Cocoa Farming Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Cocoa Farming Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

cocoa farming Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

COCOA FARMING FINANCIAL MODEL FOR STARTUP INFO

Highlights

Unlock the potential of your cocoa farming venture with a comprehensive five-year financial model template in Excel, designed specifically for cocoa agriculture. This template features prebuilt three statements, including a consolidated profit and loss forecast, balance sheet, and cash flow forecast, allowing for an in-depth financial analysis of cocoa farm profitability and cash flow management. With key financial charts and summaries integrated, you can easily assess cocoa production costs, evaluate cocoa farming ROI, and navigate cocoa price volatility. Equipped for agricultural financing for cocoa and risk management in cocoa farming, this proforma business plan template also supports budgeting for sustainable cocoa farming and cocoa yield optimization, ensuring you stay ahead of prevailing cocoa market trends while maximizing profit margins and cocoa export revenue.

This financial model offers a comprehensive solution to tackle the pain points associated with cocoa farming profitability and costs, allowing buyers to easily manage cocoa production costs while optimizing cocoa yield and cash flow. By incorporating key features such as cost analysis for cocoa cultivation and risk management strategies, users can enhance their understanding of market trends and price volatility, leading to informed investment decisions in cocoa agriculture. The template also facilitates robust budgeting and financial analysis, ensuring that buyers can effectively navigate the cocoa supply chain and maximize profit margins through improved agricultural financing and funding options tailored to their specific needs.

Description

Our cocoa farming financial projection encompasses detailed analysis and calculations tailored for operational management and investors, emphasizing cocoa farming profitability and sustainable cocoa farming practices. This comprehensive template facilitates financial decisions by evaluating cocoa production costs, cash flow, and ROI, helping gauge the economic impact of cocoa farming amid price volatility. Designed to assist in budget planning and investment in cocoa agriculture, it projects five years of financial statements including cash flow, profit loss, and balance sheets. Additionally, it enables thorough financial analysis through key metrics like FCF, IRR, NPV, and break-even revenue calculations, all while addressing risks in cocoa supply chain management and agricultural financing for cocoa initiatives.

COCOA FARMING FINANCIAL MODEL REPORTS

All in One Place

Concerned about developing a robust financial model for your cocoa farming venture? Fear not! Our expertly crafted business plan forecast template is intuitive and equipped with essential financial tools tailored for the cocoa industry. With a focus on cocoa farming profitability, cash flow analysis, and risk management, you’ll gain insights into costs, market trends, and ROI. Whether it's optimizing cocoa yields or understanding fluctuating cocoa prices, our comprehensive resources will empower you to navigate the complexities of sustainable cocoa farming with confidence. Start your journey to success today!

