Civil Engineering Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Civil Engineering Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

civil engineering Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CIVIL ENGINEERING FINANCIAL MODEL FOR STARTUP INFO

Highlights

The highly versatile and user-friendly civil engineering 5-year financial projection template is designed to facilitate project financial analysis, including profit-loss projections and cash flow forecasts, along with annual and monthly balance sheets. This tool is essential for both startups and existing civil engineering businesses, providing valuable insights into capital budgeting for projects, financial modeling in construction, and budgeting for civil engineering projects. By leveraging this template, users can effectively assess financial feasibility assessments, conduct risk assessment in civil engineering, and evaluate construction loan options. Prior to investing in a civil engineering business, consider using this template to enhance your understanding of project funding strategies, optimize ROI analysis in construction projects, and conduct thorough economic impact of civil projects assessments. Unlock the potential for improved financial management with complete editing capabilities.

The ready-made financial model in Excel template addresses key pain points in civil engineering project financing by streamlining financial modeling in construction, facilitating accurate cost estimation techniques, and enabling effective budgeting for civil engineering projects through comprehensive project financial analysis. It integrates risk assessment in civil engineering with financial risk management tools, ensuring a robust capital budgeting process for projects. Additionally, the model includes detailed infrastructure investment analysis and sustainable infrastructure financing options, enhancing the financial feasibility assessments essential for successful project funding strategies. With built-in cost-benefit analysis in civil engineering and ROI analysis in construction projects, users can make informed decisions, while the template also supports public-private partnership models, ensuring a comprehensive evaluation of construction loan options and cash flow management. Overall, the template serves as a valuable resource for optimizing value engineering and cost control, as well as understanding the economic impact of civil projects.

Description

This civil engineering financial plan serves as an essential resource for assessing the financial feasibility of initiating or managing a civil engineering venture, enabling a comprehensive 5-year financial forecast grounded in historical performance and future projections. The model includes a detailed summary of three core financial statements—pro forma income statement, projected balance sheet, and cash flow projection—while also calculating key metrics such as Free Cash Flows, Internal Rate of Return, and break-even analysis. It aids in capital budgeting for projects by detailing initial capital investments and working capital needs, thereby facilitating accurate forecasting of construction project cash flow. By integrating financial modeling in construction, this tool empowers stakeholders to conduct risk assessment in civil engineering, perform cost-benefit analysis, and explore various project funding strategies, ultimately enhancing financial risk management in construction endeavors.

CIVIL ENGINEERING FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive financial projections template integrates essential reports—profit and loss, balance sheet, and cash flow—into a cohesive financial model. Unlike simplified alternatives that rely solely on pro forma profit and loss statements, our approach provides a complete financial analysis. This enables effective scenario planning, allowing for precise assessment of how minor adjustments in your business model can influence profitability, assets, liabilities, equity, and cash flow. Such robust financial modeling is crucial for successful civil engineering project financing, risk assessment, and sustainable infrastructure investment analysis. Ensure accurate budgeting and maximize ROI with our tool.

Dashboard

Our startup financial plan template features a robust financial dashboard, ideal for project financial analysis and civil engineering project financing. Utilizing dynamic charts and graphs, it enhances the accuracy of calculations and reports. Designed for in-depth examination of financial statements, the dashboard empowers stakeholders with critical data for informed decision-making. This tool supports financial modeling in construction, facilitating effective budgeting for civil engineering projects, cost-benefit analysis, and risk assessment. Ultimately, it aids in developing sustainable infrastructure financing strategies and optimizing project funding strategies for greater ROI in construction projects.

Business Financial Statements

In managing civil engineering project financing, a thorough understanding of financial statements is essential. The **Income Statement** reveals revenues and expenses, encompassing depreciation and taxes. The **Balance Sheet** provides a snapshot of assets, liabilities, and shareholders’ equity, ensuring a balanced equation. Finally, the **Cash Flow Statement** tracks cash inflows and outflows, highlighting the project's financial health. For effective **capital budgeting for projects**, these statements inform **risk assessment in civil engineering**, facilitating informed **financial feasibility assessments** and enhancing **ROI analysis in construction projects** through robust **financial modeling** and strategic **project funding strategies**.

