Car Insurance Services Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Car Insurance Services Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

car insurance services Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CAR INSURANCE SERVICES FINANCIAL MODEL FOR STARTUP INFO

Highlights

Developing a five-year horizon excel financial model for an early-stage car insurance services startup is essential to impress investors and facilitate capital raising. This financial model should incorporate comprehensive automobile insurance financial analysis, focusing on car insurance pricing strategy and premium forecasting to enhance profitability metrics. Additionally, employing an insurance risk assessment model will help evaluate potential risks and support market segmentation efforts. Integrating insurance claims management systems and loss ratio analysis will optimize expense management and streamline the car insurance underwriting process. By emphasizing the automobile policyholder value proposition and tailoring automotive insurance service delivery, startups can effectively manage customer acquisition costs and ensure a robust insurance revenue model. Executing these strategies will provide insightful automobile insurance financial projections and aid in long-term financial planning.

The car insurance services pro forma template effectively addresses key pain points by providing a comprehensive insurance risk assessment model that enhances decision-making for pricing strategies and market segmentation. With features such as car insurance premium forecasting and profit loss statement templates, users can seamlessly analyze the automobile insurance financial analysis, ensuring a clear understanding of the car insurance cost structure. Additionally, the inclusion of insurance claims management systems aids in optimizing service delivery and customer acquisition costs, while vehicle insurance profitability metrics and loss ratio analysis highlight areas for expense management and financial planning. This structured financial model empowers stakeholders to align their efforts with realistic automobile insurance financial projections, facilitating informed discussions around investments and potential loans.

Description

This car insurance services financial model template is an excellent tool for your automobile insurance financial analysis and strategic financial planning, offering a robust framework to prepare reliable forecasts and assess the car insurance pricing strategy. It encompasses a comprehensive five-year financial projection, including the forecasted income statement, cash flow spreadsheet, and pro forma balance sheet, while facilitating effective car insurance premium forecasting. By integrating key performance indicators (KPIs) alongside vehicle insurance profitability metrics, it allows for insightful insurance risk assessment modeling that aids in understanding the auto insurance market segmentation. The model also features an insurance claims management system and expense management functionalities, essential for optimizing the car insurance revenue model and assessing the insurance loss ratio, ultimately driving informed decision-making crucial for long-term growth and sustainability.

CAR INSURANCE SERVICES FINANCIAL MODEL REPORTS

All in One Place

Our customizable financial planning startup empowers you to adapt core parameters, including financial statements, operating costs, and startup valuation multiples, to suit your specific requirements. This dynamic three-way financial model enables customized projections and the addition of new forecasting methods, ensuring alignment with your business strategy. With our flexible template, you can easily modify every cell and formula, optimizing your financial planning for automobile insurance pricing strategies, risk assessment, and profitability metrics. Tailor your entire business plan with precision to enhance your insurance service delivery and customer acquisition goals.

Dashboard

An insightful financial dashboard elevates your automobile insurance financial analysis, providing a comprehensive overview of key performance indicators (KPIs). This tool enhances cash management and empowers your team to meticulously track expenses, sales, and profits, aligning with strategic financial planning. With a focus on effective car insurance pricing strategy and risk assessment for auto insurance, the dashboard facilitates informed decision-making to optimize insurance service delivery and improve profitability metrics. Share this intuitive model with stakeholders to showcase your progress in achieving financial objectives and maximizing policyholder value.

Business Financial Statements

Our comprehensive financial forecast template empowers business owners in the automobile insurance sector. It includes pre-built sheets for detailed financial analysis, facilitating accurate car insurance premium forecasting and expense management. Users can easily configure key metrics such as the loss ratio and underwriting process, generating insightful graphs and charts. These visual representations enhance presentations and clearly convey critical findings to prospective investors. With a focus on optimizing your car insurance revenue model and evaluating policyholder value propositions, this template is essential for robust financial planning in the dynamic auto insurance market.

Sources And Uses Statement

The Sources and Uses statement within a three-way financial model provides a clear overview of capital origins (the 'Sources') and allocations (the 'Uses'). This structured template ensures that total amounts match, reflecting financial integrity. It's essential for organizations navigating recapitalization, restructuring, or mergers and acquisitions (M&A). By incorporating a car insurance pricing strategy, organizations can enhance their insurance risk assessment model and optimize their insurance claims management system, ultimately supporting effective financial planning and improving profitability through refined automobile insurance financial analysis.