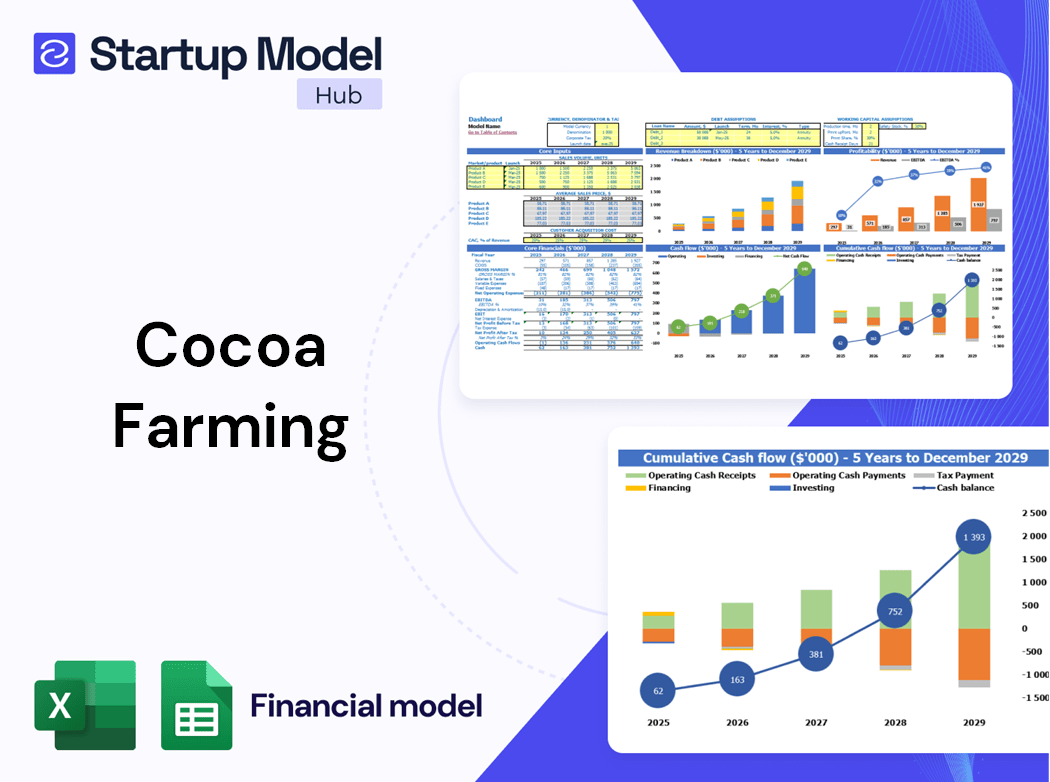

Dashboard

Our all-in-one financial model dashboard is an indispensable tool for cocoa farming profitability analysis. Designed for financial professionals, it enables quick assessments of cocoa production costs, cocoa yield optimization, and cash flow management. With real-time access to key performance indicators (KPIs), users can navigate cocoa market trends and conduct risk management in cocoa farming effectively. This dashboard not only streamlines financial reporting but also empowers stakeholders to make informed investment decisions in sustainable cocoa farming, ensuring higher profit margins and enhanced cocoa export revenue. Experience clarity and efficiency in your cocoa farm budgeting and financial analysis today.

Business Financial Statements

Effective financial analysis is crucial for enhancing cocoa farming profitability. Utilizing an income and expenditure template allows farmers to gain insights into core revenue-generating activities, while a projected balance sheet and cash flow spreadsheet facilitate a comprehensive view of capital management and budgeting. By focusing on cocoa production costs and optimizing yields, farmers can better navigate cocoa price volatility and improve profit margins. Moreover, sound cocoa supply chain management and agricultural financing can bolster cash flow and support investment in sustainable cocoa farming practices for long-term economic impact and ROI.

Sources And Uses Statement

The sources and uses of capital tab in the financial projection Excel is essential for optimizing cocoa farming profitability. It highlights primary funding sources, crucial for agricultural financing and investment in cocoa agriculture. This template enables cocoa businesses to track expenditures effectively, thereby enhancing cash flow management. Understanding these financial dynamics supports better budgeting and cost analysis, ensuring sustainable cocoa farming practices. For start-ups in the cocoa industry, this statement serves as a vital tool for navigating cocoa market trends and improving profit margins while mitigating risks associated with cocoa price volatility.

Break Even Point In Sales Dollars

Understanding the financial dynamics of cocoa farming is crucial for profitability. Our cocoa industry financial model facilitates a comprehensive break-even analysis, pinpointing the unit sales necessary to achieve positive cash flow. This template allows users to visualize the relationship between cocoa production costs, selling prices, and the required volumes to reach break-even. By adjusting variables such as cocoa yield optimization and market trends, farmers can simulate different scenarios, enhancing their investment strategies and risk management in cocoa farming. Effectively navigate cocoa price volatility and secure the financial health of your cocoa enterprise.

Top Revenue

To enhance cocoa farming profitability, leverage a comprehensive financial analysis that evaluates production costs, cash flow, and profit margins. Utilize insights from market trends and historical data to optimize cocoa yield. A thorough cost analysis and farm budgeting can reveal opportunities for sustainable cocoa farming practices, while investment in cocoa agriculture secures long-term gains. Implementing effective risk management strategies in response to cocoa price volatility will bolster your return on investment. By understanding the economic impact of cocoa farming, businesses can make informed decisions that can significantly enhance export revenue and overall profitability.