Sources And Uses Statement

An effective business plan for civil engineering projects should include a sources and uses table of funds statement. This essential component promotes transparency, allowing stakeholders to understand all funding sources and financial allocations. By integrating financial modeling in construction and cost estimation techniques, firms can assess the economic impact of their projects accurately. Additionally, implementing risk assessment in civil engineering ensures robust financial risk management and enhances project funding strategies, ultimately supporting sustainable infrastructure financing and optimizing ROI analysis in construction projects.

Break Even Point In Sales Dollars

The break-even chart is crucial in civil engineering project financing, as it identifies the sales volume needed to cover fixed and variable costs. Achieving this point signifies a zero-profit scenario. Once sales surpass this threshold, the project begins generating profits, essential for effective capital budgeting. Utilizing our customizable Excel template, you can create a tailored break-even chart, helping stakeholders assess financial feasibility and ROI. This tool not only clarifies the minimum sales needed but also enhances financial modeling in construction, providing insight into potential returns and aiding in strategic construction project cash flow management.

Top Revenue

Effective revenue generation is vital for a sustainable business in civil engineering. When developing a financial model, management must accurately forecast future revenues, as they are a key driver of the enterprise's value. Flawed revenue predictions can derail the entire financial model. Therefore, meticulous attention to detail in financial analysis and planning is essential. Utilizing proforma templates enables analysts to project revenues by employing robust cost estimation techniques and historical financial data, ultimately supporting sound project funding strategies and sustainable infrastructure financing to ensure successful outcomes in construction projects.

Business Top Expenses Spreadsheet

The startup financial model template effectively outlines a company’s annual expenses, categorized into four key areas. This comprehensive budget framework offers targeted cost estimation techniques, including customer acquisition and salary payments. By employing advanced financial modeling in construction, businesses can enhance project funding strategies and conduct thorough financial feasibility assessments. Additionally, this model supports risk assessment in civil engineering, ensuring robust financial risk management and sustainable infrastructure financing. Ultimately, it facilitates informed decision-making and optimizes cash flow, maximizing the economic impact of civil projects.

CIVIL ENGINEERING FINANCIAL PROJECTION EXPENSES

Costs

Initial costs play a crucial role in project financial analysis, particularly in civil engineering. Effective financial modeling in construction ensures that startup costs are accurately forecasted, minimizing the risk of financial losses. Our budget financial model incorporates advanced cost estimation techniques and economic impact assessments, fostering sustainable infrastructure financing. This tailored proforma aids in expense management and strategic planning, enhancing cash flow during project execution. By integrating risk assessment and capital budgeting for projects, we empower stakeholders to implement robust funding strategies and optimize ROI in construction projects.

CAPEX Spending

A well-structured capital expenditure plan is crucial for any startup’s financial modeling in construction. By integrating cost estimation techniques and depreciation methods, such as straight-line or double declining, stakeholders can enhance their construction project cash flow analysis. This approach supports effective budgeting for civil engineering projects, ensuring robust financial feasibility assessments. Furthermore, it facilitates comprehensive project financial analysis and risk assessment in civil engineering. Ultimately, these strategies contribute to improved economic impact analysis, optimizing ROI and supporting sustainable infrastructure financing through informed decision-making.

Loan Financing Calculator

Our loan amortization schedule template enhances financial modeling in construction by providing a comprehensive overview of loan repayment timelines. Equipped with intuitive formulas, it seamlessly tracks each loan’s terms and repayment dates, accommodating various payment frequencies—monthly, quarterly, or annually. This template is essential for capital budgeting for projects and reinforces effective financial risk management in construction. By using this tool, stakeholders can conduct thorough financial feasibility assessments and optimize construction project cash flow, ensuring sustainable infrastructure financing and improved ROI analysis for civil engineering projects.

