Business Brokerage Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Business Brokerage Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

business brokerage Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BUSINESS BROKERAGE STARTUP BUDGET INFO

Highlights

This comprehensive five-year business brokerage financial model template is designed for startups and entrepreneurs, focusing on fundraising and strategic growth planning. It incorporates essential elements such as cash flow projections, financial forecasting techniques, and market research for brokers, providing a robust investment analysis framework. With key financial charts, metrics, and summaries, it aids in the business sale process by evaluating the brokerage’s worth and optimizing its capital structure. Additionally, it addresses buy-sell agreement essentials, seller financing options, and includes brokerage commission structure insights, ensuring a thorough financial due diligence approach for potential mergers and acquisitions analysis. Unlocked for full customization, this template serves as a vital tool for effective exit strategy planning.

The ready-made financial model in the Excel template alleviates common pain points for buyers by offering a comprehensive business valuation strategy that integrates essential business appraisal methods, enhancing the accuracy of mergers and acquisitions analysis. With built-in financial forecasting techniques, users can easily generate cash flow projections and assess various investment return metrics, optimizing their capital structure and supporting effective exit strategy planning. The template simplifies the business sale process and ensures clarity in brokerage commission structures, while also addressing critical elements like financial due diligence and risk assessment in brokerage. Furthermore, it provides guidance on buy-sell agreement essentials and seller financing options, enabling a more strategic approach to business negotiation tactics and competitive analysis for brokers.

Description

Our business brokerage P&L template excels in enabling informed principal business and financial decisions by delivering accurate reporting aligned with international standards. This model features a comprehensive 5-year outlook with monthly and yearly financial statements, essential KPIs, financial ratios, and diagnostic tools, including cash burn analysis and investment metrics. It integrates data for business loans and equity funding, enhancing your business valuation strategy and informing exit strategy planning. Tailored for small to medium-sized enterprises, this user-friendly Excel pro forma allows for easy updates to financial assumptions, thereby offering vital insights into cash flow projections, capital structure optimization, and competitive analysis for brokers, ultimately cultivating growth while mitigating liquidity risks.

BUSINESS BROKERAGE FINANCIAL PLAN REPORTS

All in One Place

Our comprehensive financial projections template for business brokerage is essential for both start-ups and established enterprises. It includes detailed proformas for forecasted profit and loss statements, cash flow projections, and projected balance sheets over a five-year horizon, all in an accessible Excel format. Additionally, our template provides performance review reports and annual summaries, ensuring you have the insights needed for strategic growth planning, effective investment analysis, and risk assessment. Optimize your business valuation strategy and enhance your exit strategy planning with this invaluable resource.

Dashboard

Our financial dashboard serves as an essential tool for strategic growth planning and business valuation strategy. Designed for comprehensive financial forecasting techniques, it employs dynamic charts and graphs to ensure precise analysis of key financial statements. This powerful resource not only enhances financial due diligence but also equips stakeholders with critical insights for cash flow projections and investment analysis frameworks. By streamlining the business sale process, our dashboard aids in exit strategy planning and optimizes capital structure, ultimately empowering informed decision-making in mergers and acquisitions analysis.

Business Financial Statements

Understanding the three core financial statements is essential for business owners and stakeholders engaging in business valuation strategy and investment analysis framework. Each report offers critical insights into a company's financial health. The projected income statement highlights key operating activities driving earnings, while the projected balance sheet and cash flow templates are essential for optimizing capital structure. These financial forecasting techniques enable effective mergers and acquisitions analysis, ensuring a robust exit strategy planning and supporting informed decision-making throughout the business sale process. Leveraging these tools enhances both competitive analysis for brokers and strategic growth planning.

Sources And Uses Statement

This financial model Excel template features a comprehensive sources and uses of cash statement, providing a clear overview of the company's funding structure. It effectively outlines the sources and applications of funds, essential for financial due diligence and investment analysis. With this tool, you can enhance your business valuation strategy and support informed decision-making throughout the business sale process. Utilize it to optimize capital structure and improve cash flow projections, ensuring strategic growth planning aligns with your exit strategy.

Break Even Point In Sales Dollars

This financial model template offers a comprehensive analysis of the break-even point in sales dollars, crucial for business valuation strategy. By pinpointing when revenue will surpass total costs, businesses can effectively illustrate their profit potential to investors and creditors. Understanding the interplay between revenue, fixed, and variable costs is vital in risk assessment during the business sale process. Early identification of this threshold enhances the credibility of financial forecasting techniques, guiding strategic growth planning and easing the decision-making process for stakeholders considering investment return metrics. Engaging with this analysis ensures informed, confident negotiations in mergers and acquisitions.

Top Revenue

In finance, “top line” and “bottom line” are critical indicators within a company’s financial forecasting. The top line represents total revenues or gross sales, reflecting a company’s growth potential and overall performance. Conversely, the bottom line denotes net income, indicating profitability after expenses. Investors closely monitor these metrics for insights into mergers and acquisitions analysis, business valuation strategy, and exit strategy planning. Understanding these concepts fosters effective investment analysis frameworks, aiding in cash flow projections, risk assessment in brokerage, and strategic growth planning for enhanced returns.

