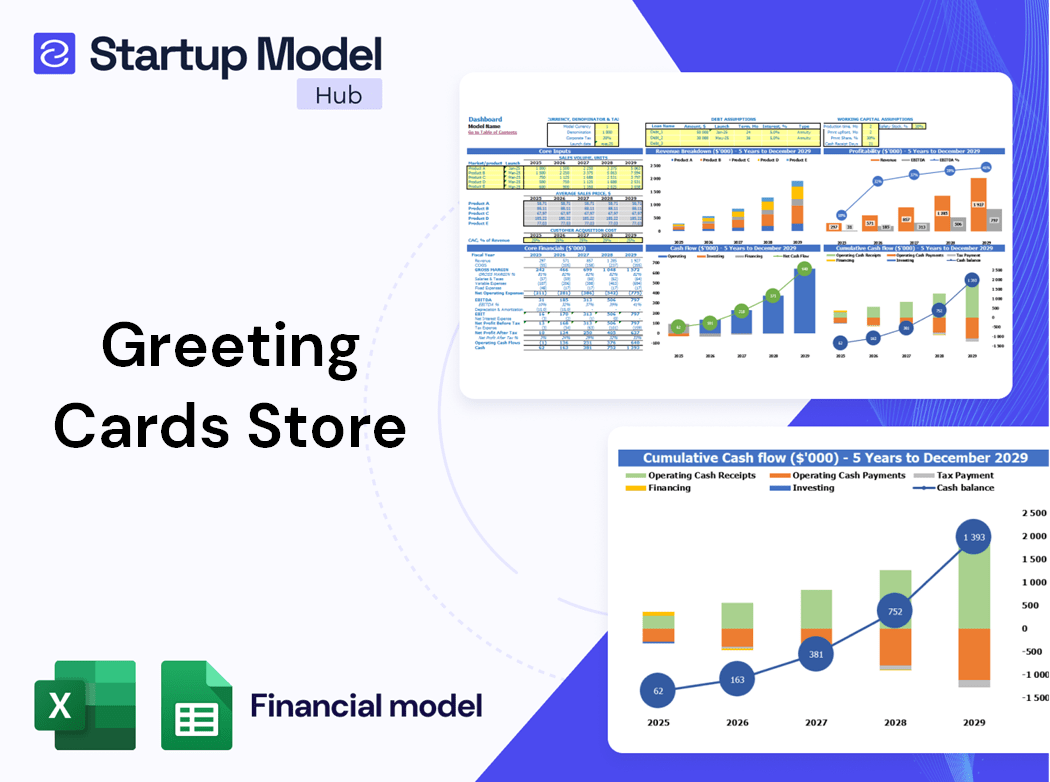

- 5-Year Financial Projection

- 40+ Charts & Metrics

- DCF & Multiple Valuation

- Free Email Support

Related Blogs

Are you aware of the seven core KPI metrics that can transform your greeting cards store's performance? Understanding how to calculate and track these essential KPIs is crucial for optimizing your business strategy and maximizing profitability. Dive deeper into the world of KPIs and discover how they can pave the way for your store’s success by exploring our comprehensive business plan at this link.

Why Is It Important To Track KPI Metrics For A Greeting Cards Store Business?

Tracking KPI metrics for greeting cards store businesses is essential for understanding performance, optimizing operations, and driving growth. KPIs provide insightful data that can help greeting card shops make informed decisions, adapt to market changes, and enhance customer engagement. For instance, businesses that actively track their greeting card store financial KPIs often see revenue increases of up to 20% annually, as they can identify and capitalize on profitable trends.

Moreover, operational KPIs for greeting cards play a critical role in managing inventory and improving customer satisfaction. By calculating KPIs for greeting card store operations, businesses can reduce excess stock, improve turnover rates, and ultimately increase profitability. In fact, a well-managed inventory can lead to a 30% increase in sales performance metrics.

Key Benefits of Tracking KPIs

- Enhances decision-making through data-driven insights.

- Identifies areas for improvement and operational efficiency.

- Facilitates better customer acquisition and retention strategies.

- Aligns business activities with strategic goals for growth.

- Monitors financial health and sustainability of the greeting card store.

Regularly reviewing KPIs helps businesses to adapt their strategies in a rapidly changing market. For example, a greeting card store that tracks its customer acquisition cost can adjust marketing budgets to maximize return on investment. Studies indicate that businesses that routinely review their KPIs can boost their sales growth by as much as 15%.

In conclusion, the importance of KPIs in greeting card business cannot be overstated. They are not merely numbers; they are vital indicators of success that inform every aspect of the business, from financial performance to customer satisfaction. By implementing best practices for KPI evaluation in greeting cards, businesses like Heartfelt Greetings can ensure they remain competitive and aligned with their long-term strategic goals.

What Are The Essential Financial KPIs For A Greeting Cards Store Business?

