Co-Operative Bank Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Co-Operative Bank Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

co operative bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CO OPERATIVE BANK STARTUP BUDGET INFO

Highlights

The cooperative bank financial analysis framework provides a comprehensive 5-year planning template tailored for institutions within the cooperative banking business model. This tool is beneficial for both startup cooperative banks and existing smaller entities, enabling them to assess their financial performance effectively. By employing financial ratios and profitability metrics specific to cooperative banks, stakeholders can evaluate startup ideas, manage their loan portfolio, and align their funding sources with capital requirements. Additionally, the model supports strategic decision-making regarding investment strategies and operational efficiency, ensuring financial sustainability while addressing risk management aspects crucial in cooperative banking. It also emphasizes the economic impact of member-owned banking structures on the community, all within a robust regulatory framework that accommodates innovative financial technology and competitive interest rates.

The cooperative bank financial analysis Excel template addresses common pain points by providing a comprehensive and customizable framework that simplifies the assessment of the cooperative banking business model's financial performance. With integrated financial ratios and profitability metrics, users can effortlessly evaluate the financial sustainability of their cooperative bank, monitor the loan portfolio, and assess capital requirements while ensuring compliance with regulatory frameworks. The template enhances operational efficiency by allowing quick updates, recalculating financial projections and key performance indicators (KPIs) with minimal effort. Additionally, the model's focus on risk management in cooperative banks ensures that potential economic impacts are strategically addressed, making it an invaluable tool for member-owned banking structures seeking to optimize their funding sources and investment strategies while adapting to varying interest rates.

Description

The cooperative bank financial model framework offers a comprehensive five-year forecast template that incorporates essential financial statements and performance metrics, allowing users to evaluate the financial performance of cooperative banks effectively. It includes a dynamic cash flow projection, tailored for both startups and existing cooperative banks, alongside a pro forma income statement, a projected balance sheet, and a cash flow analysis, all structured to accommodate various funding sources. The model also performs a discounted cash flow valuation based on projected Free Cash Flows while calculating key profitability metrics and financial ratios pertinent to cooperative banking, such as capital requirements and operational efficiency. Users can easily customize the financial forecasting model using basic Excel skills, which automatically updates all metrics and provides critical reports, including the startup cash flow statement and break-even analysis, thus ensuring sound risk management strategies for financial sustainability in the cooperative banking business model.

CO OPERATIVE BANK FINANCIAL PLAN REPORTS

All in One Place

Are you evaluating the potential of your business idea or seeking funding? Our high-level financial projection model is tailored for cooperative banks and enhances operational efficiency. This user-friendly forecasting tool allows you to effortlessly create month-on-month sales, expenses, and cash flow projections. Customize your data with editable tables, exploring various scenarios to assess financial performance and capital requirements. Perfect for analyzing your cooperative bank's loan portfolio and investment strategies, this solution prepares you for sustainable growth in the community banking landscape. Elevate your financial analysis with our innovative tool today!

Dashboard

Transform your financial model for cooperative banks into a dynamic tool that highlights your cooperative banking business model. By analyzing financial performance, funding sources, and capital requirements, you’ll gain insights into profitability metrics and operational efficiency. Leverage innovative financial technology and effective risk management strategies to optimize your loan portfolio and enhance member-owned banking structures. This engaging format not only reflects your cooperative bank's economic impact but also prepares you to present compelling data to stakeholders. Elevate your financial analysis and make your numbers resonate, ready for any pitch deck!

Business Financial Statements

Understanding a cooperative bank's financial performance requires analyzing its profit and loss forecast, balance sheet, and cash flow statement. The profit and loss forecast sheds light on earnings generated through the cooperative banking business model, while the balance sheet highlights capital management and funding sources. The cash flow statement enhances insights into operational efficiency and investment strategies, essential for maintaining financial sustainability. Together, these financial statements offer a comprehensive view of the cooperative bank's economic impact and guide effective risk management practices to ensure long-term profitability and adherence to capital requirements.

