Bar Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Bar Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

bar Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SMALL BAR BUSINESS PLAN INFO

Highlights

The five-year horizon pro forma template in Excel is specifically designed for bar startups aiming to impress investors and raise capital. This comprehensive bar financial model provides essential insights for evaluating your startup idea, enabling you to effectively plan for startup costs. With its integrated financial forecasting for bars, you can easily analyze key financial metrics, including monthly sales forecasts, profit margins, and operational expenses. Additionally, the template includes a bar budget template that aids in managing liquor inventory and calculating cost of goods sold for bars, along with drink pricing strategies and revenue projections. This powerful tool is unlocked for full customization, allowing you to conduct a thorough bar cash flow analysis and break-even analysis to support your bar business plan.

The bar financial model offers a comprehensive solution to the common pain points faced by bar owners when developing their budgets and forecasting revenues. With pre-built templates for profit and loss statements and cash flow analysis, users can easily navigate operational expenses and capital expenditures. This model streamlines financial forecasting for bars by allowing for quick adjustments to drink pricing strategies and liquor inventory management, ensuring that bar revenue projections are both accurate and realistic. Additionally, it incorporates key performance indicators and financial metrics tailored to the bar industry, facilitating effective break-even analysis and improving overall financial analysis without the need for expensive consultants or complicated software.

Description

Our Bar Financial Model is meticulously crafted to empower bar owners with essential financial forecasting tools, enabling informed decision-making based on accurate data. This bar budget template encompasses critical components such as a profit and loss statement for the bar, cash flow analysis, and break-even analysis, allowing for precise bar revenue projections and insights into operational expenses. By integrating liquor inventory management and assessing cost of goods sold for bars, this model helps optimize drink pricing strategy and improve profit margins. Additionally, it provides a comprehensive overview of startup costs and capital expenditure, while key performance indicators serve as benchmarks for ongoing bar financial analysis. Ultimately, this financial model is designed to foster investor confidence through detailed monthly sales forecasts and robust financial metrics, ensuring sustainable growth and profitability in a competitive industry.

BUSINESS PLAN FOR A BAR REPORTS

All in One Place

Elevate your bar’s financial planning with our comprehensive bar financial model template. Seamlessly forecast key metrics like liquor inventory management, operational expenses, and profit margins. Customize your data with editable tables to refine your bar budget template and enhance drink pricing strategies. Predict monthly sales, analyze cash flow, and assess startup costs with ease. Our intuitive platform empowers you to create a thorough profit and loss statement for your bar, enabling informed decisions on funding and capital expenditures. Transform your bar business plan into a strategic roadmap for success today!

Dashboard

Our 3-year financial projection template is an essential tool for bars, expertly designed to streamline your cash flow management and ensure financial order. It generates comprehensive monthly or yearly reports, catering to your needs. With a user-friendly dashboard, you can easily access key performance indicators, essential financial metrics, and operational insights. Visualize your bar’s performance through dynamic charts, simplifying your bar business plan and enhancing financial forecasting. This template is ideal for managing liquor inventory, analyzing profit margins, and projecting revenue, empowering you to make informed decisions for sustainable growth.

Business Financial Statements

A bar's financial performance is assessed through three key statements: 1. **Profit and Loss Statement** – This outlines income and expenditures, crucial for understanding operational expenses and cost of goods sold for bars. 2. **Balance Sheet** – Reflects the bar's assets, liabilities, and shareholders' equity, ensuring a balanced financial picture. 3. **Cash Flow Statement** – Details cash inflows and outflows, essential for bar cash flow analysis and determining profitability. Utilizing effective bar financial analysis tools enhances financial forecasting for bars, guiding strategies like drink pricing and revenue projections.

Sources And Uses Statement

A well-structured sources and uses of funds statement is essential for bars to monitor income sources and allocate funds effectively. This financial analysis tool supports bar financial models and enhances forecasting, ensuring operational expenses, capital expenditure, and monthly sales forecasts are aligned with revenue projections. By implementing a robust budget template, bars can optimize liquor inventory management and develop a strategic drink pricing strategy, ultimately refining their profit and loss statement. Such clarity aids in setting key performance indicators and evaluating profit margins, paving the way for informed decision-making and sustainable growth.

Break Even Point In Sales Dollars

Understanding the relationship between revenue and costs is crucial for bar success. Utilizing a comprehensive bar valuation model, we calculate the break-even point (BEP), signifying when your bar startup will turn profitable. Our financial forecasting tools illustrate BEP through engaging graphs and precise calculations. With this bar budget template, you can adjust drink pricing strategies to simulate required sales volumes, ensuring you achieve your financial goals. This approach not only enhances your profit margin but also aids in liquor inventory management and operational expenses, driving informed decision-making for sustainable growth.

Top Revenue

In bar financial analysis, the top line (gross revenue) and bottom line (net profit) are crucial metrics. Investors and stakeholders closely monitor these figures through profit and loss statements and financial forecasting for bars. An increase in the top line, often referred to as "top-line growth," signals effective operational decisions and boosts overall financial performance. Utilizing bar budget templates, revenue projections, and cash flow analysis allows bar owners to make informed decisions, enhancing their drink pricing strategy and managing operational expenses. Ultimately, understanding these key financial metrics is vital for sustainable success in the bar industry.