For a greeting cards store like Heartfelt Greetings, tracking financial KPIs is crucial to understand the business's financial health and performance. These metrics provide insights that help in making informed decisions to enhance profitability and sustainability.

- Customer Acquisition Cost (CAC): This metric indicates how much it costs to acquire a new customer. For greeting card stores, a typical CAC might range from $10 to $30, depending on marketing strategies and channels used.

- Average Order Value (AOV): Calculating AOV helps to assess customer spending habits. A well-optimized greeting card store can achieve an AOV of around $25 to $50, which can be increased through upselling and cross-selling strategies.

- Customer Retention Rate: This KPI reflects the percentage of repeat customers and is crucial for long-term success. A healthy retention rate for greeting card businesses should be above 60% to ensure a stable revenue stream.

- Sales Growth Rate: Monitoring the sales growth rate allows businesses to evaluate their performance over time. A sustainable greeting card store typically aims for an annual growth rate of 10% to 20%.

- Inventory Turnover Ratio: This ratio measures how efficiently stock is sold and replenished. For greeting cards, an ideal inventory turnover ratio would be around 4 to 6 times per year, indicating effective inventory management.

- Gross Profit Margin: Understanding gross profit margin is essential for pricing strategies and overall financial planning. A gross profit margin of 50% to 70% is common in the greeting card industry, depending on production and operational costs.

- Return On Investment (ROI): This metric assesses the profitability of investments made in marketing and products. A solid ROI for greeting card stores should ideally exceed 20%, showcasing effective use of resources.

Tips for Tracking Financial KPIs

- Regularly review financial records to ensure accuracy in calculations, especially for metrics like CAC and AOV.

- Utilize accounting software that can automate the tracking of these metrics to save time and reduce errors.

- Involve your team in discussions about KPIs to foster a culture of accountability and continuous improvement.

By effectively tracking these financial KPIs, Heartfelt Greetings can align its operational strategies with financial outcomes, ensuring a thriving and competitive presence in the greeting card industry. For more insights on financial metrics and best practices, consider visiting relevant resources like this article.

Which Operational KPIs Are Vital For A Greeting Cards Store Business?

For a greeting card store business like Heartfelt Greetings, operational KPIs are essential to ensure smooth daily operations and long-term success. These metrics help track how efficiently the business is functioning and identify areas for improvement, thus enhancing overall performance.

Here are the critical operational KPIs to monitor:

- Inventory Turnover Ratio: This metric indicates how often inventory is sold and replaced over a period. A higher ratio suggests efficient inventory management. For a greeting card store, an ideal turnover ratio typically ranges from 4 to 8 times per year.

- Sales per Square Foot: This KPI measures how much revenue is generated for every square foot of retail space, offering insights into the effectiveness of the store layout and product placement. A target of $300 to $500 in sales per square foot is common for retail establishments, including greeting card stores.

- Employee Productivity Rate: This KPI gauges the output of each employee in terms of sales or tasks completed. Maintaining a productivity rate of $150,000 to $200,000 in sales per employee annually can signify a well-performing team.

- Customer Footfall: Tracking the number of customers visiting the store daily or weekly helps assess marketing effectiveness. An increase in footfall often correlates with increased sales, indicating successful promotional strategies.

- Average Transaction Value (ATV): This metric calculates the average amount spent by customers per transaction. For greeting card stores, boosting the ATV can be crucial; aiming for an ATV of $20 to $30 is a good goal.

- Order Fulfillment Time: This KPI measures the time taken from receiving an order to delivering it to the customer. Reducing fulfillment time to less than 24 hours can enhance customer satisfaction and loyalty.

- Return Rate: Understanding the percentage of product returns can help identify issues with product quality or customer expectations. Keeping this rate below 5% is advisable for maintaining profitability.

Tips for Monitoring Operational KPIs

- Implement a robust POS system to track sales and inventory in real-time, enabling more accurate KPI calculations.

- Regularly review KPIs and adjust strategies based on performance to ensure continuous improvement.

- Engage employees in understanding these metrics, as their feedback can provide valuable insights for enhancing operational efficiency.

By carefully tracking these operational KPIs, Heartfelt Greetings can foster a sustainable business model that not only boosts revenue but also enhances customer engagement and loyalty in the greeting cards market.

How Frequently Does A Greeting Cards Store Business Review And Update Its KPIs?

For a greeting cards store like Heartfelt Greetings, the frequency of reviewing and updating KPI metrics for greeting cards store is critical to ensuring sustained success and growth. Regular evaluation enables business owners to identify trends, make informed decisions, and adapt to market changes. Typically, greeting card businesses should review their KPIs on a monthly basis, with a deep dive into the most critical metrics conducted quarterly.

