Battery Recycling Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Battery Recycling Financial Model

Bundle Includes:

ALL IN ONE MEGA PACK - CONSIST OF:

battery recycling Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BATTERY RECYCLING FINANCIAL MODEL FOR STARTUP INFO

Highlights

The battery recycling financial model template is a comprehensive tool designed for five-year financial planning in the battery recycling sector, supporting startups and established businesses alike in analyzing the economic benefits of battery recycling and enhancing operational efficiency. By utilizing this template, companies can conduct a thorough battery recycling cost analysis, focusing on the profitability of battery recycling initiatives and understanding the impact of regulatory compliance costs and capital expenditures. Furthermore, it aids in projecting cash flows linked to revenue streams from battery recycling, providing insights into market demand for recycled batteries and battery processing costs. By leveraging this unlocked template, stakeholders can improve battery collection supply chain strategies and assess the long-term profitability of recycling initiatives, ensuring a robust life cycle assessment of batteries while actively contributing to sustainability in battery recycling.

The financial model addresses key pain points by providing a comprehensive battery recycling cost analysis that highlights operational efficiency and the profitability of battery recycling initiatives over a five-year horizon. It meticulously incorporates market demand for recycled batteries and revenue streams from battery recycling, allowing users to assess the economic benefits and financial feasibility of their investment in battery recycling. By analyzing regulatory compliance costs and capital expenditures, along with competitor analysis in battery recycling, the model helps forecast battery recovery rates and refine battery waste management financials. Furthermore, it supports users in understanding the environmental impact and sustainability in battery recycling, ultimately guiding them towards long-term profitability and informed decision-making in their recycling initiatives.

Description

The battery recycling financial model is structured to provide a comprehensive cost analysis, highlighting the profitability and financial feasibility of battery recycling initiatives over a 60-month horizon. It integrates key components such as projected profit and loss statements, cash flow forecasting, and balance sheets, which collectively assess revenue streams from battery recycling while also evaluating operational efficiency, battery recovery rates, and investment requirements. Additionally, it includes tools for analyzing recycling technology costs, market demand for recycled batteries, and the environmental impact of battery waste management, helping businesses navigate regulatory compliance costs and capital expenditures effectively. This user-friendly template empowers entrepreneurs from any background to strategize for long-term profitability and sustainability in battery recycling.

BATTERY RECYCLING FINANCIAL MODEL REPORTS

All in One Place

A comprehensive projected cash flow statement integrates the pro forma income statement, balance sheet, and cash flow analysis into a cohesive financial forecast, essential for understanding the profitability of battery recycling. Simplified models may overlook the intricacies of battery recovery rates and operational efficiencies, potentially skewing your financial outlook. By adopting a full three-way financial model, businesses can conduct scenario planning, revealing the economic benefits and revenue streams from recycling initiatives, while navigating the complexities of regulatory compliance and investment in sustainable battery recycling. This holistic approach enhances decision-making for long-term profitability and fiscal responsibility.

Dashboard

An effective financial dashboard is essential for assessing profitability and operational efficiency in battery recycling. By integrating critical indicators, such as battery recovery rates and recycling technology costs, users can analyze financial statements and forecasts over selected periods. This data-driven approach enables strategic decision-making, focusing on the long-term profitability of recycling initiatives. Additionally, insights into market demand for recycled batteries and regulatory compliance costs allow for a comprehensive assessment of the financial feasibility of recycling operations, ultimately supporting sustainability in battery waste management and enhancing revenue streams.

Business Financial Statements

This business plan financial projections template offers streamlined structures for essential financial statements, including the pro forma balance sheet, profit loss projection, and cash flow chart. Each statement is meticulously designed for seamless integration, ensuring clarity and accuracy that enhances your presentation. By demonstrating the economic benefits of battery recycling, including profitability, recovery rates, and operational efficiency, you can effectively engage investors. Highlighting investment potentials and the market demand for recycled batteries further strengthens your pitch, making this template an invaluable tool for fostering sustainable practices in battery waste management.

Sources And Uses Statement

The financial projection model’s sources and uses template is vital for assessing capital expenditures in battery recycling. It outlines key financial sources and expenses, essential for start-ups in this sector. Analyzing battery recycling costs, including operational efficiency and recycling technology costs, enables firms to evaluate the economic benefits and long-term profitability of recycling initiatives. By understanding the financial feasibility and potential revenue streams from battery recycling, businesses can navigate market demand for recycled batteries while ensuring sustainability and regulatory compliance. This strategic overview aids in optimizing the battery collection supply chain and enhances overall battery waste management financials.

