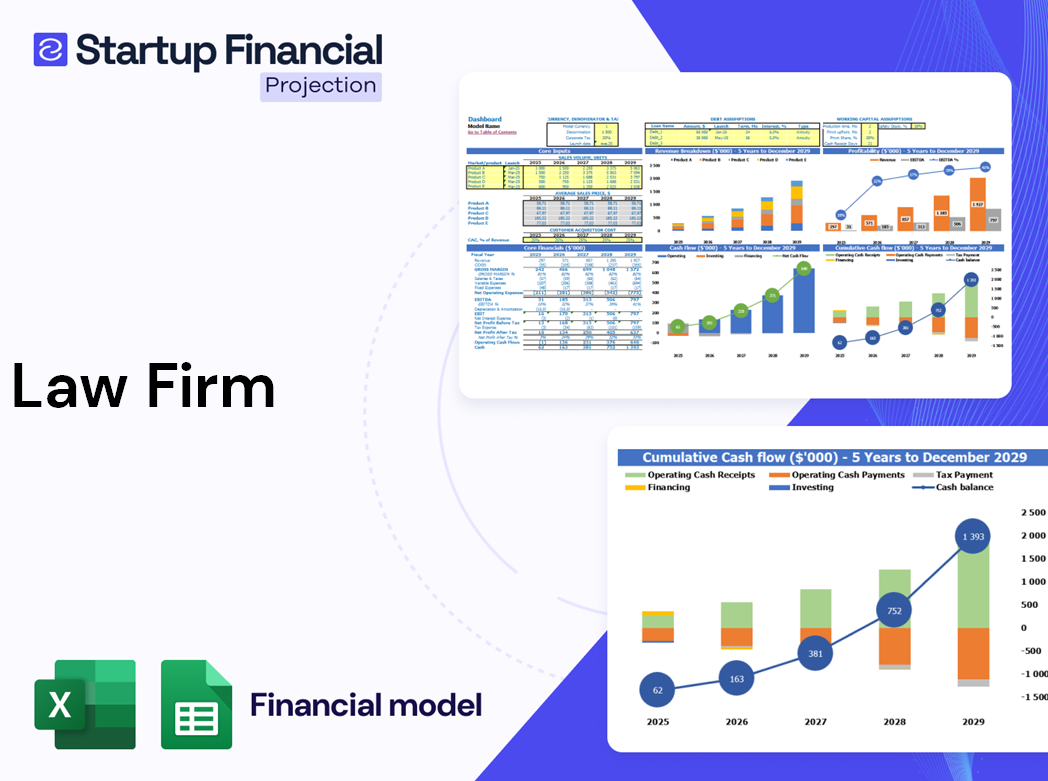

- 5-Year Financial Projection

- 40+ Charts & Metrics

- DCF & Multiple Valuation

- Free Email Support

Related Blogs

Curious about the core KPI metrics that can transform your law firm’s performance? Understanding and tracking these 7 essential KPIs is crucial for optimizing your operations and driving success. From Client Acquisition Costs to Billing Realization Rates, knowing how to calculate these metrics will empower you to make informed decisions. Ready to dive deeper? Check out this comprehensive business plan tailored for law firms!

Why Do You Need To Track KPI Metrics For A Law Firm Business?

Tracking KPI metrics for law firms is crucial for any legal practice aiming to thrive in a competitive environment. By closely monitoring these metrics, law firms can gain valuable insights into their performance, identify areas for improvement, and align their operations with their law firm business goals.

Here are some key reasons why tracking law firm performance metrics is essential:

- Informed Decision Making: KPIs provide data-driven insights that help law firms make informed decisions. For instance, understanding client acquisition cost allows firms to allocate marketing budgets efficiently.

- Financial Health Monitoring: Monitoring financial KPIs for law firms, such as average revenue per client, aids in assessing the firm's financial health and profitability.

- Operational Efficiency: By tracking operational KPIs for law firms, such as time to resolution, firms can streamline their processes and enhance client service.

- Client Satisfaction Improvement: Measuring client satisfaction through various metrics can lead to improved retention strategies, ensuring that clients receive the best service possible.

- Competitive Edge: Understanding how to calculate KPIs for law firms allows firms to benchmark against industry standards, ensuring they remain competitive within the legal sector.

Recent studies indicate that firms actively tracking their law firm success metrics see a growth of up to 30% in revenue compared to those that do not. This statistic highlights the tangible benefits of integrating a KPI strategy for law firms into everyday operations.

Tips for Effective KPI Tracking

- Define clear objectives for each KPI to ensure alignment with your law firm business goals.

- Utilize KPI tracking tools for law firms that integrate with existing systems for seamless data collection.

- Regularly review and update KPIs to reflect changes in the legal landscape and business strategy.

