Brewpub Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Brewpub Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

brewpub Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BREWPUB FINANCIAL MODEL FOR STARTUP INFO

Highlights

This highly versatile and user-friendly brewpub business plan includes a detailed financial model designed for crafting a forecasted income statement, cash flow analysis, and balance sheet with both monthly and annual timelines. Ideal for both startup and established brewpubs, this financial tool emphasizes essential components such as brewpub revenue streams, operating costs, and investment requirements. It also effectively supports brewpub financial projections, pricing strategy, and breakeven analysis, offering insights into cash flow and profit margins. By utilizing this comprehensive brewpub financial plan, you can strategically evaluate your venture before making significant investments, ensuring operational efficiency and robust financial health.

The ready-made brewpub financial model in Excel addresses critical pain points for entrepreneurs by offering a comprehensive brewpub business plan that incorporates detailed financial projections, including sales forecast and breakeven analysis, tailored to various startup scenarios. Users gain insights into brewpub revenue models, cash flow analysis, cost structures, and operating costs while benefiting from a user-friendly interface that requires no advanced Excel skills. The model helps streamline budget planning and pricing strategy development, alongside providing clarity on investment requirements and loan options, ultimately enhancing operational efficiency and profitability through robust financial assumptions and profit margins. This template not only simplifies the brewpub financial analysis process but also empowers owners to make informed decisions and effectively communicate their equity financing needs.

Description

The Brewpub Financial Projection serves as a comprehensive five-year financial plan tailored for both new and existing brewpubs, encompassing critical elements such as operating costs, startup expenses, and revenue streams. This model includes detailed financial projections like monthly and yearly profit and loss forecasts, a projected balance sheet, and cash flow analysis, along with industry-specific financial assumptions and performance KPIs. The brewpub revenue model outlines pricing strategies and breakeven analysis, while providing insights into financial ratios necessary for assessing investment requirements and loan options. Additionally, this template aids in budget planning and operational efficiency, positioning it as a vital tool for attracting equity financing and ensuring steady cash flow.

BREWPUB FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive brewpub financial projection template equips start-ups with essential tools for success. It features detailed pro formas, including forecast income statements, cash flow analysis, and balance sheets, all pivotal for effective brewpub business planning. With built-in functionality for both monthly and annual performance reporting, you can easily track your brewpub's operational efficiency. This model not only aids in budget planning but also supports your brewpub revenue model, enabling you to project profit margins, evaluate startup expenses, and conduct a thorough breakeven analysis. Secure your investment requirements and optimize your financial assumptions with this invaluable resource.

Dashboard

Our Excel financial model features a comprehensive dashboard showcasing key indicators essential for your brewpub business plan. This dashboard streamlines your financial modeling process, enabling you to assess various aspects such as operating costs, revenue streams, and profitability. Utilize it to monitor expenses, develop cash flow projections, and refine your pricing strategy. With tools for breakeven analysis and sales forecasts, this dashboard is instrumental in enhancing operational efficiency and guiding your investments, ensuring you stay on track to achieve your financial goals.

Business Financial Statements

Our expertly crafted three-statement financial model offers a comprehensive financial summary, seamlessly integrating data from detailed financial statements, pro forma balance sheets, income statements, and cash flow analysis. You don't need to be an Excel guru; our specialists have pre-configured the formulas to produce a polished financial summary for your brewpub business plan. This resource is essential for showcasing your brewpub revenue model, financial projections, and cash flow analysis, making it an invaluable tool for potential investors or lenders as you pursue equity financing or explore loan options.

Sources And Uses Statement

The sources and uses of cash statement provides a clear overview of funding sources and anticipated expenditures for your brewpub business plan. This essential component of your financial projections outlines investment requirements, startup expenses, and operating costs, ensuring a comprehensive cash flow analysis. By detailing these elements, you can effectively assess your brewpub's breakeven analysis and profitability potential, enhancing operational efficiency and informing your pricing strategy. This structured approach lays the groundwork for informed decisions regarding equity financing, loan options, and budget planning, ultimately supporting sustainable revenue streams and strong profit margins.

Break Even Point In Sales Dollars

Our brewpub business plan includes a comprehensive breakeven analysis to identify the pricing strategy that maximizes revenue while covering operating costs. By utilizing a CVP graph, we can determine the optimal price point for our offerings, ensuring financial stability. This strategic approach will enhance our cash flow analysis and support robust sales forecasts. With meticulous budget planning and a focus on operational efficiency, our financial projections will guide investment requirements and facilitate equity financing or loan options, ultimately bolstering profit margins and diversifying revenue streams.