Business Top Expenses Spreadsheet

To maximize profitability, it’s essential to analyze service costs and implement strategies for optimization. Our financial forecasting model features a “Top Expenses” tab, highlighting the four largest costs while categorizing the remainder under “Other.” This streamlined approach enables quick visibility into significant expenses, empowering both startups and established companies to devise effective strategies for cost reduction annually. Incorporating rigorous financial due diligence and market research can further enhance your exit strategy planning, ensuring sustainable growth and improved investment return metrics for long-term success.

BUSINESS BROKERAGE FINANCIAL PROJECTION EXPENSES

Costs

This financial modeling Excel template enhances your business valuation strategy by seamlessly tracking your team's FTEs and PTEs. With integrated salary cost templates and expense tracking for group or individual budgets, it streamlines the business sale process. The automated formulas eliminate the need for manual updates, ensuring accurate cash flow projections and financial forecasting. This efficient tool is essential for rigorous investment analysis and strategic growth planning, empowering you to make informed decisions in mergers and acquisitions, capital structure optimization, and risk assessment. Elevate your brokerage operations with this comprehensive solution today.

CAPEX Spending

This financial model template is essential for startups, enabling precise capital expenditure forecasting and analysis. It assists in evaluating high startup costs and optimally planning your capital structure. By utilizing this tool, entrepreneurs can effectively balance their capital expense budget, ensuring robust financial health. With a focus on strategic growth planning and financial due diligence, this model supports informed decision-making, paving the way for successful business valuation strategies and future investment analysis frameworks.

Loan Financing Calculator

Our business plan Excel template includes a comprehensive loan amortization schedule, conveniently located in the 'Capital' tab. This feature allows users to effectively manage all aspects of their loans, incorporating proformas equipped with pre-built formulas for precise calculations of loan amounts, interest rates, and equity. Leverage this tool to enhance your financial forecasting techniques and streamline your exit strategy planning. With this template, you'll be well-prepared for strategic growth and confident in your financial due diligence during the business sale process. Optimize your capital structure with ease and ensure effective business valuation strategy implementation.

BUSINESS BROKERAGE INCOME STATEMENT METRICS

Financial KPIs

Gross profit margin, an essential financial ratio featured in business valuation strategies, serves as a key indicator of a company's financial health. This metric highlights the gap between revenue and cost of sales, offering insights into profitability. An increasing gross profit percentage suggests effective expense management related to selling goods or services and/or rising revenues. Engaging in comprehensive financial forecasting techniques can enhance this analysis, leading to informed decision-making in strategic growth planning and mergers and acquisitions analysis. Ultimately, understanding gross profit margin is crucial for optimizing capital structure and ensuring long-term success.

Cash Flow Forecast Excel

Forecasting the cash flow statement marks the culmination of a comprehensive three-way financial model. This iterative process integrates critical business valuation strategies and financial forecasting techniques. The cash flow projections are significantly influenced by the evolving figures on the projected balance sheet for the startup, alongside select non-cash income statement elements. By leveraging these insights, businesses can enhance their exit strategy planning and optimize capital structure, ensuring informed decision-making in mergers and acquisitions analysis.

KPI Benchmarks

This financial projection template features a dedicated tab for conducting a comparative analysis of key performance indicators across companies within the same industry. By leveraging strategic market research for brokers, this analysis provides a comprehensive appraisal of your company’s capabilities. It identifies growth opportunities and informs your business valuation strategy, enhancing your strategic growth planning and risk assessment in brokerage. Ultimately, such insights are essential for informed decision-making in the business sale process and can significantly strengthen your exit strategy planning.

P&L Statement Excel

A well-structured forecasted income statement serves as a crucial component of your business valuation strategy. This profit and loss statement summarizes the primary income and expenses, enabling effective financial forecasting techniques and cash flow projections. By highlighting net income or loss for the reporting period, it informs investment analysis frameworks and strategic growth planning. Incorporating this data enhances exit strategy planning and supports informed decision-making during mergers and acquisitions analysis. Understanding these elements is essential for optimizing capital structure and navigating the business sale process with confidence.

Pro Forma Balance Sheet Template Excel

This pro forma balance sheet for a startup provides a comprehensive overview of your current and fixed assets, liabilities, and equity. Utilizing this financial forecasting technique allows you to effectively monitor accounts receivable, accounts payable, and accrued expenses. By employing this three-statement model, you gain critical insights into your financial position, facilitating informed decision-making in your business valuation strategy and exit strategy planning. Understanding these key financials enhances your investment analysis framework and equips you for successful negotiations and strategic growth planning in the competitive market landscape.