In conclusion, the importance of KPIs in law firms cannot be overstated. With the right metrics in place, firms like JusticePath Law Group can bridge the gap in legal representation by ensuring they operate efficiently and effectively, ultimately giving everyone a fair opportunity to seek justice.

What Are The Essential Financial KPIs For A Law Firm Business?

Tracking KPI metrics for law firms is crucial for understanding the financial health and performance of any legal practice, including the innovative

- Client Acquisition Cost (CAC): This metric measures the total expense incurred to acquire a new client. It can be calculated by dividing the total cost of marketing and sales by the number of new clients acquired in a specified period. For example, if a law firm spends $50,000 on marketing and acquires 100 clients, the CAC would be $500 per client.

- Average Revenue Per Client: This KPI helps in understanding the revenue generated from each client. It is calculated by dividing the total revenue by the number of clients served. If a law firm generates $500,000 in revenue from 200 clients, the average revenue per client would be $2,500.

- Client Retention Rate: Retaining clients is more cost-effective than acquiring new ones. This metric is calculated by dividing the number of clients retained over a period by the number of clients at the beginning of that period, multiplied by 100 for percentage. For example, if a firm starts with 150 clients and retains 120, the retention rate is 80%.

- Time to Resolution: This KPI measures the average time taken to resolve a case or issue. A shorter resolution time typically indicates efficiency and can lead to higher client satisfaction. Tracking this over time can help identify bottlenecks in case processing.

- Referral Rate: This measures the percentage of clients who refer new business to your firm. A high referral rate often indicates strong client satisfaction and loyalty. It is calculated by dividing the number of new clients from referrals by the total number of clients, multiplied by 100.

- Case Win Rate: This KPI tracks the success of the firm in winning cases. It’s calculated by dividing the number of cases won by the total number of cases handled. For example, if a firm wins 75 out of 100 cases, the win rate is 75%.

- Utilization Rate: This measures the percentage of billable hours worked compared to total hours worked. It provides insight into how effectively resources are being used. A typical target for law firms might be around 70-75%.

- Billing Realization Rate: This KPI indicates the percentage of billed hours that are collected. A realization rate of 90% or more is often seen as an indicator of good financial health within the firm.

Tips for Improving Financial KPIs in Law Firms

- Regularly review marketing strategies to optimize client acquisition costs. This involves analyzing the effectiveness of different channels and refining approaches based on performance data.

- Implement feedback mechanisms to capture client satisfaction, which can lead to improved client retention rates and more referrals.

- Invest in training staff to enhance case resolution efficiency, thereby reducing the average time to resolution.

By focusing on these **financial KPIs** and leveraging the insights gained,

Which Operational KPIs Are Vital For A Law Firm Business?

Understanding the operational KPIs for law firms is essential for measuring the effectiveness and efficiency of daily operations. These KPIs not only provide insights into a law firm's day-to-day performance but also align closely with strategic goals, ensuring a robust path toward achieving business objectives.

The following operational KPIs are vital for a law firm business:

- Client Acquisition Cost (CAC) - This metric represents the average cost of acquiring a new client, which typically includes marketing expenses, advertising costs, and other related overheads. For law firms, CAC can range from $500 to $2,000 depending on the type of legal services provided.

- Time to Resolution - This KPI measures the average time taken to resolve a case from initiation to completion. Benchmark statistics suggest that law firms should aim for a 30% reduction in resolution times year over year to improve client satisfaction and operational efficiency.

- Utilization Rate - This measurement indicates the percentage of time spent on billable work compared to non-billable work. Law firms typically strive for a utilization rate of 60% to 75% for optimal productivity.

- Billing Realization Rate - This KPI tracks the percentage of billable hours that are actually invoiced to clients. A realization rate of less than 90% may suggest inefficiencies in billing processes that need to be addressed.

- Referral Rate - This metric reflects the percentage of new clients who come through referrals, helping to gauge client satisfaction and trust. A referral rate above 30% is considered excellent in the legal industry.

By focusing on these key operational KPIs, law firms like JusticePath Law Group can effectively measure their performance and ultimately align their operational strategies with their business goals.

Tips for Tracking Operational KPIs

- Utilize KPI tracking tools specifically designed for law firms to streamline data collection and reporting processes.

- Regularly review and analyze these KPIs to identify trends, areas for improvement, and successes.

- Involve your team in discussions around these KPIs to foster a culture of accountability and continuous improvement.

Measuring success in law firms requires a balanced understanding of both financial and operational KPIs. Employing these metrics ensures that firms not only maintain profitability but also enhance client satisfaction, thereby securing a competitive edge in the legal market.

How Frequently Does A Law Firm Business Review And Update Its KPIs?

