial complexities of the cocoa supply chain, ensuring you seize opportunities within the growing demand for cocoa products.

COCOA PROCESSING INCOME STATEMENT METRICS

Financial KPIs

The gross profit margin (GPM) is a vital financial metric, indicating a business's financial health within the cocoa processing sector. It measures the difference between sales revenue and associated costs. An improving GPM signifies enhanced operational efficiency, as cocoa processing costs decrease relative to rising revenues. This percentage-based ratio is essential for conducting profitability analysis and financial forecasting in the cocoa industry, providing insights into cost structures, revenue streams, and overall market trends. Understanding GPM is crucial for effective cocoa supply chain management and identifying investment opportunities in the growing demand for cocoa products.

Cash Flow Forecast Excel

The cash balance within a company's revenue model reflects the total funds available in its financial accounts. Maintaining an adequate cash reserve is crucial for meeting short-term obligations and ensuring operational efficiency in cocoa processing. A thorough financial analysis of the cocoa industry, including cash flow analysis and break-even assessments, enables businesses to navigate market trends effectively. By leveraging cocoa processing yield calculations and understanding costs related to equipment and manufacturing overhead, companies can optimize profitability and enhance their cocoa value addition process in response to the growing demand for cocoa products.

KPI Benchmarks

Our financial benchmarking study tab in the five-year projection template empowers users to conduct an insightful comparative analysis within the cocoa industry. By identifying key financial indicators, companies can evaluate their performance against established standards from peers. Inputting financial data allows the template to generate comparative results, highlighting areas for improvement, such as cocoa processing costs and revenue streams. The more users engage in benchmarking, the better they understand their business operations, enhancing operational efficiency and driving profitability in the growing demand for cocoa products. Embrace this tool to elevate your cocoa processing investment strategy.

P&L Statement Excel

A pro forma income statement provides a comprehensive forecast of the cocoa processing enterprise’s financial performance. This profit and loss statement highlights the primary revenue streams and expense categories, including cocoa processing costs and manufacturing overhead. By analyzing these elements, stakeholders can gain valuable insights into operational efficiency, break-even analysis, and profitability. It serves as a crucial tool for financial forecasting, guiding investment analysis and decision-making in a rapidly evolving cocoa market, where growing demand for cocoa products influences pricing models and supply chain management strategies.

Pro Forma Balance Sheet Template Excel

The projected 5-year balance sheet, presented in an Excel format, serves as a crucial financial snapshot of your cocoa processing venture. It outlines key assets and liabilities, offering insights into your company's net worth throughout the forecast horizon. This financial analysis is essential for understanding cocoa processing costs, evaluating profitability, and optimizing cocoa supply chain management. By incorporating factors like cocoa bean pricing models and operational efficiency, this analysis can guide investment decisions and strategic planning in the growing cocoa export market, ultimately enhancing revenue streams and ensuring sustainable growth.

COCOA PROCESSING INCOME STATEMENT VALUATION

Startup Valuation Model

This Excel pro forma template features a robust valuation analysis tool, designed for discounted cash flow (DCF) evaluations critical in the cocoa industry. Users can easily perform profitability analysis and assess investment potential through metrics like residual value and replacement costs. Additionally, the template supports various financial analyses—including cocoa processing costs and equipment costs—while providing insights into market trends and revenue streams in the cocoa supply chain. It's an essential resource for financial forecasting and operational efficiency, helping stakeholders navigate the complexities of cocoa processing and enhance decision-making.

Cap Table

The cap table is a crucial element for startups, providing vital insights into equity distribution and investor interests. It details the ownership percentages of each investor, facilitating financial analysis and operational efficiency within the cocoa processing sector. By understanding the cost structure and revenue streams, decision-makers can effectively conduct profitability analysis and financial forecasting. This strategic overview aids in managing cocoa processing costs and enhances cocoa supply chain management, ultimately positioning the company for success amid growing demand for cocoa products in both domestic and export markets.

KEY FEATURES

A comprehensive financial model enhances profitability analysis in cocoa processing by optimizing costs and predicting market trends effectively.

Our Excel template streamlines financial analysis in the cocoa industry, ensuring compliance with lender requirements and enhancing operational efficiency.

A robust financial modeling approach enhances profitability analysis by evaluating cocoa processing costs and optimizing revenue streams for sustainable growth.

A cash flow projection model empowers cocoa processors to optimize profitability by forecasting the impact of variable costs on cash flow.

Implementing a robust financial model enhances profitability analysis and improves operational efficiency in cocoa processing businesses.

Utilizing a sophisticated cocoa processing financial model enhances profitability analysis and boosts strategic decision-making across the cocoa supply chain.

Implementing a robust financial model enhances profitability analysis, ensuring startups effectively navigate cocoa processing costs and market trends.

The 5-Year Cash Flow Projection Template enhances investment analysis in cocoa processing by delivering structured financial insights for your pitch deck.

Leverage a robust financial model to optimize cocoa processing costs and enhance profitability through insightful revenue streams and risk assessments.

This comprehensive cocoa processing financial model enhances operational efficiency and supports informed decisions for maximizing profitability and managing costs.

ADVANTAGES

Leverage our cocoa processing Excel financial model to optimize profitability analysis and enhance cash flow in the cocoa industry.

Utilizing a cocoa processing financial forecast template enhances capital demand calculations, optimizing investment and improving profitability within the cocoa industry.

Evaluate your business with a cocoa processing financial model to enhance profitability analysis and optimize operational efficiency.

The financial model ensures operational efficiency and profitability analysis, enabling sustainable cocoa processing amidst growing market demands.

Effective financial forecasting enhances cocoa processing profitability by optimizing cost structures and improving operational efficiency throughout the supply chain.