Sources And Uses Statement

The financial model template serves as a vital tool for cooperative banks, outlining essential funding sources and allocation strategies necessary for enhancing financial performance and sustainability. By analyzing operational efficiency and leveraging effective investment strategies, cooperative banks can optimize their loan portfolios and improve profitability metrics. This structured approach not only supports the member-owned banking model but also fosters a robust customer base, ensuring long-term economic impact and adherence to capital requirements within the regulatory framework. Staying attuned to interest rates and financial technology advances further empowers cooperative banks to thrive in a competitive landscape.

Break Even Point In Sales Dollars

A break-even analysis is crucial for understanding the financial performance of cooperative banks. It distinguishes between revenue, which reflects total income from services, and profit, derived by subtracting fixed and variable expenses. This financial assessment aids in strategic planning, ensuring operational efficiency and financial sustainability. By leveraging financial ratios and profitability metrics, cooperative banks can fine-tune their loan portfolios and funding sources. Ultimately, effective financial analysis supports the member-owned banking structure, enhancing community impact and fostering growth in the cooperative banking business model.

Top Revenue

In the Top Revenue tab, generate a demand report for your cooperative bank's products and services, enabling a thorough financial analysis of profitability and attractiveness. By utilizing financial modeling techniques, assess revenue depth and bridge to forecast demand fluctuations across various periods, including weekdays and weekends. This insight enhances operational efficiency by identifying optimal resource allocation times, ensuring robust risk management and supporting the financial sustainability of your member-owned banking structure. Ultimately, this strategic approach contributes to a stronger cooperative banking business model and improved financial performance metrics.

Business Top Expenses Spreadsheet

Expense reports are vital for cooperative banks, offering insights into operational efficiency and financial sustainability. By tracking expenses by category, they aid in financial analysis and support the planning of projected income statements. This data enables cooperative banks to assess their funding sources, manage risks, and optimize their loan portfolios. Analyzing expenses against profitability metrics informs strategic decisions, enhancing the member-owned banking structure. Such reports empower cooperative banks to evaluate their economic impact and improve financial performance, ensuring alignment with capital requirements and regulatory frameworks while fostering community banking initiatives.

CO OPERATIVE BANK FINANCIAL PROJECTION EXPENSES

Costs

Startup costs are crucial in any financial model, necessitating careful monitoring to ensure optimal fund utilization and avoid unnecessary expenditures. Cooperative banks, with their member-owned structure, can leverage a tailored business model to manage these costs effectively. Utilizing our financial projections template, cooperative banks can track funding sources and expenses, ensuring financial sustainability. This tool aids in developing a comprehensive budget while enhancing operational efficiency and supporting effective risk management strategies. By focusing on financial performance and employing sophisticated financial technology, cooperative banks can improve their loan portfolio and maximize profitability metrics.

CAPEX Spending

Capital expenditures (CAPEX) are crucial for establishing a robust startup budget, driving the company's growth. A comprehensive capital budgeting analysis facilitates effective financial management, ensuring resources are allocated strategically. Business owners value a five-year financial projection template for its accuracy and potential for positive outcomes. This model aligns with the cooperative banking business model, enhancing financial performance and operational efficiency. By focusing on sustainable funding sources and prudent investment strategies, cooperative banks can strengthen their member-owned structures and achieve long-term profitability, while also maximizing their economic impact within the community.

Loan Financing Calculator

Similar to asset amortization in an Excel financial model, loan amortization in cooperative banks involves distributing loan repayments over specified periods. This structured approach typically entails fixed payments made monthly, though quarterly or annual options may exist. The financial performance of cooperative banks hinges on effective management of their loan portfolios, ensuring operational efficiency and financial sustainability. By leveraging diverse funding sources and maintaining compliance with capital requirements, these member-owned institutions can enhance profitability metrics and foster a positive economic impact within the community, ultimately strengthening their customer base and service offerings.

