Brokerage Firm Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Brokerage Firm Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

brokerage firm Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BROKERAGE FIRM FINANCIAL MODEL FOR STARTUP INFO

Highlights

The five-year financial model template in Excel for a brokerage firm includes prebuilt three statements—consolidated profit and loss projections, a balance sheet, and a startup cash flow statement—essential for analyzing the brokerage firm financial structure and operational costs of brokerage firms. This comprehensive toolkit is designed to support financial analysis for brokers by incorporating key financial projections for brokerage, brokerage revenue streams, and profitability analysis. With crucial metrics and charts, it facilitates effective brokerage performance metrics evaluation and risk assessment, while also addressing capital requirements for brokerage and compliance costs. Additionally, this model aids in retail brokerage financial planning, client acquisition costs analysis, and liquidity management, ensuring a well-rounded approach to financial modeling for investment firms. Prior to acquiring a brokerage firm, utilizing this feasibility study template can significantly enhance decision-making processes while providing flexibility through its fully editable format.

This comprehensive brokerage firm financial structure template addresses common pain points by simplifying the complexities of financial modeling for investment firms, allowing users to create accurate financial projections for brokerage operations regardless of their experience level. By incorporating essential brokerage revenue streams and streamlining the cost structure in brokerage, it aids in assessing operational costs and client acquisition costs, ultimately enhancing brokerage firm profitability analysis. Moreover, the template facilitates brokerage firm risk assessment and liquidity management, ensuring that capital requirements are met while maintaining compliance with regulatory standards. With its focus on performance metrics and market share analysis for brokers, users can effectively navigate their operational challenges and optimize their investment brokerage model, thereby enabling better strategic decisions for sustainable growth.

Description

This brokerage firm financial model template is an essential tool for assessing the financial viability of launching or maintaining a brokerage firm, offering a comprehensive 5-year financial forecast based on historical performance and future assumptions. It includes a detailed summary of the three primary financial statements—income statement, pro forma balance sheet, and cash flow projections—while calculating key metrics such as Free Cash Flows, Internal Rate of Return, and Discounted Cash Flow. The model also assists in identifying the initial capital requirements and working capital needed, enabling accurate forecasting of sales and operational costs, as well as a thorough analysis of brokerage revenue streams and profitability. Furthermore, it provides a framework for conducting financial analysis for brokers, evaluating brokerage firm risk, managing liquidity, and enhancing client acquisition and compliance strategies, thereby facilitating informed decision-making in a dynamic market environment.

BROKERAGE FIRM FINANCIAL MODEL REPORTS

All in One Place

Business owners and managers can effectively navigate the intricacies of financial projections for brokerage firms using a comprehensive forecasting model. By consolidating all financial assumptions regarding revenues, operational costs, and revenue streams in one cohesive framework, this model provides a clear overview. It assists in assessing brokerage performance metrics, analyzing profitability, and managing liquidity. Moreover, it supports strategic decisions related to client acquisition costs and compliance expenses, enabling informed choices that enhance market share and optimize the investment brokerage model. A robust financial analysis empowers firms to achieve sustainable growth while mitigating risks.

Dashboard

Our startup’s financial plan includes a dynamic dashboard that consolidates key data from our financial projection template. This user-friendly interface allows for the establishment of essential performance metrics, seamlessly integrating them into calculations derived from business financial statements. Designed for flexibility, the dashboard presents crucial financial insights on a monthly basis and enables real-time updates as needed. This approach not only enhances our financial analysis for brokers but also supports strategic decision-making related to client acquisition costs and operational efficiencies, ultimately driving profitability and sustainable growth in our brokerage firm.

Business Financial Statements

Understanding a brokerage firm's financial structure requires analyzing its profit and loss statement, which highlights core revenue streams and operational efficiency. Meanwhile, the pro forma balance sheet and cash flow forecasts are essential for evaluating capital management, reflecting on assets and liabilities. Effective financial modeling for investment firms includes assessing brokerage performance metrics and profitability analysis to optimize client acquisition costs and compliance expenses. By integrating these insights, brokers can enhance their investment brokerage model and ensure robust risk assessment and liquidity management, ultimately improving market share and financial projections for sustained growth.

