ALL IN ONE MEGA PACK - CONSIST OF:

Fintech Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

FINTECH INCOME STATEMENT INFO

Highlights

Five-year financial model template in Excel for Fintech with prebuilt three statements - consolidated forecasted profit and loss statement, balance sheet, and cash flow projection excel. Key financial charts, summaries, metrics, and funding forecasts built-in. Created with the mind of the Fintech business. Used to evaluate a Fintech business before selling it. Unlocked- edit all.

The Fintech Budget Template will help you to analyze your business, identify drivers for profit and loss. The model also helps you to calculate cash-ins and outs accurately, contains financial statements, assumption sheets, and predicts future sales forecasts. Moreover, the objective of this financial projections template is to help users in profitability planning, liquidity planning, valuation of the company, and utilization of funds. This Excel cashflow projection is ideal for Startup companies wishing to determine the financial feasibility of their business and obtain an in-depth understanding of their expected financial performance over the next 5 years.

Description

The Fintech cash flow proforma template provides a comprehensive framework to prepare solid financial plans and businesses’ financial analysis within the Fintech industry. It informs the user about short and long-term financial goals performance and gives you a starting point for developing a financial strategy.

This Fintech cash flow template gives you an overview of your Fintech’s current financials and projections for growth. It prepares a complete financial plan for your Fintech business, consisting of 5-years financial statements (projected income statement, cash flow excel sheet, and projected balance sheet for startup business), break even in sales, Diagnostic Sheet and startup summary Plan, etc. Further, It enables the user to determine the Fintech business’s actual worth by calculating the DCF (Discounted Cash Flow) factor and Free Cash Flow. The model uses a bottom-up approach to calculates the expected production volume. Revenues are derived by applying the respective pricing assumptions. OPEX and capital expenditure other assumptions are then used to prepare detailed monthly profit and loss statement template and cash flow proforma.

This Fintech 5 year projection template will assist you in managing and organizing your business efficiently. Using this model, you cannot be distracted by complicated calculations, enable you to utilize more of your time in operation activities, and manage your customers’ tasks.

FINTECH BUSINESS PLAN REPORTS

All in One Place

Are you looking for an intuitive, user-friendly pro forma that is still presentable and sophisticated? Look no further.

Our pro forma excel is easy to use, expandable, and versatile; which makes it your perfect tool to map as many different business models as you want. All sheets can be very easily tailored, expanded, and edited as desired in our powerful template.

Dashboard

A simple financial projections template contains a versatile dashboard, which is considered a very valuable tool and helps professionals to solve many problems. For example, it is used for the purpose of conducting financial reports. It is used to analyze and evaluate financial indicators. It provides important data very quickly and as accurately as possible, which is extremely important for any startup company.

The panel reflects financial data of different origins, which helps assess the overall health of the company and influences important decisions and the development of further strategy. It helps to optimize the financial management of the company and not to lose sight of important data that may be needed at any time. Creating honest financial reports can help you build relationships with other company stakeholders, because guaranteeing accounting transparency is very important in the world of business cooperation.

Finacial Statement

The accounting financial statement are broken down into three major statements, as defined below: - Income Statement organizes the income and expenditure of the company for a defined period of time, including cash or non-cash transactions such as depreciation, income tax, interest income etc.; - Balance Sheet summarizes in a single report the assets, liabilities, and shareholders equity at a very specific point in time, always following the formula that assets = liabilities + shareholders equity; and - Cash Flow Statement clearly categorizes the inflows and outflows of cash and cash equivalents into cashflows from operating, investing, or financing activities.

Source And Use Of Funds

As you can understand from the title, a sources and uses of funds statement template of Funds in the startup costs template represents the company's financing sources and spending policies.

In respect of the 'Sources', this statement shows the company's money for its business activities and how it gets this money. Usually, companies have a mix of funding sources, such as business loans, investors' money, share issue, and others.

The 'Uses' section of the sources and uses of funds statement template statement shows the stakeholders how the company spends its money. For example, this statement may reflect the cost of land, building, or equipment the company plans to acquire. It also may reflect the start-up costs.

Break Even Revenue Calculator

Break-even is the terminology used for a situation wherein the company is already able to cover all its costs with the revenue earned. In other words, this is the point when the company is neither making money nor losing money.