Break Even Point In Sales Dollars

Break-even analysis is crucial for understanding the balance between variable costs, fixed costs, and revenue in the car insurance market. This metric indicates when a company achieves neither profit nor loss, providing insight into pricing strategies and financial planning. By assessing the break-even point, insurers can optimize their car insurance cost structure and enhance profitability metrics. Companies with lower fixed costs benefit from a reduced break-even point, allowing for more strategic decision-making in auto coverage pricing models and customer acquisition efforts, ultimately improving the policyholder value proposition.

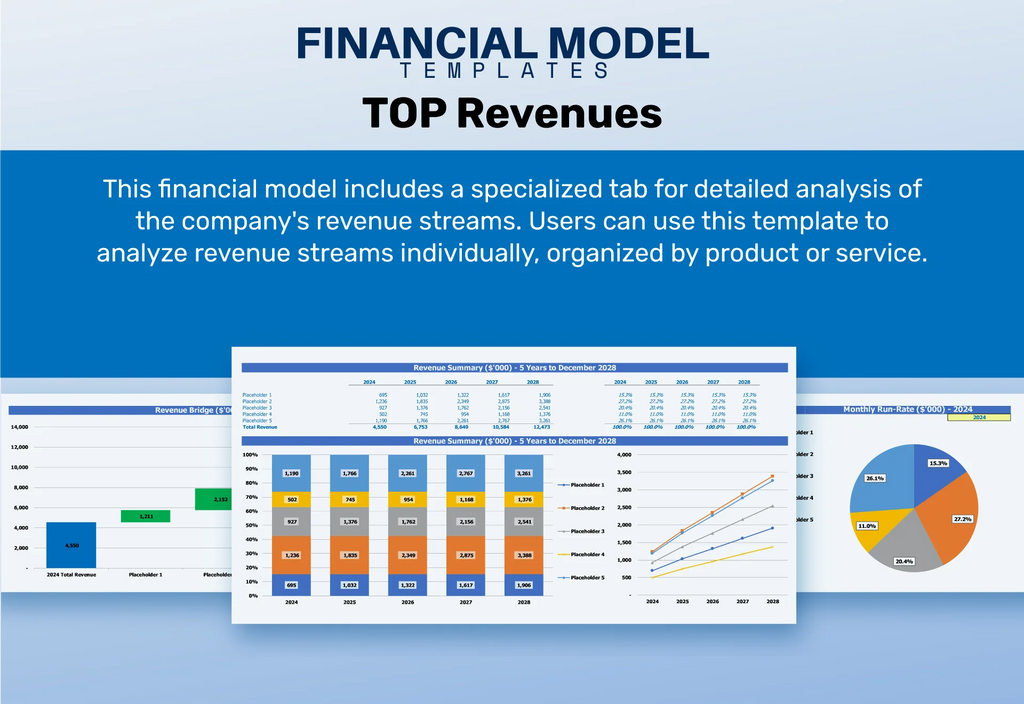

Top Revenue

Our comprehensive five-year cash flow projection template includes a dedicated tab for an in-depth financial analysis of your automobile insurance revenue streams. This allows users to evaluate specific revenue channels, whether at the product or service level, facilitating tailored insights into your car insurance pricing strategy. By understanding your car insurance cost structure and optimizing the car insurance underwriting process, you can enhance the effectiveness of your insurance risk assessment model, ultimately improving profitability metrics and driving better insurance service delivery.

Business Top Expenses Spreadsheet

In the Top Expenses section of our five-year financial projection, significant costs are categorized into four distinct groups. The pro forma Excel template includes an 'Other' category, allowing for customization to suit your specific needs. You can incorporate historical data or develop a robust financial model to assess your automobile insurance financial projections. This strategic approach enhances your car insurance cost structure analysis and informs your insurance risk assessment model, ultimately optimizing your insurance service delivery and boosting profitability metrics within the auto insurance market segment.

CAR INSURANCE SERVICES FINANCIAL PROJECTION EXPENSES

Costs

The car insurance financial model in Excel is a powerful tool designed to evaluate the feasibility of automobile insurance services by analyzing total costs and profit potential. This profit and loss template empowers users to identify challenges within their financial operations and devise effective solutions. Additionally, leveraging car insurance pricing strategies and profitability metrics enhances decision-making, enabling companies to optimize their insurance service delivery. By utilizing this model, businesses can gain valuable insights into their insurance risk assessment, customer acquisition costs, and overall financial health, ensuring sustainable growth in the competitive auto insurance market.