Business Top Expenses Spreadsheet

Evaluate your expenditures using our financial model in the Top Expenses section, organized into four key categories. An ‘Other’ category allows you to input specific data tailored to your cocoa farming needs. This comprehensive tool aids in analyzing cocoa production costs and enhances your budgeting for sustainable cocoa farming. By understanding your cash flow and optimizing yields, you can navigate cocoa price volatility and improve profit margins. Leverage our insights to strategize investments in cocoa agriculture and strengthen your position in the cocoa supply chain.

COCOA FARMING FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive financial projection Excel template for cocoa farming streamlines the analysis of production costs and cash flow. By providing insights into cost analysis and investment in cocoa agriculture, this three-statement model enhances financial management. Tracking expenses and understanding profitability is crucial in navigating cocoa price volatility and optimizing yield. With this robust proforma, users can forecast financial outcomes and make informed decisions to improve ROI and profit margins. Effectively manage risks and capitalize on market trends, ensuring sustainable cocoa farming practices while securing a healthy economic impact on your cocoa enterprise.

CAPEX Spending

Effective capital expenditure (CAPEX) planning is crucial for assessing cocoa farming profitability. Utilizing a pro forma income statement template enables precise automatic depreciation calculations, enhancing financial analysis and cocoa farm budgeting. By incorporating methods like straight-line or double-declining balance depreciation, farmers can optimize their cocoa production costs and project cash flow accurately. This strategic investment approach not only aids in cost analysis but also improves risk management in cocoa farming, ultimately driving better profit margins and higher cocoa yield optimization. Embracing these financial tools positions cocoa farmers to navigate market trends and volatility effectively.

Loan Financing Calculator

Start-ups in cocoa farming must meticulously monitor loan repayment schedules, detailing amounts and maturity terms. Such schedules are crucial for effective cash flow analysis, impacting overall financial health. By integrating principal repayments into the cash flow statement under financing activities, businesses can better manage their agricultural financing. Additionally, interest expenses, reflected in a detailed debt schedule, significantly affect cash flow and profit margins. Understanding these elements is vital for optimizing cocoa production costs and ensuring sustainable cocoa farming practices that enhance long-term ROI and mitigate risks associated with cocoa price volatility.

COCOA FARMING EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Assets (ROA) is a crucial metric for assessing cocoa farming profitability, reflecting how effectively a cocoa farm utilizes its total assets to generate profit. In the context of cocoa production costs and cash flow, a higher ROA signifies efficient management and optimal cocoa yield. By analyzing this financial ratio alongside market trends and cost analysis, cocoa farmers can make informed decisions to enhance their investment in agriculture. This approach not only helps in maximizing profit margins but also mitigates risks associated with cocoa price volatility, ultimately improving financial sustainability in the cocoa industry.

Cash Flow Forecast Excel

The pro forma cash flow in your Excel financial model is crucial for demonstrating the capability to manage cash flows effectively. It provides insights into how cocoa farm cash flow can cover liabilities, reassuring banks regarding loan repayment. By analyzing cocoa production costs, optimizing yield, and understanding market trends, you can enhance profit margins in cocoa farming. A robust financial analysis will also aid in strategic decision-making, ensuring sustainable cocoa farming practices while mitigating risks associated with price volatility. Effective cocoa supply chain management will further bolster financial viability and foster investment in cocoa agriculture.

KPI Benchmarks

Our five-year financial projection template includes a robust financial benchmarking study that enables cocoa farmers to conduct comparative analyses within the industry. By assessing key performance indicators such as cocoa farming profitability and production costs, you can gain insights into your farm's cash flow and ROI. This analysis empowers you to identify areas for optimization and risk management, helping you navigate cocoa price volatility and enhancing your profitability. Ultimately, understanding these metrics fosters sustainable cocoa farming practices and positions your enterprise for long-term financial success in the ever-evolving cocoa market.

