Oilfield Equipment Rental Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Oilfield Equipment Rental Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

oilfield equipment rental Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

OILFIELD EQUIPMENT RENTAL FINANCIAL MODEL FOR STARTUP INFO

Highlights

The oilfield equipment rental analysis template is a comprehensive 5-year financial model designed specifically for companies within the oil and gas equipment finance sector. This versatile tool caters to both emerging startups and established small businesses in the oilfield equipment rental market, facilitating rental income forecasting and cash flow analysis for rentals. By incorporating oilfield rental financial projections, oilfield asset management strategies, and an in-depth rental equipment cost analysis, users can effectively evaluate operational expenses and equipment utilization rates. Additionally, the template aids in assessing financial risk and investment returns on equipment rental, making it an invaluable resource for valuation and strategic planning in the dynamic oil and gas industry.

The oilfield equipment rental financial model offers a comprehensive solution to typical pain points faced by rental businesses, specifically addressing the complexities of rental income forecasting and cash flow analysis for rentals. By incorporating detailed oilfield rental financial projections, this model supports robust operational expense management and capital expenditure planning, ensuring users can effectively assess financial risk and optimize investment returns on equipment rental. With clear and accessible input tables, charts, and graphs, it simplifies oilfield equipment depreciation tracking and enhances asset management strategy, allowing users to better understand equipment utilization rates and respond to market demand analysis. This ready-made Excel template empowers users to navigate the intricacies of oilfield service equipment rentals without the need for advanced technical skills, making financial modeling for rental businesses accessible and actionable.

Description

The oilfield equipment rental financial projections are essential for entrepreneurs looking to establish a successful rental business within the oil and gas industry, providing dynamic insights into cash flow analysis for rentals and facilitating a thorough understanding of rental equipment cost analysis. By employing a comprehensive oilfield equipment leasing model, this financial tool assists in forecasting rental income, evaluating financial risk assessments, and determining the impact of oilfield equipment depreciation on investment returns. A detailed operational expenses breakdown, alongside oilfield market demand analysis, empowers business owners to make informed decisions about pricing strategies for oilfield service equipment rentals and to establish an effective oilfield asset management strategy. This model's bottom-up approach not only aids in calculating revenue based on realistic pricing assumptions but also supports the creation of 5-year financial statements, supporting robust financial modeling for rental businesses that optimize capital expenditure in oilfields.

OILFIELD EQUIPMENT RENTAL FINANCIAL MODEL REPORTS

All in One Place

Unlock the potential of your oilfield equipment rental business with our comprehensive financial model template. Designed for professionals of all experience levels, this user-friendly 3-way financial model empowers you to conduct in-depth cost analysis, forecast rental income, and evaluate investment returns on equipment rentals. Seamlessly analyze oilfield equipment depreciation and assess operational expenses while understanding market demand dynamics. Elevate your oil and gas equipment finance strategy and ensure robust cash flow management with our innovative model—your essential tool for successful asset management and financial growth.

Dashboard

Our financial model Excel spreadsheet features a specialized dashboard that enhances oilfield equipment rental analysis and financial projections. This tool empowers stakeholders by providing accurate insights into rental income forecasting and cash flow analysis for rentals. With a focus on operational expenses, equipment depreciation, and utilization rates, it enables customers to assess their financial metrics effectively. Startups can rely on this dashboard for robust financial modeling, guiding strategic decisions and optimizing asset management. By ensuring precise calculations, it ultimately drives investment returns and enhances overall business valuation within the oil and gas industry.

Business Financial Statements

This comprehensive financial model template for startups integrates key components necessary for success in the oil and gas sector. It features a profit and loss statement, balance sheet forecast, and cash flow projection, all interlinked to provide a cohesive analysis. Tailored for oilfield equipment rental businesses, it aids in financial modeling, accommodating aspects such as rental income forecasting, operational expenses, and equipment utilization rates. Utilize this template to enhance your investment returns, assess financial risks, and optimize your asset management strategy while making informed capital expenditure decisions in the competitive oilfield market.

Sources And Uses Statement

The sources and uses statement within the three-statement financial model template is essential for oilfield equipment rental businesses. It outlines total funding and its structure while detailing expenditures. This chart is crucial for startups aiming to accurately track the allocation of investor funds. By integrating oilfield rental financial projections and cash flow analysis for rentals, companies can enhance their oilfield asset management strategy. Monitoring these metrics ensures informed decision-making regarding capital expenditure in oilfields and fosters better financial risk assessment, ultimately leading to improved investment returns on equipment rental.