Sources And Uses Statement

The financial model template serves as a robust tool for evaluating a brokerage firm's performance and projecting its financial trajectory. By analyzing key metrics like revenue streams, operational costs, and client acquisition expenses, investors can assess a startup's viability and determine optimal capital requirements. This model enables timely insights on profitability and risk assessment, empowering brokerage firms to make informed decisions about expansion. Regular data input fosters confidence in the accuracy of financial projections, ensuring that both brokers and investors can rely on objective data for strategic planning and compliance management.

Break Even Point In Sales Dollars

Our financial projection template seamlessly integrates with your three key financial statements, enabling streamlined data flow for accurate break-even analysis. This calculation empowers management to pinpoint the moment the brokerage firm becomes profitable. The worksheet automatically computes essential metrics, including break-even sales levels, break-even units, and return on investment. By leveraging robust financial modeling for investment firms, this tool enhances your brokerage firm's profitability analysis and provides valuable insights into cost structure and revenue streams, ensuring effective financial planning and performance metrics evaluation.

Top Revenue

In a brokerage firm’s projected profit and loss statement, the top line represents revenue growth, while the bottom line reflects profitability. Analysts and investors closely monitor these vital metrics, as they influence financial projections, brokerage performance metrics, and overall company health. Top-line growth indicates increased sales, impacting various financial modeling aspects, such as operational costs and commission-based income models. Understanding these elements is essential for maintaining competitive market share and ensuring effective financial planning for investment firms, ultimately driving brokerage firm profitability and risk assessment strategies.

Business Top Expenses Spreadsheet

Our financial model template for startups features a dedicated tab that highlights the top four operational costs of brokerage firms. All remaining expenses are categorized under ‘Other’ for streamlined analysis. This investment brokerage model automatically computes your expenses based on your assumptions, providing a comprehensive financial analysis for brokers. With robust reporting, you can easily assess your brokerage firm profitability, ensuring effective financial projections and enhanced decision-making. Empower your retail brokerage financial planning and operational efficiency with this intuitive tool.

BROKERAGE FIRM FINANCIAL PROJECTION EXPENSES

Costs

Our financial template for brokerage firms enhances user experience through an intuitive design. Equipped with automated formulas, it facilitates seamless updates across all cells, alleviating the need for manual adjustments. This Excel-based financial forecast tool is tailored for investment brokerage models, enabling precise projections of operational costs and revenue streams. It supports financial analysis for brokers by providing insights into profitability, client acquisition costs, and compliance expenses. Leverage this comprehensive approach to streamline your brokerage firm’s financial planning and boost overall performance metrics. Experience efficient financial modeling that drives informed decision-making for sustained growth.

CAPEX Spending

The capital expenditure (CAPEX) forecast outlines the investments a brokerage firm allocates to enhance growth and operational efficiency, excluding headcount and other operational costs. Our analysis identifies high-value assets for investment and suggests areas to deprioritize. Given the diverse CAPEX needs across investment models, this report is essential for effective financial planning within your brokerage firm's valuation model. By understanding the cost structure and aligning it with financial projections, firms can optimize revenue streams and maximize profitability while mitigating risks through informed decision-making.

Loan Financing Calculator

A loan amortization schedule provides a detailed repayment timeline, essential for effective financial management. Our advanced cash flow statement template includes a dynamic loan amortization schedule equipped with pre-built formulas. This tool enables brokerage firms to seamlessly track monthly, quarterly, or annual payments, outlining principal and interest components. By incorporating this into your financial modeling for investment firms, you can enhance operational efficiency, refine cost structure in brokerage, and support robust financial projections for brokerage revenue streams, ultimately solidifying your brokerage firm's profitability analysis and compliance management.