Tracking KPI metrics for law firms is essential for ensuring alignment with business goals and adapting to industry changes. The frequency of reviewing and updating these metrics can vary depending on the specific firm and its operational needs, but general guidelines suggest a regular review cycle.

For most law firms, it’s advisable to review operational KPIs monthly, while financial KPIs should be assessed quarterly. This allows for timely adjustments based on performance data. In some cases, firms may choose to conduct a thorough annual review, which encompasses a comprehensive analysis of both financial and operational KPIs.

Moreover, here is a frequency breakdown to consider:

- Monthly: Review operational KPIs such as client retention rates and time to resolution to ensure day-to-day activities align with strategic objectives.

- Quarterly: Assess financial KPIs like average revenue per client and billing realization rate to evaluate overall financial health.

- Annually: Conduct a full KPI audit, analyzing trends and outcomes over the previous year to inform long-term strategic planning.

It is crucial to also consider external factors that may necessitate an immediate KPI review, such as changes in market conditions or legal regulations. According to a study by Altman Weil, firms that actively measure success using law firm performance metrics can achieve up to a **20% increase** in profitability.

Tips for Effective KPI Review and Updates

- Utilize KPI tracking tools for law firms to automate data collection and reporting.

- Engage your team in KPI discussions to foster a culture of accountability and continuous improvement.

- Stay informed about industry benchmarks to better understand your performance relative to peers.

By implementing these practices, law firms like JusticePath Law Group can enhance their operational efficiency and financial performance, ensuring they remain competitive in the legal industry. Understanding the importance of KPIs in law firms is key to successful law firm business strategies.

What KPIs Help A Law Firm Business Stay Competitive In Its Industry?

In the rapidly evolving legal landscape, tracking KPIs for law firms has become crucial for maintaining a competitive edge. As JusticePath Law Group aims to revolutionize legal services, understanding and implementing law firm performance metrics can significantly influence client satisfaction and overall business success. Below are key KPIs that aid in staying competitive:

- Client Acquisition Cost (CAC): This metric indicates how much is spent to acquire a new client. The average CAC for law firms is around $1,500. Lowering this cost can enhance profitability.

- Client Retention Rate: Calculating the percentage of clients retained over a specific period is vital. A high retention rate (typically around 70% to 90% for successful firms) indicates strong client relationships.

- Average Revenue Per Client: This metric reveals the revenue generated from each client, with top firms averaging around $5,000 to $10,000 annually per client.

- Time to Resolution: Measuring the average time taken to resolve cases is essential—competent firms aim for 3 to 6 months depending on the case type.

- Referral Rate: Tracking the percentage of new clients coming from referrals is an indicator of client satisfaction. Top firms often see referral rates of over 30%.

- Case Win Rate: The percentage of cases won versus total cases is a critical success measure. High-performing law firms typically maintain win rates of 70% or higher.

- Utilization Rate: This percentage reflects the portion of time attorneys spend on billable work compared to total work hours. A good target is around 65% to 75%.

Tips for Tracking KPIs Effectively

- Implement a KPI tracking tool to streamline data collection and reporting.

- Regularly review KPIs in team meetings to keep everyone aligned with law firm business goals.

- Set benchmarks based on industry standards to evaluate performance against competitors.

In addition to the traditional metrics, measuring client satisfaction through surveys and feedback is vital for long-term success. A high client satisfaction score, preferably over 85%, can lead to greater loyalty and referrals.

As you consider the importance of KPIs in law firms, it's crucial to align these metrics with long-term strategic goals, fostering a culture of accountability and continuous improvement. The strategic use of financial KPIs for law firms and operational KPIs for law firms can make all the difference in how a firm like JusticePath navigates challenges and seizes opportunities for growth.

For more insights on managing law firm success metrics, consider checking industry benchmarks available in articles about law firm profitability and strategic planning.

How Does A Law Firm Business Align Its KPIs With Long-Term Strategic Goals?

Aligning KPIs with long-term strategic goals is crucial for any law firm, including JusticePath Law Group, which aims to enhance access to legal services for underrepresented populations. By effectively measuring and managing performance through KPI metrics for law firms, businesses can ensure that their daily operations support their overarching mission.

To align KPIs with strategic goals effectively, a law firm should follow these steps:

- Define clear long-term strategic goals related to client service, operational efficiency, and community outreach.

- Identify appropriate KPI metrics for law firms that directly measure progress towards these goals, such as client retention rates and average revenue per client.

- Implement regular reviews of KPI performance to ensure they are on track to meet the established goals.

- Utilize KPI tracking tools for law firms to automate data collection and reporting, ensuring timely and relevant insights.

Key Performance Indicators to Consider

- Client Acquisition Cost: Measure how much is spent to gain a new client.

- Time to Resolution: Assess how efficiently cases are being resolved.