BUSINESS BROKERAGE INCOME STATEMENT VALUATION

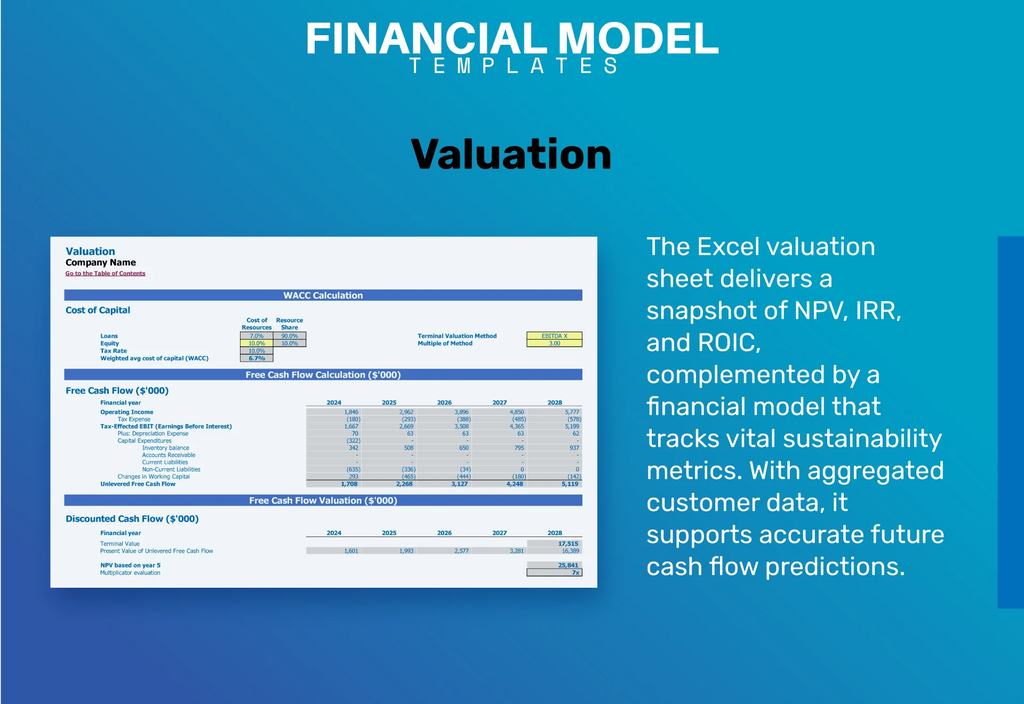

Startup Valuation Model

Our comprehensive financial plan Excel template equips investors with essential data for informed decision-making. Utilizing the weighted average cost of capital (WACC), stakeholders can assess the minimum return on invested enterprise funds. The free cash flow valuation reveals the cash flow accessible to all investors, including shareholders and creditors. Additionally, our discounted cash flow analysis illustrates the present value of anticipated future cash flows, crucial for effective business valuation strategies. This structured approach is vital for navigating mergers and acquisitions analysis, ensuring a smooth business sale process, and optimizing your exit strategy planning.

Cap Table

This financial projection model serves as a robust tool for cash flow forecasting and P&L analysis, incorporating a capital structure optimization table vital for precise forecasting. Utilizing this startup financial model, you can effectively evaluate sales and EBITDA, enhancing your investment analysis framework. The pro forma cap table you develop will be instrumental in strategic growth planning and financial due diligence, allowing investors to assess equity valuation methods and return metrics. Equip your business sale process with this comprehensive model to inform exit strategy planning and facilitate informed negotiations.

KEY FEATURES

A robust financial model enhances investment analysis, optimizes capital structure, and supports effective exit strategy planning for business success.

This versatile financial model empowers you to optimize your business valuation strategy and enhance financial forecasting for successful transactions.

Our financial model enhances business valuation strategy by providing accurate cash flow projections and robust investment return metrics.

The Startup Financial Model Template simplifies planning with essential features, eliminating the need for complex formulas and external consultants.

Utilizing financial forecasting techniques helps identify potential shortfalls in cash balances, enhancing strategic growth planning and risk management.

The financial model serves as a vital tool for proactive cash flow management and strategic decision-making in business brokerage.

Effective financial forecasting techniques streamline your business valuation strategy, ensuring informed decisions in mergers and acquisitions analysis.

The 5 Year Projection Plan streamlines financial forecasting, enabling you to focus on products, customers, and strategic growth initiatives.

Implementing robust financial forecasting techniques enhances strategic growth planning, ensuring informed mergers and acquisitions analysis for sustainable business success.

Utilizing a cash flow chart template enables strategic forecasting, revealing optimal funding options to accelerate growth and enhance valuation.

ADVANTAGES

A robust financial model enables precise cash flow projections, enhancing strategic growth planning and optimizing investment return metrics.

A regularly updated financial model enhances credibility with banks, supporting effective business valuation strategy and informed decision-making.

A financial model in Excel enables precise cash flow projections, enhancing business valuation strategy and informed decision-making during mergers and acquisitions.

Utilizing a financial model enhances strategic growth planning by providing precise cash flow projections and risk assessment in brokerage.

Effective financial forecasting techniques enhance cash flow projections, optimizing business valuation strategy during mergers and acquisitions analysis.