The essential KPIs focused on during these reviews include:

- Customer Acquisition Cost

- Average Order Value

- Customer Retention Rate

- Sales Growth Rate

- Inventory Turnover Ratio

- Gross Profit Margin

- Return On Investment

- Monthly Active Customers

- Customer Satisfaction Score

Frequent reviews help to maintain a clear understanding of business performance and uncover areas of improvement. According to industry standards, about 70% of small retail businesses that utilize ongoing KPI reviews report a noticeable improvement in their overall performance metrics, which translates to higher sales and customer satisfaction.

Moreover, the greeting card industry can be quite competitive, with many players vying for market share. Thus, integrating a robust KPI review system can lead to agile responses to consumer preferences and market demands, ensuring Heartfelt Greetings remains a relevant player in the industry.

Best Practices for Reviewing KPIs

- Set specific timeframes for KPI reviews to ensure consistency.

- Utilize a dashboard or software to track KPIs in real-time.

- Involve the entire team in KPI discussions to foster engagement and innovative ideas.

Furthermore, the importance of KPIs in greeting card business goes beyond just tracking numbers; it involves aligning these metrics with the company's long-term strategic goals. For example, if retaining customers becomes a priority, the customer retention rate should be tracked closely, analyzed, and used to refine marketing strategies. Hence, businesses need to not only measure performance but also adjust their strategies accordingly based on the findings from these KPI evaluations.

In conclusion, the continual assessment and adjustment of KPIs will empower greeting card businesses to stay on top of industry trends, make data-driven decisions, and ultimately enhance their competitive edge. For further insights, consider exploring resources on [greeting card store profitability](/blogs/profitability/greeting-cards-store) to enhance your understanding of effective KPI application in your business strategy.

What KPIs Help A Greeting Cards Store Business Stay Competitive In Its Industry?

In the competitive landscape of the greeting card industry, utilizing the right KPI metrics for greeting cards store can make a significant difference. Effective tracking of these metrics allows businesses like Heartfelt Greetings to stay ahead of the curve, understand customer preferences, and enhance operational efficiency.

Essential KPIs for greeting card shops include:

- Customer Acquisition Cost (CAC): This metric gauges the total cost associated with acquiring a new customer. Keeping CAC under 20% of Customer Lifetime Value (CLV) is a common benchmark.

- Average Order Value (AOV): This indicates the average amount spent by customers per transaction. AOV for greeting cards often ranges from $15 to $30, depending on personalization and quality.

- Customer Retention Rate: This measures how effectively a business retains customers over time. An optimal retention rate in the greeting card industry is between 60% and 80%.

- Sales Growth Rate: Tracking the increase in sales over a specific period can signal market trends and consumer interest. Aim for a sales growth rate of at least 10% annually.

- Inventory Turnover Ratio: This indicates how quickly inventory is sold and replaced. A healthy ratio for greeting cards is typically around 4 to 6, reflecting efficient inventory management.

- Gross Profit Margin: This is a critical financial KPI, with healthy margins for greeting card businesses generally falling between 40% to 60%.

- Return on Investment (ROI): This helps evaluate the profitability of investments made in marketing and product development. A target ROI of 15% or higher is recommended.

- Monthly Active Customers: Tracking this figure helps gauge customer engagement and business health. A goal could be to increase monthly active customers by 15% each quarter.

- Customer Satisfaction Score (CSAT): Regularly measuring CSAT ensures that customer expectations are met. A CSAT score of 80% or higher is ideal.

To effectively track KPIs for your greeting card business, consider implementing automated analytics tools that can simplify data collection and provide real-time insights. Additionally, regular reviews will help align your greeting card store performance metrics with evolving market conditions.

Tips for Effective KPI Tracking

- Set specific targets for each KPI to create clear benchmarks for success.

- Review KPIs monthly to identify trends and adjust strategies accordingly.

- Use visual dashboards to present KPI data clearly and accessibly to stakeholders.

- Engage staff in discussions about KPIs to foster a culture of accountability and performance.

How Does A Greeting Cards Store Business Align Its KPIs With Long-Term Strategic Goals?

Aligning KPI metrics for greeting cards store operations with long-term strategic goals is crucial for ensuring sustained growth and maintaining a competitive edge. For a business like Heartfelt Greetings, which emphasizes originality, customization, and sustainability, these metrics can help determine how effectively the store meets its vision of bridging technology with personal connection.

Firstly, identifying essential KPIs related to customer engagement and sales performance is key. These include:

- Customer Retention Rate: Aiming for a retention rate above 60% indicates strong customer loyalty, contributing to repeat sales and long-term profitability.

- Average Order Value: Targeting an average order value that increases by 10-15% year-over-year can enhance profit margins.

- Sales Growth Rate: A growth rate of at least 20% annually is a solid benchmark to aim for, ensuring the business scales effectively.

To effectively track and calculate these KPI metrics for the greeting card business, store owners should adopt a structured approach:

- Implementing a robust Customer Relationship Management (CRM) system to monitor customer acquisition costs and retention strategies.

- Analyzing inventory turnover ratios to optimize stock levels, aiming for an ideal ratio between 4-6 for greeting cards to ensure fresh inventory and reduce dead stock.