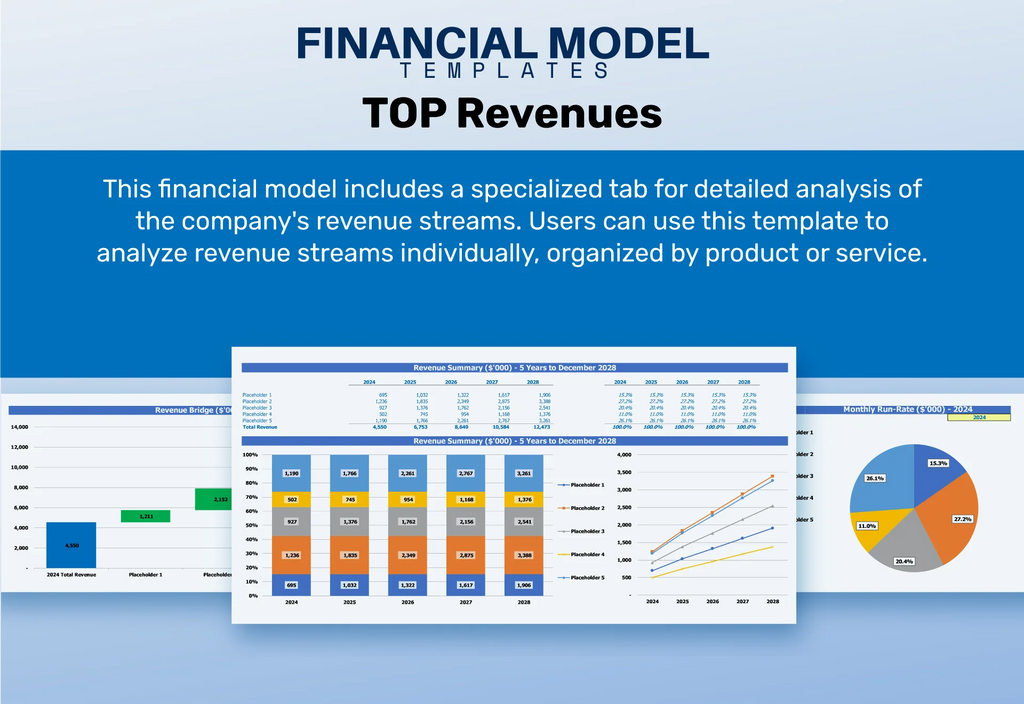

Top Revenue

In a brewpub business plan, the top line represents gross sales, a crucial metric that emphasizes revenue growth. Investors closely monitor this as it directly impacts profit margins and overall financial health. Consistent top-line growth signals strong demand and positively influences other financial aspects, such as cash flow analysis and operating costs. Moreover, understanding the brewpub revenue model and implementing a robust pricing strategy can enhance profitability. This attention to financial projections, including breakeven analysis and budget planning, ensures operational efficiency and lays the groundwork for successful equity financing or loan options.

Business Top Expenses Spreadsheet

Utilizing the Top Expenses tab, you can create a detailed cost report essential for your brewpub business plan. This internal report organizes operating costs by category, aiding in budget planning and tax preparation. By analyzing your expenses over specific periods—monthly, quarterly, or annually—you can evaluate performance against your financial projections. Understanding these costs allows for informed adjustments to your brewpub revenue model and pricing strategy, ensuring optimal profit margins. Use this data to enhance operational efficiency, conduct breakeven analysis, and refine your sales forecast, ultimately supporting strategic growth and investment requirements.

BREWPUB FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive brewpub business plan, incorporating financial projections and a robust budget planning model, is essential for success. By analyzing startup expenses, operating costs, and revenue streams, owners can identify key financial assumptions and optimize their pricing strategy. This tool not only highlights critical financial ratios and potential profit margins but also aids in cash flow analysis and breakeven analysis. With insights into investment requirements and loan options, brewpub entrepreneurs can strategically address challenges, enhance operational efficiency, and ensure sustainable growth in a competitive market.