Break Even Point In Sales Dollars

A break-even analysis is crucial for oilfield equipment rental businesses, assessing when total revenue equals total costs, encompassing both fixed and variable expenses. This financial modeling approach not only clarifies the required rental income to cover operational expenses but also aids in setting competitive pricing for equipment leasing. By analyzing the contribution margin—sales price per unit minus variable costs—companies can better forecast investment returns on equipment rentals and enhance profitability. Ultimately, this strategic tool supports effective oilfield asset management and informed decision-making in an evolving market landscape.

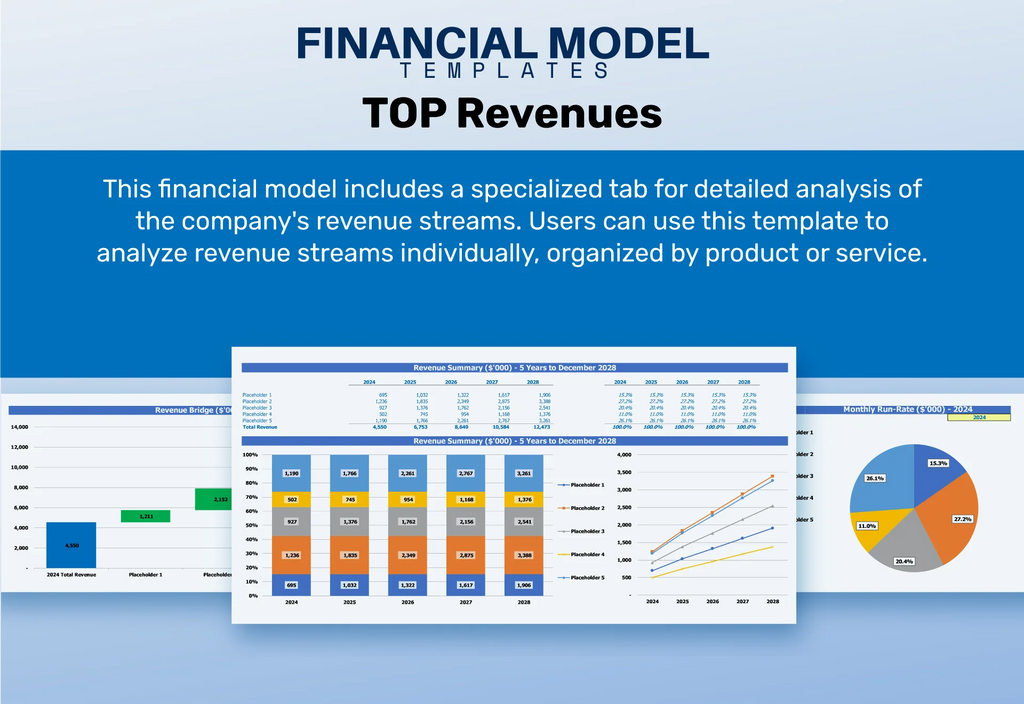

Top Revenue

The Top Revenue tab in an oilfield equipment rental financial model offers a comprehensive overview of revenue streams for your services. This sophisticated model enables clear insights into annual revenue breakdowns, allowing for precise cash flow analysis for rentals. It also highlights revenue depth and bridges, essential for understanding market demand and pricing strategies. By utilizing this data, you can better forecast rental income, assess operational expenses, and strengthen your oilfield asset management strategy, ultimately improving investment returns on equipment rental in the competitive oil and gas industry.

Business Top Expenses Spreadsheet

Our financial planning model offers a comprehensive expense report, summarizing key financial metrics across four primary categories, with additional costs classified as 'other.' This streamlined report facilitates tracking expenses and analyzing historical trends, enabling users to identify areas of increasing or decreasing costs. For startups and growing companies in the oil and gas equipment rental sector, effective expense management is crucial for enhancing profitability. Prioritizing detailed analysis of major expense categories will support optimization efforts, ensuring a robust oilfield equipment leasing model that aligns with strategic investment returns and operational efficiency.

OILFIELD EQUIPMENT RENTAL FINANCIAL PROJECTION EXPENSES

Costs

Effortlessly monitor all full-time and part-time employee costs with our intuitive salary management tool. Tailored for both individual and group budgeting, it streamlines your financial planning process. Our interconnected financial projection template enables seamless data flow throughout your startup financial model, significantly reducing manual adjustments. Spend less time on administrative tasks and more time enhancing your oilfield equipment rental strategy. By maximizing operational efficiency and optimizing asset management, you can focus on key financial metrics, such as rental income forecasting and cash flow analysis, to drive investment returns in the oil and gas industry.