- Regularly reviewing KPI performance, at least monthly, allows for necessary adjustments to marketing strategies and product offerings, enhancing alignment with long-term goals.

Moreover, the use of specific benchmarks like maintaining a Gross Profit Margin of 50% can facilitate effective pricing strategies that resonate with the target market and support financial stability. By leveraging tools and methodologies that focus on calculating KPIs for greeting card stores, such as detailed financial modeling, business owners can ensure their operational metrics are closely aligned with their strategic objectives.

Tips for Aligning KPIs with Business Goals

- Regularly update your KPIs based on market trends, customer preferences, and changes in operational costs.

- Engage your team in understanding KPI significance, fostering a culture that values performance metrics and continuous improvement.

- Utilize data visualization tools to monitor performance metrics at a glance, facilitating quicker strategic decisions.

By focusing on these essential financial and operational KPIs, Heartfelt Greetings can effectively align its metrics with its long-term vision. This synergy not only aids in measuring business growth but also ensures that each operational decision propels the company closer to its overarching goals of creativity, connection, and community engagement. Tracking these KPIs extensively enhances overall performance and sustains the business’s mission in the competitive greeting card market.

What KPIs Are Essential For A Greeting Cards Store Business’ Success?

For a greeting cards store like Heartfelt Greetings, tracking the right KPI metrics for greeting cards store is crucial for ensuring long-term success and growth. Here are the essential KPIs to monitor:

- Customer Acquisition Cost: This metric helps you understand how much it costs to acquire each new customer. For greeting card businesses, the average customer acquisition cost can range from $10 to $50, depending on marketing strategies implemented.

- Average Order Value (AOV): Calculating the average order value allows you to gauge customer spending. A well-performing greeting card store should aim for an AOV of at least $25.

- Customer Retention Rate: This KPI measures the percentage of repeat customers. A retention rate above 40% is ideal for greeting card shops, which rely on loyal customers for sustainable sales.

- Sales Growth Rate: Monitoring this metric helps you assess how well your sales are increasing over time. A healthy growth rate for greeting card stores should be around 15% annually.

- Inventory Turnover Ratio: This indicates how quickly inventory is sold and replaced. A turnover ratio of 3 to 6 is desirable, ensuring effective inventory management for greeting cards.

- Gross Profit Margin: Understanding your profit margin is critical. For greeting cards, a gross margin of approximately 50% to 70% is standard, reflecting effective pricing and cost management.

- Return On Investment (ROI): Calculating ROI lets you evaluate the profitability of your marketing strategies. A target ROI of 200% would be a strong indicator of effective spending in the greeting card business.

Tips for Effective KPI Tracking

- Utilize software tools to automate data collection and reporting.

- Benchmark against industry standards to gauge performance.

- Regularly review your KPIs to make adjustments based on market trends.

The importance of these KPIs in the greeting card business cannot be overstated. By consistently monitoring these essential metrics, Heartfelt Greetings can ensure it remains competitive, enhances customer engagement, and aligns its operations with strategic goals. Adopting best practices in KPI evaluation helps identify areas for improvement and potential growth opportunities.

For more insights on financial planning and performance metrics, consider exploring the resources on greeting card store profitability.

Customer Acquisition Cost

Understanding the Customer Acquisition Cost (CAC) is crucial for any greeting card store, including Heartfelt Greetings. CAC represents the total expense incurred to acquire a new customer. Tracking this KPI metric for greeting card stores allows businesses to assess the effectiveness of their marketing strategies and overall profitability.

To calculate CAC, the formula is straightforward:

- CAC = Total Marketing Expenses / Number of New Customers Acquired

For instance, if Heartfelt Greetings spends $10,000 on marketing in a given period and successfully acquires 200 new customers, the CAC would be:

CAC = $10,000 / 200 = $50

This means that it costs the business $50 to acquire each new customer. Understanding this metric is essential for making informed decisions about budget allocation and marketing strategies.

When comparing CAC in the greeting card industry, it’s important to consider industry benchmarks. A typical CAC in retail can range from $30 to $100 depending on various factors including market competition and customer lifetime value. Below is a comparative table showcasing CAC across various retail sectors:

| Industry | Average CAC | Remarks |

|---|---|---|

| Greeting Cards | $50 | Optimal for customer retention |

| Fashion Retail | $70 | Higher due to trends and seasonality |

| Electronics | $90 | Involves substantial marketing costs |

Tips for Reducing Customer Acquisition Cost

- Leverage social media platforms to reach a wider audience at a lower cost.

- Invest in search engine optimization (SEO) to increase organic traffic and reduce reliance on paid ads.

- Utilize customer referral programs to encourage existing customers to bring in new clients.

By focusing on reducing the customer acquisition cost, Heartfelt Greetings can enhance its profit margins, allowing for further investment in product quality and customer experience. This approach supports the long-term sustainability of the business while ensuring financial health. In the evolving market, being mindful of how much is spent to acquire a customer is a pivotal part of the overall business strategy.