Business Top Expenses Spreadsheet

In our financial forecasting model for bars, key expenses are categorized into four main groups. Additionally, our five-year financial projection template includes an 'other' category to accommodate unique company needs. To effectively manage your bar's finances, consider developing a startup costs spreadsheet, valid for up to five years, to monitor your progress. This strategic approach will enhance your bar business plan, streamline liquor inventory management, and support your profit and loss statement by facilitating comprehensive bar financial analysis and aiding in accurate bar revenue projections.

BUSINESS PLAN FOR BAR EXPENSES

Costs

Unlock the potential of your bar with our advanced financial modeling tools. Our comprehensive bar financial model enables precise forecasting and robust profit and loss statements, ensuring you're equipped to assess startup costs, operational expenses, and revenue projections. With detailed drink pricing strategies and effective liquor inventory management, you can enhance your profit margins. Utilize our bar budget template and cash flow analysis to identify key performance indicators that attract investors and drive profitability. Elevate your bar business plan and achieve informed decision-making for sustainable growth. Let's maximize your bar's financial success together!

CAPEX Spending

Capital expenditure (CAPEX) is a vital element of any bar's financial model. Financial experts must carefully establish a startup budget and monitor investments to ensure optimal financial performance. Understanding startup costs is essential for accurate cash flow forecasting and effective liquor inventory management. This knowledge directly influences key performance indicators and profit margin for bars. A well-prepared bar business plan, combined with a reliable bar budget template, enables owners to strategically manage operational expenses and project revenue. Prioritizing caution during initial budgeting phases is crucial for long-term success in a competitive market.

Loan Financing Calculator

Start-ups and growing bars must closely monitor their loan repayment schedules, which detail amounts and terms. This schedule is vital for effective cash flow analysis, influencing both the cash flow statement and balance sheet. Interest expenses from debts affect cash flow projections, while principal repayments are integrated into financing activities. Incorporating robust financial forecasting for bars, including a bar budget template and break-even analysis, ensures informed decision-making. Tools for bar financial analysis, such as profit and loss statements and revenue projections, provide key insights to optimize liquidity and maximize profit margins.

BAR START UP BUSINESS PLAN METRICS

Financial KPIs

Effortlessly monitor your key performance indicators with our comprehensive bar financial model! Tailored for periods ranging from 24 months to 5 years, this dynamic cash flow projection template includes essential KPIs such as EBITDA/EBIT for evaluating operational performance, detailed cash flow tracking for precise liquidity management, and cash balance insights to ensure financial stability. Enhance your financial forecasting for bars, optimize your drink pricing strategy, and streamline your operational expenses. Empower your bar business plan with these crucial metrics and tools to drive profitability and achieve sustainable growth!

Cash Flow Forecast Excel

An Excel cash flow format is essential for projecting financial activity, particularly for bars aiming to secure capital or loans. By conducting a thorough cash flow analysis, bar owners can mitigate the risks of illiquidity. This tool aids in developing a comprehensive bar business plan, incorporating key financial metrics and operational expenses. With accurate forecasting, including bar revenue projections and monthly sales forecasts, you can strategically manage cash flow and optimize your drink pricing strategy. Using bar financial analysis tools ensures a solid foundation for your establishment’s financial health and growth.

KPI Benchmarks

Monitoring key performance indicators (KPIs) through a pro forma template is essential for bar financial analysis. Utilizing a financial forecasting model allows for a comprehensive comparison, helping establish benchmarks to enhance revenue projections and profitability. The Benchmark Tab synthesizes metrics such as operational expenses, cost of goods sold, and cash flow analysis to identify best practices. For startups, effective benchmarking empowers strategic decision-making, ensuring alignment with financial goals. Investing time in these analyses can significantly influence growth strategies, ultimately leading to improved profit margins and financial success in the competitive bar industry.

P&L Statement Excel

The 5-year financial projection template for bars streamlines your financial forecasting, making calculations effortless. With built-in formulas, it simplifies complex analyses, enabling you to generate insightful reports and charts effortlessly. The projected profit and loss statement is crucial for monitoring profitability, while the pro forma income statement helps identify areas for improvement. By utilizing this template, you can enhance your bar's operational efficiency, refine your drink pricing strategy, and ultimately boost your profit margin. Empower your bar business plan with accurate bar financial metrics and achieve sustainable growth.

Pro Forma Balance Sheet Template Excel

A balance sheet forecast is a vital financial tool that outlines your bar's assets, liabilities, and equity at a specific point in time. Key assets often include buildings and equipment, crucial for operational success. Banks closely examine projected balance sheets, especially the detailed asset sections, to assess loan security and overall financial health. Utilizing bar financial analysis tools and including this forecast in your bar business plan can enhance liquidity management and support strategic decision-making. Incorporating these insights allows for informed capital expenditure planning and improved profit margin for bars.