- Client Satisfaction Score: Gauge client feedback to enhance service quality and retention.

Statistics indicate that firms tracking essential financial KPIs for law firms can see a 20% increase in overall efficiency. By focusing specifically on operational KPIs for law firms, such as utilization rates and billing realization rates, JusticePath Law Group can optimize its resources, ensuring that the firm not only meets but exceeds its strategic objectives.

Continuously revisiting and refining KPIs allows the law firm to stay agile and competitive in the legal industry. For example, if client acquisition costs exceed industry standards, adjustments can be made to marketing strategies or referral systems to improve law firm business goals.

In summary, the integration of well-defined KPIs into the strategic framework of a law firm, such as JusticePath Law Group, enables a focused approach to achieving long-term goals while addressing the immediate needs of clients. This method ensures that the firm remains aligned with its mission to provide accessible and affordable legal services while effectively measuring success in law firms.

What KPIs Are Essential For A Law Firm Business's Success?

For a law firm like JusticePath Law Group, which aims to provide accessible and comprehensive legal services, tracking the right KPI metrics for law firms is crucial for ensuring sustainable growth and achieving business goals. Essential KPIs not only measure current performance but also guide strategic planning and operational improvements. Here are some of the most impactful metrics:

- Client Acquisition Cost (CAC): This metric helps law firms understand how much it costs to acquire a new client. For JusticePath Law Group, reducing CAC could enhance profitability and allow for reinvestment into community outreach efforts. Consider that a desirable CAC for legal practices is typically below 20% of the first-year revenue from a new client.

- Average Revenue Per Client (ARPC): Calculating ARPC involves dividing the total revenue by the number of clients. For example, if your law firm generated $1,000,000 in revenue from 500 clients, your ARPC would be $2,000. Increasing ARPC is vital for sustainable growth and can be influenced by upselling services.

- Client Retention Rate: This KPI measures the percentage of clients who continue to utilize services over a period. A high retention rate, ideally above 70%, indicates client satisfaction and loyalty. Implementing effective client retention strategies for law firms can include regular follow-ups and tailored services.

- Time to Resolution: This measures the average time taken to close a case. A shorter time to resolution boosts client satisfaction and firm efficiency. A benchmark to aim for can be under 90 days for most standard cases.

- Referral Rate: This demonstrates how many new clients come through referrals. A strong referral rate, typically around 30%, indicates a high level of client satisfaction. Enhancing this metric can involve creating incentives for referrals.

- Case Win Rate: This essential KPI quantifies the firm’s success in winning cases. For a law firm, a win rate of over 70% is generally seen as excellent performance, reflecting case preparation and client confidence.

- Utilization Rate: For law firms, this metric indicates the percentage of time spent on billable work. A healthy utilization rate for legal professionals is often around 60% to 75%. Improving this can help increase overall revenue.

- Billing Realization Rate: This measures the percentage of billable hours that a firm actually receives payment for. A typical target is a realization rate of over 80%, indicating effective billing practices that ensure receivables are collected.

- Client Satisfaction Score (CSAT): This critical metric gives insight into client experiences and satisfaction. Regularly surveying clients can help maintain a score above 85%, showing that your firm meets or exceeds client expectations.

Tips for Measuring Success in Law Firms

- Implement KPI tracking tools for law firms to streamline data collection and analysis, enabling quicker decision-making based on real-time data.

- Consider regular staff training to improve case win rates and client satisfaction metrics, leading to higher retention and referral rates.

- Schedule quarterly reviews of all KPIs to assess progress toward law firm business goals and adjust strategies promptly.

By consistently monitoring these essential KPIs, JusticePath Law Group can ensure it remains competitive in the legal industry while providing valuable services to its community. These metrics not only measure past performance but also set the foundation for future strategic initiatives. For more detailed insights into law firm profitability and growth, consider checking out resources that delve into financial strategies tailored for legal practices.

Client Acquisition Cost

Client Acquisition Cost (CAC) is a critical KPI metric for law firms, especially for a business like JusticePath Law Group, which strives to make legal services accessible and affordable. Understanding and managing CAC is vital for improving law firm performance metrics and achieving business goals. This metric gives insight into how much a firm spends to acquire each new client, allowing firms to fine-tune their marketing strategies and optimize resource allocation.

To calculate Client Acquisition Cost, you can use the following formula:

CAC = Total Marketing and Sales Expenses / Number of New Clients Acquired

For instance, if JusticePath Law Group spends $20,000 on marketing and successfully acquires 100 new clients, the CAC would be:

CAC = $20,000 / 100 = $200

This means that the firm spends $200 to acquire each new client, which can be evaluated against the average revenue per client to ensure profitability.

Tips for Reducing Client Acquisition Cost

- Refine target audience: Focus on specific demographics to reduce wasted marketing efforts.