BROKERAGE FIRM EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Utilizing a three-way financial model empowers entrepreneurs to leverage key performance indicators (KPIs) for effective financial analysis in brokerage firms. This approach enables a thorough assessment of brokerage performance metrics, facilitating insight into operational costs, revenue streams, and overall financial health. With our business plan financial projections template, key metrics are presented in visual formats for swift analysis, enhancing decision-making and strategic planning. This streamlined visibility aids in optimizing the brokerage firm’s profitability and compliance costs while attracting clients and managing liquidity effectively.

Cash Flow Forecast Excel

Forecasting the cash flow statement represents the culmination of an intricate, iterative process in developing a robust financial model for a brokerage firm. This cash flow projection hinges significantly on variations within the projected balance sheet and select non-cash income statement items. Effective financial analysis for brokers necessitates a deep understanding of the brokerage firm's financial structure, including revenue streams, cost structure, and capital requirements. By integrating these elements, firms can enhance their profitability analysis and ensure optimal liquidity management, ultimately driving strategic growth and client acquisition.

KPI Benchmarks

Our Excel pro forma template offers a comprehensive framework for industry benchmark analysis, including vital financial projections for brokerage firms. By comparing performance metrics—such as revenue streams and operational costs—with industry peers, users gain valuable insights into their brokerage firm valuation model and profitability analysis. This tool aids in evaluating commission-based income models and client acquisition costs, ensuring an informed approach to retail brokerage financial planning. Enhance your financial analysis for brokers and improve your market share with our expertly designed template.

P&L Statement Excel

The income statement is crucial for financial projections in a brokerage firm, highlighting its ability to generate profits or identify pathways to future profitability. While it details historical and forecasted income and expenses, it provides a limited view, lacking insight into assets, liabilities, and cash flow dynamics. A comprehensive financial analysis must include the balance sheet and cash flow statement to evaluate the complete financial structure. This holistic approach is essential for effective brokerage firm valuation, operational cost assessment, and understanding revenue streams, ensuring a robust profitability analysis and informed financial planning.

Pro Forma Balance Sheet Template Excel

The projected balance sheet for the startup's financial model provides a comprehensive overview of the company's assets and liabilities over the next five years. Utilizing an investment brokerage model, it highlights funding strategies, property holdings, and financial projections for brokerage operations. This essential tool informs owners, investors, and stakeholders about the firm's capital requirements, operational costs, and overall valuation. By showcasing crucial metrics, such as brokerage revenue streams and compliance costs, it supports informed decision-making and effective retail brokerage financial planning, ultimately enhancing brokerage firm profitability analysis.