CIVIL ENGINEERING EXCEL FINANCIAL MODEL METRICS

Financial KPIs

In the realm of civil engineering project financing, key performance indicators (KPIs) serve as vital tools for both firm owners and investors. These metrics facilitate robust project financial analysis and enable effective budgeting for civil engineering projects. By employing financial modeling in construction, stakeholders can accurately assess cash flow, conduct risk assessments, and perform cost-benefit analysis. This focus on KPIs ensures strategic alignment with established goals, ultimately enhancing financial feasibility assessments and optimizing infrastructure investment analysis. Engaging with these indicators fosters informed decisions and promotes sustainable infrastructure financing.

Cash Flow Forecast Excel

A cash flow model is essential for effective project financial analysis in civil engineering. It illustrates cash movements, highlighting the available balance for liabilities and construction project investments. This model informs stakeholders about financial modeling in construction, ensuring robust budgeting for civil engineering projects. Additionally, it underscores the efficiency of managing investor funding and capital budgeting for projects, ultimately supporting informed decision-making. By integrating risk assessment in civil engineering and cost-benefit analysis, organizations can enhance financial feasibility assessments and develop strategies for sustainable infrastructure financing, maximizing ROI and economic impact.

KPI Benchmarks

Leverage our financial model template to conduct a comprehensive benchmarking analysis, featuring a dedicated tab for comparison. By examining key financial and operational indicators of industry peers, users can evaluate their company's performance against competitors. This benchmarking approach facilitates insights into competitiveness, productivity, and profitability, essential for informed decision-making in civil engineering project financing. Enhance your project financial analysis, optimize capital budgeting, and ensure robust risk assessment in civil engineering with effective cost estimation techniques. Drive superior economic impact and sustainable infrastructure financing through strategic project funding strategies.

P&L Statement Excel

This business plan template is designed for both professionals and those new to financial planning and analysis. By utilizing advanced cost estimation techniques and financial modeling in construction, you can gain valuable insights into your project's income and expenses. This provides a solid foundation for effective capital budgeting and project financial analysis. The template also incorporates risk assessment in civil engineering, ensuring a comprehensive understanding of financial feasibility. Embrace sustainable infrastructure financing and strategic project funding strategies to maximize ROI and enhance the economic impact of your civil engineering projects.