- Utilize referral programs: Encourage satisfied clients to refer others, lowering CAC by leveraging existing relationships.

- Invest in digital marketing: Optimize online presence through SEO and social media to attract clients cost-effectively.

Tracking CAC also allows for benchmarking against industry standards. According to legal industry reports, the average CAC for law firms typically ranges from $200 to $500, depending on the firm's size and practice area. This variability highlights the importance of evaluating the efficiency of marketing campaigns and adjusting strategies accordingly.

| Metric | Typical Range | JusticePath Target |

|---|---|---|

| Client Acquisition Cost | $200 - $500 | $200 |

| Average Revenue Per Client | $1,500 - $3,000 | To be determined |

| Client Retention Rate | 60% - 80% | Target > 75% |

To effectively manage CAC, it is crucial to monitor it regularly and align it with other operational KPIs for law firms, such as Client Retention Rate and Average Revenue Per Client. By maintaining a low CAC in conjunction with high retention rates, JusticePath Law Group can ensure sustainable growth and profitability while fulfilling its mission to serve underrepresented populations.

Average Revenue Per Client

The Average Revenue Per Client (ARPC) is a critical KPI metric for law firms, directly reflecting the firm’s ability to generate income from its clientele. This financial KPI allows law firms to assess how effectively they monetize their services and can highlight potential areas for improvement within the legal practice. To calculate ARPC, you can use the following formula:

ARPC = Total Revenue / Number of Clients

For instance, if JusticePath Law Group earned $500,000 in revenue last year and served 250 clients, the ARPC would be:

ARPC = $500,000 / 250 = $2,000

This means that, on average, each client contributed $2,000 to the firm’s revenue.

Tracking ARPC not only helps in understanding the firm’s financial health but also serves as a tool for strategic planning. An increasing ARPC can indicate successful client engagement and satisfaction, while a declining figure might suggest the need for better client acquisition strategies or enhanced service offerings.

| Year | Total Revenue | Number of Clients | ARPC |

|---|---|---|---|

| 2021 | $300,000 | 150 | $2,000 |

| 2022 | $500,000 | 250 | $2,000 |

| 2023 | $750,000 | 350 | $2,143 |

The ARPC also plays a significant role in determining the firm’s overall law firm performance metrics. An analysis of ARPC trends over time can provide valuable insights into:

- Client demographics and preferences.

- Effectiveness of marketing strategies and client acquisition costs.

- Potential areas for upselling or cross-selling services.

Tips for Improving Average Revenue Per Client

- Enhance service offerings to meet diverse client needs, potentially increasing overall fees.

- Implement client retention strategies to maintain long-term relationships, boosting repeat business.

- Utilize data analytics to tailor marketing campaigns, attracting higher-value clients.

Moreover, comparing ARPC against industry benchmarks can help JusticePath Law Group identify where it stands in the competitive landscape. According to recent statistics, the average ARPC for law firms varies widely by specialization—ranging from $1,200 in family law to over $4,000 in corporate law. Understanding these metrics can guide your law firm business goals and strategies.

Ultimately, measuring the Average Revenue Per Client is essential for any law firm looking to enhance its financial performance and achieve sustainable growth. By focusing on this KPI, firms like JusticePath Law Group can make informed decisions that align with their mission of providing accessible legal services while ensuring profitability.

For those looking to dive deeper into financial modeling and projections for law firms, consider utilizing tools that are designed specifically for the legal industry. This can enhance your ability to track and improve financial KPIs for law firms effectively. Check out the resources available at Law Firm Financial Model Templates to facilitate your strategic planning and KPI tracking.

Client Retention Rate

The Client Retention Rate is a vital KPI metric for law firms that plays a crucial role in measuring law firm performance metrics and overall success. This metric indicates the percentage of clients who continue to engage with your firm over a specific period, reflecting client loyalty and satisfaction. For legal practices like JusticePath Law Group, which focuses on accessible legal services, maintaining a high retention rate is essential to achieving long-term business goals.

To calculate the Client Retention Rate, you can use the formula:

Client Retention Rate (%) = [(E - N) / S] x 100

Where:

- E = Number of clients at the end of the period

- N = Number of new clients acquired during the period

- S = Number of clients at the start of the period

For example, if your law firm started with 100 clients (S), gained 20 new clients (N), and ended with 110 clients (E), the calculation would be:

Client Retention Rate = [(110 - 20) / 100] x 100 = 90%

A solid retention rate of **90% or higher** is typically seen as an excellent benchmark in the legal industry. High retention rates not only indicate satisfied clients but also contribute significantly to the financial KPIs for law firms.

Tips to Improve Client Retention Rate

- Implement regular follow-ups to maintain client engagement.

- Solicit feedback to identify areas for improvement.