CAPEX Spending

The CAPEX forecast plays a pivotal role in automobile insurance financial projections, guiding startups in their budgeting and investment strategies. By meticulously analyzing start-up expenses, companies can enhance their insurance risk assessment model and optimize their car insurance cost structure. This understanding aids in cash flow analysis and influences decision-making. A detailed capital expenditure budget not only supports effective insurance claims management but also drives forward-looking car insurance premium forecasting. Ultimately, this strategic approach is crucial for maximizing the vehicle insurance profitability metrics and ensuring a robust insurance revenue model.

Loan Financing Calculator

Our comprehensive financial model integrates formulas directly within the loan amortization schedule, enabling clear differentiation between principal and interest calculations. This streamlined approach provides instant insights into your company's payment obligations, detailing the breakdown of principal repayment, interest payments, payment frequency, and total repayment duration. Leveraging this model enhances your car insurance pricing strategy, optimizing your financial planning and risk assessment for auto insurance, ultimately improving profitability metrics and enhancing the policyholder value proposition. Experience effective expense management and informed decision-making with our sophisticated financial tool.

CAR INSURANCE SERVICES EXCEL FINANCIAL MODEL METRICS

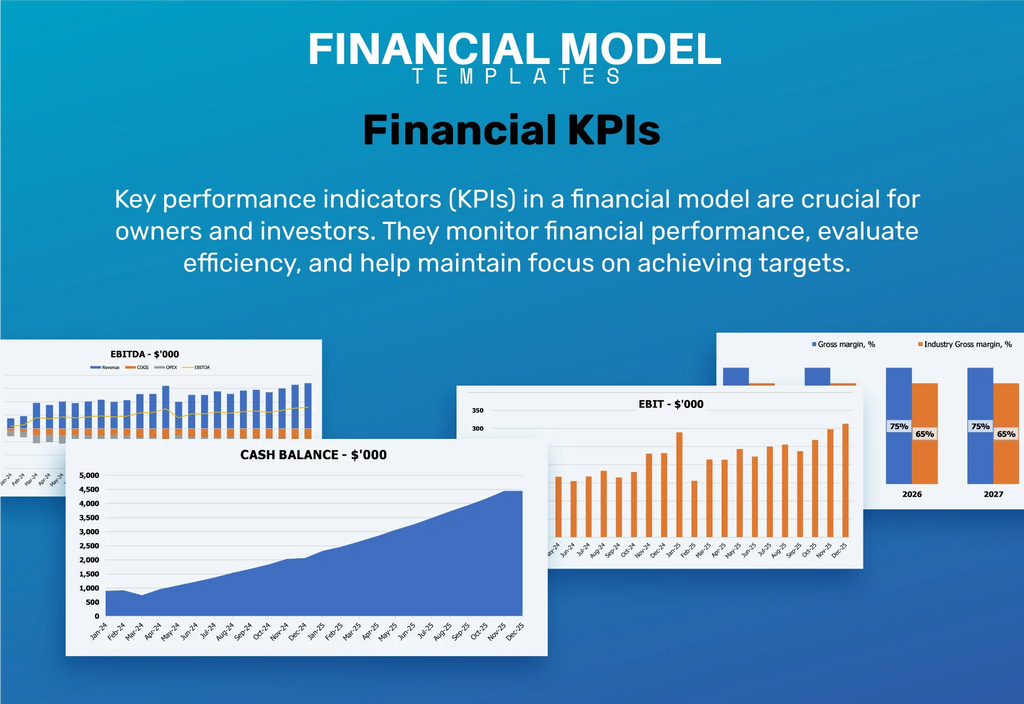

Financial KPIs

The operating income, represented as EBIT (Earnings Before Interest and Taxes), is a crucial profitability metric in automobile insurance financial analysis. This figure is derived by subtracting operating expenses, including sales costs, interest, and taxes, from total revenues. EBIT provides insights into a company's genuine profit-generating potential, reflecting its efficiency in managing car insurance cost structures and optimizing service delivery. By understanding EBIT, insurers can enhance their car insurance revenue model and refine their customer acquisition strategies, ultimately driving profitability in a competitive market.

Cash Flow Forecast Excel

A projected cash flow statement provides a clear overview of the fluctuations in cash balance over a specified period, highlighting key inflow and outflow points. This financial analysis is crucial for developing a robust car insurance pricing strategy, optimizing underwriting processes, and managing expenses effectively. By understanding these dynamics, insurers can enhance their automobile insurance financial projections, improve risk assessment models, and optimize service delivery. Ultimately, this leads to better profitability metrics, reduced customer acquisition costs, and an improved value proposition for policyholders in a competitive auto insurance market.