The break even analysis is a useful concept in studying the relation between the variable cost, fixed cost, and the company's revenue. Usually, companies with low fixed cost levels have a low break even point.

Top Revenue

When a company's management begins to develop an financial projection templates, revenue is the most important factor to consider. In the startup financial model template excel free, revenue is one of the most important generators of the enterprise's worth. As a result, financial analysts must devote extra attention to planning and designing the most effective technique for estimating future income streams.

Revenue predictions should also include growth rate assumptions based on past financial data. In our financial plan excel, users will find all of the components of sensible revenue stream financial planning.

Business Top Expenses List

Keeping track of your costs is an important rule for any company. Managing them helps to maintain a stable level of income and gradually increase profits. In our business plan there is a report on the largest financial expenses of the company, it contains four categories of expenses, as well as a category called 'other', which includes additional data.

With this cash flow projection template excel, users can compare increases or decreases in spending over a given year. This excel financial model allows you to track trends related to the growth and reduction of costs for the needs of the company.

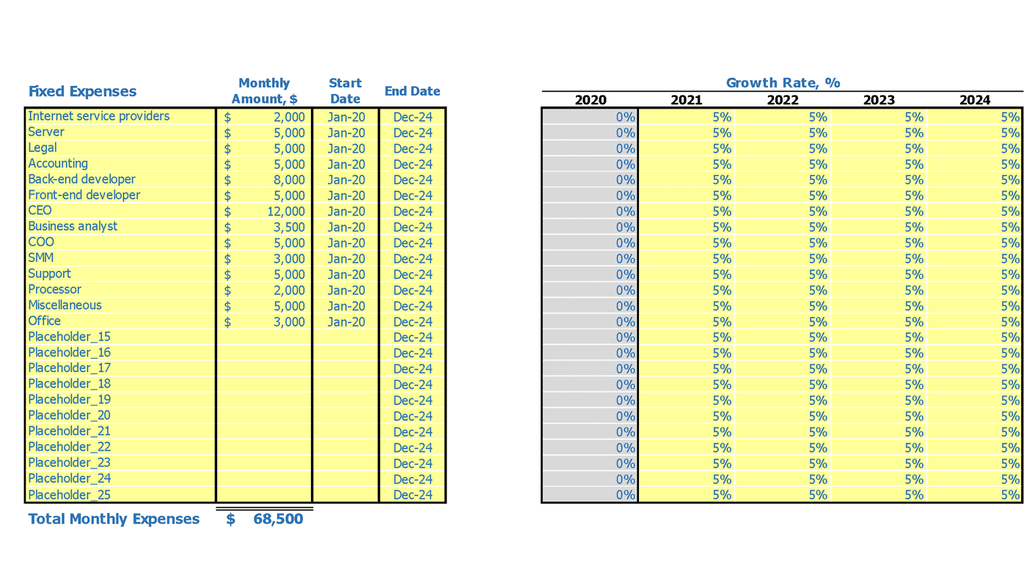

FINTECH FINANCIAL MODEL EXPENSES

Costs

Our financial projections template excel is an effective and efficient tool that empowers its users to forecast business costs, assess the business potential, and ensure that the business achieves its financial objectives.

A well-structured budgeting template would allow its users to quickly identify business weaknesses and provide guidance to take the right steps in achieving the business objectives. The Cost budgeting template is a key part of the startup business plan that assists entrepreneurs in availing loans or assistance from investors.

CAPEX Expenditure

A company's capital expenditure plan show the amount of financial investment the company has made in its development and improvement of business performance. This usually refers to the purchase of new equipment or the implementation of new management and analysis methods. These funds are also used to expand the range of products or services.

Capital expenditures are shown on the pro forma balance sheet template excel as depreciated expenditures over a period of time.

Loan opt-in

Start-up and developing businesses must keep track of and manage their loan payback schedules. Typically, such schedules show the company's loan line-by-line breakdown, including amounts, maturity terms, and other details.

A company's cash flow analysis should include this loan payback plan. In addition, interest expenditure on the debt schedule affects the company's format of cash flow statement in excel, and the closing debt level is shown on the pro forma balance. Furthermore, as part of the company's financing activity, principal repayments pass via the cash flow projection.