CAPEX Spending

The automatic startup budget integrates capital expenditure analysis within a cash flow framework in Excel. It also encompasses financial projections for oilfield equipment rental, highlighting alternative income sources. By leveraging insights from oilfield asset management strategies, this budget assesses rental equipment utilization rates and operational expenses. Additionally, it provides a comprehensive overview of oil and gas equipment finance, enabling effective rental income forecasting and investment return evaluations. This approach ensures a robust financial modeling framework tailored for the unique demands of the oilfield rental market, optimizing cash flow and minimizing financial risks.

Loan Financing Calculator

Start-ups and growing companies must diligently monitor their loan repayment schedules, which provide a detailed breakdown of amounts and maturity terms. This schedule is crucial for effective cash flow analysis, as it directly influences the interest expense in financial modeling. The closing debt balance is reflected on the balance sheet, while principal repayments are integrated into cash flow projections, impacting financing activities. By understanding these components, companies can enhance their oilfield equipment rental financial projections, optimize capital expenditure, and improve investment returns on equipment rentals, ultimately strengthening their oilfield asset management strategy.

OILFIELD EQUIPMENT RENTAL EXCEL FINANCIAL MODEL METRICS

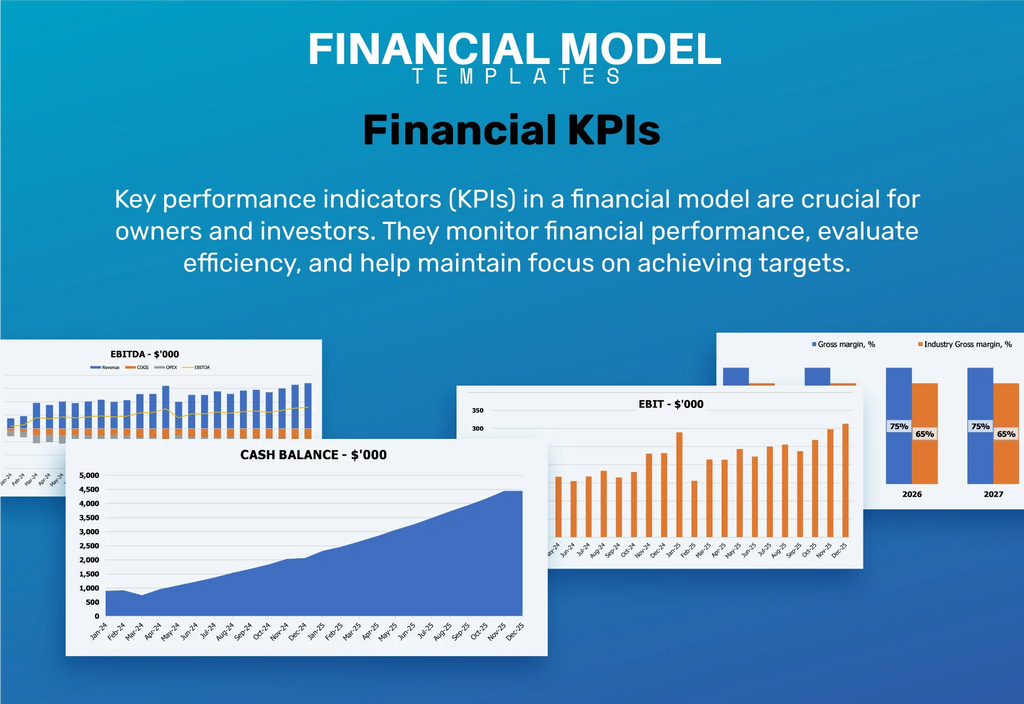

Financial KPIs

The gross profit margin in oilfield equipment rental is a critical financial metric, reflecting a company's profitability. It is calculated by dividing gross profit by net sales, providing insight into operational efficiency. A robust gross profit margin enables effective capital expenditure planning and enhances cash flow analysis for rentals. By leveraging accurate financial projections and conducting thorough rental equipment cost analysis, businesses can optimize their oilfield asset management strategy, ultimately driving investment returns and ensuring sustainable growth in the competitive oil and gas industry.

Cash Flow Forecast Excel

In the oil and gas industry, effective cash flow analysis for rentals is crucial for sustaining operational efficiency and attracting investment. A well-structured cash flow proforma serves as a vital financial statement, highlighting accumulated funds and identifying any shortfalls that may hinder further financing. By integrating financial modeling for rental businesses, companies can enhance their oilfield equipment rental analysis and optimize asset management strategies. This approach not only supports accurate rental income forecasting but also aids in evaluating capital expenditures and oilfield equipment leasing models, ultimately driving investment returns and improving equipment utilization rates.