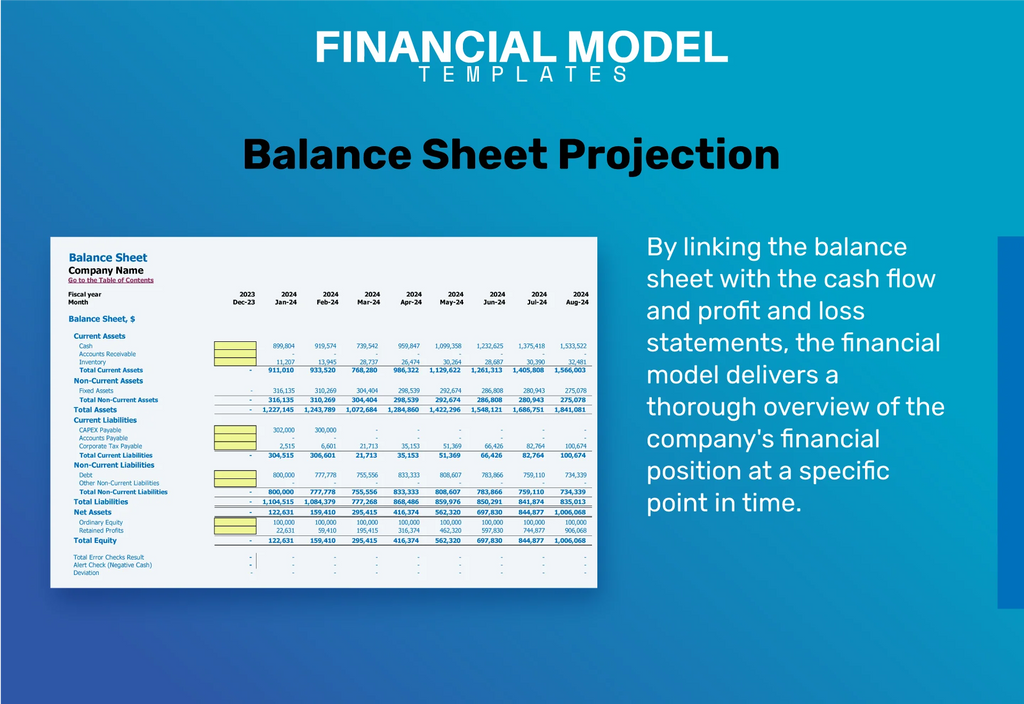

Pro Forma Balance Sheet Template Excel

The balance sheet forecast is an essential component of financial modeling in construction, providing critical insights into a project's current and long-term assets, liabilities, and equity. By utilizing a pro forma balance sheet template in Excel, stakeholders can effectively conduct project financial analysis, supporting key activities such as cost estimation techniques and risk assessment in civil engineering. This approach not only aids in financial feasibility assessments but also enhances budgeting for civil engineering projects, ultimately facilitating informed decision-making and optimizing economic impact through robust project funding strategies.

CIVIL ENGINEERING FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our pre-built valuation template enhances your project's financial modeling in construction, providing essential data for investor assessments. The weighted average cost of capital (WACC) delineates the minimum return on invested capital, critical for stakeholders. Utilizing free cash flow valuation clarifies the liquidity available to all investors, while discounted cash flow analysis offers insight into future cash flows' present value. This comprehensive approach supports effective budgeting for civil engineering projects and strengthens your financial feasibility assessments, fostering strategic project funding strategies and ensuring successful infrastructure investment analysis.

Cap Table

The capital table for startups is crucial for assessing shareholder ownership dilution. Within our five-year financial modeling in construction, we incorporate various project funding strategies, including four distinct funding rounds. Users have the flexibility to apply all rounds or selectively choose one or two, facilitating precise financial feasibility assessments and risk assessment in civil engineering projects. This empowers business owners to effectively manage capital budgeting for projects while ensuring robust construction project cash flow management and enhancements in value engineering and cost control.

KEY FEATURES

Effective financial modeling in construction enhances project funding strategies, ensuring accurate cost estimation and improved risk management for successful outcomes.

Utilizing financial modeling in construction enhances project funding strategies, ensuring accurate budgeting and risk assessment for successful civil engineering projects.

Effective financial modeling in construction enhances project funding strategies, ensuring robust risk assessment and sustainable infrastructure financing for success.

Effective financial modeling in construction enhances cash flow forecasting, helping mitigate risks and enabling informed decision-making for project success.

Effective financial modeling in construction enhances decision-making by providing accurate project financial analysis and optimizing resource allocation.

Leverage financial modeling in construction to confidently assess cash flow impacts of staffing versus equipment investments on project viability.

An effective financial model enhances project funding strategies, ensuring accurate cost estimation and optimized cash flow in civil engineering.

Effective financial modeling in construction enhances project funding strategies by providing comprehensive forecasts and performance metrics to ensure financial feasibility.

Effective financial modeling in construction enhances project funding strategies, ensuring robust cost estimation and improved risk assessment for successful outcomes.

A robust financial model enhances project funding strategies, minimizing risks and maximizing ROI in civil engineering projects.

ADVANTAGES

A robust financial model demonstrates your project's viability, ensuring lenders that you can effectively repay the requested financing.

Effective financial modeling in construction enhances project funding strategies, ensuring robust cash flow and risk management for civil engineering projects.

Effective financial modeling in construction enhances project funding strategies by accurately identifying cash inflows and outflows, ensuring fiscal sustainability.

A flexible, 5-year financial model enhances project funding strategies by providing detailed cash flow and risk assessment for civil engineering projects.

A robust financial model enhances project funding strategies, ensuring effective risk assessment and maximizing returns on civil engineering investments.