CO OPERATIVE BANK INCOME STATEMENT METRICS

Financial KPIs

For start-ups, understanding the cost of acquiring new customers is crucial for financial sustainability. This metric, calculated by dividing total marketing expenses by the number of new consumers gained in a year, should be integrated into your business plan Excel template. Effectively managing this operational efficiency helps cooperative banks enhance their financial performance and optimize their funding sources. By leveraging strategic cooperative banking models, start-ups can align their growth objectives with the needs of their member-owned customer base, ultimately driving profitability and community economic impact.

Cash Flow Forecast Excel

A well-structured cash flow statement in Excel is crucial for enhancing the financial performance of cooperative banks. By utilizing a cash flow forecast spreadsheet, cooperative banks can effectively manage their financial sustainability and optimize their capital requirements. This tool aids in predicting cash flows, ensuring operational efficiency, and supporting investment strategies. Moreover, it helps in assessing the cooperative bank's loan portfolio and understanding interest rates, ultimately contributing to a strong member-owned banking structure that thrives within the community banking financial model. Embracing such financial technology is key to maintaining resilience in today's dynamic banking environment.

KPI Benchmarks

An Excel template's benchmark tab effectively calculates key performance indicators (KPIs) for cooperative banks, enabling a robust financial analysis. By comparing these metrics against industry averages, banks can assess their financial performance and operational efficiency. This benchmarking process is vital for cooperative banks, particularly startups, as it highlights best practices and informs strategic decisions. Utilizing these insights, banks can enhance their financial sustainability, optimize their loan portfolio, and refine their investment strategies, ultimately strengthening their member-owned banking structure and economic impact within the community.

P&L Statement Excel

This pro forma income statement template for cooperative banks provides a reliable forecast of financial performance, aiding in strategic planning for enhanced operational efficiency and profitability. By leveraging these projections, you can conduct a thorough financial analysis, identifying strengths and weaknesses within your cooperative bank's funding sources and loan portfolio. This approach supports better risk management and investment strategies, ultimately fostering financial sustainability in the member-owned banking structure. Utilize this valuable tool to inform decision-making and enhance the economic impact of your cooperative banking business model.

Pro Forma Balance Sheet Template Excel

The projected balance sheet template serves as a vital financial report, outlining a cooperative bank's assets, liabilities, and shareholders' equity at a specific moment. This snapshot provides insights into the bank's financial performance, illustrating what it owes and owns. By utilizing our projected balance sheet template, users can effectively assess the bank's financial sustainability, operational efficiency, and overall economic impact. This tool empowers cooperative banks to strengthen their member-owned banking structure and optimize funding sources while maintaining a robust regulatory framework. Engage with our model to enhance your financial analysis and strategic investment decisions.