Average Order Value

The Average Order Value (AOV) is a crucial financial KPI metric for a greeting cards store. It represents the average dollar amount spent by customers in a single transaction. AOV is essential for assessing the effectiveness of marketing strategies and understanding customer purchasing behavior, making it a key metric to track KPIs for your greeting card business.

To calculate AOV, use the following formula:

- AOV = Total Revenue / Number of Orders

For instance, if your greeting cards store generates $10,000 in revenue with 500 orders in a month, your AOV would be:

- AOV = $10,000 / 500 = $20

Tracking AOV helps identify trends in customer spending and can inform pricing strategies as well as promotional offers.

Tips for Increasing Average Order Value

- Implement upselling and cross-selling techniques at the checkout.

- Offer bundle discounts for purchasing multiple cards.

- Introduce loyalty programs that reward customers for higher spending.

As a part of Heartfelt Greetings, focusing on AOV can enhance your greeting cards store’s financial KPIs. A higher AOV not only improves revenue but also supports sustainability initiatives by encouraging customers to invest in original and customizable cards, ultimately aligning with your business model of creativity and human connection.

| Month | Total Revenue ($) | Number of Orders | Average Order Value ($) |

|---|---|---|---|

| January | 10,000 | 500 | 20 |

| February | 12,000 | 600 | 20 |

| March | 15,000 | 750 | 20 |

As shown in the table above, maintaining a consistent AOV across months can signal customer loyalty and satisfaction with your product offerings. Variations in AOV may indicate a need to adjust your marketing strategies or product mix.

In the greeting card store sector, the average AOV can be around $15-$25, depending on the product range and customer engagement strategies. Therefore, setting benchmarks around this range can help with the evaluation of your store’s performance metrics.

Regularly reviewing AOV can also aid in understanding customer engagement in your greeting card store. Consider integrating customer feedback mechanisms to enhance the overall shopping experience, leading to higher order values.

For those looking to delve deeper into financial planning and projections, check out this comprehensive greeting cards store financial model. This tool can assist in visualizing the impact of different AOV strategies on your overall business growth.

Customer Retention Rate

The Customer Retention Rate (CRR) is a pivotal KPI metric for greeting card businesses like Heartfelt Greetings. This metric measures the percentage of customers who continue to purchase from your store over a specified period. A high CRR not only indicates customer satisfaction but also contributes to long-term profitability, reducing the high costs associated with acquiring new customers.

To calculate the Customer Retention Rate, use the following formula:

CRR = [(E-N)/S] x 100

Where:

- E = the number of customers at the end of the period

- N = the number of new customers acquired during the period

- S = the number of customers at the start of the period

For example, if your greeting card store started with 200 customers, gained 50 new customers, and ended with 220 customers, your calculation would be:

CRR = [(220 - 50)/200] x 100 = 85%

This means that 85% of your original customers continued to shop at Heartfelt Greetings over that period, indicating a solid retention strategy is in place.

Tips for Improving Customer Retention Rate

- Implement customer loyalty programs that reward repeat purchases with discounts or exclusive offers.

- Engage customers through personalized communication, reminding them of special occasions or promotions related to their past purchases.

- Solicit feedback and act on it to improve customer satisfaction and address any issues that may cause them to leave.

Keeping track of your customer retention metrics is crucial for understanding how well your greeting card store is performing in retaining its clientele. According to industry benchmarks, a healthy retention rate for retail businesses generally falls between 60% and 80%. However, aiming higher can significantly impact your overall profitability, as it is often cited that acquiring new customers can cost 5 to 25 times more than retaining existing ones.

Operational KPIs for greeting cards also encompass understanding customer engagement levels. Regularly reviewing your retention metrics allows you to spot trends and implement necessary adjustments. As you implement strategies to boost customer loyalty, you may also consider analyzing the financial implications of your efforts, such as measuring the Customer Acquisition Cost and the Average Order Value, which further reveal the effectiveness of your retention strategies.

| Metric | Score | Industry Benchmark |

|---|---|---|

| Customer Retention Rate | 85% | 60-80% |

| Customer Acquisition Cost | $20 | $10-$30 |

| Average Order Value | $50 | $40-$60 |

Measuring customer retention in the context of your greeting card store’s financial KPIs is integral to understanding how well you are meeting customer needs and fostering a loyal customer base. By leveraging effective retention strategies, you can significantly enhance your greeting card store's performance metrics.

For a comprehensive approach to managing your greeting card store's KPIs, including financial models, consider exploring resources that provide detailed analytics tailored to your business needs at Heartfelt Greetings Financial Model.