P&L Statement Excel

For stakeholders in cocoa farming, the monthly forecasted profit and loss statement is essential, providing key indicators like gross margin. The annual report offers comprehensive insights, detailing profit after taxes, net income, and production costs. Utilizing a five-year projected profit-loss statement template is invaluable for long-term forecasting, enabling accurate assessments of financial performance and risk management in cocoa farming. This approach aligns with sustainable cocoa farming practices, ensuring profitability and optimizing cocoa yields while adapting to cocoa market trends and price volatility, ultimately enhancing overall cash flow and return on investment in the cocoa industry.

Pro Forma Balance Sheet Template Excel

The three-statement financial model delivers a comprehensive overview of a cocoa farm’s financial health by integrating the pro forma balance sheet with cash flow analysis and profit and loss statements. This interconnected framework ensures that all elements work in harmony, providing insights into cocoa farming profitability and ROI. By analyzing cocoa production costs, cash flow, and market trends, farmers can make informed decisions about sustainable cocoa farming and optimize cocoa yield. Furthermore, this model aids in effective budgeting and risk management, enhancing investment potential in cocoa agriculture while navigating price volatility in the market.

COCOA FARMING FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Unlock the potential of your cocoa farm with our comprehensive financial projection template. This tool offers crucial insights into cocoa farming profitability, emphasizing metrics like the weighted average cost of capital (WACC) and free cash flow (FCF). Understanding these figures allows stakeholders to gauge minimum returns on investments and available cash flow for reinvestment. Additionally, our analysis includes risk management strategies and insights into market trends, helping you navigate cocoa price volatility and optimize profit margins. Invest wisely in sustainable cocoa farming and enhance your farm's financial performance today.

Cap Table

A comprehensive Cap Table provides valuable insights into a company's financial health, detailing ownership structures and share distribution among investors. It encompasses equity shares, preferred shares, and options, offering clarity on capital allocation. This transparency is crucial for understanding financial metrics, assessing cocoa farming profitability, and conducting effective investment analyses in the cocoa industry. By examining this data, stakeholders can make informed decisions regarding agricultural financing, risk management, and optimizing cocoa production costs, ultimately enhancing profit margins and cash flow in cocoa farming operations.

KEY FEATURES

A robust financial model enhances cocoa farming profitability by optimizing costs, improving cash flow, and guiding strategic investment decisions.

This financial model streamlines cocoa farm budgeting, ensuring easy compliance with lender requirements and enhancing profitability analysis.

A robust financial model enhances cocoa farming profitability by optimizing costs and managing market volatility effectively.

A comprehensive financial model enhances cocoa farming profitability by providing clear insights into costs, yields, and market trends.

A robust financial model for cocoa farming helps identify potential cash shortfalls, ensuring better budget management and investment decisions.

The cocoa industry financial model serves as a crucial tool for optimizing cash flow and anticipating market changes effectively.

A robust financial model enhances cocoa farming ROI by optimizing production costs and improving cash flow stability amidst price volatility.

A robust financial model for cocoa farming enhances loan approval chances by clearly demonstrating cash flow management and repayment strategies.

A robust cocoa industry financial model enhances profitability through effective cost analysis and risk management, ensuring sustainable farming success.

Invest in a proven cocoa farming financial model to enhance profitability and optimize cash flow without hidden costs.

ADVANTAGES

The three-statement financial model empowers cocoa farmers to strategically forecast cash flow and enhance profitability amid market volatility.

A robust financial model for cocoa farming enhances profitability, optimizes costs, and boosts cash flow amid market volatility.

The cocoa industry financial model enhances profitability by providing clear insights into costs and investment opportunities for sustainable farming.

An effective cocoa industry financial model ensures profitability by optimizing costs, enhancing cash flow, and managing price volatility risks.

The 3 Way Financial Model enhances cocoa farm profitability by optimizing budgeting, cash flow, and investment strategies amidst market volatility.