CAPEX Spending

When launching a brewpub, capital expenditure (CAPEX) covers significant startup expenses, including property, equipment, and facilities. These assets, with a defined lifespan, depreciate over time, impacting the brewpub’s financial projections and profit margins. Essential financial metrics, such as the projected balance sheet and cash flow analysis, will illustrate development costs over five years. By strategically planning CAPEX, the brewpub aims to enhance operational efficiency and ensure sustainable revenue streams, ultimately contributing to robust financial ratios and achieving breakeven. A well-thought-out budget will support effective pricing strategy and informed investment requirements.

Loan Financing Calculator

Start-up and early-stage brewpubs must diligently monitor their loan repayment schedules. These schedules provide a detailed breakdown of loan amounts and maturity terms, essential for effective cash flow analysis. By including these repayments in the brewpub's financial projections, owners can better understand their financial health. Principal repayments, reflected in the cash flow forecast under financing activities, combined with interest expenses, significantly impact the brewpub's overall financial ratios and cash flow analysis. Careful management of these elements ensures operational efficiency and supports sound budget planning for future growth.

BREWPUB EXCEL FINANCIAL MODEL METRICS

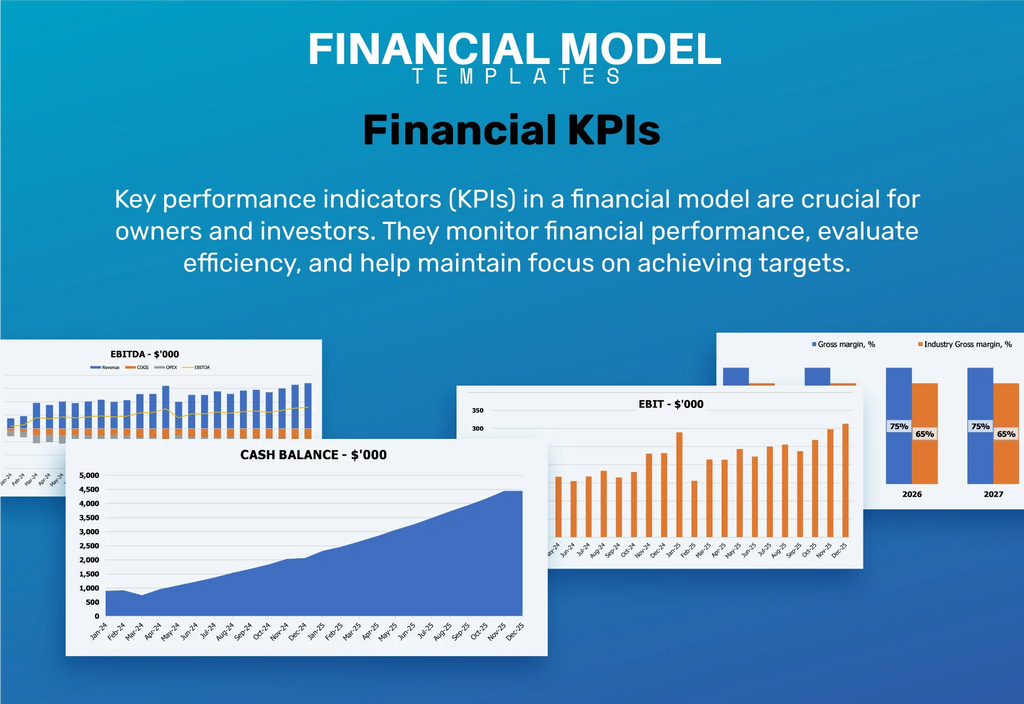

Financial KPIs

EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a crucial metric for evaluating the profitability of a brewpub. Unlike cash flow analysis, EBITDA incorporates both monetary and non-monetary elements, providing a clearer picture of operational performance. Understanding this statistic is essential for developing a robust brewpub business plan, as it influences financial projections, pricing strategy, and profit margins. By analyzing EBITDA alongside other financial ratios and operational efficiency, brewpub owners can make informed decisions about investment requirements, cost structure, and ultimately, sustainable revenue streams.

Cash Flow Forecast Excel

The operating cash flow forecasting model in our brewpub business plan provides a clear picture of cash generated from core operations, excluding secondary revenue sources such as interest or investments. This vital component forms the basis of our brewpub financial projections, enabling effective assessment of brewpub operating costs and profit margins. Understanding the cash flow in relation to our brewpub pricing strategy is key for strategic budget planning and operational efficiency. By conducting a thorough brewpub breakeven analysis, we can identify the necessary sales forecast to ensure sustainable revenue streams and align with our investment requirements.