Sales Growth Rate

Sales growth rate is a fundamental KPI metric for greeting cards store businesses like Heartfelt Greetings. This metric measures the percentage increase in sales over a specific period, allowing business owners to gauge their revenue performance and market demand. To properly calculate this KPI, one can use the formula:

Sales Growth Rate (%) = ((Current Period Sales - Previous Period Sales) / Previous Period Sales) x 100

For instance, if Heartfelt Greetings generated $50,000 in sales during Q1 and $60,000 in Q2, the sales growth rate would be:

Sales Growth Rate = (($60,000 - $50,000) / $50,000) x 100 = 20%

Tracking this KPI is crucial as it helps to identify trends in customer purchasing behavior and the effectiveness of marketing strategies. Here are a few benchmarks that could be relevant for greeting card businesses:

| Period | Sales Growth Rate | Industry Benchmark |

|---|---|---|

| Q1 | 15% | 10% |

| Q2 | 20% | 15% |

| Q3 | 10% | 8% |

| Q4 | 25% | 20% |

By comparing these figures against industry benchmarks, Heartfelt Greetings can better understand its position in the market and make informed decisions to accelerate growth.

Tips for Tracking Sales Growth Rate

- Set realistic growth targets based on previous sales data and market conditions.

- Analyze seasonal trends to predict peak sales periods, allowing for improved inventory management.

- Utilize promotional strategies during slow seasons to boost sales.

Furthermore, understanding customer acquisition cost and average order value can also enhance insights into sales growth rate. A rising customer acquisition cost might indicate the need for more effective marketing strategies, while an increasing average order value could signal successful upselling or cross-selling techniques.

In today’s competitive market, being aware of these metrics is vital. Consistent reviews and updates of the sales growth rate will empower Heartfelt Greetings to align its business strategies with long-term goals. This alignment may involve adjusting marketing tactics, reevaluating product offerings, or focusing on customer retention strategies.

By effectively tracking and analyzing sales growth rate, Heartfelt Greetings can not only measure its success but also craft a more engaging experience for its customers, fostering community and creativity through uniquely designed greeting cards.

Inventory Turnover Ratio

The Inventory Turnover Ratio is a crucial KPI metric for greeting cards store businesses like Heartfelt Greetings. This ratio indicates how efficiently a store is managing its stock by measuring how many times inventory is sold and replaced over a specific period. Understanding this metric helps evaluate sales performance and inventory management effectiveness.

To calculate the Inventory Turnover Ratio, you can use the following formula:

Inventory Turnover Ratio = Cost of Goods Sold (COGS) / Average Inventory

For a greeting card store, calculating this ratio reveals the frequency at which inventory, such as various card designs and seasonal offerings, is sold. A higher ratio signifies efficient inventory management, suggesting that the store is effectively attracting customers and reducing excess stock.

| Period | COGS | Average Inventory | Inventory Turnover Ratio |

|---|---|---|---|

| Quarter 1 | $15,000 | $5,000 | 3.0 |

| Quarter 2 | $20,000 | $7,500 | 2.67 |

| Quarter 3 | $18,000 | $6,000 | 3.0 |

| Quarter 4 | $25,000 | $10,000 | 2.5 |

As seen in the table, Heartfelt Greetings had an Inventory Turnover Ratio ranging from 2.5 to 3.0 over the quarters. A ratio of 3.0 means that the store sold and replaced its inventory three times in the analyzed period, which suggests a healthy turnover and indicates proactive inventory management — essential for maintaining fresh and relevant stock.

Monitoring the Inventory Turnover Ratio allows Heartfelt Greetings to align its inventory strategy with customer preferences, promoting popular card styles while reducing the lag in inventory that can lead to markdowns. This practice not only maximizes profitability but also ensures that the store remains stocked with trending designs and seasonal cards, enhancing the customer experience.

Best Practices for Managing Inventory Turnover

- Regularly review sales data to identify which card designs are most popular, allowing for informed purchasing decisions.

- Implement a just-in-time inventory system to minimize holding costs and reduce waste from unsold items.

- Engage with customers to gauge preferences, allowing personalized designs that can improve inventory movement.

In addition to sales techniques, it’s also essential to analyze seasonality trends. Greeting card sales often fluctuate based on holidays and events, impacting the inventory turnover ratio significantly. For instance, during holidays like Valentine's Day or Christmas, the demand for greeting cards typically surges, requiring a potential increase in stock levels.

According to industry data, the average inventory turnover ratio for retail businesses is around 2.0 to 4.0. Maintaining a ratio within this range indicates that Heartfelt Greetings is effectively managing its inventory relative to its sales volume.

By prioritizing KPI metrics for greeting cards store businesses, such as the Inventory Turnover Ratio, Heartfelt Greetings can explore innovative ways to enhance customer engagement and overall business performance. For additional resources and insights on how to effectively manage inventory and KPIs, you can check out [this financial model for greeting cards stores](/products/greeting-cards-store-financial-model).

