ALL IN ONE MEGA PACK - CONSIST OF:

Condominium Development Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CONDO DEVELOPMENT MODEL INFO

Highlights

Highly versatile and user-friendly Condominium Development real estate financial modeling xls for the preparation of a profit loss statement template excel, cash flow budget template excel, and Balance Sheet with a monthly and annual timeline. Works for a startup or existing Condominium Development business. Condominium Development real estate spreadsheets helps you evaluate your startup idea and/or plan a startup costs. Unlocked - edit all.

Condominium Development real estate waterfall model xls provides a wide range of specific financial tools and KPI s report with detailed 5-year financials projections, which can save the user’s significant time while managing operations tasks and making decisions. This real estate excel model also presents a highly adaptable framework to anticipate the expected cash flows from operations and calculates the financial metrics related to investors and banks for acquiring funds and loans. Condominium Development Excel real estate calculations is not solely needed to make efforts and to attract funds, but it also plays a vital role to organize and analyze everything correctly from the beginning.

Description

This model works best if you are looking for a professional Financial Projection Template which is simple and easy to understand while containing all the main metrics, then this model is for you.

As well as if you are looking to present the investment opportunity to clients or investors in a clean and well-designed manner.

The model is fully dynamic and allows for an extremely quick analysis of a Condominium property, which is extremely helpful in high-demand markets.

This Condominium buy, hold and sell acquisition model will help you to:

- Present main metrics of an investment opportunity;

- Measure operating, capital and financing costs;

- Present the cash flow of an investment;

- Create dashboard to present to the bank or clients;

- Run “if sold” scenarios which allows to choose the best sale date;

- Perform valuation of an investment property;

- Assess the feasibility of the refinancing option and an amount of take out;

- Assess a range of rental and exit scenarios.

The model consists of:

- Assumptions Tab;

- Annual Cash Flow for 10 years;

- Debt Schedule, which includes the refinancing and interest-only option for the loan;

- Dashboard with main metrics, charts, and graphs.

In addition, the model includes a detailed notes/instructions section which will guide you through the model.

Key Metrics:

- Cost/Square Footage (Sqm), Sale Price/Unit, Net Rental Revenue;

- NOI, Debt Service, Net Leveraged Cash Flow;

- NPV, DCF Valuation;

- DSCR, Cash on Cash Return, IRR, Equity Multiple, Net Profit.

- Exit value for the property is calculated automatically based on NOI for a period and cap rate you assume in your projection.

CONDOMINIUM DEVELOPMENT PRO FORMA REPORTS

All in One Place

A particularly made and easy to-use pro forma real estate development. You don't need to be a financial expert to design your start up Excel Financial Model Template. All you require is the right game plan of financial gadgets, and our Condominium Development real estate proforma template excel will give you them.

Core Inputs

On this tab you can input main assumptions for your business: acquisition date, purchase price, operation start date, hold period, loan-to-value ratio, exit cap rate, sales expenses, occupancy ramp up period, and assumptions for the sensitivity analysis

Equity Waterfall with IRR hardles

Enter equity contributions for the General Partner and Limited Partner as well as 3 IRR hurdles

Property Metrics

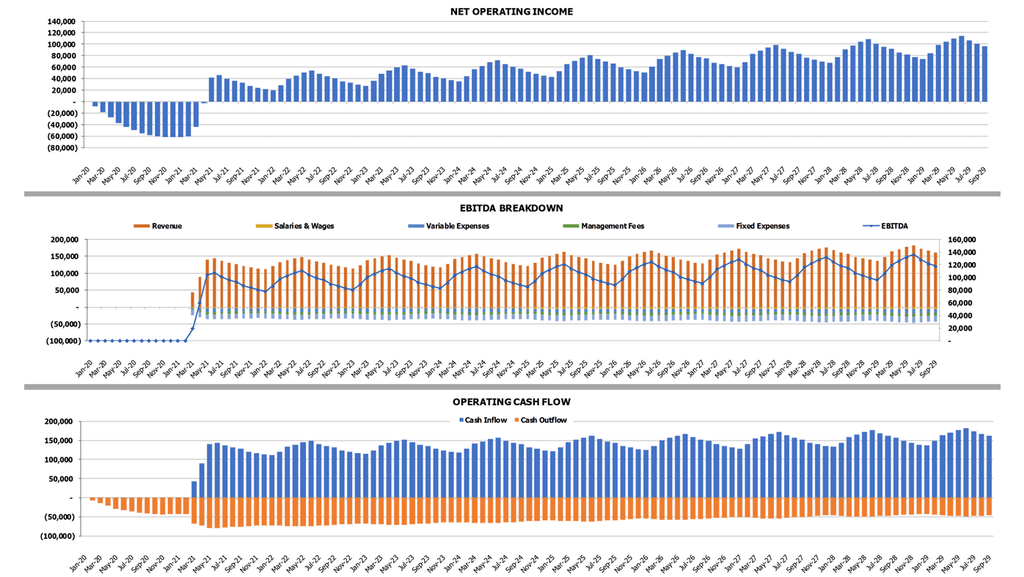

NOI & EBITDA

Net Operating Income and EBIDTA chart

Property Inputs

On this tab you can input main property assumptions - unit types, count of units by types, sq. ft. per unit type, occupancy, rent per month per unit, other revenue per month per unit and reserve for replacement per month per unit.

CONDOMINIUM DEVELOPMENT REAL ESTATE FINANCIAL MODELS ADVANTAGES

Property Level Return Metrics - Levered and UnLevered

Bell Curve distribution of Soft Costs by individual line item

Condominium Operations Summary, which calculates operating revenues and expenses

Flexible Condominium operations start date

Construction Loan: The model assumes that first the constructions expenses are first funded with Equity, once we draw all of our equity; we can, then we can start drawing construction loan tranches in order to pay for the remaining costs of the project.