- Provide value-added services or resources that clients can benefit from.

In the realm of law firm business strategies, understanding the importance of KPIs in law firms is pivotal. The Client Retention Rate serves not just as a number, but as a reflection of your law firm’s reputation and service quality. Tracking this KPI effectively can offer insights into client satisfaction and areas requiring improvement, enabling you to design targeted client retention strategies for law firms.

| Retention Rate | Industry Average | JusticePath Law Group Goal |

|---|---|---|

| 85% - 90% | 80% - 85% | 90%+ |

Having a high Client Retention Rate allows firms like JusticePath Law Group to strengthen client relationships, drive repeat business, and enhance their overall reputation in the legal community. Organizations with effective client retention practices typically report upwards of **30%** of their annual revenue generated from repeat clients, underscoring the financial viability of focusing on this KPI.

Additionally, leveraging KPI tracking tools for law firms can aid in assessing and improving retention strategies. By integrating technology into client relationship management, firms can streamline communication and ensure clients feel valued throughout their journey.

Time To Resolution

The metric known as **Time to Resolution** is crucial for any law firm looking to optimize its operations and enhance client satisfaction. For JusticePath Law Group, which aims to provide accessible and comprehensive legal services, tracking this KPI is essential in demonstrating efficiency and commitment to clients. This metric measures the duration taken to resolve a case from initiation to closure, and it can significantly impact a firm's reputation and client retention.

To calculate Time to Resolution, the formula is straightforward:

Time to Resolution = Total Time Taken to Resolve Cases / Total Number of Cases Resolved

By effectively analyzing this metric, JusticePath Law Group can benchmark its performance against industry standards and implement strategies for improvement. Industry data shows that the average Time to Resolution for law firms can vary significantly, often ranging from **30 to 180 days**, depending on the complexity of cases handled. Thus, maintaining a lower average can be a strong competitive advantage.

| Time to Resolution (Average Days) | Industry Benchmark | JusticePath Target |

|---|---|---|

| 30-60 | Simple Cases | Under 30 |

| 90-120 | Moderate Complexity | Under 90 |

| 150-180 | Complex Cases | Under 150 |

Reducing Time to Resolution not only enhances client satisfaction but also improves financial performance. Quicker resolutions mean higher capacity to take on more cases, leading to increased revenue. Law firms that prioritize this metric often see a positive correlation with **financial KPIs** such as revenue per client and overall profitability.

Tips for Reducing Time to Resolution

- Implement case management software to streamline processes and communication.

- Regularly train staff on best practices in case handling and management.

- Conduct weekly reviews of ongoing cases to identify bottlenecks early.

Tracking Time to Resolution is also vital for measuring client satisfaction, as clients often prioritize the speed of service when choosing a law firm. Incorporating client feedback mechanisms can provide vital insights into the factors affecting resolution times.

In conclusion, maintaining and tracking the Time to Resolution KPI not only aligns with JusticePath Law Group’s mission to provide efficient legal services but also strengthens its operational capabilities, making it a leader in accessible legal representation.

For law firms looking to improve their KPI metrics, utilizing tools and resources can make a significant difference. Investing in solutions that track these vital metrics can facilitate better decision-making and enhance performance. Explore more about KPI tracking tools tailored for law firms [here](https://financialmodeltemplates.com/products/law-firm-financial-model).

Referral Rate

The referral rate is a crucial KPI metric for law firms, particularly for a firm like JusticePath Law Group, which aims to enhance legal access and representation. This metric indicates the percentage of clients acquired through referrals from existing clients or other professionals. A high referral rate not only demonstrates client satisfaction but also reflects the firm's reputation and visibility in the community.

To calculate the referral rate, you can use the following formula:

| Referral Rate (%) | = (Number of Referrals / Total New Clients) x 100 |

For example, if JusticePath Law Group receives 30 referrals in a year and brings in a total of 100 new clients, the referral rate would be:

| Referral Rate | = (30 / 100) x 100 | = 30% |

Tracking this KPI is especially important in today's competitive legal landscape, where client acquisition costs can be high. Referral clients often have a lower acquisition cost compared to those acquired through traditional marketing channels.

Research suggests that law firms with a referral rate of 20% to 30% typically see stronger growth and higher client retention rates. By focusing on enhancing client experiences and cultivating relationships, firms can boost their referral rates significantly.

Strategies to Improve Referral Rates

- Implementing a client satisfaction survey to identify areas for improvement.

- Creating a referral program that rewards existing clients for successful referrals.

- Engaging in community outreach initiatives to build relationships with potential referral sources.

- Maintaining regular communication with past clients to keep the firm top-of-mind.