Gross Profit Margin

The Gross Profit Margin is a critical financial KPI metric for any greeting cards store like Heartfelt Greetings. It provides insight into the store’s profitability by measuring the percentage of revenue that exceeds the cost of goods sold (COGS). Understanding this KPI is essential for evaluating the overall health and sustainability of the business. To calculate the gross profit margin, the formula is:

Gross Profit Margin (%) = (Gross Profit / Revenue) x 100

Where:

- Gross Profit = Revenue - COGS

- Revenue = Total sales income

- COGS = Direct costs attributable to the production of the greeting cards sold

For instance, if Heartfelt Greetings generates $100,000 in revenue and incurs $40,000 in COGS, the calculation would be:

Gross Profit Margin = (($100,000 - $40,000) / $100,000) x 100 = 60%

In the greeting card industry, an average gross profit margin typically ranges from 40% to 60%, with many successful shops targeting the higher end of this spectrum. Monitoring this KPI helps Heartfelt Greetings ensure that it maintains its pricing strategy and keeps COGS under control to maximize profitability.

Tips for Improving Gross Profit Margin

- Review supplier contracts regularly to negotiate better prices on materials.

- Implement cost-effective production methods to minimize waste.

- Analyze customer buying habits to focus on high-margin products.

By improving the gross profit margin, Heartfelt Greetings can increase its ability to reinvest in the business, enhance customer engagement, and create a sustainable competitive advantage. When tracking KPIs for the greeting card business, it’s crucial to integrate gross profit margin with other financial metrics to gain a holistic view of operational efficiency and profitability.

| Year | Revenue | COGS | Gross Profit Margin (%) |

|---|---|---|---|

| 2021 | $80,000 | $32,000 | 60% |

| 2022 | $100,000 | $40,000 | 60% |

| 2023 | $120,000 | $48,000 | 60% |

Consistently tracking this KPI allows Heartfelt Greetings to assess operational performance, adjust marketing strategies, and focus on enhancing customer relationships, which are essential for long-term success in the greeting card industry.

For more detailed financial planning, consider utilizing professional financial models tailored for greeting card businesses. You can explore this resource here: Greeting Cards Store Financial Model.

Return On Investment

In the realm of retail, particularly for a greeting cards store like Heartfelt Greetings, tracking KPI metrics for greeting cards store is essential for understanding the financial health and sustainability of the business. One of the most crucial metrics to consider is Return on Investment (ROI). This metric allows business owners to measure the efficiency of their investments and helps inform future business strategies.

To calculate ROI for your greeting card shop, the formula is relatively straightforward:

ROI = (Net Profit / Cost of Investment) x 100%

Where:

- Net Profit is the total revenue generated minus the total costs associated with the investment.

- Cost of Investment encompasses all expenses related to the investment, including inventory, marketing costs, and overheads.

For example, if Heartfelt Greetings invests $10,000 in a new line of eco-friendly cards and achieves a revenue of $15,000 from this investment over a specified period, the ROI would be calculated as follows:

ROI = (($15,000 - $10,000) / $10,000) x 100% = 50%

This means that for every dollar invested, the store gains 50 cents back, a strong indicator of the effectiveness of the investment.

Importance of Tracking ROI

Understanding ROI enables Heartfelt Greetings to make informed decisions about product offerings and marketing strategies. Some benefits of tracking ROI include:

- Identifying Successful Strategies: Tracking ROI helps determine which marketing campaigns and products yield the highest returns.

- Resource Allocation: By knowing where money is best spent, resources can be allocated more effectively.

- Benchmarking: Comparing your ROI against industry standards can help identify areas for improvement.

According to industry benchmarks, the average ROI in retail can range from 10% to 20%, emphasizing the importance of striving for a higher return by closely monitoring and optimizing your investment decisions.

Tips for Maximizing ROI

Strategies to Enhance ROI

- Analyze Customer Acquisition Costs: Understanding costs associated with bringing in new customers can help tailor marketing efforts more effectively.

- Optimize Average Order Value: Encourage upselling and cross-selling to boost the amount each customer spends, thereby increasing revenue relative to costs.

- Focus on Customer Retention: Higher customer retention rates lead to lower acquisition costs overall, thereby positively impacting ROI.

Gathering data through KPI tracking in retail, specifically focusing on financial KPIs for greeting cards stores, allows Heartfelt Greetings to refine its approach continuously and adapt to changing market conditions. This ongoing review will not only aid in measuring greeting card store performance metrics but also align with long-term strategic goals.

| Investment Type | Cost of Investment | Revenue Generated | ROI (%) |

|---|---|---|---|

| New Card Line | $10,000 | $15,000 | 50% |

| Marketing Campaign | $5,000 | $8,000 | 60% |

| Store Renovation | $20,000 | $30,000 | 50% |

In conclusion, effectively managing and calculating ROI while leveraging essential KPIs for greeting card shops will ultimately guide Heartfelt Greetings towards sustained growth and customer satisfaction in a competitive market. For a comprehensive financial model to support your greeting card store, check out the resources available at Greeting Cards Store Financial Model.