Break Even Point In Sales Dollars

The break-even point analysis in this financial projections spreadsheet highlights the critical moment when your battery recycling venture transitions from a cost incurrence phase to profitability. By calculating this pivotal threshold, you can forecast when revenue from recycled batteries surpasses operational and capital expenditures. Understanding the financial feasibility of recycling batteries not only aids in navigating regulatory compliance costs but also enhances strategic investment decisions, ensuring long-term profitability and sustainability in battery recycling initiatives. This insight is essential for optimizing your battery collection supply chain and maximizing the economic benefits derived from effective battery waste management.

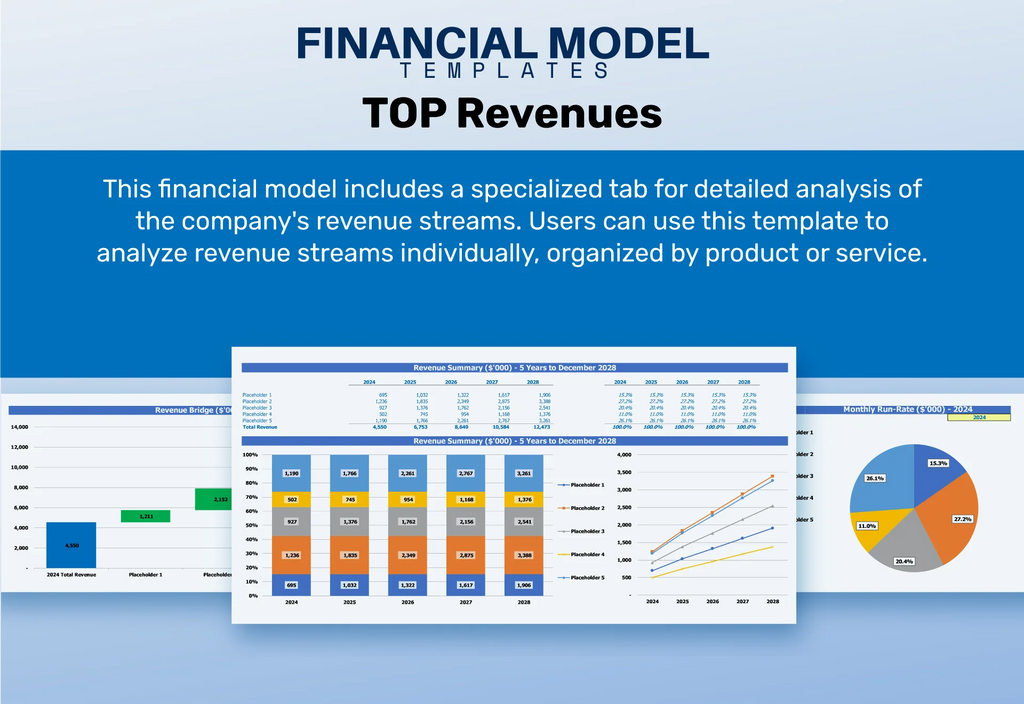

Top Revenue

This Excel financial model template features a dedicated tab for in-depth analysis of revenue streams within the battery recycling sector. Users can evaluate profitability across various product and service categories, enabling a comprehensive understanding of market demand for recycled batteries. By assessing factors like operational efficiency and processing costs, this template supports strategic investment decisions. Additionally, it aids in calculating the financial feasibility and long-term profitability of recycling initiatives, aligning with sustainability goals while considering regulatory compliance costs. Enhance your battery waste management financials and unlock the economic benefits of effective battery recovery.

Business Top Expenses Spreadsheet

To maximize your company's productivity and profitability, it's essential to analyze and control expenses effectively. Our pro forma template includes key categories, focusing on significant costs while grouping others as "miscellaneous." In the context of battery recycling, understanding financials—such as operational efficiency, battery processing costs, and the financial feasibility of recycling—can guide investments towards sustainable practices. By scrutinizing these expenses, you can enhance revenue streams from battery recycling and position your organization favorably in a growing market driven by regulatory compliance and environmental considerations.

BATTERY RECYCLING FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive cost report is tailored to support both individual and group budgets, ensuring a clear understanding of the financial landscape in battery recycling. By incorporating salary costs, including full-time and part-time equivalents, you'll gain insight into operational efficiency and investment needs. This user-friendly Excel financial model seamlessly integrates your company's unique inputs, enabling you to evaluate the profitability of battery recycling initiatives, assess regulatory compliance costs, and identify revenue streams. The analysis empowers informed decision-making, driving sustainability and maximizing long-term profitability in the evolving battery recycling market.