CO OPERATIVE BANK INCOME STATEMENT VALUATION

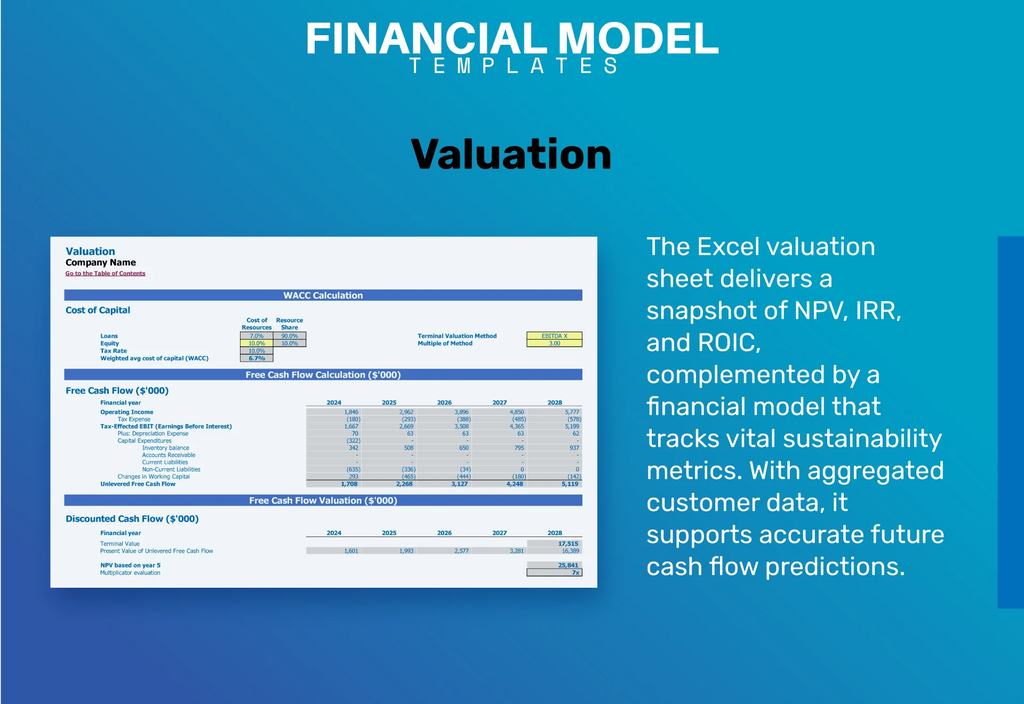

Startup Valuation Model

The cooperative bank financial analysis model includes essential tools like Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC evaluates the capital costs, reflecting the risk management vital for loan approval. DCF assists investors in appraising future cash flows, facilitating informed decisions in the competitive cooperative banking business model. Together, these metrics enhance financial performance, ensuring sustainability and operational efficiency, while supporting the member-owned banking structure essential for community impact and fostering strong customer relations in the evolving regulatory framework.

Cap Table

The capitalization table in a cooperative bank's financial model is essential for analyzing financial flows. It details various funding sources and their impact on the cooperative bank's financial performance and sustainability. By showcasing how decisions influence profitability and capital requirements, it aids in assessing the cooperative banking business model. This tool not only enhances operational efficiency but also informs investment strategies and risk management approaches, ensuring alignment with member needs. Ultimately, it reflects the economic impact of cooperative banks while fostering a stronger customer base through informed financial services.

KEY FEATURES

The cooperative banking business model enhances financial sustainability, empowering member-owned institutions to thrive through effective risk management and community support.

Utilizing pro forma cash flow projections empowers cooperative banks to strategically plan for growth and enhance their financial sustainability.

The cooperative banking business model enhances community engagement and financial sustainability through member-owned structures and tailored investment strategies.

Cooperative banking's member-owned structure fosters financial sustainability, enabling startups to attract investors and secure essential funding.

The cooperative banking business model fosters financial sustainability and community impact through member-owned structures and effective risk management strategies.

Our financial model empowers cooperative banks to enhance operational efficiency, manage risks, and ensure sustainable growth for the next five years.

Investing in cooperative banks ensures sustainable financial performance through member-owned structures and robust risk management, driving community economic growth.

A robust financial model enhances cooperative banks' operational efficiency, attracting investors and supporting sustainable growth within their communities.

The cooperative banking business model enhances financial performance and sustainability through strong community ties and tailored funding sources.

The cooperative banking financial model enhances profitability and sustainability, ensuring robust community support and effective risk management strategies.

ADVANTAGES

The cooperative banking business model enhances community engagement and financial sustainability through member-owned structures and tailored funding strategies.

The cooperative banking business model enhances financial sustainability by prioritizing member-owned principles over traditional profit-driven approaches.

The cooperative banking business model enhances financial sustainability through member-owned structures, optimized funding sources, and community-focused services.

Utilize our cooperative bank financial projection model to effectively schedule your startup loan repayments and enhance financial sustainability.

The cooperative banking business model enhances financial sustainability through member-owned structures, fostering community engagement and operational efficiency.