Monthly Active Customers

Tracking Monthly Active Customers (MAC) is crucial for a greeting cards store like Heartfelt Greetings. This key performance indicator (KPI) provides insight into customer engagement and helps evaluate the effectiveness of marketing strategies and overall business performance. By measuring the number of customers who interact with the business each month, the store can better assess the popularity of its products and the impact of promotional campaigns.

To calculate MAC, the formula is straightforward:

| Formula | Description |

|---|---|

| Monthly Active Customers = Total Unique Customers in a Month | Count the distinct customers who make a purchase or interact with the store monthly. |

For a greeting card store, retaining a steady or increasing MAC is a sign of health and sustainability. For example, if Heartfelt Greetings started the month with 200 customers and ended with 250, the MAC for that month would be 250. This metric not only reflects customer retention and acquisition but also directly correlates with sales performance.

In the greeting card industry, benchmarks for MAC can vary, but a good target to aim for is to maintain around 30-50% of total customers as active customers each month. This percentage can indicate a loyal customer base engaged with the brand. If Heartfelt Greetings has 500 total customers, ideally, at least 150-250 should be active each month.

Tips for Enhancing Monthly Active Customers

- Implement loyalty programs to encourage repeat purchases.

- Engage customers through social media campaigns and personalized emails.

- Host creative workshops in-store to strengthen community ties and attract new customers.

Regularly reviewing MAC can also illuminate trends. For instance, if there is a spike during holiday seasons, this can inform inventory and marketing strategies, ensuring that Heartfelt Greetings is well-prepared for peak demand. Additionally, correlating MAC with other KPIs, such as Customer Acquisition Cost and Customer Retention Rate, can provide a comprehensive view of business health and areas for improvement.

Utilizing advanced analytics tools and CRM software can greatly assist in tracking this vital metric. Tools that help evaluate customer behavior, such as purchase frequency and product preferences, will enable Heartfelt Greetings to tailor its offerings and marketing strategies effectively. A robust understanding of MAC leads to better alignment with customer expectations and enhances overall satisfaction within the community the store serves.

In conclusion, tracking the MAC metric is paramount for Heartfelt Greetings to maintain its goal of bridging personal connections through heartfelt messages. With an emphasis on engagement and community, understanding and optimizing MAC can improve both financial performance and customer loyalty as the store continues to thrive in the evolving greeting card market.

To explore more about how to enhance your greeting card business's performance metrics, consider visiting this resource for comprehensive financial models specifically tailored for greeting card stores.

Customer Satisfaction Score

The Customer Satisfaction Score (CSAT) is a crucial KPI metric for a greeting cards store like Heartfelt Greetings. It provides clear insights into how your customers perceive your products and services, ultimately influencing their decision to return. A high CSAT indicates that your greeting cards resonate well with your customers’ emotions and needs, while a low score may signal areas requiring immediate improvement.

To calculate the CSAT, follow these steps:

- Conduct surveys post-purchase or after customer interactions.

- Ask customers to rate their satisfaction on a scale (e.g., 1-5 or 1-10).

- Calculate the percentage of satisfied customers by dividing the number of positive responses by the total number of responses and multiplying by 100.

For instance, if you gather responses from 200 customers and 160 rate their experience as satisfactory (4 or 5 on a 5-point scale), your calculation would be:

CSAT = (160/200) x 100 = 80%

Monitoring your CSAT not only aids in understanding customer engagement in the greeting card store but also helps tailor your product offerings. According to recent data, businesses with a high CSAT score can expect a 20% increase in repeat purchases, making it a pivotal metric for business growth.

Best Practices for Enhancing Customer Satisfaction in Greeting Cards

- Solicit frequent feedback to understand customer preferences.

- Implement changes based on feedback to improve product offerings.

- Offer personalized greeting card options to enhance emotional connections.

In terms of benchmarking, maintaining a CSAT score above 75% is generally considered healthy for retail businesses. Heartfelt Greetings can aim for a score of around 85% to establish itself as a leader in customer satisfaction within the greeting card industry.

| CSAT Score | Repeat Purchase Rate | Industry Benchmark |

|---|---|---|

| 80% | 20% | Retail Avg: 75% |

| 85% | 20% - 30% | Top Performers: 85%+ |

Regularly reviewing your CSAT scores will allow Heartfelt Greetings to adjust its approach efficiently. For example, if you notice a dip in scores after a new product launch, consider revisiting your design and messaging strategy. Utilizing tools like customer surveys and feedback forms can yield valuable insights that guide your operations.

Ultimately, prioritizing customer satisfaction is not just about tracking KPIs for your greeting card store; it's about fostering a community that values meaningful connections and creativity. By aligning your operational KPIs for greeting cards with customer feedback, you can ensure that your store remains a beloved destination for heartfelt messages.

For detailed financial planning information, explore a comprehensive financial model tailored for greeting card stores: Heartfelt Greetings Financial Model.