CAPEX Spending

Capital expenditure budgeting is vital for a solid financial model in battery recycling. Accurate CAPEX calculations enable professionals to monitor and evaluate spending effectively, ensuring sustainability in battery recovery initiatives. A well-structured CAPEX schedule provides essential insights into asset growth, informing investment strategies and operational efficiency. This understanding is crucial for determining startup expenses, maximizing the profitability of battery recycling, and enhancing the overall financial feasibility of recycling initiatives. Ultimately, strategic management of capital expenditures supports the long-term profitability and environmental impact of battery waste management.

Loan Financing Calculator

Our financial Excel template integrates a comprehensive loan amortization schedule, detailing both principal and interest calculations. This tool not only determines your company's payment amounts but also considers key factors like interest rates, loan duration, and payment frequency. By streamlining your financial planning, it enhances operational efficiency and supports profitability analyses. Additionally, this template can play a crucial role in assessing the financial feasibility of battery recycling investments, ultimately guiding decision-making for sustainable and profitable recycling initiatives. Optimize your cash flow management and navigate the complex landscape of battery waste management effectively.

BATTERY RECYCLING EXCEL FINANCIAL MODEL METRICS

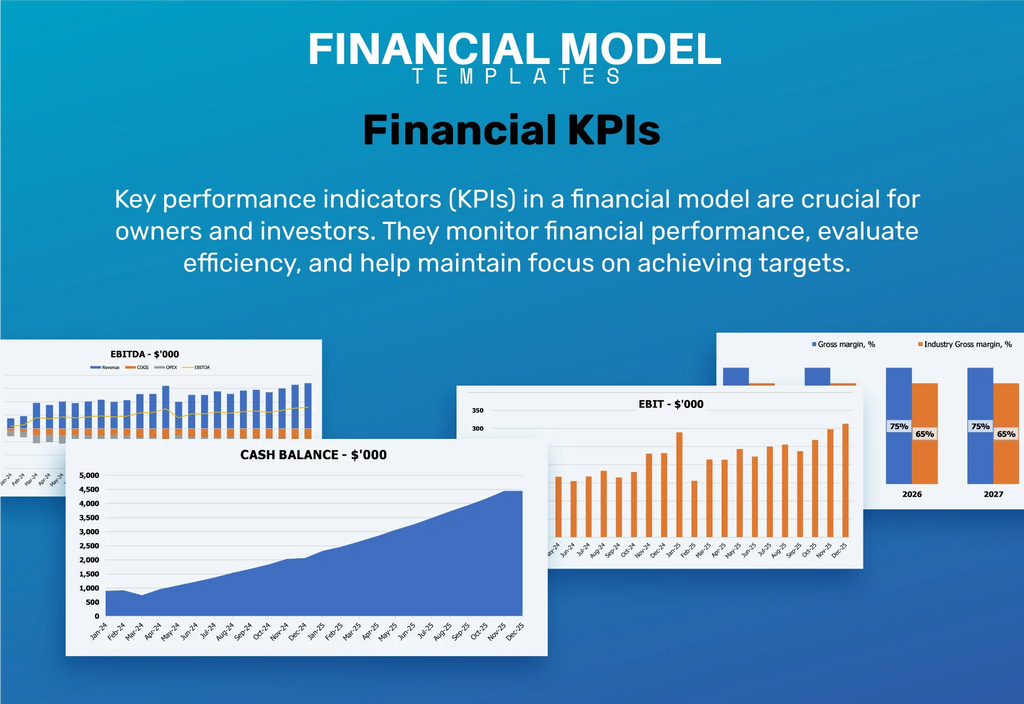

Financial KPIs

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) serves as a crucial indicator of a company's operational performance, particularly in the context of battery recycling. In financial projections, this metric reflects the profitability of battery recycling initiatives, guiding investment decisions and enhancing operational efficiency. A thorough cost analysis of battery processing, alongside evaluating recycling technology costs and regulatory compliance expenses, informs the financial feasibility of these ventures. As market demand for recycled batteries escalates, understanding revenue streams and the battery collection supply chain becomes essential for ensuring long-term profitability and sustainability in battery recycling efforts.

Cash Flow Forecast Excel

A comprehensive cash flow analysis is essential for assessing the financial feasibility of battery recycling ventures. This report provides a clearer perspective on cash inflows and outflows compared to traditional profit-loss statements. Our integrated financial model includes projected cash flow templates, enabling businesses to evaluate operational efficiency and investment returns over a 12-month period or up to five years. By analyzing battery recycling costs and potential revenue streams, companies can enhance sustainability efforts while navigating regulatory compliance, ultimately paving the way for long-term profitability in this evolving market.