FINTECH PRO FORMA METRICS

Profitability KPIs

The Fintech 5 year financial projection contains all performance metrics that correspond with pre-built templates and financial reports. It also has pre-built proformas for forecasted profit and loss statement, Balance Sheet, and cash flow forecast excel, which you can use both for financial planning and presentations for investors.

With these reports, you can easily monitor your company's cash flows, revenues, costs, and profitability, including profitability margins, liquidity analysis, sources and uses, and others. The model calculates profitability ratios and other performance metrics, e.g., customer acquisition costs, and KPI metrics, if applicable.

Cash Flow Budgeting And Forecasting

Today's monthly excel spreadsheet cash flow helps us to determine many important things. A cash flow forecasting model excel for business plan startup is a modern solution for those who want to make their business more efficient.

Industry Benchmarks

The financial benchmarking study tab in our financial model xls is going to help you with comparative analysis, that is, companies will be able to evaluate their performance on the basis of losses and relate the results to the performance of another company. Benchmarking involves comparing the performance of companies operating in the same industry. First of all, these indicators relate to finance. After the analysis, the client will receive a result that will tell him how to work further in order to get the highest possible results. This is why benchmarking is so important to building startups. If you understand all aspects of your business, then you will definitely be able to constantly take your company to the next level of financial success.

Projected Income Statement

The projected income statement is a key statement within the financial projection model. It is the statement that captures the gross and net profits of the business. A well-developed pro forma profit and loss statement keeps a company making data-backed decisions.

No matter how successful a business appears, unless all of the numbers are captured in traditional financial statements to show a company's strength, the success cannot be trusted by stakeholders.

Balance Sheet Forecast

The projected balance sheet for 5 years in excel format is a statement of the corporation's assets and liabilities. The projected profit and loss statement (P&L) summarises the company's operational and financial performance over time (flow concept). The balance sheet forecast expresses the state of the company at a specific point in time (spot concept).

A pro forma balance shows the company's net worth and divides it into two categories: own equity and borrowed cash. Liquidity, solvency, and acceptable turnover ratios are all key indications that can only be found on a balance sheet.

FINTECH STARTUP BUDGET VALUATION

Startup Valuation Multiples

To help you with your valuation needs, our Business Plan Fintech provides two methods for forecasting: the discounted cash flow (DCF) and the weighted average cost of capital (WACC) calculations.

Cap Table Template

The pro forma cap table in our financial projections 12 months template includes four rounds of financing, and it shows how the shares issued to new investors impact the investment income. After each round of financing, the simple cap table shows users the ownership structure and the percentage of changes, i. e. , the dilution.

FINTECH 5 YEAR CASH FLOW PROJECTION TEMPLATE EXCEL KEY FEATURES

Plan for Future Growth

cash flow statement excel template can help you plan for future growth and expansion. No matter you're extending your company with new employees and need to take into account increased staff expenses. Or to scale production to keep up with increased sales, future projections help you see accurately where you're running — and how you'll get there. Forecasting is also a well-known goal-setting framework to help you plan out the financial steps your company has to take to reach targets. There's power in cash flow projection in excel and the insight they can provide your business. Fortunately, this competitive advantage comes with little effort when you use the cash flow forecasting tools.

Currency for inputs and denomination

In pro forma financial statements template excel define any currency code or symbol and preferred denomination (e.g. 000s) to reflect your preferences.

Simple and Incredibly Practical

Simple-to-use yet very sophisticated Fintech financial projection excel template tool. Whatever size and stage of development your business is, with minimal planning experience and very basic knowledge of Excel you can get complete and reliable results. Additionally, you will receive uncompromised after-sales service and access to valuable tutorial videos and blog posts.

5 years forecast horizon

Generate fully-integrated Fintech financial projection excel template for 5 years (on a monthly basis). Automatic aggregation of annual summaries on outputs tabs.

Works for startups

Budget Spreadsheet creates a financial summary formatted for your pitch deck

FINTECH BUSINESS REVENUE MODEL TEMPLATE ADVANTAGES

Control Over Your Business With Fintech financial projection excel

Financial Projections Template Excel Makes Sure You Have Enough Cash To Pay Suppliers And Employees

Demonstrate Integrity To Investors With Fintech P&L Template

Reduce Risk With Fintech P&L Template

Assess The Feasibility Of Your Idea With Fintech projected financial statements in excel format