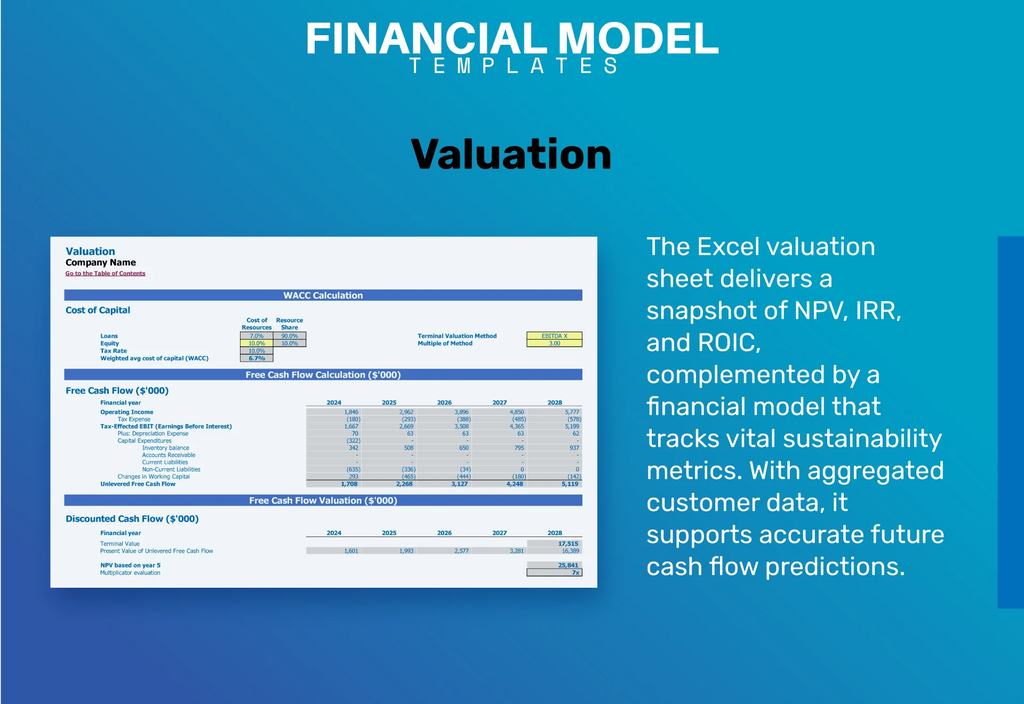

BROKERAGE FIRM FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Unlock crucial insights for your brokerage firm with a comprehensive valuation template included in our startup costs spreadsheet. This tool aids in financial modeling for investment firms, providing clarity on brokerage revenue streams, operational costs, and client acquisition costs. By employing methods like the weighted average cost of capital (WACC) and discounted cash flow (DCF), you can conduct a thorough brokerage firm valuation. Enhance your financial analysis for brokers and assess profitability through effective market share analysis, ensuring robust financial projections for your brokerage's growth and sustainability.

Cap Table

The cap table model effectively outlines a brokerage firm's equity structure, crucial for assessing share value and overall market capitalization. Utilizing this template enables investors to gauge the market value of prospective brokerage firms. Our comprehensive financial model for startups includes proformas for essential financial reports and additional calculations, facilitating a thorough financial analysis for brokerage performance metrics. Leverage this tool to enhance your investment brokerage model, streamline financial planning, and ensure informed decision-making for your brokerage firm’s profitability analysis. Invest in our financial model today to elevate your strategic insights.

KEY FEATURES

A robust financial model enhances profitability analysis, ensuring brokerage firms effectively manage operational costs and maximize revenue streams.

Utilizing a financial model enables proactive cash flow management, enhancing growth potential and safeguarding against future financial gaps.

A robust financial model enhances brokerage firm profitability by optimizing revenue streams and minimizing operational costs for sustainable growth.

Utilizing financial modeling empowers brokerage firms to forecast growth, manage operational costs, and enhance profitability with strategic insights.

A robust financial model enhances brokerage firm profitability analysis, optimizing revenue streams and minimizing operational costs for strategic growth.

Developing a robust brokerage firm financial model enhances profitability analysis and attracts investors with compelling projections and insights.

A robust financial model enhances brokerage firm profitability analysis, ensuring informed decisions on revenue streams and operational costs.

This sophisticated financial model empowers brokerage firms to achieve accurate financial projections and enhance profitability with ease.

An integrated financial model enhances brokerage firm profitability analysis, optimizing revenue streams and minimizing operational costs for better investor confidence.

A comprehensive financial model enhances brokerage firm profitability analysis by connecting assumptions, calculations, and outputs in an investor-friendly format.

ADVANTAGES

Leveraging a robust financial model enhances brokerage firm profitability analysis, ensuring informed decision-making and improved revenue streams.

The financial model enhances brokerage firm profitability analysis, enabling strategic decision-making and improved client acquisition costs management.

A well-structured financial model enhances brokerage profitability analysis, ensuring effective budgeting and optimal spending management over five years.

An effective financial model enhances cash flow visibility, enabling brokerage firms to identify potential shortfalls and optimize liquidity management.

A robust financial modeling for investment firms enhances profitability analysis, optimizing brokerage firm revenue streams and operational costs effectively.