KPI Benchmarks

This pro forma Excel template features a benchmarking tool designed for business owners in the battery recycling sector. By organizing and analyzing industry and financial data, it provides valuable insights into operational efficiency and profitability of battery recycling initiatives. Users can easily identify key competitors, assess market demand for recycled batteries, and evaluate the financial feasibility of their recycling strategies. This resource supports informed decision-making, enabling businesses to pursue optimal revenue streams while ensuring compliance with regulatory standards and enhancing sustainability practices in battery waste management.

P&L Statement Excel

Forecasting the projected income statement is crucial for startups, particularly in the battery recycling sector. This analysis not only informs financial projections but also influences the balance sheet and cash flow statements. Understanding battery recycling costs, recovery rates, and market demand is essential for evaluating the financial feasibility and long-term profitability of recycling initiatives. Moreover, a comprehensive income statement aids in assessing investment opportunities, operational efficiency, and revenue streams, ultimately driving sustainable practices and mitigating environmental impacts. Accurate forecasting ensures a competitive edge and compliance with regulatory requirements in battery waste management.

Pro Forma Balance Sheet Template Excel

Our financial projection template delivers a comprehensive analysis of battery recycling, integrating cash flow forecasts, profit and loss projections, and detailed balance sheets. Whether on a monthly or yearly basis, this robust tool evaluates key metrics, including battery recovery rates and operational efficiency. With insights into the profitability of battery recycling, investment potential, and environmental impact, it guides informed decision-making. Optimize capital expenditures for sustainable growth and explore revenue streams from recycled batteries, ensuring compliance with regulations while maximizing long-term profitability through strategic planning.

BATTERY RECYCLING FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Net Present Value (NPV) assesses the profitability of battery recycling initiatives by evaluating future cash flows, both positive and negative, discounted to present value. This financial model encompasses essential metrics such as investment required, equity raised, and projected growth rates. By analyzing battery processing costs and operational efficiency, businesses can determine the financial feasibility of their recycling strategies. Moreover, understanding market demand for recycled batteries and capital expenditures ensures sustainable revenue streams, reinforcing the long-term viability of these initiatives while contributing to environmental impact mitigation and battery waste management financials.

Cap Table

Implementing a comprehensive cap table enhances a company’s success potential by meticulously tracking securities, including common and preferred stock, warrants, and options. This insight into investor shareholdings is crucial for evaluating the financial feasibility of recycling initiatives. By understanding capital expenditures and operational efficiency in battery recycling, companies can optimize revenue streams and improve recovery rates. With growing market demand for recycled batteries, informed management of battery waste and regulatory compliance costs can drive long-term profitability while fostering sustainability in battery recycling. Ultimately, strategic data management is key to navigating the economic benefits and environmental impacts of this vital industry.

KEY FEATURES

A robust financial model over five years highlights the long-term profitability and economic benefits of battery recycling investments.

A comprehensive financial model for battery recycling enhances profitability assessment, guiding investments and optimizing operational efficiency over five years.

A robust financial model enhances investment attractiveness by projecting the long-term profitability and operational efficiency of battery recycling initiatives.

A solid financial model enhances investor confidence by demonstrating the long-term profitability and economic benefits of battery recycling initiatives.

A robust financial model enhances investment in battery recycling, ensuring long-term profitability and operational efficiency amid growing market demand.

A robust financial model enhances profitability and operational efficiency in battery recycling, driving sustainable growth and informed decision-making.

A robust financial model for battery recycling enhances profitability, reveals revenue streams, and maximizes operational efficiency through informed investment.

Conducting a battery recycling cost analysis reveals profitable growth avenues and enhances financial feasibility for sustainable operations.

A comprehensive financial model reveals the long-term profitability and sustainability potential of investment in battery recycling initiatives.

A robust financial model enhances the investment decision-making process by clearly illustrating the profitability of battery recycling initiatives.

ADVANTAGES

A robust financial model enhances the credibility and attractiveness of your battery recycling investment by demonstrating profitability and operational efficiency.

A robust financial model for battery recycling highlights revenue streams, operational efficiency, and long-term profitability of sustainability initiatives.

A robust financial model ensures the sustainability and long-term profitability of battery recycling investments while optimizing operational efficiency and revenue streams.

A robust financial model for battery recycling enhances operational efficiency and reveals long-term profitability, driving investment decisions and market growth.

A robust financial model can enhance credibility, attracting banks by demonstrating updated profit-loss projections for battery recycling ventures.