KPI Benchmarks

This financial modeling Excel template features a dedicated tab for comprehensive financial benchmarking analysis. It provides in-depth insights into oilfield equipment rental performance alongside critical industry comparisons. Users can evaluate key financial metrics, such as rental income forecasting and operational expenses, to gauge competitiveness and efficiency. This robust analysis supports informed decision-making regarding oilfield asset management strategies, capital expenditure, and investment returns. Leverage this tool to enhance your understanding of oil and gas equipment finance, ultimately optimizing your rental business valuation and financial risk assessment in a dynamic market.

P&L Statement Excel

This advanced financial model template in Excel streamlines your oilfield equipment rental analysis, generating accurate pro forma profit and loss statements for monthly and long-term forecasts up to five years. By integrating with other financial reports, it ensures real-time updates across all metrics, enhancing cash flow analysis and rental income forecasting. This tool enables you to make informed management decisions, considering operational expenses, capital expenditures, and equipment utilization rates. Optimize your oilfield asset management strategy while minimizing financial risk and maximizing investment returns on equipment rental with this comprehensive solution.

Pro Forma Balance Sheet Template Excel

Integrating a profit and loss projection with a projected balance sheet is essential for oilfield equipment rental businesses. This combination reveals the necessary investment to support anticipated sales and profits, enhancing cash flow analysis for rentals. Accurate balance sheet forecasting enables firms to assess their financial positioning over time, aiding in strategic decision-making regarding capital expenditure and operational expenses. By leveraging these financial models, businesses can optimize asset management strategies and improve investment returns on equipment rentals, ensuring long-term sustainability in the competitive oil and gas industry.

OILFIELD EQUIPMENT RENTAL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

When engaging with investors, thorough preparation is essential. Utilize our oilfield equipment rental analysis template to present detailed financial projections. With built-in valuation tools, you can easily showcase the weighted average cost of capital (WACC) to illustrate minimum returns. Highlight your total cash flow and its availability to all stakeholders with our cash flow analysis feature. For a comprehensive view of future cash flows, our discounted cash flow model provides clarity. Leverage these insights to strengthen your investment strategy in the dynamic oil and gas sector.

Cap Table

The pro forma cap table is a vital tool that outlines ownership stakes in the company, detailing each investor's contributions and their corresponding equity percentages. Understanding these shares is crucial for maintaining accurate financial records and effectively managing cash flows. In the context of oilfield equipment rental analysis, this transparency aids in optimizing capital expenditure and enhances rental income forecasting. Proper insight into ownership can also inform financial modeling for rental businesses, ensuring strategic asset management and maximizing investment returns in the competitive oil and gas industry.

KEY FEATURES

A robust financial model enhances cash flow analysis, ensuring optimal investment returns and efficient management of oilfield equipment rentals.

Implementing a financial model enhances cash flow management by predicting impacts of late payments on your rental business's profitability.

Implementing a financial modeling for rental businesses enhances profitability by accurately projecting cash flow and optimizing equipment utilization rates.

The oilfield equipment leasing model enhances cash flow analysis, enabling strategic financial projections for improved investment returns and risk assessment.

A robust financial model enhances decision-making through precise rental income forecasting and optimized oilfield equipment utilization rates.

A robust financial model enhances forecasting accuracy, optimizing oilfield equipment rental investments and maximizing profitability while managing risks effectively.

Utilizing a robust financial modeling for rental businesses streamlines oilfield equipment rental analysis and maximizes investment returns.

Our financial modeling for rental businesses minimizes cash flow projection time, enabling you to focus on product and customer growth.

Leverage a robust financial modeling for rental businesses to confidently demonstrate your ability to repay the requested loan.

Utilizing financial modeling for rental businesses enhances loan applications by demonstrating repayment capability and strategic cash flow management.

ADVANTAGES

A robust financial model ensures oilfield rental businesses can predict cash flow and manage costs effectively for sustainable growth.

A robust three-way financial model empowers stakeholders, ensuring accurate cash flow analysis and informed decision-making in oilfield equipment rentals.

A robust financial model for oilfield equipment rental minimizes risks and optimizes opportunities, ensuring better investment returns and strategic decisions.

A robust financial model enhances decision-making, enabling precise oilfield equipment rental analysis and improved management of operational expenses and cash flow.

Utilizing a comprehensive oilfield equipment rental financial model allows for strategic insights and improved decision-making through scenario analysis.