The importance of tracking KPIs in law firms cannot be overstated, especially in relation to how well they perform over time. For JusticePath Law Group, focusing on referral rates can not only help in measuring success but also in aligning with broader business goals aimed at providing enhanced legal services to underrepresented populations. Regularly assessing referral rates, along with other law firm performance metrics, will enable the firm to develop strategies that drive growth and community engagement.

In conclusion, understanding and improving the referral rate is a key step in achieving long-term success for any law firm. For more insights and tools on how to effectively track and calculate KPIs for law firms, consider exploring further resources available for law firm financial modeling.

For detailed information on financial models tailored for law firms, visit: Law Firm Financial Model.

Case Win Rate

The case win rate is a pivotal KPI metric for law firms, serving as a direct indicator of a firm’s effectiveness in achieving favorable outcomes for clients. This metric is calculated by dividing the number of cases won by the total number of cases handled, expressed as a percentage. For example, if a firm wins 75 out of 100 cases, the case win rate would be 75%. This simple but powerful metric not only reflects the firm’s legal expertise but also plays a crucial role in business development and client acquisition.

High case win rates are often associated with client satisfaction and can significantly influence a potential client’s decision when choosing legal representation. Monitoring this KPI helps law firms to not only gauge their performance but also to identify areas for improvement in legal strategies and client communication.

To effectively track and improve the case win rate, JusticePath Law Group can leverage various tools and methodologies:

- Analyze past case outcomes to identify common factors in successful cases.

- Conduct regular training sessions to enhance legal professionals’ skills and knowledge.

- Utilize technology to streamline processes and improve case management.

Maintaining a competitive edge in the legal industry necessitates a keen focus on this metric. On average, successful law firms aim for a case win rate of around 70% to 85%. Achieving or exceeding this benchmark can significantly bolster a firm’s reputation within the community, directly impacting its client acquisition cost and overall revenue.

| Win Rate Benchmark | Poor Performance | Average Performance | High Performance |

|---|---|---|---|

| Case Win Rate (%) | Below 50% | 50% - 70% | Above 70% |

Tips for Improving Case Win Rate:

- Invest in ongoing legal education and training for attorneys.

- Encourage collaboration and knowledge-sharing among team members.

- Utilize data analytics to predict case outcomes more accurately.

By prioritizing the case win rate as part of its KPI strategy, JusticePath Law Group not only enhances its law firm performance metrics but also aligns with its overarching business goals of providing accessible and effective legal services. The importance of KPIs in law firms cannot be overstated, as they are fundamental to measuring success and driving continuous improvement.

For law firms looking to implement a robust KPI tracking system, consider exploring KPI tracking tools for law firms that can provide insights and streamline the process of measuring vital metrics, including the case win rate.

Utilization Rate

The Utilization Rate is a critical operational KPI for law firms, representing the ratio of billable hours to total hours worked by attorneys. This metric not only reflects the efficiency of lawyers in terms of generating revenue but also illustrates how effectively a law firm utilizes its available resources.

To calculate the Utilization Rate, use the following formula:

Utilization Rate = (Total Billable Hours / Total Hours Worked) × 100

For instance, if an attorney works 40 hours in a week and bills 30 hours to clients, the Utilization Rate would be:

Utilization Rate = (30 / 40) × 100 = 75%

This indicates that 75% of the lawyer's time is being billed to clients, which is generally considered a strong performance benchmark in the industry.

According to industry studies, top-performing law firms often achieve utilization rates of over 80%, while rates below 60% may signal inefficiencies that need addressing. Tracking this metric helps firms assess workload distribution, identify underutilized resources, and optimize practice management.

Tips for Improving Utilization Rate

- Implement efficient case management tools to streamline workflows and reduce administrative burdens.

- Regularly review and adjust staffing levels to match demand, ensuring that attorneys are not over or underworked.

- Invest in training for attorneys on time management and billing practices to maximize billable hours.

Utilization Rate directly ties into the financial KPIs for law firms as well. An increased utilization rate often correlates with enhanced profitability. For JusticePath Law Group, a firm dedicated to accessible legal services, monitoring this metric is essential to ensure that resources are allocated wisely while meeting community needs.

| KPI | Benchmark | JusticePath Target |

|---|---|---|

| Utilization Rate | 75% - 80% | 80% |

| Client Satisfaction Score | 4.5/5 | 4.7/5 |

| Average Revenue Per Client | $1,500 | $1,800 |

Monitoring and optimizing the Utilization Rate is crucial for measuring success in law firms, especially for those like JusticePath Law Group, who aim to maintain a balance between profitability and service quality.

With the use of KPI tracking tools for law firms, JusticePath can ensure they stay competitive while achieving their business goals. For more insights on KPI metrics for law firms, visit JusticePath Law Group.