BAR START UP BUSINESS PLAN VALUATION

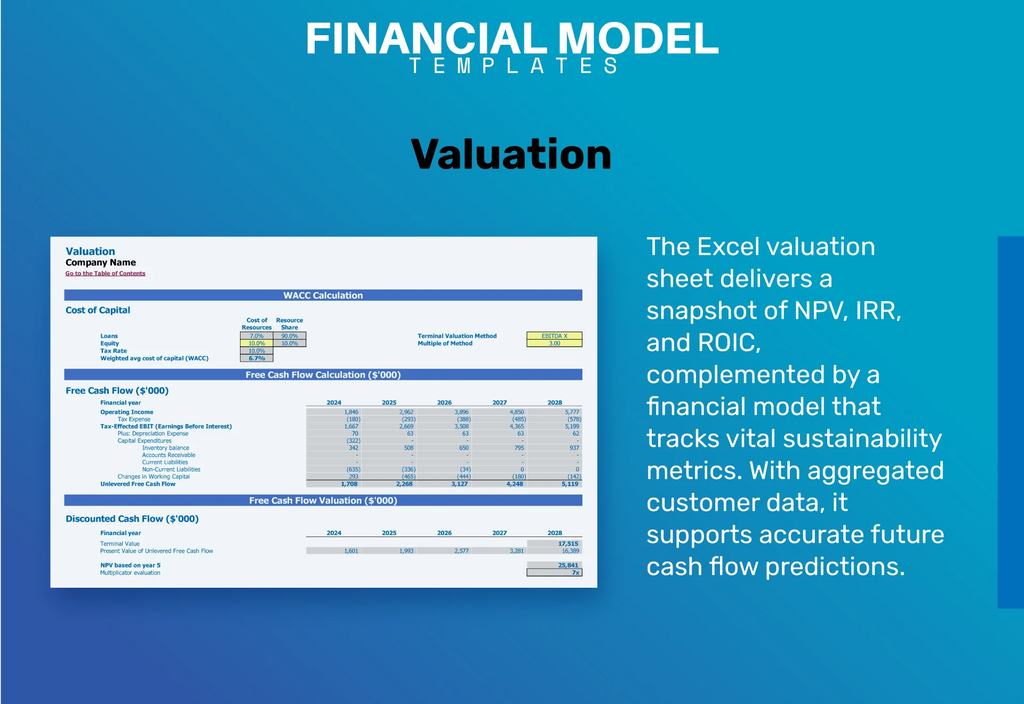

Startup Valuation Model

Our bar financial model streamlines startup valuation with critical metrics like Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC assesses capital cost, vital for banks evaluating loan risks. DCF helps investors gauge future cash flow values, crucial for informed investment decisions. Leverage these financial forecasting tools alongside a bar budget template to drive profitability. Understanding key performance indicators and conducting a bar break-even analysis enhances your strategic approach, optimizing operational expenses while maximizing profit margins. Ensure your bar business plan is solid with accurate cash flow analysis and revenue projections.

Cap Table

Our comprehensive bar financial model Excel template includes a dedicated cap table on a separate spreadsheet, providing a clear ownership breakdown at various milestones. This cap table is essential for investors, illustrating potential returns upon exit. By integrating this with bar financial analysis tools, you can enhance your financial forecasting for bars, assess startup costs, and create a robust business plan. Utilize our template to optimize your bar's valuation model and stay on top of key performance indicators, ensuring your venture remains financially sound and strategically focused.

KEY FEATURES

Utilizing a bar financial model enhances budgeting accuracy, enabling effective spending management and improved profitability for your establishment.

Utilizing a bar financial model enables precise cash flow forecasting, empowering informed decisions for future revenue and expense management.

Using a bar financial model enables precise revenue projections, enhancing profitability and guiding your successful business strategy.

The bar financial model offers comprehensive tools for effortless forecasting and analysis, ensuring your business thrives without external costs.

Unlock your bar’s potential with a robust financial model that enhances revenue projections and optimizes profit margins effectively.

This comprehensive bar financial model empowers owners to make informed decisions, optimize profitability, and streamline operational efficiency.

A robust bar financial model demonstrates your ability to repay loans while optimizing profitability and ensuring sustainable growth.

A robust cash flow analysis strengthens your loan application by demonstrating repayment capability and financial planning confidence to lenders.

A robust bar financial model streamlines budgeting, enhances revenue projections, and maximizes profit margins for sustainable growth.

Our easy-to-use bar financial model provides reliable insights for effective budgeting, revenue projections, and operational decision-making.

ADVANTAGES

Optimize your bar's profitability and efficiency using a comprehensive bar financial model for informed decision-making and strategic planning.

Developing a sales strategy with a bar financial model enhances profitability through accurate revenue projections and effective cost management.

A robust bar financial model enables accurate revenue projections and effective management of operational expenses for long-term profitability.

Utilizing a bar financial model enables precise forecasting, helping to optimize startup costs and enhance profitability for your establishment.

Utilizing a bar financial model enables precise expense estimation, facilitating effective budgeting and enhanced profitability for your establishment.