ALL IN ONE MEGA PACK - CONSIST OF:

Hotel Acquisition Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

HOTEL ACQUISITION REAL ESTATE PROFORMA TEMPLATE INFO

Highlights

Five-year Hotel Acquisition real estate financial model xls for startups and entrepreneurs to impress investors and get funded. Key financial charts, summaries, metrics, and funding forecasts built-in. Created with the mind of the Hotel Acquisition business. Hotel Acquisition real estate waterfall model xls helps to estimate required startup costs. Unlocked - edit all.

This versatile Hotel Acquisition Excel real estate calculations is an ideal Hotel Acquisition for smart Hotel Acquisition businesses that allow you to estimate financial projections and investor’s equity valuation by providing all related input tables, charts, and graphs.

Description

Acquire a Hotel Property, Manage Rental Revenues, and Expenses, Sell the Hotel Property, Distribute the Equity via GP/LP with IRR hurdles.

This Inventory Control Software Profit Loss Projection is built for real estate investors looking at acquisition projects. However, it could be useful for financial analysts or students looking to improve their real estate financial modeling skills.

It is ready to use Three Statement Financial Model Template with on the fly calculations and provides a complete analysis of a potential Hotel Property acquisition.

User-friendly design streamlines the assumptions entering process up to 10 minutes.

HOTEL ACQUISITION REAL ESTATE MODEL REPORTS

All in One Place

Our coordinated Hotel Acquisition financing real estate development incorporates and associates all you require for speculators' gathering. It has financial assumptions, proformas, counts, income gauges, and different templates. In addition, our real estate financial models presents it in a speculator amicable way.

Core Inputs

On this tab you can input main assumptions for your business: acquisition date, purchase price, operation start date, hold period, loan-to-value ratio, exit cap rate, sales expenses, occupancy ramp up period, and assumptions for the sensitivity analysis

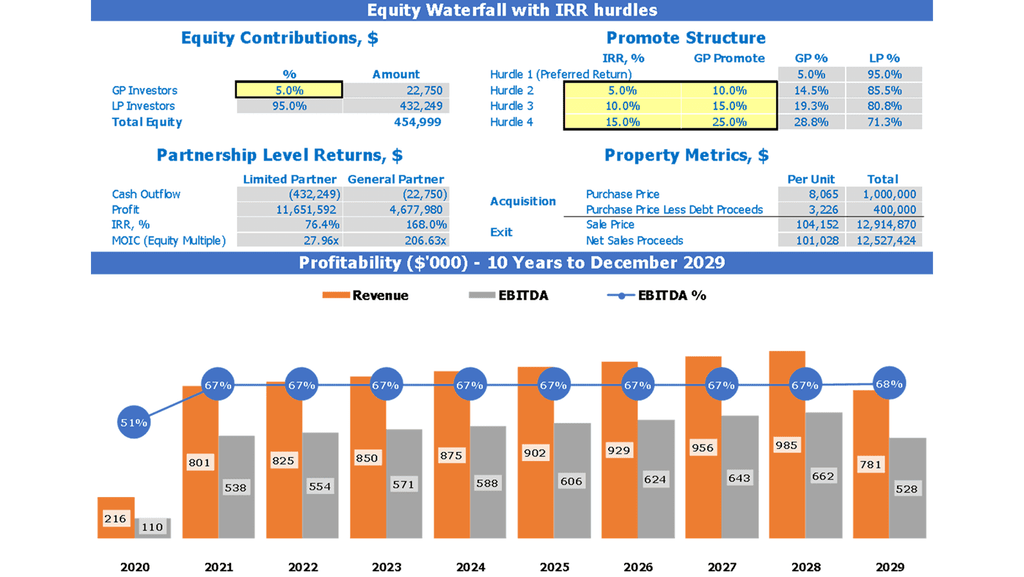

Equity Waterfall with IRR hardles

Enter equity contributions for the General Partner and Limited Partner as well as 3 IRR hurdles

Property Metrics

On this tab you can input main property assumptions - unit types, count of units by types, sq. ft. per unit type, occupancy, rent per month per unit, other revenue per month per unit and reserve for replacement per month per unit.

NOI & EBITDA

Net Operating Income and EBITDA chart

Property Inputs

On this tab you can input main property assumptions - unit types, count of units by types, sq. ft. per unit type, occupancy, rent per month per unit, other revenue per month per unit and reserve for replacement per month per unit.

HOTEL ACQUISITION REAL ESTATE EXCEL MODEL ADVANTAGES

NPV, DCF model Valuation

Hotel Cash Flow: includes operating revenues, operating costs, NOI, capital costs, debt service, and net income

KPIs summary - Property metrics, Partnership returns, Property Returns and Sensitivity Analysis

Property Level Return Metrics - IRR, %, MOIC, Total Cash Invested/Revenue/Profit, Cash on Cash Return

Scenarios: The scenarios modeling sheets provides four possible scenarios based on the Rent, Vacancy, construction Costs and exit Cap rate variance, etc. The base scenario is defined by default with the inputs set on the Investment Summary and the Assumptions sheets.