KPI Benchmarks

Utilize our brewpub business plan Excel template to conduct a comprehensive benchmarking analysis. This tool simplifies comparative industry assessments, enabling you to evaluate your brewpub's financial position and operational efficiency against industry peers. Gain insights into your brewpub's profit margins, revenue streams, and pricing strategy while identifying key areas for improvement. Understanding your financial ratios and cash flow analysis will inform your startup expenses and investment requirements. Benchmarking is essential for startups, providing a clear view of how to close gaps and enhance performance in the competitive brewpub landscape.

P&L Statement Excel

This comprehensive financial model template generates projected income and expenditure statements based on your brewpub's unique financial assumptions. By utilizing this pro forma profit and loss statement, you gain valuable insights to inform your brewpub business plan and optimize performance. Conducting a thorough brewpub cash flow analysis and breakeven analysis enables you to identify strengths and weaknesses in your financial activities. With this data, you can strategize effectively, enhancing operational efficiency, improving profit margins, and refining your pricing strategy for sustainable revenue growth.

Pro Forma Balance Sheet Template Excel

A robust brewpub business plan includes a projected balance sheet that details assets and liabilities, offering insights into the company’s financial health. The profit and loss projection highlights operational results over time, while the pro forma balance sheet presents a snapshot of the business at a specific moment. Forecasting net worth differentiates between equity and debt, enabling analysis of liquidity, solvency, and turnover ratios. Key to your brewpub’s financial success, these components inform budget planning, cash flow analysis, and investment requirements, ultimately optimizing operational efficiency and profit margins.

BREWPUB FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive brewpub business plan includes a detailed startup valuation, addressing key data that investors often seek. The weighted average cost of capital (WACC) assures stakeholders of a minimum return on their investment. Our financial projections emphasize free cash flow, illustrating the cash available to shareholders and creditors. Additionally, the discounted cash flow analysis provides insight into the present value of all anticipated future cash flows. This approach enhances operational efficiency and supports informed decision-making, ensuring a solid foundation for our brewpub venture.

Cap Table

The brewpub business plan should include a comprehensive cap table template, essential for outlining ownership structures and stakeholder equity. This pro forma cap table details shares—equity and preferred—along with options and their respective valuations. By integrating this financial tool into your brewpub startup expenses and revenue model, you can enhance financial projections, optimize operational efficiency, and develop a robust pricing strategy. Incorporating a breakeven analysis and cash flow analysis will further strengthen your investment requirements and aid in achieving desired profit margins while navigating the complexities of brewpub financial ratios.

KEY FEATURES

A solid brewpub financial model streamlines budget planning, optimizing cash flow and enhancing overall operational efficiency for increased profitability.

An effective brewpub financial model enables you to focus on growth while optimizing your revenue streams and cost structure.

A well-structured brewpub financial model enhances decision-making, ensuring optimal revenue streams and operational efficiency for sustainable growth.

A clear financial model enables precise budgeting, enhances operational efficiency, and optimizes the brewpub's revenue and profit margins.

A robust financial model enhances your brewpub business plan by optimizing revenue streams and improving operational efficiency for sustainable growth.

A comprehensive brewpub financial model ensures insightful forecasts and efficient budgeting for strategic decision-making and improved profitability.

A solid brewpub financial model ensures sustainable growth, maximizes profit margins, and enhances cash flow management for long-term success.

Utilizing a comprehensive cash flow analysis and financial projections can help optimize your brewpub's growth and investment strategies.

A robust financial model ensures accurate brewpub financial projections, enhancing profitability and guiding strategic decisions for long-term success.

This comprehensive brewpub financial model empowers entrepreneurs to optimize operations and confidently forecast revenue and expenses.

ADVANTAGES

A flexible, 5-year financial model enhances brewpub planning by accurately projecting revenue streams and optimizing operating costs.

A robust brewpub financial model enhances clarity, ensuring accurate projections and informed decisions for sustainable growth and profitability.

A comprehensive brewpub financial model enhances budget planning and optimizes cash flow, ensuring sustainable growth and profitability.

A robust brewpub financial model enhances decision-making, ensuring strategic budget planning and optimizing profit margins for sustainable growth.

A robust brewpub financial model identifies potential shortfalls in cash balances, ensuring strategic decisions for sustained profitability and growth.