Billing Realization Rate

The Billing Realization Rate is a critical KPI metric for law firms, particularly for a business like JusticePath Law Group, which aims to offer accessible and affordable legal services. This metric helps measure the effectiveness of a law firm in translating its billable hours into actual revenue. It is calculated by taking the total billed amount and dividing it by the total fees that could have been billed during a specific period. The formula can be expressed as:

Billing Realization Rate (%) = (Total Billed Amount / Total Billable Hours) x 100

For example, if a law firm bills $100,000 in a month but could have billed $150,000, the Billing Realization Rate would be:

(100,000 / 150,000) x 100 = 66.67%

This means that the firm realized approximately 66.67% of its potential revenue. A higher realization rate indicates efficient billing practices and suggests that the firm is effectively capturing the value of its services. Law firms typically target a realization rate of between 85% to 95% as an industry benchmark.

Tracking this KPI is essential for understanding the profitability of legal practices and can inform strategies for improving operational efficiency and maximizing revenue. Analyzing billing realization rates alongside other financial KPIs for law firms provides a more comprehensive view of financial health.

Tips for Improving Billing Realization Rate

- Implement billing software that tracks time accurately to minimize write-offs.

- Regularly review and update billing practices to ensure they align with client expectations.

- Train staff on effective billing communication to reduce client disputes over invoices.

In the competitive legal industry, firms often utilize operational KPIs for law firms like the Billing Realization Rate to identify areas for improvement. By doing so, JusticePath Law Group can strategically align its services to meet the financial needs of clients while also maintaining profitability.

| Metric | Calculation | Industry Benchmark |

|---|---|---|

| Billing Realization Rate | (Total Billed Amount / Total Billable Hours) x 100 | 85% - 95% |

| Average Revenue Per Client | Total Revenue / Number of Clients | $3,000 - $7,000 |

| Client Retention Rate | ((Clients at End of Period - New Clients) / Clients at Start of Period) x 100 | 75% - 85% |

Understanding the Billing Realization Rate is only the first step. Law firms need to implement consistent tracking strategies to monitor this KPI regularly. Regular updates and reviews will not only help in keeping track of performance but also in measuring success in law firms. Utilizing KPI tracking tools for law firms can facilitate ongoing evaluation, enabling firms to make necessary adjustments to their business strategies promptly.

By emphasizing the importance of the Billing Realization Rate, JusticePath Law Group can enhance its operational efficiency, contributing to its overarching goal of providing equitable legal services to underrepresented populations. As this law firm continues to innovate and expand, understanding these critical law firm performance metrics will be vital in achieving long-term success.

Client Satisfaction Score

A law firm's Client Satisfaction Score is a critical KPI metric that reflects the overall perception of clients regarding the service they received. For JusticePath Law Group, this metric is not only a measure of success but also a vital tool in ensuring that the firm meets its mission of providing accessible and comprehensive legal services. By systematically measuring client satisfaction, the firm can identify both strengths and areas for improvement, ultimately leading to enhanced client experiences and better outcomes.

To calculate the Client Satisfaction Score, law firms can use various methods, including surveys, feedback forms, and interviews. The formula for calculating the score typically looks like this:

| Method | Calculation | Details |

|---|---|---|

| Survey Ratings | (Total Positive Responses / Total Responses) * 100 | Collect ratings on a scale (e.g., 1-10) and categorize them as positive. |

| Net Promoter Score (NPS) | % of Promoters - % of Detractors | Measure the likelihood of clients recommending your firm. |

Tracking client satisfaction can lead to tangible outcomes, such as increased client retention, referrals, and revenue. Studies show that a firm with a high Client Satisfaction Score can see a 25% increase in repeat business, as satisfied clients are more likely to return for future legal needs.

Tips for Improving Client Satisfaction

- Implement follow-up communications after case closures to gather informal feedback.

- Utilize client satisfaction surveys that include open-ended questions to capture qualitative insights.

- Establish clear communication protocols to keep clients informed about their case progress.

Moreover, the impact of client satisfaction on law firm performance metrics can be staggering. A legal practice that invests in measuring and enhancing client satisfaction often experiences:

- Higher Client Retention Rate: Practices with high client satisfaction levels often retain up to 90% of their clients.

- Increased Referral Rate: Happy clients are likely to refer new clients, contributing to a 30% increase in business through word-of-mouth.

- Competitive Advantage: A firm that prioritizes client satisfaction stands out in a crowded market, improving its overall law firm performance metrics.

At JusticePath Law Group, the importance of client satisfaction cannot be overstated. By focusing on this KPI, the firm aligns its services with the needs of its clients, ensuring a fair opportunity for every individual and small business striving for justice. For legal practices looking to delve deep into effective KPI strategies, including the Client Satisfaction Score, consider utilizing KPI tracking tools for law firms to streamline your efforts and achieve your law firm business goals.