KPI Benchmarks

A comprehensive financial model template assesses key performance indicators critical to automobile insurance profitability. By leveraging average values in financial analysis, companies can evaluate their car insurance pricing strategy and optimize the underwriting process. This comparative analysis is essential for startups aiming for success in the competitive auto insurance market. Understanding metrics like insurance loss ratios and customer acquisition costs lays the groundwork for effective financial planning and risk assessment. Ultimately, a well-informed strategy enhances service delivery and improves policyholder value, driving sustainable growth in the automobile insurance sector.

P&L Statement Excel

For consumers, understanding a company's profit potential is crucial, particularly in the context of car insurance. While the projected profit and loss template offers a reliable snapshot of expected earnings, it lacks insight into the assets and liabilities that underpin profitability. Additionally, the results may not align perfectly with actual cash flows, rendering the P&L alone somewhat insufficient. A comprehensive approach, incorporating automobile insurance financial analysis and car insurance financial planning, ensures that all dimensions—like pricing strategy, premium forecasting, and risk assessment—are accurately represented for informed decision-making.

Pro Forma Balance Sheet Template Excel

The projected balance sheet, when integrated with the profit and loss statement in Excel, is crucial for understanding the investments required to sustain anticipated sales and profits. This financial analysis provides a clear view of the company's future position, informing decisions related to car insurance pricing strategies and profitability metrics. By aligning the balance sheet forecast with automobile insurance financial projections, businesses can optimize their insurance revenue model, enhance risk assessment for auto insurance, and improve customer acquisition costs, ultimately driving effective financial planning and service delivery in the auto insurance market.

CAR INSURANCE SERVICES FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Investors can leverage the comprehensive startup valuation calculator within the car insurance financial projection template. It features critical metrics such as the weighted average cost of capital (WACC), revealing the minimum return rate on invested funds. The Free Cash Flow (FCF) metric highlights available cash for stakeholders post-operations and investments, while the Discounted Cash Flow (DCF) method effectively assesses future cash flows at their present value. These insights aid in optimizing the automobile insurance revenue model by aligning with effective pricing strategies and enhancing the customer acquisition process.

Cap Table

This car insurance pricing strategy model is a powerful tool for analyzing various aspects of the automobile insurance landscape. By incorporating automobile insurance financial projections and sophisticated insurance risk assessment models, it effectively forecasts car insurance premiums while optimizing the underwriting process. The model enhances insurance claims management systems and improves vehicle insurance profitability metrics, ensuring efficient auto coverage pricing. Furthermore, it aids in evaluating insurance customer acquisition costs and refining the automobile policyholder value proposition, ultimately driving better service delivery and robust financial planning for the auto insurance market.

KEY FEATURES

Implementing a robust car insurance pricing strategy enhances profitability through informed risk assessments and optimized customer acquisition costs.

A dynamic cash flow forecast empowers businesses to visualize financial impacts of various scenarios, enhancing strategic decision-making.

An effective car insurance pricing strategy enhances profitability by optimizing risk assessment and accurately forecasting premiums for diverse market segments.

Effective cash flow forecasting empowers your business to anticipate financial gaps, enabling proactive decisions for sustained growth and profitability.

A robust car insurance pricing strategy enhances profitability by optimizing risk assessment and improving customer acquisition costs.

Implementing a robust car insurance pricing strategy enhances profitability while optimizing risk assessment and customer acquisition costs.

Implementing a robust car insurance pricing strategy enhances profitability by optimizing underwriting and minimizing customer acquisition costs effectively.

Effective car insurance financial projections enhance decision-making, minimize risks, and optimize profitability in an increasingly competitive market.

Our comprehensive car insurance financial models enhance profitability through precise pricing strategies and optimized risk assessments for better decision-making.

Enhance your car insurance pricing strategy effortlessly with our comprehensive financial model, designed for seamless planning without complex setup.

ADVANTAGES

Implementing a robust financial model enhances car insurance pricing strategy, optimizing cash inflows while effectively managing expense outflows.

Utilizing a robust car insurance pricing strategy enhances profitability through precise premium forecasting and effective risk assessment models.

Leverage a robust car insurance financial forecasting model to enhance investor confidence and optimize profitability through precise risk assessment.

The Car Insurance Services Excel Financial Model enhances clarity in pricing strategy and optimizes profitability through comprehensive financial analysis.

The car insurance pricing strategy enhances clarity and profitability by optimizing expense management and customer acquisition costs.